FHA loans are a popular mortgage option for New Jersey homebuyers. With low down payments and flexible credit requirements, FHA loans open the door to homeownership for many buyers who may not qualify for conventional loans.

But to get approved for an FHA loan in New Jersey, you need to meet certain requirements In this comprehensive guide, we’ll explain everything you need to know about FHA loan eligibility, limits, and lenders in the Garden State.

What is an FHA Loan?

FHA loans are government-insured mortgages backed by the Federal Housing Administration (FHA). The FHA insures these loans, so lenders can offer more flexible terms to borrowers who may not meet conventional underwriting standards.

Key features of FHA loans include:

- Low down payments – Just 3.5% is required for borrowers with credit scores of 580 or higher

- Lenient credit requirements – You can qualify with a credit score as low as 500

- Lower monthly mortgage insurance – More affordable than conventional loans

- Available for purchase or refinance

In addition to single-family homes, FHA loans can also be used to buy multifamily properties with 2-4 units.

FHA Loan Limits in New Jersey

The maximum FHA loan amount you can borrow depends on what county you are buying in. FHA sets loan limits for each county based on median home prices in the area.

For 2023, FHA loan limits in New Jersey range from a floor of $420,680 up to a ceiling of $1,089,300:

- Floor: $420,680 (Atlantic, Camden, Cumberland, Gloucester, Hudson, Mercer, Monmouth, Ocean, Salem Counties)

- Ceiling: $1,089,300 (Bergen, Essex, Hunterdon, Middlesex, Morris, Passaic, Somerset, Sussex, Union Counties)

So in more expensive counties like Bergen and Morris, you can qualify for up to $1,089,300 with an FHA loan. But in lower cost areas like Cumberland or Salem, the max is $420,680.

FHA also sets higher loan limits for 2-4 unit properties,

FHA Loan Requirements in New Jersey

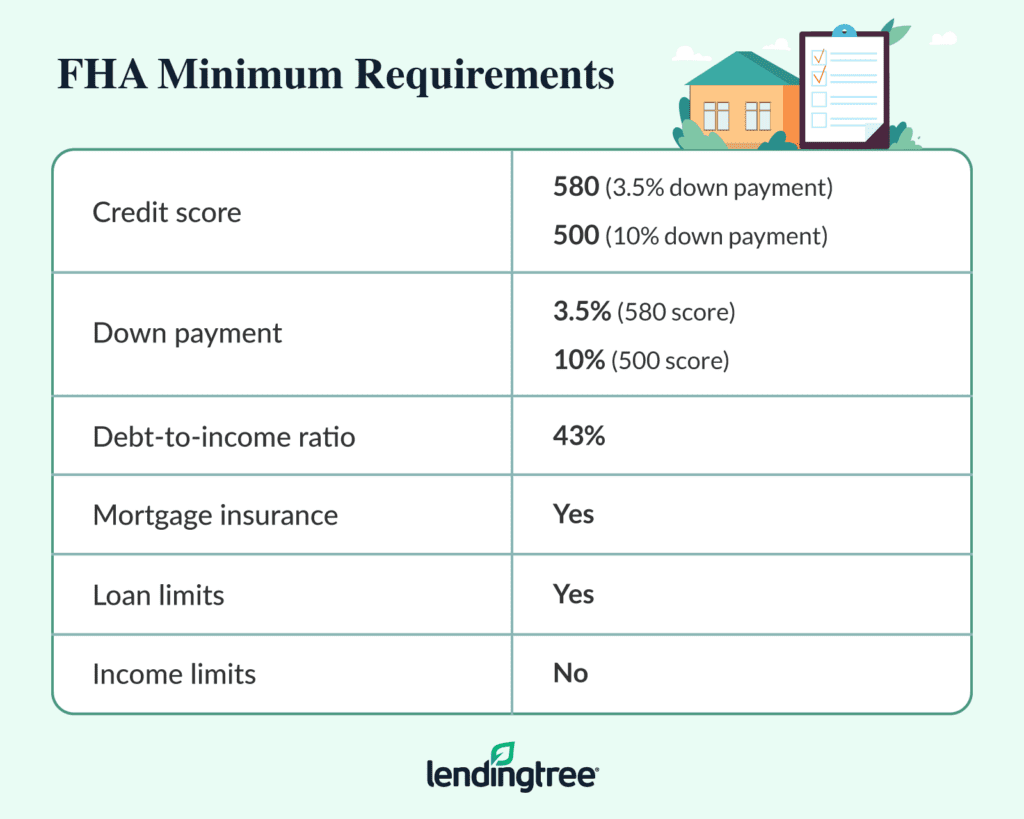

To be eligible for an FHA mortgage in NJ, there are some basic requirements you must meet:

Credit Score

- 500+ minimum credit score

- Under 580 – 10% down payment required

- 580+ – 3.5% down payment allowed

Down Payment

- At least 3.5% down payment for 580+ credit score

- 10% down for 500-579 credit score

Debt-to-Income Ratio

- DTI of 43% or less

Occupancy

- Must be owner-occupied primary residence

- Live in home within 60 days of closing

Home Appraisal

- Property must be appraised by FHA-approved appraiser

Mortgage Insurance

- Upfront MIP of 1.75% of loan amount

- Annual MIP of 0.45% – 0.85% of loan balance

Credit History

- 2 years since bankruptcy discharge or foreclosure

- No late housing payments in past 12 months

Meeting these requirements is the first step to getting approved. But you’ll also need to provide documentation to verify your income, assets, employment, and credit history.

How to Get an FHA Loan in New Jersey

Follow these steps if you’re interested in getting an FHA mortgage in New Jersey:

-

Check your credit score and report – Make sure there are no errors or issues that need resolving first.

-

Get pre-approved – Work with an FHA lender to get a pre-approval letter for the max loan amount you can qualify for.

-

Find a home and make an offer – Make sure the purchase price falls within FHA limits for that county.

-

Get an appraisal – The property must be appraised by an FHA-approved appraiser.

-

Final underwriting – Provide all required income and asset documentation for final approval.

-

Close on your new home! – Bring your down payment and closing costs to the table.

Reaching out to an experienced FHA lender early in the process can help guide you through every step.

FHA Lenders in New Jersey

There are many mortgage lenders in New Jersey that offer FHA loans. Here are a few top options to consider:

Quicken Loans

- One of the largest FHA lenders nationwide

- Online mortgage process, fast approvals

- Rate match guarantee

Fairway Independent Mortgage

- Large regional lender with local expertise

- Personalized assistance from local loan officers

- Competitive rates and quick closing times

Freedom Mortgage

- Top 10 FHA lender based in NJ

- Wide range of FHA loan programs

- Digital and in-person application options

LoanDepot

- Online lender with low rates

- Fast online pre-approval process

- Mobile app for application tracking

New Jersey Housing and Mortgage Finance Agency

- State housing agency offers first-time buyer programs

- Down payment assistance up to $15,000

- Must use NJHMFA approved lender

Be sure to shop around and compare multiple lender quotes. Even a small difference in interest rates can really impact your total costs over the loan term.

Tips for Getting Approved for an FHA Loan in NJ

Though FHA loans are more flexible than conventional mortgages, you still need to make sure you put your best foot forward with your application. Here are some tips for improving your chances of getting approved:

-

Work on improving your credit – Pay down balances and dispute any errors to maximize your score.

-

Save for a bigger down payment – The higher your down payment, the better your interest rate and overall loan terms will be.

-

Reduce your debt-to-income ratio – Pay off credit cards and other debts so you have lower monthly obligations.

-

Provide all documentation upfront – Have pay stubs, tax returns, and bank statements ready to make for a smoother approval process.

-

Include a co-borrower – Adding a co-borrower with better credit or income can help you qualify if you fall short alone.

-

Connect with a mortgage broker – An experienced broker can help you find the best lender and loan program for your situation.

With some preparation and strategic planning, an FHA loan can be an affordable path to buying your first home or next home in New Jersey.

Other First-Time Homebuyer Options in NJ

In addition to FHA loans, New Jersey residents have a few other options to make buying a home more affordable:

NJHMFA First-Time Homebuyer Loans

The New Jersey Housing and Mortgage Finance Agency offers 30-year fixed-rate mortgages for first-time buyers along with down payment assistance up to $15,000 through the Smart Start program. You must use an approved NJHMFA lender.

Neighborhood Revitalization Tax Credit

This $50 million program provides tax credits to developers to fund homeownership in certain urban neighborhoods. Buyers meeting income limits can benefit from lower purchase prices.

Federal Home Loan Bank HomeStart Program

The FHLB’s HomeStart program offers grants to assist with down payments and closing costs. New Jersey residents must meet income limits and purchase through the Neighborhood Revival program.

County and City First-Time Buyer Programs

Many local municipalities and counties also offer down payment or closing cost assistance to eligible buyers. Reach out to your county or city housing authority to learn more.

The Bottom Line

FHA loans can be a great mortgage option for New Jersey homebuyers. Just make sure you understand the current FHA requirements and loan limits before applying. Connecting with an experienced lender familiar with NJ real estate and FHA loans can help ensure your success.

With some preparation and strategic planning, you can leverage the benefits of an FHA loan to buy your dream home in the Garden State!

New Jersey FHA Loan FAQs

New Jersey FHA loans work the same way as national FHA loans. They follow guidelines set out by HUD. The difference in New Jersey-specific FHA loans is the loan limit. Loan limits are based on the home values in each county. They can be different from county to county and state to state.

What is the max FHA loan in New Jersey?

The maximum loan amount for FHA loans varies by county. They also change year-to-year based on the rise and fall of property values. The common loan limit across the country is $498,257 for a single-family home. However, only four out of 21 counties in New Jersey adhere to that loan limit. The rest have loan limits up to $1,149,825 for a single-family home.

New Jersey FHA Loan Requirements 2024 – Complete Guide

FAQ

What will disqualify an FHA loan?

What is the FHA limit in New Jersey?

What qualifies as a first time home buyer in NJ?

What are the requirements for FHA loans in New Jersey?

Credit scores are another important requirement for FHA loans in New Jersey. In fact, these three-digit numbers are important for anyone trying to borrow money from a bank or other lender. They are computed from information found within your credit reports, which are basically a history of your borrowing activity.

Are FHA-insured mortgage loans a good option in New Jersey?

FHA-insured mortgage loans are a popular financing option among home buyers in New Jersey. They’re especially popular with first-time buyers, though they are not limited to this group. Here’s a quick look at the basic FHA loan requirements for New Jersey borrowers, updated for 2017.

What are the minimum requirements to get an FHA loan?

Beyond that, these are the minimum requirements to get an FHA loan: → 500+ credit score: You must have a credit score of at least 500 to get an FHA loan, though requirements change for those with higher scores. → At least a 3.5% down payment: Applicants with a 580 or higher credit score can qualify for a 3.5% down payment.

Can I get an FHA loan in New Jersey?

To qualify for an FHA loan in New Jersey, your home loan must be below the local FHA loan limits in your area. For 2024, the maximum loan limit in New Jersey is $498,257 for a single-family home and $2,211,600 for a four-plex. Limits varies by county. The minimum loan limit is $5,000. Loan limits vary by county and home size.

What are the FHA loan limits in New Jersey?

For 2024, the limits in New Jersey range from $498,257 to $1,149,825 for single-family homes. Here’s what else you should know about qualifying for an FHA loan in New Jersey. How are FHA loan limits determined? Both the FHA loan limit “floor” and “ceiling” are set each year and are based on conforming loan limits and localized median home prices.

Where can I find conforming loan limits in New Jersey?

Bankrate compiled the conforming loan limits data from Federal Housing Finance Agency and the FHA loan limits from the U.S. Department of Housing and Urban Development (HUD). Find New Jersey mortgage rates View the current FHA and conforming loan limits for all counties in New Jersey. Each New Jersey county loan limit is displayed.