As a homeowner, you’ve invested time and money into your house. Now, you may wonder how you can get more out of your home. A home equity loan is a great way to pay for home renovations, an emergency bill, or something else entirely without draining your savings account!

But how long does it take to get a home equity loan? What’s the approval process and how can you prepare? We’ll go over the average time it takes to get a home equity loan including some insights into what could slow down the process.

Getting a home equity loan allows homeowners to tap into the equity they’ve built up in their home over time With a home equity loan, you can borrow a lump sum of cash and pay it back over time with interest. Home equity loans can be useful for financing large expenses like home renovations, medical bills, college tuition, or consolidating high-interest debt.

But how long does the process take from application to getting the cash in hand? Let’s walk through the typical timeline and key steps to getting a home equity loan approved.

An Overview of Home Equity Loans

A home equity loan sometimes called a second mortgage allows you to borrow against the equity in your home. The equity is the difference between what you owe on your mortgage and your home’s current market value.

For example if your home is worth $300000 and you owe $180,000 on your mortgage, you have $120,000 in equity ($300,000 – $180,000 = $120,000). With a home equity loan, you can tap into that equity without having to sell or refinance your home.

Benefits of a home equity loan include:

- Access to a large lump sum of cash

- Potentially lower interest rates compared to other loan types

- Interest may be tax deductible (consult a tax professional)

- More flexible qualifying criteria compared to cash-out refinancing

The amount you can borrow depends on how much equity you have, your income, credit score, and other factors. Many lenders let you borrow up to 85% of your home’s value minus what you owe on your mortgage.

Home equity loans have fixed interest rates, fixed monthly payments, and a set repayment term. This helps make budgeting predictable.

Timeline for Getting a Home Equity Loan

The typical process for getting approved for and closing on a home equity loan takes between 2 to 8 weeks. Here is a general timeline:

Week 1: Initial application and document collection

- Contact lenders and apply for preapproval

- Gather required documents (pay stubs, W2s, tax returns, bank statements etc.)

Weeks 2-3: Underwriting

- Lender reviews application, runs credit check, and verifies documentation

- Lender may request additional documentation

- Home appraisal is ordered if required

Weeks 4-5: Loan processing and approval

- Loan processor reviews application, documentation, and appraisal if needed

- Final underwriting review and approval decision

- Closing documents are prepared

Weeks 6-8: Closing and funding

- Final loan documents are signed at closing

- Three-day right of rescission period

- Loan funds are disbursed into your account

As you can see, the bulk of the time is spent on document collection, underwriting, and the closing process. Next, let’s look at the key steps in more detail.

Step 1: Initial Application and Document Collection

The first step is to research lenders and submit a loan application. When comparing lenders, look at interest rates, fees, loan amounts offered, and customer service.

Many homeowners start with their current mortgage lender since they already have your information on file. But make sure to shop around, as you can often get better rates from credit unions or online lenders.

In the loan application, you’ll provide basic personal and financial information including:

- Your name, date of birth, Social Security Number

- Employment history

- Annual income

- Existing debts and assets

- Property address

The lender will also ask for documentation to verify this information, including:

- Pay stubs going back 30 days

- W2 and tax returns for the past 2 years

- Monthly bank statements

- Your most recent mortgage statement

Having these documents ready to submit with your application can speed up processing time. If any required documents are missing, it causes delays.

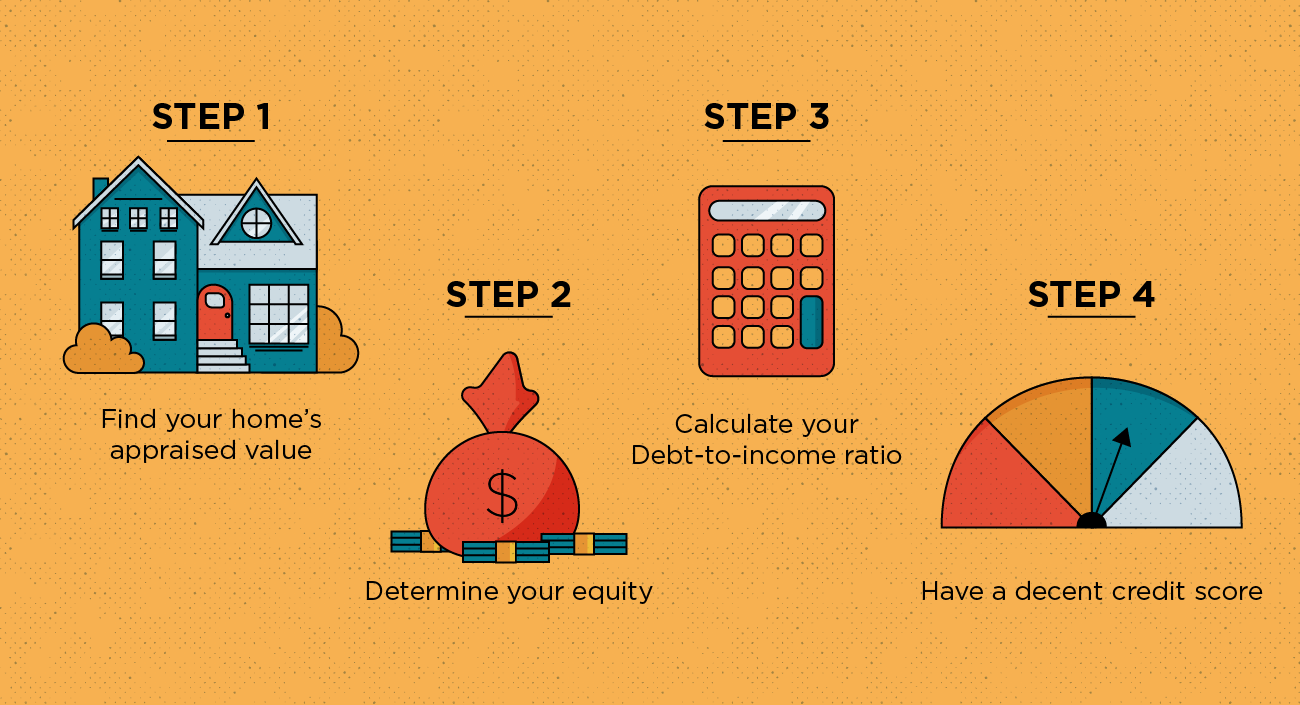

Step 2: Underwriting

Once the lender has your application and documentation, it goes through underwriting. This is where the lender reviews your financial situation in depth to decide whether or not to approve your loan.

Some key things underwriters look at:

-

Credit score: Most lenders require a minimum score in the mid 600s. Higher scores get better rates.

-

Debt-to-income ratio: Your total monthly debt payments divided by gross monthly income. Below 50% is good, below 43% preferred.

-

Loan-to-value ratio: The loan amount divided by the home’s value. Most lenders limit this to 80-85% combined for all loans.

-

Home appraisal: If required, the lender will order an appraisal to confirm the home’s market value. This generally adds 1-3 weeks to the process.

The underwriter may request additional documents or explanations if they have any questions or need clarification. Respond promptly to these requests to avoid delays.

Step 3: Loan Processing and Approval

After underwriting, a loan processor will do a final review of your application, documents, appraisal, and credit check. They verify all information is complete, consistent, and meets the lender’s criteria.

The file then goes through final underwriting approval. As long as everything checks out, you will receive a loan approval letter. This specifies the loan amount, interest rate, fees, and other terms of the loan.

Step 4: Closing and Funding

Once approved, the lender will prepare the closing documents. This includes the promissory note stating the loan terms and conditions. There will also be documents to record the second mortgage lien against your home.

You’ll then have a closing meeting where you sign these documents. This is your last chance to review everything and back out if needed. In most states, you have a 3-day “right of rescission” window after closing where you can change your mind with no penalties.

After the right of rescission period, the lender will deposit the loan funds into your bank account. And just like that, the cash is yours!

Now you have the lump sum to put toward your intended purpose, while repaying the loan over time like any other mortgage.

Factors That Can Speed Up or Delay the Process

While the typical timeline is 2 to 8 weeks, your specific situation could be faster or slower. Here are some things that can impact the schedule:

Speed Up:

- Strong credit score and financial profile

- Having all documentation ready upfront

- Getting a waiver on the home appraisal

- States without required attorney closing

Slow Down:

- Weak credit or high debt-to-income ratio

- Missing documents that require follow up

- Property needs repairs impacting appraisal

- Difficulty scheduling appraisal or closing

- Complex state laws and regulations

The more prepared you are with a strong application, the more likely you’ll end up on the faster end of the spectrum.

Ready to Apply? Know What to Expect

The process of getting approved for a home equity loan spans several weeks. While it may seem daunting, going in knowing what to expect helps set realistic expectations.

The most important steps you control are gathering documents, researching lenders, and submitting a strong application. Taking care to get these pieces right goes a long way to smoothing the road to getting your cash.

Home equity loans allow homeowners to unlock their equity for large expenses, without having to sell or refinance. Now that you know the typical timeline for getting approved, you can start planning your application. Reach out to lenders to get pre-qualified and request any checklists they have for required documents. Follow the steps outlined here and you’ll be on your way to accessing funds through a home equity loan.

Know Your Appraisal Timeline

As a lender, we will need to know what your home is worth. To figure that out, your home will be appraised by a professional appraiser who will look over the home to determine its value and consider the sale price of comparable homes (known as “comps”) in the area.

With today’s advanced technology, many lenders will use the Automated Value Model or AVM. An AVM gives an instant value of your home through computer-generated metrics. Having an AVM can expedite the application process if it’s available. If not, expect to add 1 to 3 weeks for a full appraisal report to be created.

Collect Supporting Documents

The sooner you collect and submit your documents, the faster you’ll go through the underwriting process. We’ll want to see paperwork like your credit report, current pay stubs, and bank statements as proof of your income and employment history.

A mortgage underwriter will analyze your credit history, income, assets, and your home’s value to help decide the approval of your home equity loan.

Bonus tip: Gather the documents you had collected for your mortgage application and update them. These will most likely be the same things you’ll need to submit for your home equity loan approval.

How Long Does it Take to Get a Home Equity Loan?

FAQ

How fast to get a home equity loan?

How hard is it to get an equity loan?

Why does it take so long to get an equity loan?

Can you be denied for a home equity loan?