Taking out a home loan is one of the biggest financial commitments most people make in their lifetimes. A 30-year mortgage can end up costing double the amount you originally borrowed by the time it’s fully paid off due to all the interest charges.

But what if there was a way you could pay off your home loan faster and save thousands in interest charges? This is where home loan lump sum calculators come in handy.

What is a Home Loan Lump Sum Calculator?

A home loan lump sum calculator is an online tool that allows you to estimate how making extra lump sum repayments can reduce the total interest paid and time taken to pay off your home loan

Lump sum repayments are one-off extra payments made in addition to your regular monthly home loan repayments They help pay down the loan principal faster, which reduces the amount of interest charged over the lifetime of the loan

Home loan lump sum calculators take key details like your loan amount. interest rate loan term and lump sum payment amount and crunch the numbers to show you

- New loan repayment time frame

- Total interest savings

- Time saved on the loan term

This gives you a clear picture of the potential impact extra lump sum repayments can have on your overall interest costs and loan duration.

How Do Home Loan Lump Sum Calculators Work?

These calculators use some simple behind-the-scenes math to estimate your savings. Here’s a quick overview of what they do:

-

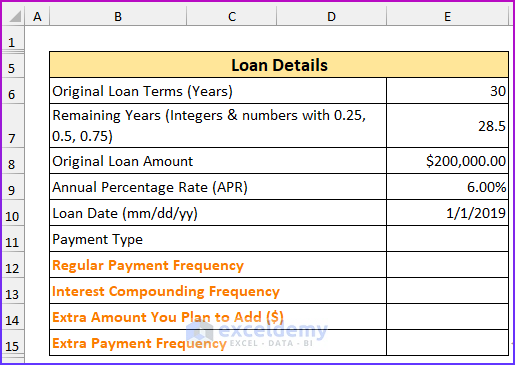

Take your current loan details – amount borrowed, interest rate, loan term, regular repayment amount.

-

Allow you to input a hypothetical lump sum payment amount and date.

-

Recalculate your amortization schedule and remaining loan balance after the lump sum payment is made.

-

Compare the new loan balance and schedule to the original and determine the total interest savings and time reduction.

-

Display the results so you can see the overall impact.

So in a nutshell, the calculator simulates what would happen if you made a lump sum payment and provides the new loan details so you can see just how much you stand to save.

Key Benefits of Using a Lump Sum Calculator

Taking the time to use a home loan lump sum calculator offers a few useful benefits:

Estimate your potential interest savings

The main advantage is getting an estimate of just how much you could potentially save on your total interest paid over the life of your loan by making lump sum repayments. Seeing a concrete figure can really motivate you to come up with some extra funds.

Decide the best time to make repayments

The calculator allows you to play around with different lump sum amounts and payment dates. This helps you identify the most strategic times to make repayments to maximize interest savings. Typically, the earlier in the loan term you make lump sums, the more interest you’ll save.

See the impact on your loan duration

You can also get an idea of by how much you might be able to shorten your loan term by making lump sum repayments. The sooner you can pay off your mortgage, the less interest you’ll end up paying overall.

Model different scenarios

Having the ability to model various lump sum amounts and dates gives you flexibility to see the impact of different repayment strategies. You can model best and worst case scenarios to help plan your repayments.

Make informed repayment decisions

The insight provided by home loan lump sum calculators helps you make better informed decisions about whether, when, and how much to make extra repayments. You can ensure any extra funds are used in the most optimal way.

Real-Life Example Using a Lump Sum Calculator

Let’s look at how using a lump sum calculator could work in the real world using a fictional example:

-

Sarah takes out a $400,000 home loan on a 30-year term at 5% interest.

-

Her regular monthly repayments are $2,147.

-

After 5 years, she receives a $50,000 work bonus and considers making a lump sum repayment.

-

She inputs her loan details into a lump sum calculator along with the $50,000 one-off payment amount.

-

The calculator estimates she would save $62,263 in interest and cut 6 years off her loan term by making this repayment.

Seeing these tangible results motivates Sarah to go ahead and make the $50,000 lump sum payment since the savings are substantial. She’s happy she used the calculator to model the scenario first.

Things to Keep in Mind When Using Lump Sum Calculators

While these calculators provide helpful guidance, there are a few things to be aware of:

-

The results are estimates only – the actual savings may differ slightly.

-

Check if your loan has any prepayment penalties or conditions.

-

Consider any tax implications of making lump sum repayments.

-

Weigh up alternate uses for any spare funds that could also save money.

-

Speak to your mortgage provider before making any lump sum payments.

So while the calculators offer indicative results, be sure to do your homework to determine if lump sum repayments suit your situation.

How to Find a Good Home Loan Lump Sum Calculator

Now that you know the ins and outs of lump sum calculators, let’s look at how you can find a good one to use. Here are a few tips:

-

Search online – keywords like “lump sum calculator” or “home loan calculator” will bring up options.

-

Use bank websites – most major lenders offer calculators on their sites.

-

Try comparison sites – aggregators like Finder and Canstar have useful calculators.

-

Look for comprehensive tools – find ones that allow scenarios and have detailed results.

-

Read the disclaimers – check any assumptions made and disclaimer text.

-

Try before you buy – test out a few free calculators before purchasing any premium tools.

Two well-known lump sum calculators to consider are:

-

Mortgage Choice Lump Sum Calculator – free and easy to use with detailed results.

-

Bankrate Extra Payment Calculator – allows very customizable scenarios.

You may also find these other calculators helpful

This material is for informational purposes only and is not intended to be an offer, specific investment strategy, recommendation or solicitation to purchase or sell any security or insurance product, and should not be construed as legal, tax or accounting advice. Please consult with your legal or tax advisor regarding the particular facts and circumstances of your situation prior to making any financial decision. While we believe that the information presented is from reliable sources, we do not represent, warrant or guarantee that it is accurate or complete.

Third parties mentioned are not affiliated with First-Citizens Bank & Trust Company.

Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website. First Citizens Bank and its affiliates are not responsible for the products, services and content on any third-party website.

Please select the option that best matches your needs.

Customers with account-related questions who arent enrolled in Digital Banking or who would prefer to talk with someone can call us directly.

How To Calculate Your Mortgage Payment

FAQ

How much of my mortgage can I pay off in a lump sum?

How much lump sum can I pay on my mortgage?

How much will a lump sum payment affect my loan?

Is it worth paying a lump sum off your mortgage?

Are lump sum payments allowed for a home loan?

Talk to your Mortgage Choice mortgage broker to find out if lump sum payments are permitted for your home loan. Some lenders will only allow a certain extra amount to be paid off each year without incurring additional fees, and a broker can help you figure out the best way to save money and time off your home loan.

How does a lump sum payment affect my mortgage?

Making a lump sum payment, particularly in the early years of your loan, can have a big effect on the total interest paid on the loan. This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage and the total interest paid.

What is a lump-sum extra payment calculator?

This calculator is for making a lump-sum extra payment along with extra monthly payments. You can enter these payments to coincide with your regular monthly payments. We also offer three other options for other additional payment scenarios.

How do you calculate a mortgage payment per month?

Take the amount of your mortgage payment and divide it by 12. The following amount is the extra payment that must be applied to your principal each month. For instance, your monthly mortgage payment is $1,167.52. If we divide it by 12, the resulting amount will be $97.30. This is the extra payment you must make on your mortgage per month.