The FHA one-time close loan, also known as the FHA construction-to-permanent loan, allows homebuyers to finance the construction of a new home and take out a mortgage in just one loan closing. This convenient loan product combines the construction loan and permanent mortgage into a single lending solution.

If you’re looking to build your dream home, the FHA one-time close loan can be an attractive option thanks to its low down payment requirement and flexible credit standards. However, these loans also come with specific eligibility criteria and requirements you’ll need to meet.

In this comprehensive guide we’ll explain everything you need to know about FHA one-time close loan requirements from credit scores to down payments and beyond. Read on for tips to ensure you qualify for this unique construction loan program.

FHA One-Time Close Loan Overview

The FHA one-time close construction loan provides several key benefits

-

Single closing: Avoid the hassle of two separate closings by combining the construction financing and permanent mortgage into one FHA-backed loan.

-

Low down payment: Only 3.5% is required for down payment on the total loan amount.

-

Flexible credit FHA loans allow lower credit scores starting at 580

-

Streamlined process: Get all your financing needs met in one loan product from a single lender.

-

Government backing: FHA insurance protects lenders and offers improved rates/terms to borrowers.

While traditional construction loans require two closings and separate financing sources, the FHA one-time close loan simplifies the process into one mortgage and closing.

FHA One-Time Close Loan Requirements

The FHA has certain borrower eligibility standards and criteria for its one-time close construction loan program. Meeting these FHA requirements is key to qualifying for the loan.

Credit Score Requirements

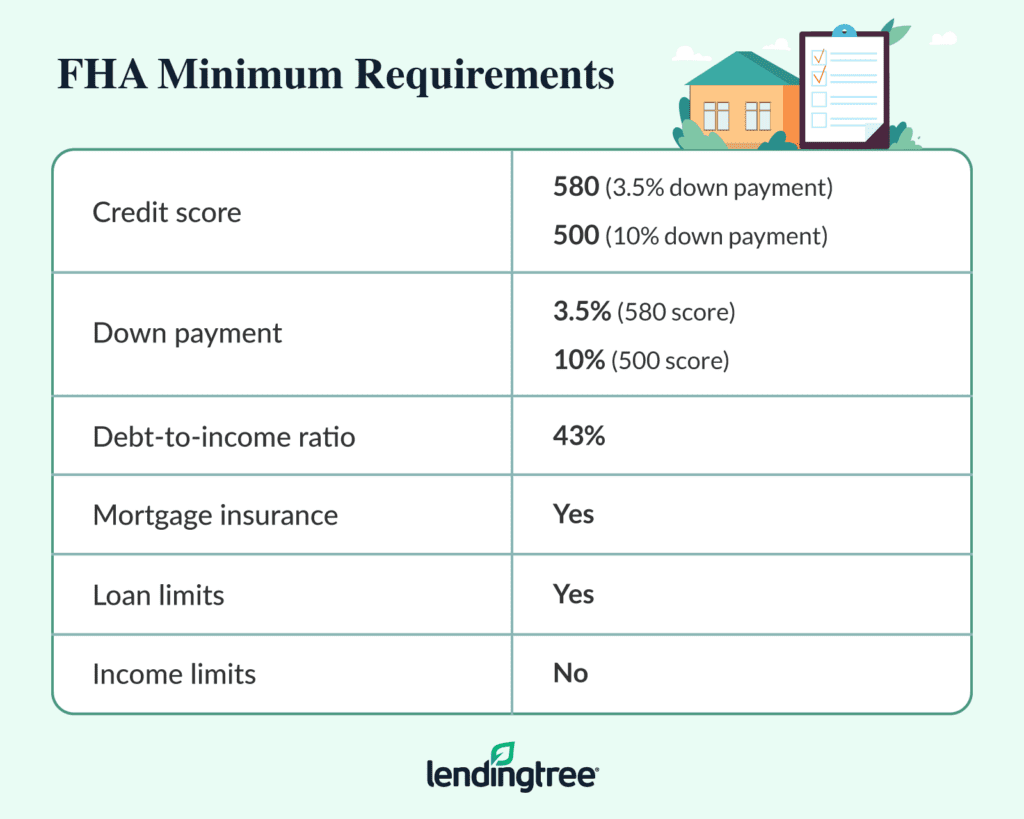

The first FHA one-time close loan requirement relates to your credit score:

-

Minimum credit score: 580

-

Ideal credit score: 640+

While FHA loans allow scores as low as 580, lenders often prefer 640+ for less risk. The higher your score, the better your interest rate and overall loan terms will be.

Improving your credit before applying can help boost your chances of approval and secure a lower rate.

Down Payment Requirements

Another key FHA one-time close loan requirement is the down payment:

-

Minimum down payment: 3.5% of total loan amount

-

No maximum down payment

With an FHA loan, you’re required to make a minimum down payment of 3.5%. However, you can put down more if you have the funds available.

A larger down payment will lead to better rates/terms and lower monthly mortgage payments. But the 3.5% minimum makes these loans more affordable than conventional mortgages.

Debt-to-Income (DTI) Ratio Requirements

Your debt-to-income ratio is also an important factor. To qualify for an FHA one-time close loan:

-

Your DTI must not exceed 43%

-

DTI of 36% or lower is ideal

DTI looks at your total monthly debt payments (including the new mortgage payment) relative to your gross monthly income. Staying under 43% shows lenders you can afford the loan.

Employment History Requirements

Lenders want to see you have steady income to repay the mortgage. FHA requirements include:

-

2 years of verifiable employment history

-

W-2s and tax returns to document income

Being employed in the same line of work for 2+ years shows stability. Provide recent pay stubs plus the last 2 years of W-2s and tax returns.

Property Requirements

The FHA has a few basic property requirements as well:

-

Must be residential property for your primary residence

-

Existing homes or new construction are eligible

-

Condos must be FHA approved

-

Manufactured homes that meet FHA standards are allowed

The home must be a single-unit property and your primary residence. Both existing homes and new construction are eligible.

Land Requirements

Since these are construction loans, there are also requirements around the land:

-

Land must be purchased at time of closing

-

Or borrower must already own land outright

Borrowers must either buy the land at the time of closing, or currently own the land free and clear. The loan can cover land acquisition costs if needed.

Contractor Requirements

With new construction, FHA requires:

-

Licensed, experienced contractor

-

Contractor must be FHA approved

Your builder must be an approved, licensed contractor with proper credentials and liability insurance. They should also have at least 2 years of home building experience.

Mortgage Insurance Requirements

All FHA loans require:

-

Upfront mortgage insurance premium (MIP)

-

Annual MIP for life of loan

This insurance protects the lender in case of default. It adds costs but makes approval more accessible for buyers.

Summary of FHA One-Time Close Requirements

To recap, here are the key FHA one-time close loan requirements:

-

Minimum credit score of 580 (640+ recommended)

-

Minimum 3.5% down payment

-

Maximum 43% debt-to-income ratio

-

2 years of stable employment history

-

Loan for primary residence only

-

FHA-approved property and land

-

Licensed and approved contractor

-

Mortgage insurance premiums

Meeting these FHA requirements is essential to qualifying for a one-time close construction loan. A lender can guide you through the process and help ensure you meet the necessary criteria.

Tips for Securing FHA One-Time Close Financing

Follow these tips to boost your chances of successfully obtaining an FHA one-time close loan:

-

Improve your credit – Increasing your score can help you qualify and get better rates. Pay down balances, dispute errors, don’t take on new credit before applying.

-

Save for a larger down payment – Putting down more than 3.5% shows lenders you’re financially committed. Even an extra 1-2% can make a difference.

-

Lower your DTI – Reduce recurring debts and avoid taking on new installment loans that can negatively impact your DTI. Pay off credit cards, cars, student loans, etc.

-

Obtain tax returns – Have 2 years of personal and business returns prepared if self-employed. This documents your income history.

-

Verify contractor qualifications – Research builders thoroughly and pick one familiar with FHA guidelines. Get required licenses, insurance, and experience confirmed upfront.

-

Talk to a mortgage expert – Consult a lender early about one-time close loans. They can provide guidance and customized strategies to help you secure financing.

Alternatives to the FHA One-Time Close Loan

If you don’t meet the FHA requirements, here are a few alternatives to consider:

-

Conventional construction loans – Have higher credit and down payment requirements but may offer more flexibility and better rates if you qualify.

-

203(k) renovation loans – Allow you to buy and renovate existing housing in one loan, including up to $35K in repairs.

-

VA construction loans – Offer zero down payment options and flexible terms to eligible veterans and service members.

-

USDA construction loans – Provide 100% financing and low rates/fees for low-income buyers in rural areas.

Work With a Trusted Lender

The FHA one-time close construction loan provides an affordable financing solution for building a new home. But make sure you understand the specific FHA requirements and work with an experienced lender familiar with these unique loans.

A knowledgeable lender can guide you through the mortgage process, help ensure you meet eligibility standards, and assist with completing paperwork and documentation accurately.

Get pre-qualified to discuss your options and find out if you may qualify for an FHA one-time close loan. With an expert lender on your side, you can make financing the construction of your dream home a reality.

What is the FHA One-Time Close Construction Loan?

The FHA One-Time Close (OTC) Construction loan is a product that allows borrowers to combine financing for a lot purchase, construction and permanent mortgage into one first mortgage loan. Ideally suited for borrowers who are purchasing new construction, the FHA OTC loan offers the benefits of low money down financing, competitive interest rates and one closing for all financing.

Updated FHA OTC Program overlays and eligibility include:

- Modular and Manufactured homes:

- Maximum of $250,000 disbursement at closing for land acquisition or payoff.

- Building permits (where required by the jurisdiction):

- Site-Built and Modular home – applicable building permits to be obtained prior to closing.

- Manufactured home – applicable building permits to be obtained prior to closing when the initial disbursement is greater than $75,000.

- A minimum five percent (5%) contingency of the total cost to construct be built into the contract price. The contingency is not required for No Draw manufactured Home transaction.

In which scenarios is the FHA One-Time Close Construction Loan a good option?

The FHA One-Time Close Construction loan program can provide an ideal solution for the following borrower scenarios:

- Building a new home on a vacant lot and in need of financing

- Less-than-perfect credit rating

- Not a lot of cash available for a down payment

- Wants the security of a fixed interest rate

- Having trouble finding an available home

- Wants custom home features

FHA One Time Close Construction Loan Explained 2024

FAQ

Can you only qualify for an FHA loan once?

Are FHA loans difficult to close?

What is a one-time close loan?

How fast can you close an FHA loan?

What is an FHA one-time close loan?

The FHA One-Time Close Loan allows borrowers to finance the construction, lot purchase, and permanent loan into a single mortgage. It provides for a single all-at-once closing with a minimum down payment of 3.5 percent.

How do I buy a home with an FHA one-time close loan?

The process of buying a home with the FHA One-Time Close Loan begins with the borrower’s pre-approval to ensure they meet the necessary income and credit guidelines. Next, the borrower must secure a general contractor or builder for the property and the lender must approve that builder. Once the builder has been confirmed, site selection begins.

How many closings do you need for a construction loan?

Most construction loans require two separate closings—once to qualify for the construction itself, and again when converting into a permanent mortgage. The One-Time Close Loan gives buyers a new option. How Much Down Payment Do I Need to Build My Home?