Securing a loan when you already have a high debt-to-income ratio (DTI) can be challenging, but its not impossible. Whether youre looking to consolidate existing debt, fund a major purchase, or cover unexpected expenses, understanding how to navigate the lending landscape with a high DTI is essential. Let’s explore strategies and solutions to help you obtain a loan even with a high debt burden…

Your debt-to-income (DTI) ratio compares your monthly debt payments to your monthly gross income. The higher this ratio, the more difficult it can be to qualify for loans, including personal loans. But options exist even if your DTI exceeds lender limits. This guide covers getting personal loans with a high DTI ratio.

What is Considered a High DTI Ratio?

Lenders view DTI ratios above 43% as high for most loans. However personal loan providers may set lower DTI limits since the loans are unsecured.

As a general guideline

-

36% DTI or lower – Considered good by most personal loan lenders

-

36-43% – Acceptable to some lenders but may trigger higher rates or fees

-

Over 43% – Generally leads to personal loan denials from mainstream lenders

The maximum DTI tolerated depends on the lender. Having a ratio above 50% makes approval very difficult unless you find a specialized lender.

Why is DTI Ratio Important for Personal Loans?

Lenders analyze DTI to gauge borrowers’ ability to make monthly payments. A high ratio means you have less income left over after covering existing debts and bills. This raises questions about whether you can afford additional debt.

Since personal loans are unsecured, lenders rely heavily on DTI analysis versus collateral for repayment confidence. That’s why many set conservative DTI limits.

What are Some Options for Personal Loans With High DTIs?

If your DTI is above 43%, here are some options to get approved:

-

Use a cosigner – Add someone with better credit to strengthen the application.

-

Offer collateral – Put up an asset, like a car title, to secure the loan.

-

Work with subprime lenders – Specialize in riskier borrowers but charge higher rates.

-

Try peer-to-peer lending – Individual investors may accept higher DTIs.

-

Build your credit – Improve your scores to qualify for lower rates.

-

Pay down debts – Reduce your DTI by paying down balances before applying.

Shopping with subprime, alternative, and online lenders can help find more flexible DTI requirements.

7 Lenders to Consider for High DTI Personal Loans

These 7 personal loan providers may approve borrowers with DTIs over 43%:

-

OneMain Financial – No strict DTI limits. Avg APR 59%

-

LendingPoint – Uses alternative data for high DTI approvals. Avg APR 32%

-

NetCredit – Custom lending criteria. Prequalify online. Avg APR 34%

-

LendingClub – Peer-to-peer loans. Individual investors review. Rates 7-35%

-

Upgrade – Custom DTI limits. Prequalify without credit check. Rates 6-35%

-

Avant – Uses alternative data for approvals. Avg APR 9-35%

-

Payoff – Focuses on high debt consolidators. Fixed rates 15-25%

Research lenders thoroughly. Compare estimated rates, fees, and terms before applying.

What’s the Minimum Credit Score for High DTI Personal Loans?

Most lenders require minimum credit scores between 580 and 640 for unsecured personal loans. But specialized lenders may approve scores in the 500s if your DTI exceeds limits.

The lower your credit score, the higher your interest rate will likely be. Weigh the costs carefully before accepting a personal loan with a high rate.

Do these Lenders Offer Bad Credit Personal Loans?

Many lenders approving high DTIs will also work with bad credit borrowers. Having past credit issues on top of a high DTI presents extra challenges. But bad credit personal loans are still possible in some cases.

Lenders focused on high-DTI borrowers analyze alternative data like income, assets, and payment history. This helps offset the risks of weak credit.

Just know that low credit scores combined with elevated DTI will result in much higher rates and stricter loan caps. If possible, spend time improving your credit before applying.

Should I Get a Personal Loan With a High DTI Ratio?

Ask yourself these questions before pursuing a personal loan with an already high DTI:

-

Can I afford the payments? Don’t overextend yourself further. Make sure you can make the monthly payments comfortably.

-

Will the loan help or hurt my finances? If used wisely for debt consolidation, a personal loan can potentially help. But more debt could dig your hole deeper.

-

Have I optimized my budget? Reduce unnecessary spending wherever possible to improve your DTI.

-

Can I improve my credit first? Building your score before applying may result in better loan offers.

-

Are there alternatives? Explore options like balance transfer cards, 401k loans, or family loans.

If you do proceed, use personal loan funds responsibly to avoid worsening your debt situation.

Tips for Lowering Your DTI to Qualify for Better Rates

To reduce your DTI and qualify for affordable personal loan offers, take these steps:

-

Pay down credit card and loan balances below 30% of limits

-

Pay off small debts in collection one by one

-

Stick to a tight budget minimizing discretionary spending

-

Request credit limit increases on cards to lower utilization

-

Have co-borrowers with better credit apply with you

-

Build your score by responsibly using secured cards or credit builder loans

-

Boost income with a side gig, promotion, new job, or overtime hours

-

Refinance high-rate debts for lower monthly payments

The lower you can get your DTI, the better personal loan terms you can qualify for.

Alternatives to High-DTI Personal Loans

If your DTI is too high for a reasonable personal loan, other options include:

-

0% balance transfer credit cards to save on interest

-

Borrowing from friends, family, or employer at lower rates

-

401k or pension loans if allowed by your plan

-

Debt management plans through non-profit credit counseling

-

Debt consolidation with home equity loan or cash-out refinance

-

Low-interest bank/credit union loans with relationship discounts

-

Debt settlement programs for negotiating reduced balances

-

Chapter 7 or 13 bankruptcy to eliminate unsecured debts

Weigh the pros and cons of each option for your unique situation. Non-loan alternatives may provide cheaper relief.

Key Takeaways on High-DTI Personal Loans

While approval is harder, you can still receive a personal loan with a high debt-to-income ratio in many cases. Just remember:

-

Shop specialized lenders open to higher DTIs like peer-to-peer platforms.

-

Be prepared for higher rates and stricter loan caps than low-DTI borrowers receive.

-

Improving your credit score and income will result in better loan offers over time.

-

Make sure you can truly afford the payments and avoid worsening your debt situation.

-

Consider alternatives like balance transfers, borrowing from family, or debt management plans.

With prudent research and realistic expectations, a high DTI personal loan can serve as a financial lifeline if used carefully.

Understanding the Impact

Lenders use DTI to assess your financial risk and determine your eligibility for a loan. A high DTI suggests that a significant portion of your income is already allocated to debt payments, which may make you a higher risk borrower. As a result, a high DTI can make it more difficult to qualify for loans, as lenders may be hesitant to extend credit to individuals with already strained financial circumstances.

Understanding Debt-to-Income Ratio

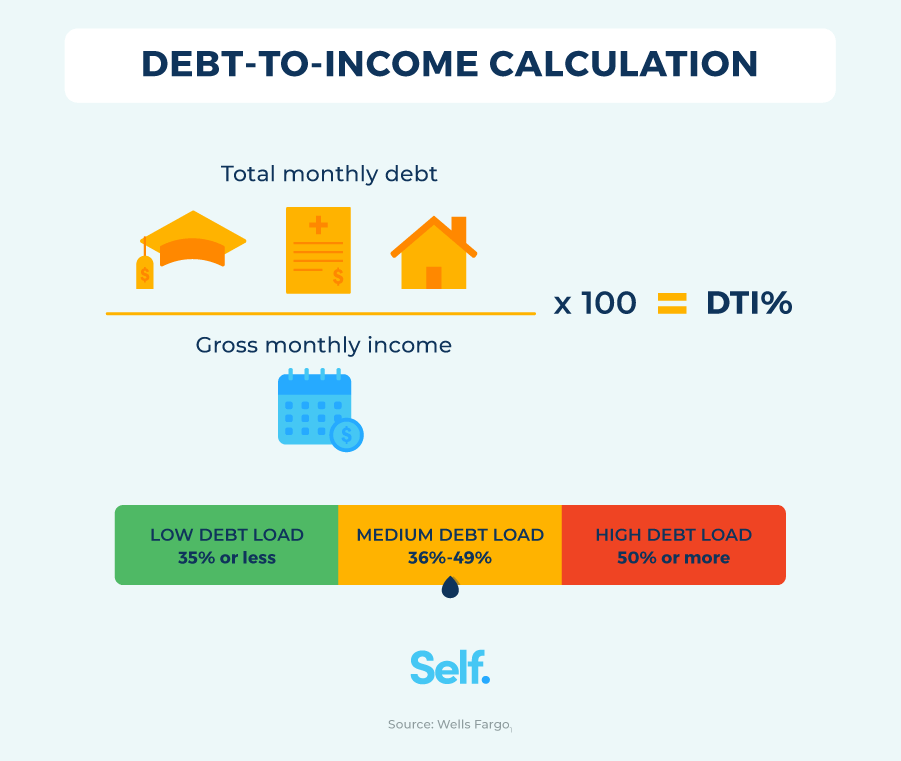

DTI is a financial metric that compares your monthly debt payments to your gross monthly income. Its expressed as a percentage and provides lenders with insight into your ability to manage additional debt obligations. To calculate DTI, divide your total monthly debt payments by your gross monthly income and multiply by 100. For example, if your total monthly debt payments are $2,000 and your gross monthly income is $5,000, your DTI would be 40% (2000 / 5000 * 100).

$35000 Low Income Loans High Debt To Income Ratio | Low Credit Score Loans

FAQ

Can I get a loan with a high debt-to-income ratio?

What is the maximum debt-to-income ratio for a personal loan?

What is the 28 36 rule?

What is too high for debt-to-income ratio?

What is a good debt-to-income ratio for a personal loan?

DTI requirements vary by lender and loan product. For example, mortgage lenders typically require a DTI under 43%. The maximum debt-to-income ratio for a personal loan typically is 50%, but you’ll have the best chance of qualifying for a loan with competitive rates if your debt-to-income ratio is lower than that.

Can you get a loan with a high debt-to-income ratio?

A high DTI, on the other hand, suggests a higher level of debt relative to income and may raise concerns about an applicant’s ability to manage further debts. Even if you have a high debt-to-income ratio, there are still loans you could qualify for. Below are some types of high debt-to-income ratio loans that could be accessible to you.

What does a high debt-to-income ratio mean?

A high DTI means that more of your money already goes towards debt repayment. A low DTI ratio indicates that you have more money available. To lenders, a low debt-to-income ratio demonstrates a good balance between debt and income. The lower the percentage, the better the chance you will be able to get the loan or line of credit you want.

Why do Lenders look at debt-to-income ratios?

Lenders look at debt-to-income ratios because research shows borrowers with high DTIs have more trouble making consistent payments. Each lender sets its own DTI requirement, but not all creditors publish them. Generally, a personal loan can have higher allowable maximum DTI than a mortgage. » MORE: Understanding debt-to-income ratio for a mortgage