When considering taking out a loan of any kind, itâs important to understand the repayment model. Otherwise, youâll be flying blind into an expensive financial commitment. One common repayment structure is a fully amortized loan.

Fully amortized loans are one of the most common types of loans that people take out especially when it comes to mortgages. But what exactly does “fully amortized” mean and what makes this type of loan different? In this complete guide, we’ll explain everything you need to know about fully amortized loans.

What is a Fully Amortized Loan?

A fully amortized loan is a loan where the payments are structured so that the entire loan balance will be paid off by the end of the loan term This means that each payment is equal and pays both interest and principal.

With a fully amortized loan, the payments are calculated based on the original loan amount, interest rate, and repayment term. If you make all payments on time and as scheduled, the loan will be completely paid off with the final payment and you won’t owe anything more.

This is in contrast to loans that only require interest payments or partially amortize. With those types of loans, a large balloon payment is due at the end to pay off the remaining principal balance.

Fully amortizing loans are structured to be predictable, with even payments spread out over the full loan term. This helps borrowers budget and know exactly what their payment will be each month.

How Does a Fully Amortized Loan Work?

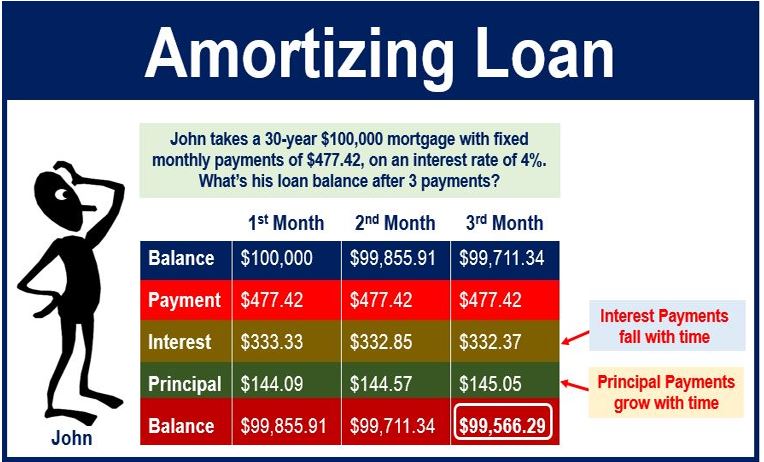

When you take out a fully amortized loan, the lender will use an amortization schedule to calculate your payments. This schedule shows how each payment is applied to interest and principal over the life of the loan.

In the beginning of the loan, the majority of each payment goes towards interest. As you make payments over time, the amount going to principal increases while the amount to interest decreases. The last payment is usually mostly principal with just a small amount of interest.

For example, let’s say you take out a 30-year fixed-rate mortgage for $200,000 with a 5% interest rate. Your monthly principal and interest payment would be calculated as $1,073.64 over those 360 months.

Here is how the first and last few payments on this loan would breakdown:

- Month 1: $1,000 to interest, $73.64 to principal

- Month 12: $916.67 to interest, $156.97 to principal

- Month 120: $739.22 to interest, $334.42 to principal

- Month 359: $8.56 to interest, $1,065.08 to principal

- Month 360: $0 to interest, $1,073.64 to principal

As you can see, over time more and more of the payment is applied to paying down the loan balance until it is fully paid off.

Benefits of Fully Amortized Loans

There are several benefits that fully amortized loans offer compared to other loan structures:

-

Predictable payments – Since the monthly payment stays the same over the full loan term, it’s easy to budget for. You’ll always know exactly what your payment will be.

-

Payoff security – With the payments structured to pay off the full balance, you can be sure that as long as you make the payments, the loan will be fully paid at the end of the term.

-

Interest savings – More of your payment goes towards principal earlier in the loan, which reduces the total interest paid over the life of the loan.

-

No balloon payment – There is no large final lump-sum payment due as there is with partially amortizing loans.

Examples of Fully Amortized Loans

Some of the most common types of fully amortized loans include:

-

Mortgages – The standard fixed-rate mortgage is structured as a fully amortizing loan. The payments pay down both interest and principal over the full loan term (usually 15 or 30 years).

-

Auto loans – Most car loans from dealerships or banks are fully amortizing, with predictable monthly payments for the 3-5 year loan term.

-

Personal loans – Unsecured personal loans from banks or online lenders also tend to be fully amortizing with fixed monthly payments.

-

Student loans – Many student loans are designed as fully amortizing, especially federal loans. The payments are calculated to pay off interest and principal over 10-25 years.

How Fully Amortized Loans Differ from Interest-Only Loans

Interest-only loans are the opposite of fully amortized loans. With interest-only loans:

- You only pay the interest due each month, not any principal

- Your payments are lower in the beginning since you aren’t paying down the loan balance

- At the end of the loan, you must make a large balloon payment of the full principal balance

Interest-only loans allow lower payments at first, but you don’t build any equity and still owe the full balance at the end. Fully amortized loans have higher starter payments, but you slowly pay down the balance each month.

Many adjustable-rate mortgages start as interest-only before switching to fully amortizing payments. This structure can make it easier to qualify, but the future principal and interest payments will be much higher.

Tips for Managing a Fully Amortized Loan

If you take out a fully amortized loan, here are some tips to manage it effectively:

-

Understand exactly when your payments are due and schedule them to ensure on-time payment every month. Setting up autopay can help.

-

Try to pay a little extra each month if possible. The extra amount goes directly to principal and will help you pay the loan down faster and save on interest.

-

Look for opportunities to refinance at a lower interest rate. This will lower your monthly payments and total interest costs.

-

Avoid skipping payments or extending your loan term. Sticking to the original schedule ensures the loan will be paid off on time.

-

Be prepared if you have an adjustable-rate loan. Your payment will change when the interest rate resets – make sure you can still afford the new payment amount.

-

Contact your lender immediately if you anticipate having trouble making payments due to financial hardship. They may be able to offer assistance.

The Bottom Line

Fully amortized loans provide a predictable payment schedule that leads to a loan payoff by the end of the term. This structure allows you to budget effectively and guarantees the loan will be paid off on time as long as you make the payments. Understanding how these loans work and managing them properly is key to staying on track.

What Is A Fully Amortized Loan?

A fully amortized loan is a type of loan where borrowers pay off their balance based on the loanâs amortization schedule. Borrowers who stick to this schedule will pay off their loan at the end of the loan term.

Within a fully amortized loan, amortization refers to the amount of principal and interest paid each month during the loanâs term. At the beginning of a loan, the bulk of your payment will cover interest. But as you continue further into the loan, the scales will tip. As you near the end of the loan term, your payment will increasingly cover the remaining principal balance.

As a borrower, you can explore what each of your payments will cover through an amortization schedule. Itâs useful to see how your loan payments are allocated toward your outstanding principal balance.

Advantages And Disadvantages Of Fully Amortized Mortgages

Every financial product has advantages and disadvantages. Hereâs what to be aware of:

Amortization schedules on a fixed-rate loan simplify your mortgage payment breakdown. With a fully amortized fixed-rate loan, youâll always know exactly what your mortgage payment is. And youâll know exactly how much is going toward your principal balance.

Youâll quickly spot the main disadvantage when you review the amortization schedule. With fully amortized loans, you pay the bulk of your interest charges upfront. It can take years before the bulk of your mortgage payment goes toward your principal balance.

The interest payments can be frustrating for borrowers trying to get out of debt.

Loan Amortization Explained

FAQ

What is the difference between a partially amortized loan and a fully amortized loan?

What is another name for a fully amortized loan?

What is the difference between interest only and fully amortized?

What is the duration of a fully amortized loan?

What is an amortized loan?

An amortized loan is a type of loan with scheduled, periodic payments that are applied to both the loan’s principal amount and the interest accrued. An amortized loan payment first pays off the relevant interest expense for the period, after which the remainder of the payment is put toward reducing the principal amount.

Is a mortgage fully amortized?

Almost all mortgages are fully amortized — meaning the loan balance reaches $0 at the end of the loan term. The same is true for most student loans, auto loans, and personal loans, too. Unlike with credit cards, if you stay on schedule with a fully amortized loan, you’ll pay off the loan in a set number of payments.

What is a fully amortizing payment?

A fully amortizing payment is a periodic loan payment made according to a schedule that ensures it will be paid off by the end of the loan’s set term. Loans for which fully amortizing payments are made are known as self-amortizing loans. Traditional fixed-rate, long-term mortgages typically take fully amortizing payments.

How does a fully amortizing loan work?

Near the beginning of a loan, the vast majority of your payment goes toward interest. Over the course of your loan term, the scale slowly tips the other way until at the end of the term when nearly your entire payment goes toward paying off the principal, or balance of the loan. How Do Fully Amortizing Loans Work?