If you’re looking to purchase a single-family home in Georgia, you could borrow up to $498,257 with an FHA loan in most counties. In some higher-cost counties, you could borrow as much as $649,750, as long as you meet minimum down payment and credit score requirements. Here’s what you need to know on how to qualify.

The Federal Housing Administration (FHA) mortgage loan program can be an excellent option for Georgia homebuyers who want to purchase a home with a low down payment FHA loans are backed by the federal government and have flexible credit and income requirements compared to conventional loans

In this comprehensive guide we will cover everything you need to know about FHA loan requirements and limits for Georgia, including

Overview of FHA Loans

FHA loans only require a 35% down payment and allow gift funds for the down payment FHA loans are popular with first-time home buyers and buyers with lower credit scores because of the low down payment and flexible credit requirements,

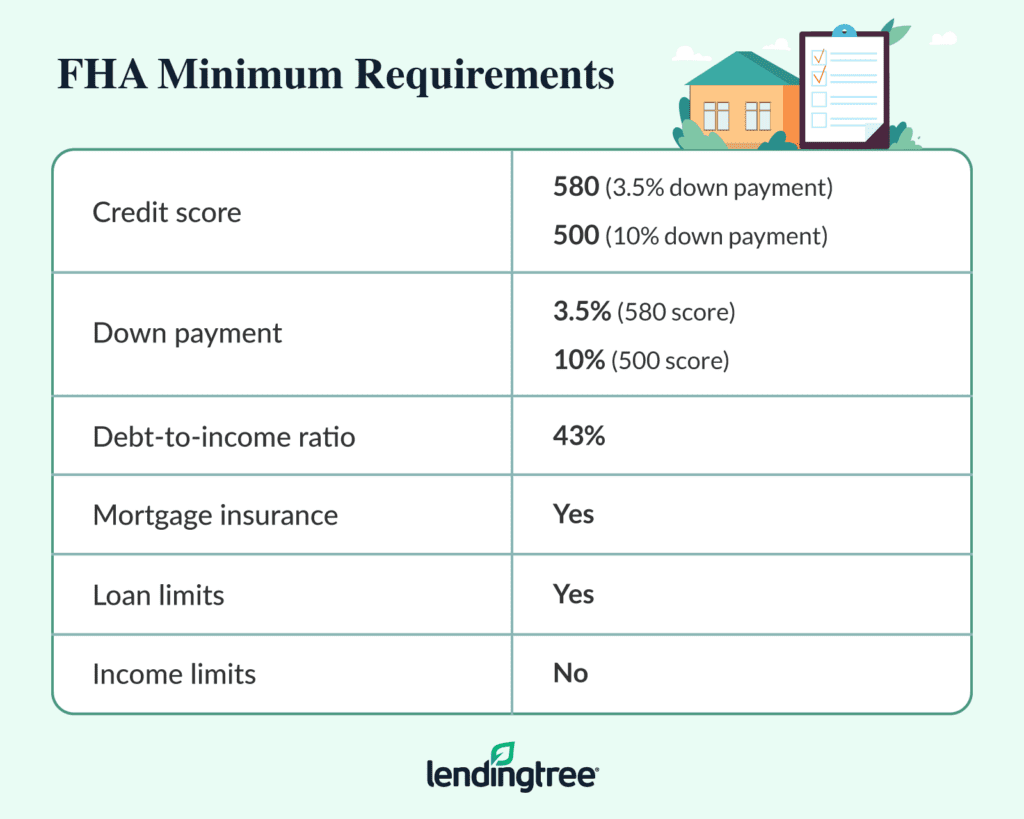

To qualify for an FHA loan, you’ll need a minimum credit score of 580. Many lenders require higher scores between 620-680. With an FHA loan, you can have a debt-to-income ratio up to 50% in some cases.

FHA loans charge an upfront mortgage insurance premium and an annual mortgage insurance premium. On a $300,000 loan in Georgia, you can expect to pay around 1.75% of the loan amount upfront plus 0.85% annually. This premium is required for the life of the loan unless you refinance.

FHA Loan Limits in Georgia

FHA sets county-by-county limits on the maximum loan amount that can be insured. For a single-family home in most Georgia counties, the FHA loan limit is $420,680 for 2023.

However, in high-cost counties like Cobb, DeKalb, Fulton, and Gwinnett, the limit is higher at $648,000. You can finance up to 96.5% of the home’s appraised value or purchase price, whichever is lower.

So if you found a home for $500,000 in an area with the $420,680 limit, your maximum FHA loan would be $420,680. But in high-cost counties, you could potentially finance up to $648,000 with an FHA loan.

Minimum FHA Down Payment in Georgia

The minimum down payment on an FHA loan is 3.5% of the purchase price. For example, if you purchase a $300,000 home, your minimum down payment would be $10,500.

Gift funds from relatives are allowed for your FHA down payment. You can also use grants and down payment assistance programs. Unlike conventional loans, you are not required to put down 20% to avoid private mortgage insurance.

FHA Credit Score Requirements in Georgia

To qualify for an FHA loan in Georgia, you’ll need a minimum credit score of 580. However, each lender sets their own requirements above this minimum. Many lenders require a minimum score between 620-680 to qualify for the best rates.

The middle score of all borrowers is used to determine eligibility. FHA loans are more flexible than conventional loans when it comes to credit scores and credit history requirements. They allow for non-traditional credit references and higher debt-to-income ratios.

Georgia FHA Income Limits

FHA does not set specific income limits for borrowers in Georgia. Rather, lenders will calculate your debt-to-income ratio based on your monthly income and expenses.

As a general rule, your front-end DTI (housing expenses divided by income) should be below 31% and your back-end DTI (total monthly debt payments divided by income) should be below 43%.

However, some lenders will go up to a 50% back-end DTI for borrowers with strong compensating factors like high credit scores or substantial cash reserves. There is no minimum income requirement for FHA loans in Georgia.

Georgia FHA Homebuyer Education

To qualify for an FHA loan in Georgia, you must complete a HUD-approved homebuyer education course. Many first-time home buyers complete an online course, which takes around 5 hours.

Getting educated on the home buying process, budgeting, and maintaining your home can help prepare you for the responsibilities of homeownership. Most lenders will require a certificate showing you completed the course.

Using FHA in Georgia with Low Down Payment Programs

Georgia homebuyers can combine an FHA loan with down payment assistance programs like the Georgia Dream Homeownership Program. Qualified buyers can receive loans covering up to 6% of the purchase price to help with the down payment and closing costs.

Combining low down payment programs with an FHA loan allows buyers to get into a home with very little out of pocket. Be sure to ask your lender about programs available for FHA borrowers.

Finding an FHA Lender in Georgia

Many national lenders like Bank of America, Wells Fargo, and loanDepot offer FHA loans in Georgia. You can also find small local lenders approved by FHA. Getting pre-approved by a few lenders will help you compare options.

Focus on finding a lender that can guide you through credit report issues, down payment assistance programs, and the buying process. Rates and fees will vary, so shop around for the best deal.

Next Steps to Getting an FHA Loan in GA

Now that you know the basics of FHA loan requirements for Georgia, follow these steps to getting approved:

-

Check your credit reports and scores so you know where you stand. Work on improving your score if needed.

-

Calculate your monthly DTI using your income, debts, and estimated housing payment.

-

Complete an online homebuyer education course and get a certificate of completion.

-

Get pre-approved with a few lenders and compare options. Look for lenders familiar with down payment assistance programs.

-

Determine your price range and start shopping for homes in your area.

-

Make an offer when you find the right home and get through the home inspection contingencies.

-

Provide all documentation required by the lender for final underwriting and approval. This includes pay stubs, tax returns, bank statements, and an appraisal.

-

Close on your new home with an FHA loan!

FHA loans open homeownership opportunities to buyers who may not qualify for conventional financing. If you meet the credit score, down payment, and DTI requirements, an FHA loan can help you buy a home in Georgia with a low down payment and flexible requirements.

How are FHA loan limits determined?

FHA loan limits are determined every year by the U.S. Department of Housing and Urban Development (HUD). The amount you’re allowed to borrow for an FHA-backed loan may differ from county to county and depends on changes to median home prices in the previous year.

FHA loan limits are based on a percentage of the conforming loan limits for conventional mortgages. For 2024, the FHA “floor” or lowest FHA loan limit, is set at $498,257. This figure is 65% of the national conforming limit of $766,550 for a single-family home in most areas of the U.S.

The FHA “ceiling,” or highest loan limit, is 150% of the national conforming limit and reflects market conditions in regions with higher housing prices. In 2024, the ceiling is set at $1,149,825 for a single-family unit.

How to qualify for an FHA loan in Georgia

The highest amount you can borrow with a FHA-backed loan for a single-family unit in Georgia is $649,750. Requirements are generally less stringent than for conventional loans. To qualify, you’ll have to meet the following minimum FHA home loan requirements:

→ Minimum down payment and credit scores. If your credit score is at least 580, you only need a 3.5% down payment. However, you could qualify with a credit score as low as 500 if you’re able to provide a 10% down payment.

→ Debt-to-income (DTI) ratio. Your monthly debt payments divided by your before-tax income is your DTI ratio, which most lenders prefer to be under 43%. However, if you have a high credit score, extra savings or a large down payment, some lenders may make an exception.

→ Mortgage insurance. To qualify for an FHA loan, you must purchase two types of mortgage insurance. One type is an upfront mortgage insurance premium (UFMIP) that is rolled into your mortgage and costs 1.75% of your loan amount. The other type is an annual mortgage insurance premium (MIP) that costs 0.45% to 1.05% of your loan amount and is paid out monthly on top of your mortgage payments.

→ FHA home appraisal. You’ll need to purchase an FHA home appraisal to buy a home with an FHA loan. This involves more stringent requirements than with conventional loans and includes both market research and a physical inspection of the building and property site.

→ Occupancy requirements. FHA has strict rules against house-flipping, so you’ll have to live in the home you purchase as your primary residence for at least 12 consecutive months.

Georgia FHA Loans – who are the lenders?

FAQ

What are the qualifications for an FHA loan in Georgia?

What will disqualify you from an FHA loan?

Is it hard to qualify for FHA?

Can I get an FHA loan in Georgia?

To qualify for an FHA loan in Georgia, your home loan must be below the local FHA loan limits in your area. For 2024, the maximum loan limit in Georgia is $498,257 for a single-family home and $1,249,550 for a four-plex. Limits varies by county. The minimum loan limit is $5,000. Loan limits vary by county and home size.

What are FHA loan limits in Georgia?

FHA loan limits in Georgia represent the maximum amount a borrower can secure through an FHA loan. The FHA sets these limits annually based on current home prices and aims to ensure that financing remains viable for borrowers. In 2024, a single-family home’s standard FHA loan limit is $498,257.

What is the Georgia FHA mortgage program?

The Georgia FHA mortgage program provides several benefits, keeping in mind the budget difficulties of many homeowners who are considering purchasing their first home. Compared to most traditional mortgage loans, the FHA mortgage loan simplifies the process for the buyer.

What is the 2024 FHA mortgage limit in Georgia?

The 2024 FHA mortgage limit for most of Georgia in at $498,257 for a single 1-unit property. Other locations just to the north and south of Atlanta like Alpharetta, Clayton, Dekalb, Cobb, Bartow, Douglas, Butts County, and others allow for higher loan limits of up to $649,750. Please find the complete county list below.