Getting a home equity loan without having to verify your income can seem daunting. Traditional lenders typically require proof of income which can be a roadblock for retirees the self-employed, and those with unconventional income streams. However, there are ways to tap into your home’s equity even if you can’t document your earnings in the usual way.

In this comprehensive guide, we’ll walk through the ins and outs of no-doc home equity loans You’ll learn about

- What no-income verification home equity loans are

- Pros and cons of no-doc loans

- Alternative documentation you can provide

- Tips for qualifying and improving your chances

- Creative alternatives beyond standard home equity loans

Armed with this knowledge, you’ll be equipped to make the best decision on how to unlock your home equity without conventional income verification

What Are No-Income Verification Home Equity Loans?

Also known as “no-doc loans,” these products allow you to borrow against your home equity without having to document your income via tax returns, pay stubs, etc.

Lenders will look at other factors to determine if you qualify, such as:

- Your credit score and history

- The amount of home equity you have

- Your debt-to-income ratio

- Other assets you may have

No-doc loans can be beneficial if you:

- Are self-employed

- Have irregular income

- Are retired

- Have rental income or unconventional earnings

They provide a way to access your equity when traditional loan standards don’t fit your situation.

The Pros and Cons of No-Income Verification Loans

Pros:

- Access equity without income proof

- May accept alternative documentation

- Fixed rates and terms available

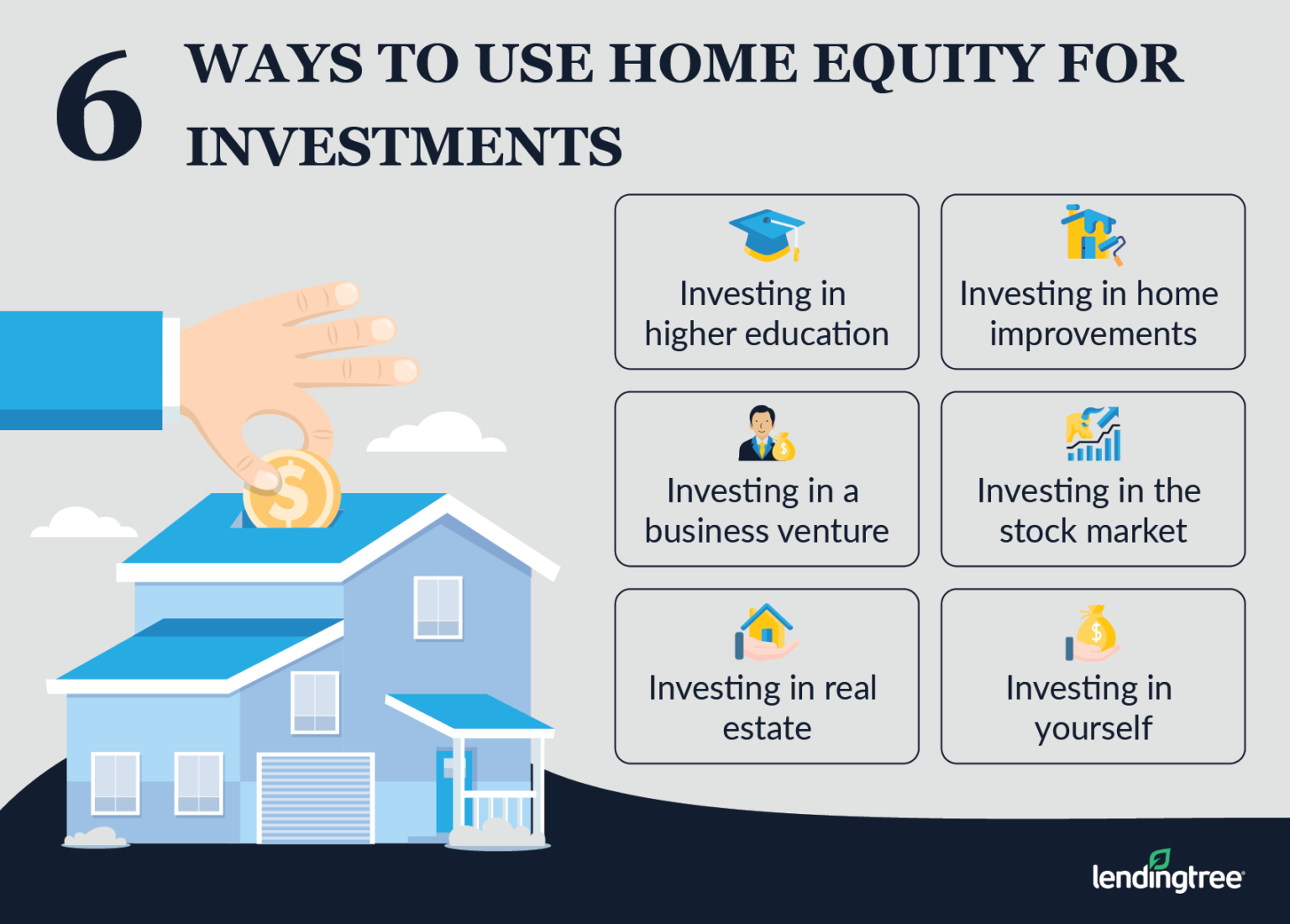

- Can be used for anything – debt consolidation, home improvements, etc.

Cons:

- Higher interest rates than conventional loans

- Potentially unfavorable terms

- Risk of foreclosure if payments aren’t made

- Limited lender options

Carefully weighing the pros and cons based on your specific needs is important. These loans aren’t right for everyone.

Alternative Documentation You Can Provide

While lenders won’t require typical income verification, they will want to see that you can manage the loan responsibly. Here are some examples of alternative documentation that may be accepted:

- Bank statements showing cash balances and deposits

- Brokerage and investment account statements

- Proof of rental or royalty income

- Records of freelance or side work earnings

- Documentation of social security, pension, or retirement income

- Tax returns (even if not required)

The more you can show in liquid assets and steady cash flow, the better. Having a co-signer with verifiable income is also an option.

Tips for Qualifying and Improving Your Chances

A no-doc home equity loan is based heavily on your creditworthiness and home equity. Here are tips to boost your chances of approval:

- Have a down payment of at least 15-20% – This gives you enough equity to tap into.

- Maintain a credit score over 640 – Scores of 700+ are ideal, but even scores in the mid 600s can qualify with strong equity.

- Keep your debt-to-income ratio below 45% – Lower is better to prove you can manage debt responsibly.

- Consider adding a co-signer – Their income can complement what you lack in verifiable earnings.

- Shop around with multiple lenders – Each lender has different requirements, so cast a wide net.

- Leverage assets – Bank accounts, investments, and other assets can help demonstrate repayment ability.

Meeting as many of these benchmarks as possible sets you up for the best chance of success.

Creative Alternatives Beyond Standard Home Equity Loans

If you have difficulty qualifying for a no-doc home equity loan, there are other creative ways to tap into your equity without income verification:

Home Equity Agreement

With products like MyHECM, homeowners can receive funds from their equity without required monthly payments or interest charges. No income documentation is needed. You don’t give up ownership and repayment isn’t due until you sell or vacate the home.

Cash-Out Refinance

This replaces your existing mortgage with a new loan for more than what you currently owe. The difference is paid out to you as cash. VA and FHA loans allow for refinancing without full income documentation in some cases.

Reverse Mortgage

For homeowners 62 and older, reverse mortgages provide tax-free income based on your home equity without any monthly payments required. You retain ownership and occupancy.

Home Equity Investment

Companies like Point offer lump sums of cash in exchange for a share of your home’s future value. You get funds from equity without monthly payments or credit requirements.

Sale-Leaseback

You sell your home to an investor and lease it back to live in as a renter. This allows you to tap equity without having to move.

The Bottom Line

While getting a no-doc home equity loan won’t always be easy, it can be done under the right circumstances. The keys are having sufficient home equity, good credit management, and exploring creative alternatives like equity sharing agreements.

Weigh your options carefully and consult qualified financial advisors. With perseverance and the right knowledge, accessing your equity without income verification is achievable. The resources are out there – you just have to do your homework to find the solution that fits your situation.

Exploring No-Income Verification Home Equity Loans

For homeowners who can’t provide traditional income documentation, no-income verification home equity loans offer an alternative path to accessing home equity. These loans, sometimes known as “no-doc” loans, cater to individuals with non-traditional income sources or those who are self-employed.

Leveraging Non-Traditional Income for Equity Access

At RenoFi, we recognize the diverse financial situations of homeowners. If you have non-traditional income sources, you may still be able to tap into your home equity. A home equity agreement, as detailed by MyHECM, is one such option that doesn’t typically require income verification. This can be especially advantageous for retirees, the self-employed, or those with variable income. These agreements often come without monthly payments and interest charges, providing a flexible alternative.

Another avenue is a no doc home equity loan, which allows you to qualify using alternative documentation like bank statements. This can be ideal for those with unconventional jobs or income sources. Griffin Funding offers insights into these loans. For veterans, a VA-backed cash-out refinance loan is available, allowing for the replacement of a current loan with new terms, even with non-traditional income, provided other VA and lender criteria are met.

How to get a No Income Verification Mortgage Loan

FAQ

Can I get a home equity loan without showing income?

Do you need proof of income for equity loan?

What disqualifies you from getting a home equity loan?

Which type of loan requires no verification of income?