We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free – so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Buying land to build a home on can be an exciting prospect. With the current housing shortage, finding an existing home to purchase can be challenging Purchasing land and building a custom home allows you to design your perfect living space However, buying land requires creative financing since you can’t use a traditional mortgage. A home equity loan is one option for financing a land purchase.

In this article, we’ll explain what a home equity loan is, the pros and cons of using one to buy land, factors to consider, whether land is a good investment, alternative financing options, and more Read on to learn everything you need to know about using home equity to turn your dream of owning land into a reality

What is a Home Equity Loan?

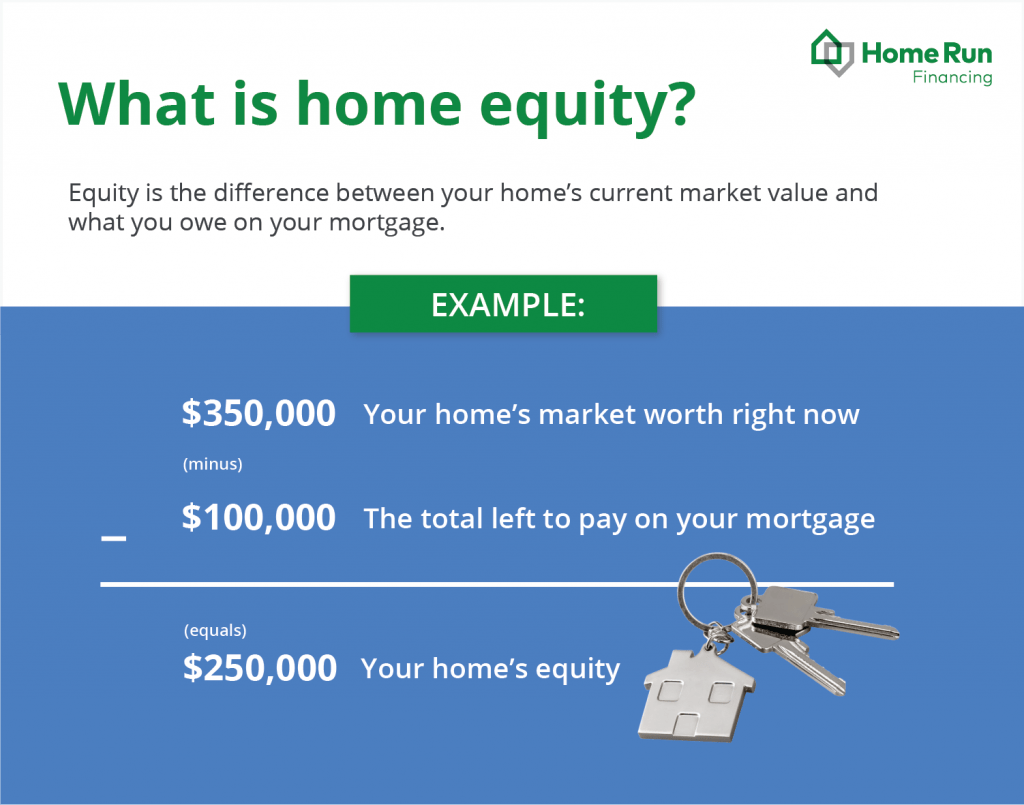

A home equity loan, sometimes called a second mortgage, allows you to borrow against the equity in your home. Equity is the portion of your home that you own free and clear. For example, if your home is worth $300,000 and you owe $180,000 on your mortgage, your equity is $120,000.

With a home equity loan, you’re using your equity as collateral for the loan. The lender places a second lien on your home behind your first mortgage. Home equity loans provide funds in a lump sum and have a fixed interest rate and term length. The repayment terms are similar to a regular mortgage, often 10 to 30 years.

If you fail to repay a home equity loan, the lender can foreclose, meaning you could lose your home. So this is not a risk-free option and should be approached with caution. However, home equity loans tend to have lower interest rates than other financing options.

Pros and Cons of Using Home Equity to Buy Land

Before deciding if a home equity loan is right for you, weigh the advantages and drawbacks:

Pros

- Lower interest rates than alternatives like personal loans

- Fixed rates mean predictable monthly payments

- Interest may be tax deductible (consult a tax pro)

- Lenders may have lower qualification standards than other loans

Cons

- Risk losing your home if you default

- Must have substantial home equity already built up

- Land can decline in value, unlike homes in most cases

- Closing costs and fees apply

As you can see, while home equity loans offer nice perks, the risks are real. Make sure you’re comfortable putting your current home on the line before proceeding.

What to Consider Before Using Home Equity to Buy Land

If you’re thinking of buying land with a home equity loan, here are some important things to think through first:

-

How much land costs in your area – Pricing varies drastically across the country. Know your budget.

-

What you’ll use the land for – Do you have plans to build right away or hold it as an investment? Different uses may change what kind of financing works best.

-

Additional costs – Land surveys, title searches, permits and more can add up. Account for these.

-

Future construction costs – Buying land is step one, building is step two. Make sure you’ll have enough equity leftover.

-

Your equity amount – Home equity loans typically let you borrow up to 85% of your equity. Will that be enough for the land and future building?

Research these factors to determine if a home equity loan is your best move.

Is Land a Good Investment?

Whether land is a wise investment depends on several factors:

-

Location – Land values vary greatly based on desirability of the area. Remote parcels won’t appreciate as quickly.

-

Use cases – Land with utilities, zoning approval and nearby amenities holds more value.

-

Future development costs – Raw land will need a lot more money put into it before it can be used, eating into profits.

-

Market conditions – Local real estate trends impact land values just like homes.

As a general rule, land in developing and high-demand areas near schools, shopping, and other conveniences offers better return potential. But there are never guarantees with real estate investing.

If using a home equity loan, which puts your current home at risk, make sure you have a solid business plan and purpose for the land beyond just speculation.

Alternative Ways to Finance a Land Purchase

Beyond home equity loans, a few other options exist for financing land:

-

Land loans – Designed specifically for buying plots of land. Tend to require 20-35% down and have shorter repayment terms.

-

Construction loans – Short-term financing for building costs. Can cover land purchase as part of the project costs.

-

Personal loans – Higher rates but more accessible for those with limited home equity. Good for smaller land parcels.

-

Seller financing – In some cases, sellers may directly finance a land sale for a buyer. This avoids bank loans altogether.

Each option has pros and cons. Shop around and compare terms to choose the right loan for your situation.

What is a Land Equity Loan?

A land equity loan is a loan using land as the collateral rather than your home. This may make sense once you already own land and want to buy an adjacent parcel or make improvements. The equity in the land you already own backs the debt.

Land equity loans allow you to avoid putting your home at risk. And you may qualify for better rates and terms than other land financing options since the land itself secures the loan. There are also land equity lines of credit available which function like home equity lines.

The amount you can borrow depends on the equity built up in the land you already own. And as with home equity loans, you risk losing the land if you default on a land equity loan.

Key Takeaways on Using Home Equity to Buy Land

-

A home equity loan lets you tap equity in your current home to fund a land purchase. This comes with risks, so proceed carefully.

-

Consider costs beyond just the land price, and be sure you’ll have enough equity to also finance future building.

-

Research land values and trends in the area you’re looking to buy. Not all land makes a good investment.

-

Compare home equity loans to alternative financing like land loans and construction loans before deciding.

-

If you already own land, a land equity loan lets you use the equity in it to buy more land or make improvements.

While creative financing is needed to buy vacant land, don’t rush into using home equity without giving the decision proper weight. And always speak to a financial advisor and real estate attorney before making major financing decisions like taking out a home equity loan.

What to consider before buying land with home equity

Before using home equity to buy land, consider what you’ll use the land for. Residential land sales represent about one-quarter (24 percent) of all U.S. land sales overall, but can approach close to half (42 percent) in some regions, like the southern East Coast, according to the latest “Land Market Survey” by the National Association of Realtors and Realtors Land Institute, released this past March.

Then there’s the value of the land itself. As noted by the U.S. Bureau of Economic Analysis, land values vary drastically across the U.S. depending on location (for example, rural versus urban), proximity to facilities, local market conditions and other factors. Those looking to build a home are likely looking for developed or improved land that’s already connected to main utilities and roads. Developed land is generally more costly than raw land.

Finally, there’s how much money you need. Many other expenses exist beyond the price tag of the land, including a land survey and title search. And of course, the costs to build a home once you’ve purchased the land it’ll sit on.

All of these can be paid for with a home equity loan, but you’d need a substantial ownership stake to cover everything involved in the land purchase and construction. And don’t forget the maximum you can borrow with a home equity loan is typically no more than 85 percent of your equity (sometimes just 80 percent). It might not be enough, in other words.

The highest land value per acre is in New Jersey. The lowest is in Wyoming.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

- You may be able to use a home equity loan to secure a loan to buy — and potentially improve — a plot of land.

- A home equity loan might offer better terms and interest rates than other financing options, such as construction, land or personal loans.

- However, you’d need substantial equity in your home to cover all the costs of the land purchase and construction of a home.

Given the current shortage of housing inventory, many would-be homeowners are thinking harder about buying land and building a house on it. But purchasing a parcel for new construction isn’t as straightforward as purchasing an existing home, especially when it comes to financing. While a regular mortgage is not an option, there are loans that can help cover the cost of a land purchase, including a home equity loan.

Let’s talk about how to buy land using home equity.

Use the Equity In Your Home to Purchase Land & Other Difficult to Finance Properties

FAQ

Is it smart to use home equity to buy land?

Is it hard to get equity loan on land?

How do I borrow against property equity?

What is a HELOC vs. home equity loan?