Hard money loans can be useful financial solutions for real estate investors, particularly those doing fix and flip projects. Let’s take a look at a hard money loan example so that you can see how hard money works and what the main costs associated with hard money loans are.

Hard money loans can be a great alternative to traditional loans and mortgages because they offer fast funding, with less stringent lending criteria. If you’ve never used a hard money loan before, we’ll take you through the process step by step, by showing you two examples and explaining how hard money loans work and what you can expect.

Hard money loans are becoming an increasingly popular financing option for real estate investors and other borrowers who don’t qualify for traditional bank loans. Unlike conventional mortgages which can take weeks or months to close, hard money loans can provide funding in as little as a few days. This speed and flexibility comes from working with private lenders rather than big banks

However, this fast process means that hard money loans come with their own unique set of paperwork and legal requirements that borrowers need to understand. The hard money loan contract lays out the specific terms, interest rates, fees, repayment schedule and other important details of the private loan agreement.

In this comprehensive guide we’ll explain everything you need to know about hard money loan contracts so you can enter into your private lending deal prepared and protected.

What is a Hard Money Loan Contract?

A hard money loan contract is a legal financing agreement made between a borrower and a private lender. It specifies the loan amount, interest rate, length of the loan term, repayment schedule, fees, and other key details of the hard money deal

Unlike personal loans between family and friends, hard money contracts are binding legal documents enforced by the courts if either party violates the terms. Having a written hard money loan agreement protects both the lender and borrower in case disagreements arise.

These agreements vary from lender to lender, but generally include sections addressing:

-

Loan amount: The principal amount being borrowed.

-

Interest rate: The annual interest charged on the borrowed funds, typically ranges from 7% to 15%.

-

Loan term: The length of time until the full loan amount plus interest is due, often 6-18 months.

-

Amortization: The schedule of equal installment payments to pay down the loan over the term. Hard money loans are usually interest-only paid monthly.

-

Prepayment: Terms if borrower pays off the loan early. Often includes a penalty fee.

-

Late fees: Extra fees if the borrower misses or is late on a payment, usually around 5% of the missed payment amount.

-

Loan extension terms: Conditions if the borrower requests extra time to repay the loan.

-

Collateral: The property or asset being used to secure the hard money loan.

-

Loan-to-value (LTV) ratio: The percentage of the total property value being borrowed. Hard money loans often fall between 50% – 75% LTV.

-

Points/origination fees: Upfront fees lenders charge to arrange and process the loan, typically 2-5% of the loan amount.

-

Exiting the loan: Requirements for repaying the loan in full and releasing the collateral lien.

Why Hard Money Loan Contracts Matter

You might be tempted to just verbalize or loosely email the details of your hard money loan, especially if you’re working with a friend or family member as the lender. However, solid written contracts are crucial to protecting both the lender and borrower. Here are some key reasons hard money contracts are important:

-

Legally binding: Oral agreements are difficult to prove in court. The signed contract provides legal evidence of the loan terms.

-

Define clear repayment terms: The contract prevents confusion by making the loan amount, interest, payment schedule, and payoff date clear.

-

Outline lender remedies: If the borrower defaults, the lender has legal standing to exercise remedies like foreclosing or attaching liens.

-

Protect against liability: A contract shows the lender performed due diligence in making the loan, which helps avoid potential liability if the deal goes bad.

-

Tax implications: The IRS requires proper documentation of loans or it could see the funds as income.

-

Enforce loan extensions or modifications: Any changes to the original loan can be enforced by referring to the initial contract.

Having a solid hard money loan contract in place provides security to both the private lender and the borrower that each party will uphold their end of the deal.

Key Sections of a Hard Money Loan Contract

Hard money contracts contain many standard sections similar to conventional mortgages, but with terms tailored specifically to these short-term, high-cost private loans. Here are some of the most important sections to be familiar with:

Loan Amount and Disbursement

This section states the total principal amount being loaned to the borrower. It also explains the timing, requirements, and method for the lender providing the funds. Often the lender will schedule an initial disbursement of a portion of the funds, with the remainder provided once repairs or other requirements are completed.

Interest Rate, Payments, and Late Fees

A key section of the contract is the interest rate being charged, the total monthly payment, and payment due dates. It also specifies policies if the borrower is late on payments, such as a set late fee amount or increased interest rate after a grace period.

Loan Term and Payoff

The contract defines the length of the loan term and final maturity date when the borrower must repay the loan amount in full. It explains requirements for the borrower providing notice of intent to pay off the loan.

Prepayment Penalties

Most hard money loans include prepayment penalties if the borrower pays the loan off early. This compensates the lender for the loss of interest they expected to earn. The contract specifies the amount, often a percentage of the remaining loan balance.

Collateral

Hard money loans are asset-backed, so the contract pledges a property or other asset owned by the borrower as collateral for the loan. It grants the lender a lien against the collateral and right to assume ownership if the borrower defaults.

Loan-to-Value (LTV) Ratio

A section will state the LTV ratio, which is the percentage of the collateral asset’s value that is being borrowed. Hard money lenders often approve deals up to 65-75% LTV. The contract specifies requirements like appraisals to validate the property value.

Representations and Warranties

These statements assert facts like the borrower legally owns the home, has insurance, and that there are no other liens against the property. This protects lenders from unknowingly funding a fraudulent deal.

Common Contract Sections to Watch For

Some less common sections in hard money contracts deserve close attention as well:

-

Loan extension terms – Costs and procedures if the borrower needs more time to repay the loan after the initial term.

-

Callability – Ability for the lender to “call” the loan due immediately if certain conditions are violated, like missing a payment.

-

Due on sale clause – Requires the borrower to pay off the loan if they sell the property before maturity.

-

Points/origination fees – Upfront costs deducted from the loan funds disbursed to the borrower.

-

Personal guarantee – Holds the borrower personally liable beyond just the collateral for repaying the loan.

-

Recourse vs. nonrecourse – Whether lender can go after the borrower’s other assets if collateral property value falls below loan balance.

Who Provides the Hard Money Loan Contract?

Most private lenders already have their own standard hard money loan contract template they work from. However, contracts are open to negotiation so experienced real estate investors may request modifications to better suit their deal. Having an attorney review any contract before signing is highly recommended as well.

Borrowers should be sure to read the entire document closely and get clarification on any points that seem unfavorable or are unclear before signing. Know that negotiable items can include:

- Loan amount

- Interest rates

- Loan term length

- Prepayment penalties

- Late fees

- Callability

Can a Hard Money Lender Change the Loan Contract?

Yes, lenders can request changes to the loan contract, though both parties must agree in writing to any modifications to the original terms. Common reasons a lender may want to amend the contract include:

-

Extending the loan term – If the borrower needs more time to finish the project or repay the loan, the lender could agree to push out the maturity date in exchange for points, higher interest, or other concessions.

-

Altering disbursement schedule – Disbursing less upfront and tying remaining funds to completion of repairs protects lenders from cost overruns.

-

Increasing interest rate – If the market shifts, the lender may request a higher interest rate from what was originally stated.

-

Revising late fee amounts – Lenders can stipulate steeper late fees if a borrower chronically pays past the grace period.

Any amendments to the hard money loan contract should be added as formal addendums with new signatures from both parties. Verbal side-deals are hard to legally enforce.

Mistakes to Avoid With Hard Money Loan Contracts

Because hard money loans move so quickly, it’s easy to gloss over sections of the contract you don’t fully understand. But small details can come back to haunt borrowers. Be sure to avoid these common mistakes:

- Not recording the collateral lien properly

- Missing balloon payment provisions that require a large lump sum payment

- Overlooking prepayment penalties

Hard Money Loan Example 1 – $100,000 Loan

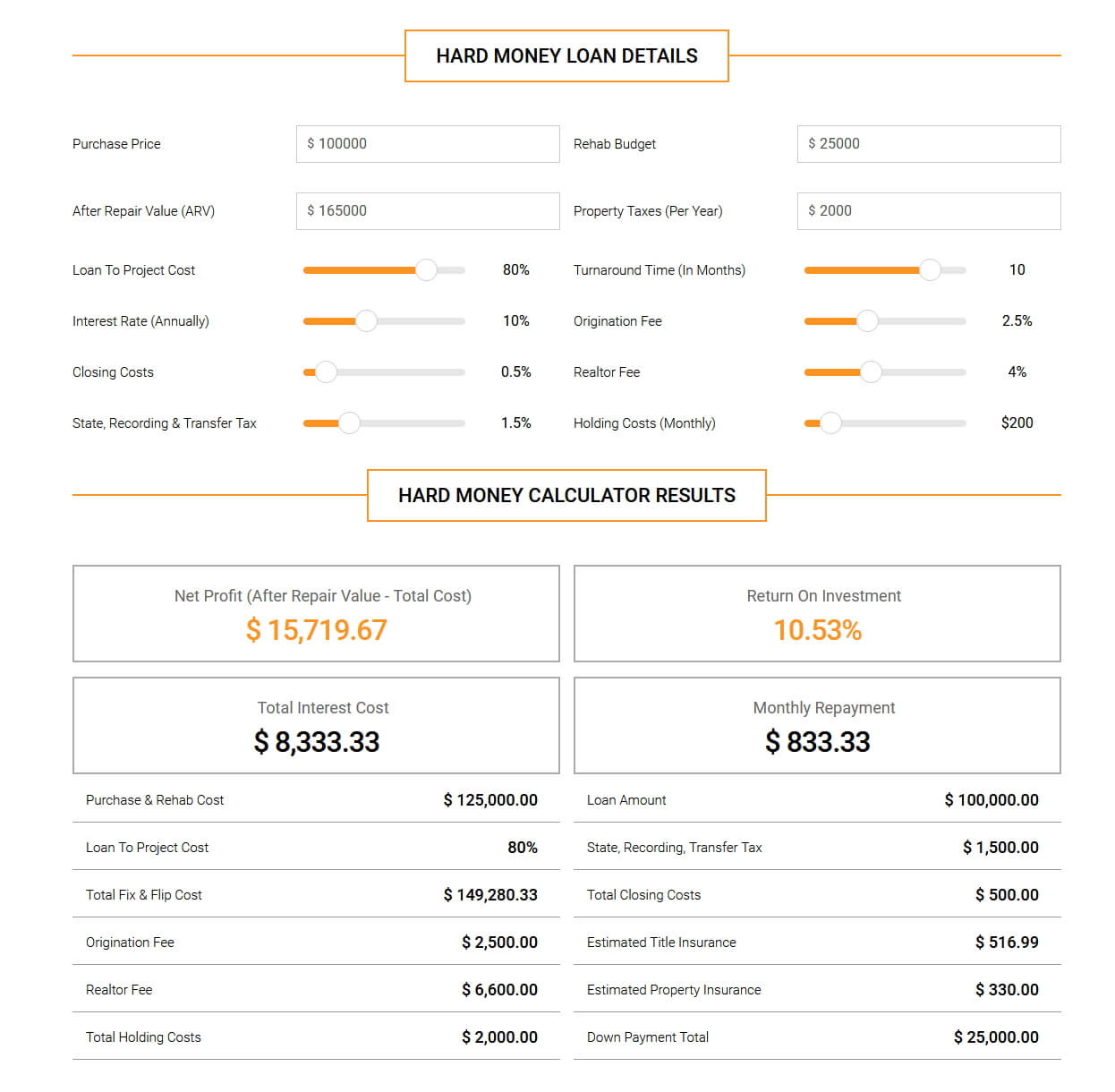

For our first example, we’ll look at a $100,000 hard money loan with a 10% interest rate, taken over 10 months. We’ve used the New Silver Hard Money Loans Calculator to give you an idea of the information you’ll need to input to work this out, and how this calculation looks. For this deal, the return on investment is estimated to be 10.53%, based on a Net Profit of $15,719.67.

To Work Out the Net Profit, you simply take the After Repair Value (ARV), and deduct the total cost of completing the house flip.

At a higher level you are taking the total income and deducting the total expenses to workout how much money you are likely to make.

In this example:

- Net Profit = $165,000 (ARV) – $149,280.33 (Total Fix & Flip Cost)

- Net Profit = $15,719.67

In this example, the Loan Amount is $100,000.00. This number represents 80% of the Project Cost.

- Loan Amount = (Purchase Price + Rehab Budget * 80%)

- Loan Amount = ($100,000.00 + $25,000) * 0.8

- Loan Amount = $125,000.00

The monthly repayment of $833.33 is based on the loan amount of $100,000.00 and the interest rate of 10%. You work out the monthly interest rate by multiplying the loan amount by the interest rate, and then dividing by 12.

- Monthly Repayment = $100,000.00 * 0.1 / 12

- Monthly Repayment = $833.33

To calculate the total interest paid, multiply the monthly interest payment by the number of months that the loan is active (turnaround time).

- Total Interest Paid = Monthly Interest Payment x Turnaround Time In Months

- Total Interest Paid = $8,33.33 * 10 Months

- Total Interest Paid = $8,333.33

With most hard money loans, a down payment is needed to secure the deal. The down payment is the shortfall between the project cost and the loan amount provided.

- Down Payment = Purchase Price + Rehab Budget – Loan Amount

- Down Payment = $100,000.00 + $25,000.00 – $100,000.00

- Down Payment = $25,000.00

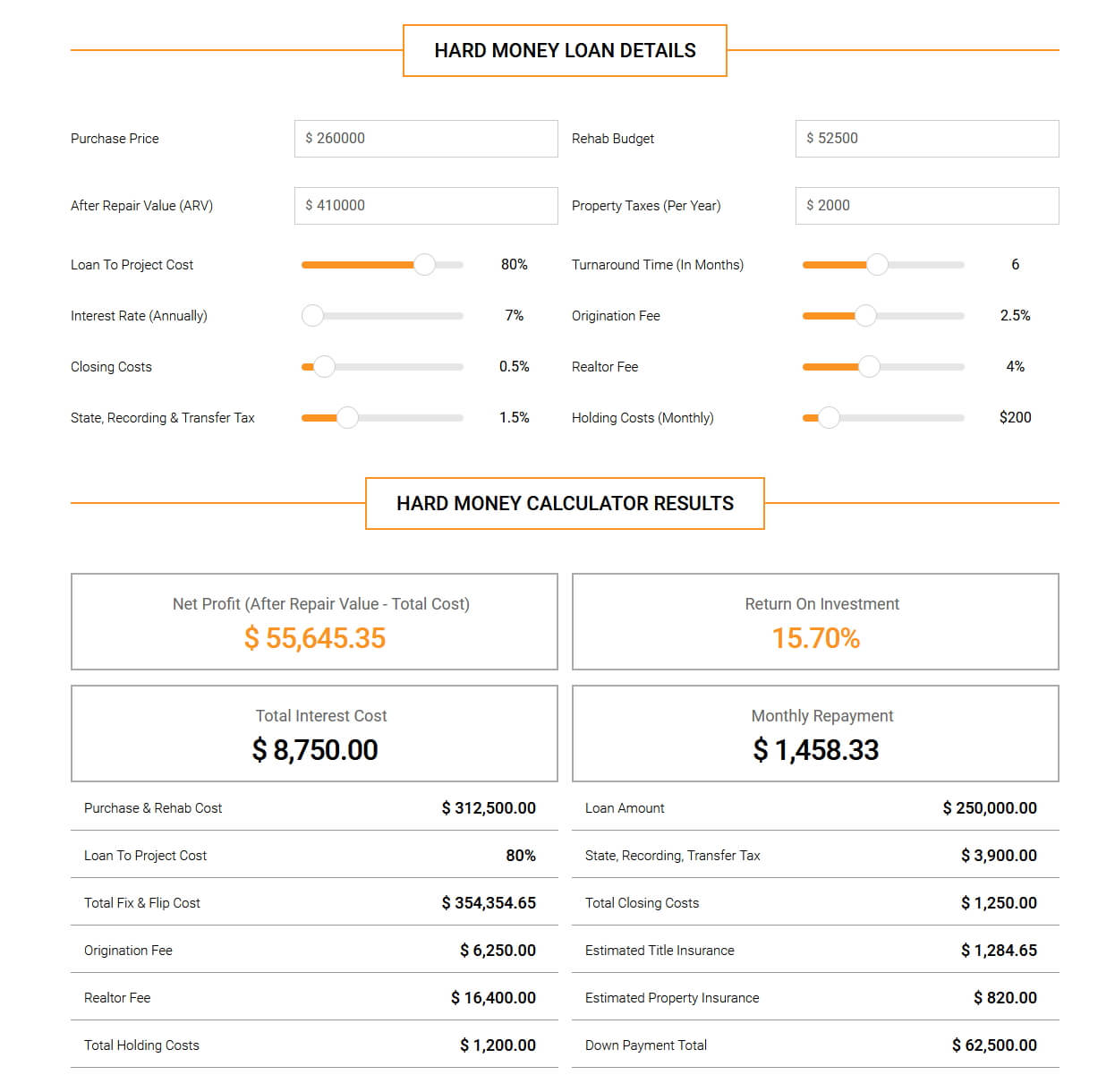

Hard Money Loan Example 2 – $250,000.00

For the next example we’ll use a $250,000 hard money loan with 7% interest rate and a project turnaround time of 6 months.

- Net Profit = $410,000 (ARV) – $354,354.65 (Total Fix & Flip Cost)

- Net Profit = $55,645.35

- Loan Amount = ($260,000.00 + $52,500) * 0.8

- Loan Amount = $250,000.00

- Monthly Repayment = $250,000.00 * 0.07 / 12.

- Monthly Repayment = $1,458.33

- Total Interest Paid = $1,458.33* 6 Months

- Total Interest Paid = $8,750.00

- Down Payment = Purchase Price + Rehab Budget – Loan Amount

- Down Payment = $260,000.00 + $52,500.00 – $250,000.00

- Down Payment = $62,500.00

Hard Money Lenders Explained – How To Properly Find & Utilize Them

FAQ

What is a hard money contract?

What are typical terms for a hard money loan?

What is an example of a hard money deal?