At Tidal Loans, we understand to become a successful real estate investor, flexibility is important. That is why we provide a wide range of quick and easy residential hard money loan options. We have a proven success rate for closing quickly, and we’re here to help make your next real estate project a success.

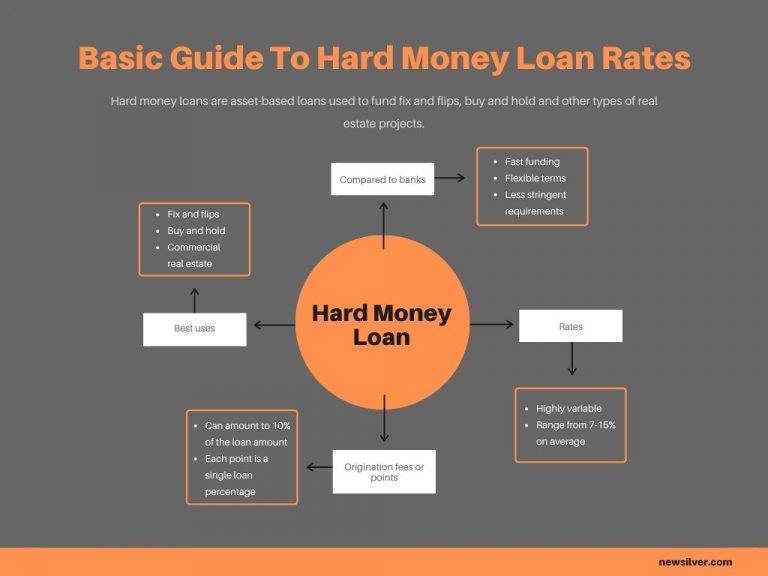

Hard money loans are a type of financing that can be useful for real estate investors or homeowners who need funds quickly and have trouble qualifying for traditional bank loans. However, these loans come with higher interest rates and costs compared to conventional mortgages. In this article we’ll break down everything you need to know about hard money loan rates and how they work.

What are Hard Money Loans?

Hard money loans are issued by private investors rather than banks or mortgage lenders The “hard” refers to the real estate or other asset used as collateral for the loan.

These loans are desirable for their quick process and flexible qualifying guidelines. Borrowers often use hard money loans for real estate investments like flipping houses or financing commercial property purchases.

The loan approval is based more on the property’s value rather than the borrower’s creditworthiness. This allows people who may not qualify for a traditional mortgage to still access financing, albeit at a higher cost.

Hard Money Loan Interest Rates

The biggest drawback of hard money loans is the higher interest rates charged. Rates for hard money loans can vary, but the average interest rate is generally between 10% and 18%, which is significantly higher than a conventional loan.

On top of that, other costs are often associated with these types of loans, including points and origination fees ranging from 2% to 6%.

Here’s a breakdown of typical hard money loan rates:

- Interest rates: 10% – 18%

- Points: 2% – 6% of the loan amount

- Origination fees: 2% – 5% of the loan amount

So on a $200,000 hard money loan with a 15% interest rate, 3 points, and a 3% origination fee, the costs would be:

- Interest rate: 15%

- Points: $6,000 (3% of $200,000)

- Origination fee: $6,000 (3% of $200,000)

The higher rates and fees are how private hard money lenders offset the increased risk of lending to borrowers who may not qualify for conventional financing.

Rates can vary depending on the lender, loan amount, location, collateral, and loan-to-value ratio. Generally the higher the LTV, the higher the rate.

Comparing to Conventional Loan Rates

To understand just how much more expensive hard money loans are, let’s compare them to current conventional mortgage rates.

The average 30-year fixed mortgage rate is around 7% as of August 2022. Fifteen-year fixed rates are lower, around 6%.

On a $200,000 30-year loan at 7%, the monthly principal and interest payment would be around $1,331.

Compare that to a $200,000 hard money loan at 15% interest and the monthly P&I jumps up to $2,297 – a $966 difference per month!

Clearly, the interest savings on a conventional loan make a significant impact on affordability. Hard money loans can cost tens of thousands more in interest over the life of the loan.

What Impacts Hard Money Loan Rates?

Several factors determine the interest rate and costs on a private hard money loan:

Loan-to-Value (LTV) Ratio – The LTV compares the loan amount to the appraised property value. The lower the LTV, the lower the rate since the lender assumes less risk.

Credit Score – While credit isn’t weighed as heavily, a higher score can still mean a better rate.

Collateral Type – Loans on residential properties tend to have lower rates than commercial real estate. Unique or distressed properties may also have higher rates.

Loan Term – Shorter loan terms often correlate with lower rates. Hard money loans usually have terms of 1-3 years.

Location – Properties in desirable markets are seen as lower risk.

Loan Purpose – Loans for fix-and-flips carry more risk and higher rates.

Prepayment Penalties – Agreeing to penalties can reduce rates.

Points & Fees – Paying points upfront may secure a better interest rate.

Lender Relationship – Having an established relationship with a lender can result in better pricing.

Pros and Cons of Hard Money Loans

Before taking out a hard money loan, weigh the advantages against the higher cost:

Pros

- Fast approvals, often in days

- Based on collateral value rather than credit

- Option for those who can’t get a traditional mortgage

- Flexible terms and qualifying guidelines

Cons

- Interest rates from 10% – 18%

- Points and origination fees add to costs

- Usually require 20%-30% down payment

- Short repayment terms of 1-3 years

- Prepayment penalties may apply

For many real estate investors, the speed and convenience make it worthwhile despite the higher rates and costs. But less experienced borrowers risk getting in over their heads with these loans.

It’s critical to have a profitable exit strategy and realistic timeline before taking on a hard money loan.

Alternatives to Hard Money Loans

Here are a few options that may provide better rates and terms than a hard money loan:

- FHA loan – Requires just 3.5% down and has more flexible qualifying.

- Family loan – Borrow from family or friends at agreed upon terms.

- Home equity loan – Tap equity on an existing home if you have substantial equity.

- Credit card cash advance – A very last resort due to sky-high rates!

Questions to Ask Hard Money Lenders

If you do opt to apply for a hard money loan, ask these questions upfront to compare options:

- What is your minimum credit score requirement?

- What is the maximum LTV you will lend?

- How much are points and origination fees?

- Do you charge prepayment penalties?

- What is the interest rate on my specific loan scenario?

- What is the loan term you can offer?

- How long does the approval process take?

Shopping around with multiple hard money lenders can help you secure the best possible rate and terms. Just be sure to compare the true total costs, not just the interest rate.

The Bottom Line

Hard money loans fill a niche for real estate investors who need quick financing but don’t qualify for conventional mortgages. However, these loans charge interest rates ranging from 10% – 18% and levy high origination fees.

Carefully assess your exit strategy before taking on a hard money loan, as the short repayment terms and high costs can be risky. Examine all your options and ask lenders key questions to find the best loan program.

TEMP TO PERM LOAN

Are you looking to buy a “fixer-upper” rental property? At Tidal, our loans can help you acquire and renovate your investment property with ease, while helping you secure your permanent financing.

This loan provides developers, builders and general contractors the needed funds to build an investment property under market value.

So, you found the perfect real estate investment property you want to hold as rental investment. You got a sweet deal on the property, executed the contract, called us at Tidal Loans for a hard money rehab loan.

SHORT TERM RENTAL FINANCING | AIRBNB LOANS

Managing an Airbnb property has become increasingly prevalent as travelers frequently seek more relaxed and inexpensive accommodations while on vacation. Airbnb, Vrbo, etc has become exceedingly popular and continues to present profitable prospects for short term real estate investors looking to diversify their portfolio.

Hard Money Lenders Explained – How To Properly Find & Utilize Them

FAQ

What is a typical interest rate for a hard money loan?

What are typical terms for a hard money loan?

What are the hard money loans interest rates in 2024?

Are hard money lenders worth it?

What is the average interest rate on a hard money loan?

Let’s compare hard money loan interest rates to traditional loan rates. In August 2023, the average rate on a conventional 30-year fixed-rate mortgage was 7.09%, according to Freddie Mac. Hard money loans have much higher interest rates, typically around 8% – 15%.

Why do hard money loans have higher interest rates?

Due to the risky nature of hard money loans, the interest rates are higher than traditional mortgages. The actual interest rate may also change based on the property type, borrower’s credit score, and the use of the loan. For example, a fix-and-flip loan will almost always have a higher interest rate than a rental property.

What is a hard money loan?

Hard money loans are secured, short-term loans often used to finance a home purchase. Real estate investors commonly rely on hard money loans to manage multiple flip projects. Hard money loans deliver cash quickly but at a higher interest rate compared to other types of financing. Hard money loans are a way of borrowing funds over the short term.

Why is a hard money loan a risky loan?

High interest rates: Because the lender isn’t taking your credit score into account, the loan is considered riskier and earns a higher interest rate than other loan types. Lower loan-to-value (LTV): In a hard money loan, you may be able to borrow up to only 75% of the asset’s value.