The time it takes to receive funds from a home equity loan or HELOC varies based on the length of the application, the lender’s processing time, and the appraisal process.

Most home equity lenders disburse funds in two to four weeks. However, we’ve found a lender that can release your funds in as little as five days.

Taking out a home equity loan can be a great way to access the equity in your home for major expenses, debt consolidation, or home improvements. But how long does the process take from application to getting the funds in your account? Let’s take a closer look.

What is a Home Equity Loan?

A home equity loan is a type of second mortgage that allows you to borrow against the equity in your home Equity is the difference between what your home is worth and what you still owe on your mortgage

For example if your home is worth $300000 and you owe $200,000 on your mortgage, you have $100,000 in equity. With a home equity loan, you can tap into that equity, up to a certain percentage, and receive the amount in a lump sum of cash.

Home equity loans typically have fixed interest rates and a set repayment term of anywhere from 5 to 30 years. The home acts as collateral for the loan so if you default the lender can foreclose.

Factors That Determine Home Equity Loan Timelines

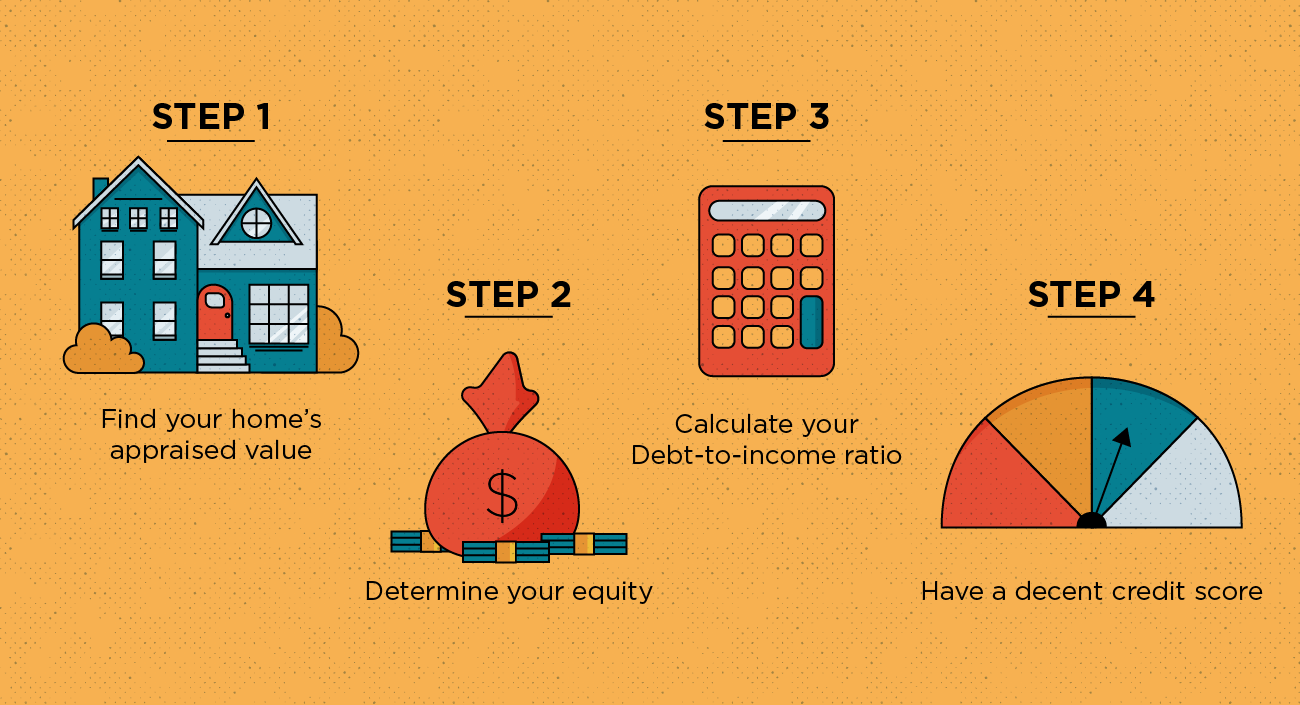

Several key factors determine how quickly you can get approved for and receive funds from a home equity loan:

-

Your preparation and documents – Having all your financial documentation ready to submit will speed things up. This includes W-2s, 1099s, paystubs, bank statements, and tax returns showing your income.

-

Your credit and finances – Good credit, low debt-to-income ratio, and sufficient home equity will make for a quicker approval. Any issues will slow things down.

-

Appraisal timing – Your home must be appraised to determine available equity. This can take 1-2 weeks.

-

Underwriting – The lender must underwrite and approve the loan. This takes roughly 2-4 weeks.

-

State laws – Some states have mandatory waiting periods between application and closing. This adds time.

Overall, it typically takes 2-6 weeks from application to funding for most borrowers. Let’s look at the step-by-step process and timeline.

The Home Equity Loan Process Timeline

Here are the general steps and timeframes involved from application to receiving your home equity loan funds:

1. Application – 1-2 Days

You’ll start by submitting your application with documents that verify your income, assets, debts, and employment. This can usually be done in 1-2 days.

2. Home Appraisal – 1-2 Weeks

The lender will order an appraisal to determine your home’s market value and the amount of equity available. Appraisals typically take 1-2 weeks to be completed.

3. Underwriting and Approval – 2-4 Weeks

The lender will thoroughly analyze your income, debts, credit, and collateral to decide whether to approve the loan. Underwriting often takes 2-4 weeks.

4. Closing Disclosure – 3 Days

You’ll get closing disclosures at least 3 business days before closing that outline the terms of the loan. This starts the cooling off period.

5. Loan Signing – 1 Day

You’ll sign the final loan documents. This can usually be done in a day.

6. Funding – 1 Week

After signing, the lender will disburse the loan proceeds directly into your specified bank account within 1 week.

So in total, expect 2-6 weeks from the time you apply until the money hits your account, depending on the lender and your specific financial situation.

Tips for Speeding Up the Home Equity Loan Process

Here are some tips to help expedite the home equity loan process:

-

Have all your financial documents ready before applying – income statements, bank statements, tax returns, etc.

-

Shop lenders and compare quotes to pick the right lender for your situation

-

Get pre-approved to show you’re a qualified borrower and speed things up

-

Provide prompt responses to any requests or questions from your lender

-

Ensure there are no surprises or red flags in your credit report or financials

-

Get an informal valuation or estimate of your home’s value prior to applying

-

Ask your lender if they offer expedited processing or closing options for a fee

-

Be flexible on closing dates if possible to take earlier openings

-

Opt for eSign and eClosing to bypass physical closing appointments if available

Common Home Equity Loan Closing Timelines

While timelines vary case-by-case, here are some general home equity loan closing timeframes by lender type:

-

Online lenders – 2-4 weeks closing time

-

Banks and credit unions – 3-6 weeks

-

Mortgage lenders – 4-8 weeks

Again, your specific timeline depends on many factors. Online lenders and fintech companies tend to have the quickest closing times due to easy online applications and streamlined processes.

The Waiting Period Before Receiving Funds

Once closed, there is usually a mandated 3-day waiting period before you receive the loan funds. This is known as the “right of rescission” period, during which a borrower can cancel the loan for any reason.

After the waiting period, expect to receive the home equity loan proceeds within 1 week, either via wire transfer, direct deposit, or paper check. Consult your lender to see if you can get expedited funding.

Is It Possible to Get a Home Equity Loan in Less Than 2 Weeks?

While rare, it is possible to get a home equity loan in less than 2 weeks in some cases. The keys are:

-

Having perfect credit and finances

-

Using an extremely efficient online lender

-

Paying extra fees for rushed processing and overnight shipping

-

Being extremely responsive throughout the process

-

Having simple employment/income that’s easy to verify

-

Flexible scheduling and availability for appraisal and closing

Even then, state rescission period laws can make under 2 week closings difficult. But with perfect conditions and some luck, borrowers can potentially get home equity loan funds in 10-14 days.

What If My Home Equity Loan is Taking Longer Than Expected?

If your home equity loan is taking longer than the typical 2-6 week timeline, here are some things you can do:

-

Ask your loan officer for a status update on any hold ups

-

Check if any documents are still needed from you and provide quickly

-

Call the appraiser’s office to check on the appraisal timeline

-

Ask if the underwriter needs any clarification or if there are conditions to meet

-

See if you can get expedited handling for any remaining steps for a fee

-

Be patient and stay on top of things – the finish line is close!

While delays can be frustrating, it’s usually just a matter of staying organized and responsive, so the lender has everything they need to approve you and fund the home equity loan as quickly as possible. With proactive follow up, you’ll get there!

The Bottom Line

Taking out a home equity loan allows you to tap into your home’s equity for large expenses or projects. Approval times typically range from 2-6 weeks total. The exact timeline depends on the lender as well as your preparation, credit profile, and loan amount. With good planning and organization, you can get a home equity loan closed and funded ASAP. Just focus on providing the lender everything they need in a timely manner.

What factors affect the length of the process the most?

The most significant influences on how long it takes to get a home equity loan or HELOC are often the lender you’re working with, what’s required for underwriting, and whether an in-person appraisal is needed. Not having your supporting documents prepared beforehand can also slow you down.

It may be faster to apply for a home equity loan or HELOC with the lender that holds your current mortgage because it already has your personal and financial information on file. But consider whether that makes sense if you could get a lower interest rate or pay fewer fees elsewhere. Cost may outweigh convenience.

How long does it take to get a HELOC?

The time frame to get a HELOC is similar to a home equity loan. Based on the lender, the process may take two weeks to two months. You’ll need to shop around to find a lender, submit your application, complete the home appraisal, provide the lender with supporting documents, and sign off on the paperwork at closing before you can access your credit line.

How Long Does it Take to Get a Home Equity Loan?

FAQ

How fast can you get a home equity line?

Is it easy to get approved for a home equity loan?

How long after closing on a home equity loan do you receive money?

How long does it take to get a home equity loan?

A home equity loan can provide you with fast access to equity, putting cash in hand within two to six weeks. It is also easier to qualify for than a cash-out refinance. Once approved, you’ll receive a lump sum payout that you can use immediately, then repay slowly over time.

How long does a home equity loan last?

A home equity loan lasts anywhere from five to 30 years, with the most common term being 20 years. Speak with your lender to determine a repayment term that suits your needs. Home equity loan funds can be used for various purposes.

How long does a home equity loan take to repay?

How long a home equity loan takes to repay will depend on your budget, what you qualify for, and how quickly you want to repay your loan. In general, you can get a home equity loan with a repayment term ranging from 10 to 30 years.

How long does it take to get a home loan?

It can take a couple of months to get approved for a home equity loan while you wait for your lender to process the application. Completing the loan application accurately and having your documents ready can expedite the process.