Getting preapproved for a mortgage is one of the first steps when buying a home. It allows you to know your budget and shows sellers you’re a serious buyer. But preapprovals don’t last forever – so how long is a mortgage preapproval good for?

In this comprehensive guide, we’ll explain everything you need to know about mortgage preapprovals, including:

- What is a mortgage preapproval?

- The difference between preapproval and prequalification

- When to get preapproved

- How long preapprovals last

- Renewing an expired preapproval

Plus we’ll provide tips on shopping for the best preapproval and what to do once yours expires

What is Mortgage Preapproval?

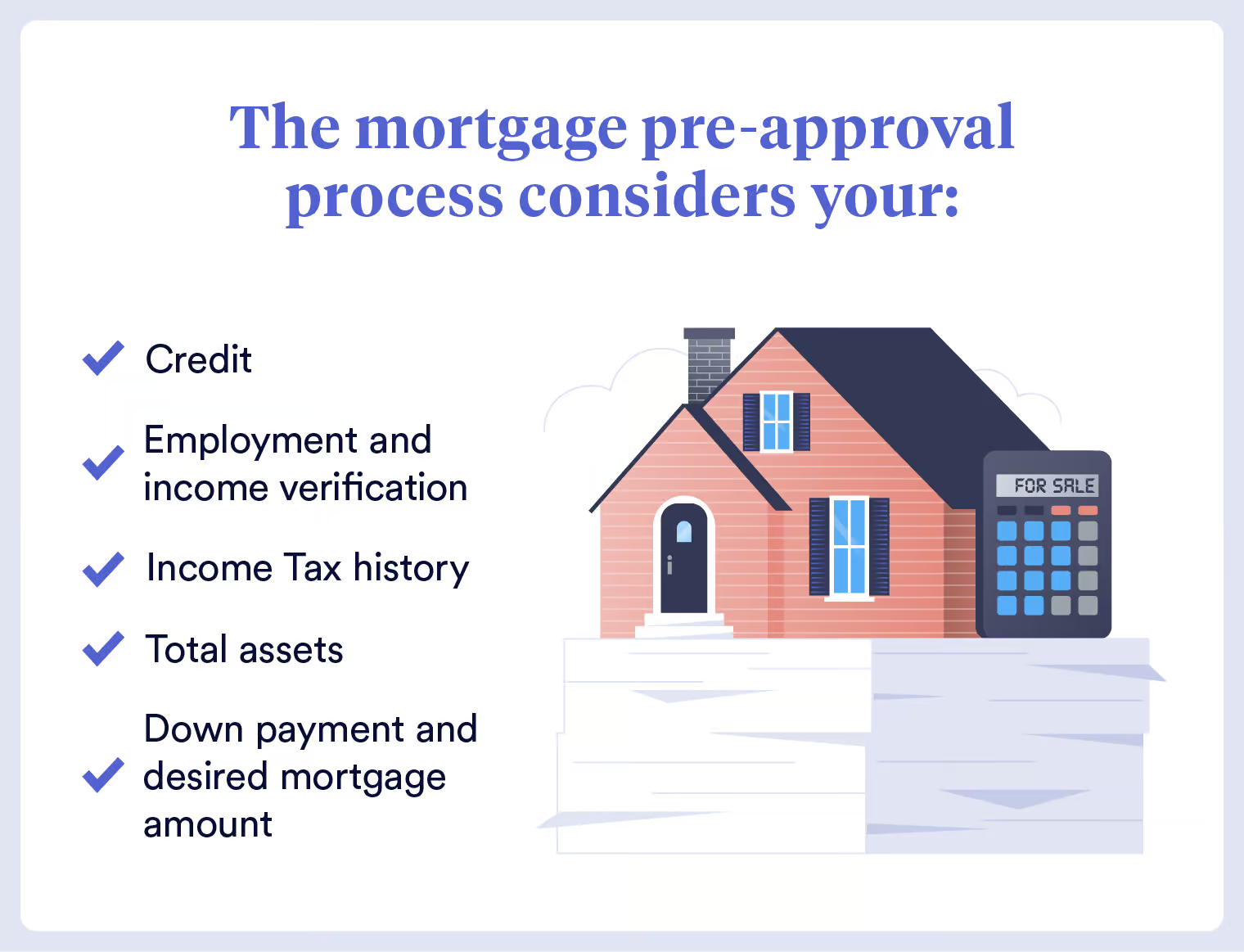

Preapproval is when a lender reviews your finances and credit to determine the loan amount you qualify for.

Getting preapproved has two big benefits:

-

It shows home sellers you’re financially ready to buy, This gives you an edge over buyers without preapproval,

-

You’ll know your price range. Preapproval lets you shop confidently knowing what you can afford.

Preapprovals aren’t guaranteed approvals The lender still has to underwrite the loan once you’re under contract, But being preapproved puts you in a strong position to get the mortgage

Preapproval vs. Prequalification: What’s the Difference?

Preapproval and prequalification sound similar but are different:

-

Prequalification is estimates based on limited info you provide. No verification is done yet.

-

Preapproval involves providing documents so the lender can thoroughly assess your finances. This verification makes preapprovals stronger.

Preapprovals carry more weight with sellers. Go with preapproval if you’re serious about buying soon. Prequalification works if you just want a ballpark estimate.

When Should You Get Preapproved for a Mortgage?

Timing is important with preapprovals. Here are some tips on when to apply:

-

Apply about 2-3 months before you plan to buy. This ensures it’s still valid once you’re ready to make offers.

-

Don’t apply too far in advance. Preapprovals expire after 90 days typically. Apply too soon and it could expire before you need it.

-

Shop for preapproval once you start seriously looking at homes and know your price range.

-

Check with your real estate agent on the best timing for your local market.

How Long Do Mortgage Preapprovals Last?

Now let’s look at how long preapprovals last:

-

Most preapprovals are valid for 90 days. This can vary by lender from 60 to 120 days. The expiration date will be on your preapproval letter.

-

Lenders limit preapprovals because your finances can change over months. They want to ensure you still qualify when you make an offer.

-

If your preapproval expires, you’ll need to reapply for a new one.

-

Some lenders may extend preapprovals an additional 30 days without resubmitting documents. But don’t count on an extension – 90 days is the standard validity.

How to Shop for the Best Mortgage Preapproval

Getting multiple preapprovals allows you to shop around for the best loan offer. Here are some tips:

-

Apply within a 14-day period. Credit inquiries hurt your score but multiple inquiries in 2 weeks count as one inquiry.

-

Compare interest rates, fees, and lender reputation. Make sure you’re comparing the same loan types.

-

Ask about “verified preapproval” programs. These require more documents but get you the strongest preapproval letter.

-

Work with an experienced loan officer who can guide you through the process. Online lenders also offer easy preapprovals.

-

Lock in a rate if you find an offer you love. This guarantees the rate for 60-90 days typically.

What Should You Do Once Your Preapproval Expires?

Don’t panic if your preapproval expires before you’ve made an offer. Here are your options:

-

Reapply with the same lender. This is easiest if your finances haven’t changed. You may just need to provide updated pay stubs or bank statements.

-

Shop around for a better deal if rates have dropped. You can try a new lender for possibly better terms.

-

Get a prequalification to have something while reapplying for preapproval. Prequalifications can buy you some extra time.

-

Extend your rate lock if you locked your rate but need more time. Lenders often allow 30-60 day rate lock extensions for a small fee.

The bottom line: Having an updated preapproval letter is critical. Work quickly to renew yours if it expires so you can keep house hunting without delay.

Are Mortgage Preapprovals Guaranteed?

While extremely helpful, keep in mind preapprovals aren’t guaranteed mortgages. They state you qualify for a certain loan amount – not that you are definitely approved.

Final approval happens once you are under contract and the lender underwrites your full application. Things that can put your approval at risk include:

- Your credit score drops significantly

- You take on new debt

- Loss of job or income

- The appraisal comes in low

Stay on top of your finances to avoid unpleasant surprises. Also be conservative with the loan amount you shop for – don’t max out your preapproval limit.

Preapproval Gives You a Head Start on Buying

Now you understand exactly how long mortgage preapprovals last and why they are so useful when buying a home.

Get preapproved as soon as you start seriously browsing homes so you’re ready to make a competitive offer when you find the right one.

Just be sure to apply close enough to your purchase timeframe so your preapproval doesn’t expire. And if it does expire, promptly get re-preapproved so you can quickly get back to house hunting!

Follow these tips and you’ll have the strongest position for getting approved for the mortgage you need.

What Is A Mortgage Preapproval Letter?

Rocket Mortgage® lets you do it all online.

What Is A Mortgage Preapproval?

Your Credit Profile Excellent 720+ Good 660-719 Avg. 620-659 Below Avg. 580-619 Poor ≤ 579

When do you plan to purchase your home? Signed a Purchase Agreement Offer Pending / Found a House Buying in 30 Days Buying in 2 to 3 Months Buying in 4 to 5 Months Buying in 6+ Months Researching Options

Do you have a second mortgage?

Are you a first time homebuyer?

Consent:

By submitting your contact information you agree to our Terms of Use and our Privacy Policy, which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! NMLS #3030

Congratulations! Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage.

If a sign-in page does not automatically pop up in a new tab, click here

How long is a Home Loan Approval good for?

FAQ

Do loan approvals expire?

How long is a loan good for once approved?

How long is a loan approval letter good for?

How long is an approval good for?

How long is a preapproved loan valid?

In most cases, it’s valid for around 60 – 90 days. Your financial situation can change substantially within a few months, and many lenders require you to get preapproved again if you’ve gone beyond the 90-day mark. It can, however, be a good thing for a borrower’s financial situation to change.

When should I get a mortgage preapproval letter?

A borrower should apply for a mortgage preapproval when they’re actively in the home buying process, but not so far in advance that they risk their preapproval expiring. If you’re unsure if you should get a mortgage preapproval letter, you may want to have a conversation with your real estate agent.

How long is a mortgage pre-approval good for?

Most mortgage pre-approvals are good for 90 days, and they’re simple to refresh at any time. The mortgage pre-approval is your first big step towards homeownership. And getting pre-approved early in the process simplifies everything that comes next. No home seller will take you seriously unless you show them that you’re qualified.

How long do mortgage pre-approval letters last?

It shows sellers that a lender has determined that you are likely to be approved for a home loan based on your finances. But mortgage pre-approval letters do have an expiration date, which will vary by lender. Generally, they last from 30 to 90 days. Learn how mortgage pre-approvals work, how to get one, and why they are a key part of homebuying.