The FHA loan program offers several benefits like low down payments and flexible credit requirements that make homebuying more accessible. However, FHA loans do come with specific eligibility rules you must meet to qualify.

In this comprehensive guide, we will outline all the key FHA loan requirements in California you need to know about, including:

- FHA occupancy rules

- Down payment amounts

- Credit score minimums

- Debt-to-income ratio limits

- Loan size limits by county

- First-time homebuyer programs

- Non-traditional credit options

- Alternative FHA eligiblity options

Meeting the core FHA qualification guidelines is crucial for loan approval Read on for a full overview of what it takes to get an FHA mortgage in California

FHA Owner Occupancy Rules in California

FHA loans require you to live in the home as your primary residence Non-owner occupied FHA loans are not allowed in California or anywhere else

If you are purchasing a multi-unit property with 2 to 4 units, you must occupy one of the units. Renting out the entire property is prohibited with FHA financing.

These occupancy rules apply for the entire duration of the loan. You cannot get an FHA loan to initially live in the property and then quickly convert it to a rental.

Minimum FHA Down Payments in California

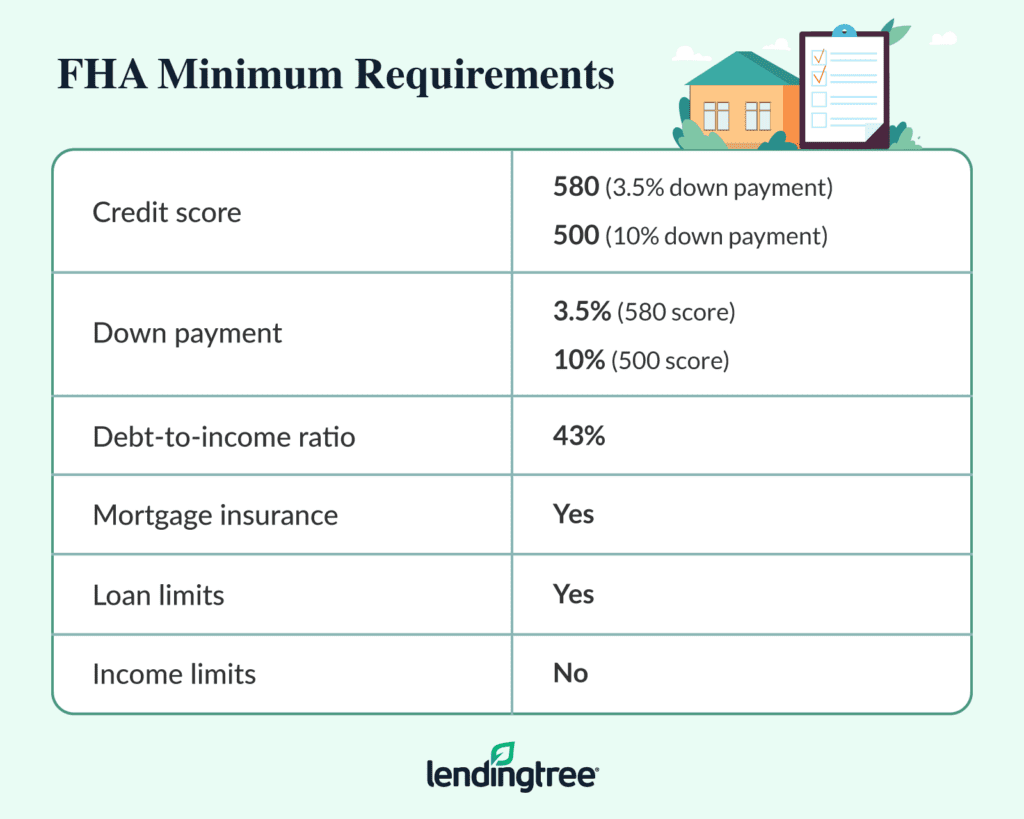

One major advantage of FHA loans is the low down payment requirements

- 3.5% down payment for buyers with credit scores of 580 or higher

- 10% down for applicants with credit between 500 to 579

The down payment can be funded from savings, gifts, grants, or other eligible sources. The funds cannot be borrowed.

With such low down payments, buyers can more easily save up enough for closing costs plus the required FHA down payment amount. VA and USDA loans also feature low down payments for eligible buyers.

Minimum FHA Credit Score Requirements in California

To qualify for the best terms, you need a minimum credit score of 580. Here are the FHA credit guidelines:

- 580+ credit score = 3.5% down payment

- 500-579 score = 10% down payment required

- No minimum score but must show non-traditional credit history

The higher your credit score, the better the mortgage interest rate and overall loan terms will be. Those with scores below 500 will have a very difficult time getting approved.

Checking your credit reports and scores from all three bureaus before applying is recommended. This gives you time to correct any errors that could be dragging down your scores.

Maximum FHA Debt-to-Income Ratio

Your total monthly debt payments, including the new mortgage payment, cannot exceed 43% of your gross monthly income. This is known as your debt-to-income (DTI) ratio.

The maximum DTI for FHA loans is 43%, but many lenders prefer approving borrowers with DTIs of 41% or less for better loan quality.

Keeping your DTI as low as possible through paying down current debts, or increasing your income can help you qualify for more favorable mortgage rates.

FHA Loan Size Limits in California by County

In addition to your DTI, your loan amount must be below the FHA mortgage limits for your area:

- Minimum FHA loan size is $5,000

- Maximum loan limit ranges from $290,150 to $822,375 by county

The FHA sets both minimum and maximum loan limits for each county in California annually. Loan limits typically increase year to year.

You can use the FHA loan limits lookup tool to find the current purchasing power in your desired location. The high cost area limit for a 1-unit home in San Francisco county is $822,375 for example.

Down Payment Assistance Programs for First-Time Buyers

First-time homebuyers have access to various down payment assistance programs that can help fund the FHA down payment and closing costs.

Some popular options include:

- MyHome Assistance Program – 3% or 5% down payment help

- School Employees Down Payment Assistance – $7,500 to $15,000 grants

- First Responders Down Payment Assistance – Grants up to $10,000 to $20,000

Be sure to also check for employer, local, and nonprofit housing grants available in your area. Combining programs can help cover most or even the full down payment amount.

Alternative Credit Options for Non-Traditional Applicants

If you cannot qualify for an FHA loan in California with your credit reports alone due to a thin credit file or lack of scores, you still have options.

FHA allows you to demonstrate a valid credit history through alternative credit references like:

- Rent payment history

- Utility bill payment history

- Insurance payment history

- Documentation of savings or assets

- Mobile phone payments

This helps those with insufficient traditional credit access FHA financing. Borrowers using alternative credit must complete homebuyer education.

Special Eligibility Exceptions

In some cases, you can still qualify for an FHA loan if you do not meet a specific program guideline. Some examples include:

- Gift funds from family to help meet down payment requirements

- Adding a co-signer to compensate forpoor credit or income

- Eligible non-occupying co-borrowers on multi-unit properties

- Manual underwriting for self-employed borrowers

Be sure to discuss all your circumstances with an FHA lender to identify any exceptions that may allow loan approval.

Summary of Core FHA Loan Requirements

To recap, here are the key FHA mortgage eligibility rules:

- Move into the home as your primary residence

- Minimum down payment of 3.5% to 10% of purchase price

- Credit score starting at 500 but 580+ recommended

- Maximum debt-to-income ratio of 43%

- Loan amount below FHA mortgage limits for the county

- Meet any state specific first-time buyer requirements

Checking all these qualification boxes makes approval much more likely and secures better mortgage terms. An FHA-approved lender can guide you through the documentation and verification process.

With the right preparation and planning, FHA financing makes the dream of homeownership attainable for many more California families.

FHA Streamline Refinance in California

Refinancing your FHA loan can be a great idea if you can use it to get a lower interest rate. FHA Streamline Refinance is designed to let you lower your monthly mortgage payments. It switches your original interest rate to a new one calculated using current market rates.

Refinancing your FHA loan is simple.

- Requires less documentation

- No appraisal required

- No need to document income

- No employment requirement

- No credit check

They can also be used to change an FHA Adjustable-Rate Mortgage to a fixed-rate mortgage.

FHA 203(k) Loans

FHA 203(k) loans help borrowers who want to purchase a house that needs repairs. Investing in upgrades and renovations can be costly. FHA 203(k) loans, also known as a rehab loan, are designed to finance the costs of house renovations and repairs. They are not limited to the purchase of a new home. They can also be used by a homeowner to upgrade their current property.

FHA 203(k) Limited Loan

- Good for homes that need renovations (not major structural repairs)

- Can finance mortgage payments during home repairs

- Accepts lower credit scores

- Can be used for energy efficient upgrades

FHA 203(k) Standard Loan

- Can cover more costly renovations like structural repairs

- Can be used by a homeowner to increase accessibility for persons with disabilities

- Can also cover mortgage payments during home repairs

- Can be used to add value to your existing home

What is the max FHA loan in California?

FHA loans have maximum loan limits based on county. Many counties in California have a limit of $1,149,825. However, there are some counties where that limit is higher because the value of property is higher. San Diego County has a loan limit of $1,006,250. The FHA loan limit in Los Angeles County is $1,149,825 for a single-family home. $1,149,825 is the highest loan limit for a single-family home in California.

NEW FHA Loan Requirements 2024 – First Time Home Buyer – FHA Loan 2024

FAQ

What will disqualify you from an FHA loan?

Who qualifies as a first-time home buyer in California?

What is the FHA loan limit in California?

To qualify for an FHA loan in California, your home loan must be below the local FHA loan limits in your area. For 2024, the maximum loan limit in California is $498,257 for a single-family home and $2,211,600 for a four-plex. Limits varies by county. The minimum loan limit is $5,000. Loan limits vary by county and home size.

What are the requirements for an FHA loan?

To qualify for an **FHA loan**, you’ll need to meet the following requirements: 1.**Credit Score**: A credit score of **580 or higher** is typically required.If your credit score falls between **500 and

What are the eligibility requirements for a CalHFA loan?

In general these are borrower eligibility requirements for all CalHFA programs: You will need to meet credit, CalHFA income limits and loan requirements of the CalHFA-approved lender and the mortgage insurer. You will need to occupy the property as your primary residence.

How much does an FHA home cost in California?

California has 58 counties with FHA Limits ranging from a low of $498,257 for a 1-bedroom unit in Amador County to a high of $2,211,600 for a 4-bedroom unit in Alameda County .