We are an independent, advertising-supported comparison service. Our mission is to empower you to make more informed financial decisions by giving you access to interactive tools and financial calculators, publishing original and unbiased content, allowing you to conduct free research and information comparisons, and publishing original and objective content. Partnerships between Bankrate and issuers like American Express, Bank of America, Capital One, Chase, Citi, and Discover are just a few examples.

How We Make Money

The offers that show up on this website are from businesses that pay us. This compensation may have an effect on the placement of products on this website and other factors, such as the order in which they may appear within listing categories. However, the information we publish or the user reviews you see on this website are unaffected by this compensation. We exclude the full range of businesses and financial opportunities that may be available to you.

At Bankrate, we work to guide you toward making more informed financial decisions. Although we follow strict guidelines, this post may mention products from our partners. Heres an explanation for . Bankrate logo.

Bankrate, which was established in 1976, has a long history of assisting people in making wise financial decisions. By demystifying the financial decision-making process and empowering people to know what to do next, we’ve maintained this reputation for more than 40 years.

You can trust that Bankrate adheres to a strict editorial policy and is acting in your best interests. Our content is written by highly qualified professionals, and it is edited by specialists in the fields in which it is published, ensuring that it is impartial, truthful, and reliable.

Our home equity reporters and editors concentrate on the topics that matter most to consumers, such as the most current rates, the top lenders, various home equity options, and more, so you can be confident in the decisions you make as a borrower or homeowner. Bankrate logo.

You can trust that Bankrate adheres to a strict editorial policy and is acting in your best interests. Our esteemed editors and reporters produce truthful and accurate content to assist you in making wise financial decisions.

We value your trust. Our editorial standards are in place to ensure that we fulfill our mission of giving readers accurate and unbiased information. To make sure the information you’re reading is accurate, our editors and reporters conduct extensive fact-checking on editorial content. Our editorial team and advertisers are separated by a wall that we uphold. Our editorial staff does not get paid directly by our advertisers.

The editorial staff at Bankrate writes on behalf of YOU, the reader. Our aim is to provide you with the best guidance so that you can make wise decisions regarding your personal finances. To prevent advertisers from influencing our editorial content, we adhere to strict guidelines. Our editorial staff is not paid directly by advertisers, and all of our content is meticulously fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can be sure that the information is reliable and trustworthy. Bankrate logo.

How we make money

You have money questions. Bankrate has answers. For more than 40 years, our experts have been assisting you in becoming financially savvy. We continuously work to give customers the knowledge and resources necessary to be successful in their financial endeavors.

You can rely on Bankrate’s editorial standards to produce truthful and accurate content. Our esteemed editors and reporters produce truthful and accurate content to assist you in making wise financial decisions. Our editorial team produces factual, unbiased content that isn’t influenced by our advertisers.

We are open and honest about how we earn money in order to provide you with high-quality content, affordable prices, and practical tools.

Bankrate. com is an independent, advertising-supported publisher and comparison service. We receive payment in exchange for the placement of sponsored goods and services on our website or when you click on specific links there. As a result, this compensation may affect the placement, timing, and order of products within listing categories. A product’s availability in your area or within your self-selected credit score range, among other things, may have an impact on how and where it appears on this site. Bankrate does not provide information on every financial or credit product or service, despite our efforts to do so.

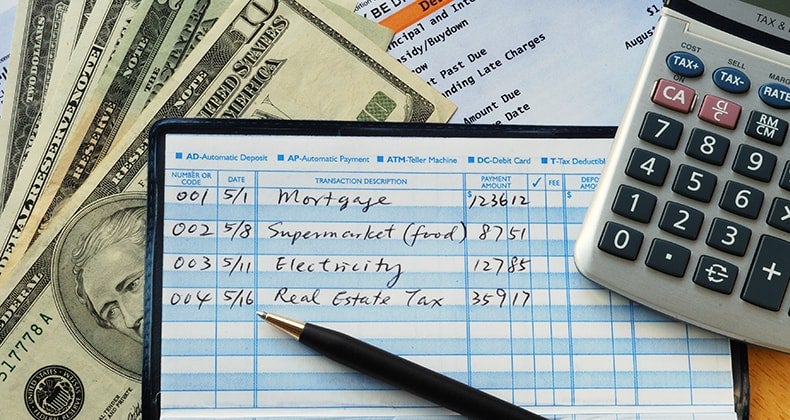

Home equity loans and home equity lines of credit (HELOCs) are two ways to borrow money using the equity in your house. A home equity loan is a lump sum paid back in fixed installments, whereas a HELOC is a line of credit with a variable interest rate. Both typically let you borrow up to 85% of the value of your house less the balance of any outstanding mortgages.

What is a home equity loan?

With a home equity loan, which is a secured loan with a fixed interest rate and repayment term of typically up to 30 years, you can borrow a specific amount against your equity. Your credit score, payment history, loan amount, and income all affect the interest rate.

You decide how to use the funds from a home equity loan. Some people employ it to pay for significant upkeep or remodeling projects, such as building an addition, gutting and remodeling a kitchen, or modernizing a bathroom. Some people take out a lower-interest, fixed-rate home equity loan to pay off high-interest credit card debt.

Pros of a home equity loan

Cons of a home equity loan

What is a home equity line of credit?

A HELOC, or home equity line of credit, is a credit limit based on the amount of equity in your house. A HELOC, as opposed to a home equity loan, has a variable interest rate, which means that it may rise or fall along with your monthly payments at predetermined intervals. Some HELOCs have low introductory rates for a while (for instance, six months), after which they switch to higher but still variable rates.

Similar to a credit card, a HELOC is a revolving line of credit that allows you to borrow money, use it, and then pay it back. However, you can only use the money during the draw period, which is typically 10 years. You might only have to pay interest during this period. You’ll have a certain amount of time after the draw period is over to pay back the money you borrowed plus interest, typically up to 20 years.

Pros of a HELOC

Cons of a HELOC

How do I choose between a home equity loan and a HELOC?

Both options have benefits, but if you know exactly what you’ll do with the money and don’t need much flexibility, a home equity loan might be a better option. If you prefer a fixed interest rate and constant monthly payment, a home equity loan might be a better option.

However, if you want to borrow as little or as much as you want, whenever you want, have upcoming expenses like college tuition and don’t want to borrow until you’re ready, and don’t mind if your payment fluctuates, a HELOC may be a better option.

Can you have a HELOC and a home equity loan?

The number of home equity loans or lines of credit you can have at once is theoretically unlimited, but as your equity decreases, it will become more difficult for you to qualify for each new loan.

For example, if your home is worth $500,000 and you have two home equity loans totaling $425,000, you have already borrowed 85% of its value, which is the maximum allowed by many home equity lenders.

Additionally, a lender may charge higher interest rates for additional loans or credit lines, particularly if you request a second loan from them.

How does the Fed rate increase impact home equity products?

The prime rate, which is typically three percentage points higher than the fed funds rate, serves as the foundation for many lenders’ home equity product rates. Due to the Federal Reserve’s recent rate increases, home equity loans and HELOCs are now more expensive.

You do have some degree of certainty regarding borrowing costs if you’re looking for a home equity loan because the interest rates on these products are typically fixed. HELOCs, however, differ in that their interest rates are variable. Following Fed rate hikes could result in an increase in your monthly payments.

You can borrow money using your home equity with home equity loans and HELOCs, but they work differently. Think about why you need the money, how much you need, and whether you plan to borrow more money in the future. Once you’ve made a choice, repair your credit and shop around for the best interest rate.

FAQ

What is the difference between HELOC and home equity?

With a home equity loan, you can take out a one-time loan against the value of your house. An open line of credit can be requested by homeowners through a HELOC, which also leverages the equity in a home. Then, as required, you may borrow up to a fixed amount.

What is the downside to a HELOC?

Lack of discipline on the part of the borrower is one drawback of HELOCs. HELOCs make it possible for you to make interest-only payments throughout the draw period, making it simple to access cash without thinking about the potential financial repercussions.

How do you determine between HELOC and home equity loan?

A HELOC is typically a better option if you require long-term access to funds, while a home equity loan may be more suitable if you require funds for a significant one-time expense. You should also think about the potential effects on your finances of a fixed rate versus a variable rate.

Is there a better option than a HELOC?

If you know the exact amount you need for a fixed expense, a home equity loan is preferable to a home equity line of credit (HELOC). You desire debt consolidation but do not desire to open a new credit line and run the risk of incurring additional debt.