Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

As a home seller in today’s market, you may receive offers from buyers using FHA loans. FHA loans are popular because they allow buyers to purchase homes with lower credit scores and down payments than conventional loans. If you get an FHA offer on your property, it’s important to understand the program’s unique requirements to ensure a smooth transaction. This comprehensive guide will explain key FHA loan requirements and how they impact you as the seller.

What is an FHA Loan?

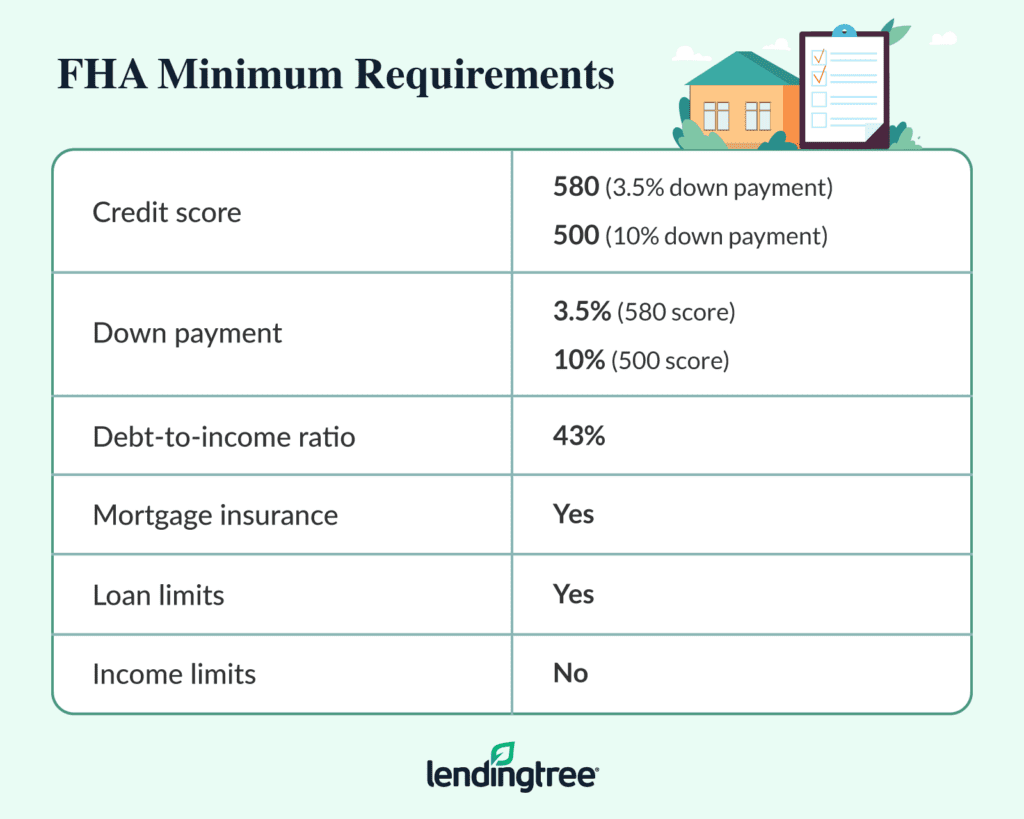

FHA stands for Federal Housing Administration. The FHA insures mortgages provided by private lenders which enables them to offer more flexible terms to buyers. Key features of FHA loans

- Down payments as low as 3.5%

- Minimum credit scores around 580

- More flexible debt-to-income ratios than conventional loans

- Mortgage insurance required for life of loan if under 10% down

Because of the low down payment option, FHA loans are extremely popular with first-time homebuyers and those with limited funds for a down payment FHA loans made up about 12% of all mortgages in 2018

Why Do FHA Loan Requirements Matter for Sellers?

When you accept an FHA offer, you agree to comply with additional requirements throughout the transaction. FHA appraisals and inspections are more rigorous than conventional loans. The property itself must meet FHA minimum quality standards. And as the seller, you may have to pay for repairs identified during the appraisal.

While FHA offers are solid, you take on more risk of delays or even cancellation if you miss any steps required by the lender. It pays to understand these requirements up front before accepting an FHA offer.

Key FHA Loan Requirements for Sellers

Here are the most important FHA guidelines you need to know about as a home seller:

Appraisals

FHA appraisals are performed by HUD-approved appraisers according to strict guidelines. The appraiser will thoroughly evaluate both your home itself and any appliances or systems included in the purchase contract.

-

Major repairs: The appraiser will require repair of any defects that affect livability, safety, or structural soundness. This includes issues like an unsafe deck, leaking roof, cracked foundation, or faulty electrical system.

-

Minor repairs: The appraiser will note minor repairs needed but not require them to close. This includes cosmetic fixes like chipped paint or worn carpets.

-

Repair limits: Total repair costs cannot exceed $10,000 for FHA to insure the loan. If repairs required exceed this amount, the buyer will likely need to cancel.

-

Appliances: Appliances included in the purchase contract must be in working order. If utilities are off, the appraiser may re-inspect once they are restored.

Condominiums

For condos, the entire project must be FHA-approved for your buyer to use an FHA loan. The lender will initiate certification if needed, which adds 30+ days to the process. Be prepared for a longer timeline or consider other offers if your condo is not already FHA-approved.

Seller Credits

You can pay closing costs on the buyer’s behalf up to 6% of the home’s sale price. This helps provide financing incentives like prepaid taxes or home warranty.

Home Warranty

FHA requires buyers to purchase a one year home warranty plan. As the seller, you can purchase this warranty on their behalf as a closing gift.

Timeline

In general, expect a 45 day timeline from contract acceptance to closing with an FHA loan. The appraisal and inspection process is lengthier than conventional loans. Be prepared for a longer escrow period than you may be used to.

FHA Appraisal Process Explained

Understanding a few key details about the FHA appraisal process can help you avoid surprises:

-

Assigned appraiser: FHA provides the buyer’s lender with an approved appraiser. This prevents any inflating of value that could occur if the buyer chooses their own appraiser.

-

Minimum Property Standards: The appraiser checks that all aspects of the home meet FHA’s minimum quality standards. Items are deemed “required to repair,” “required to inspect,” or meeting standards.

-

Utilities on: For accuracy, appraiser will re-inspect if utilities like electricity or water are off during the initial evaluation.

-

Thorough inspection: Appraiser will test appliances, flush toilets, check water flow, open windows, and evaluate both interior and exterior condition.

-

Cosmetics noted: Minor repairs like peeling paint will be pointed out but not required to close. These issues do get factored into the appraised value however.

-

Detailed report: You can review the appraisal yourself once completed to understand any required or recommended repairs.

While the FHA appraisal sets a higher bar, it’s designed to ensure homeowners aren’t saddled with unexpected repairs or safety issues. Being aware of the process up front prevents surprises.

Preparing Your Home for an FHA Appraisal

You can take a few simple steps to maximize your chances of a smooth FHA appraisal:

-

Declutter: Remove excess furniture and personal items so the appraiser can easily access each room. A cluttered home can appear smaller or in disarray.

-

Clean thoroughly: Pay special attention to kitchens, bathrooms, walls and floors. A deep clean makes a great impression.

-

Repair minor issues: Even if not required, fixing small items like cracked grout or leaky faucets shows your home is well cared for.

-

Landscape: Cut the grass, trim bushes and tidy up the yard before the appraiser visits. A maintained exterior looks welcoming and adds curb appeal.

-

Have repairs quoted: If you know of any problems like a cracked window or loose railing, get estimates so you can negotiate repairs with the buyer later on if needed.

While you don’t have to go overboard, taking a few easy steps minimizes the repairs an appraiser may call for down the line.

Negotiating Repairs with FHA Buyers

If the FHA appraisal does identify required repairs, you’ll need to negotiate who pays for and completes the work. Here are some tips:

-

Review the report and get contractor estimates for any expensive repairs. Understand your potential costs.

-

Ask buyers to split costs or agree to a credit at closing if repairs exceed a certain amount.

-

For minor repairs, offer to complete the work yourself before closing. This saves both parties money.

-

If repairs derail the deal, see if the buyer is willing to switch to a conventional loan where repairs may not be required.

-

Be prepared to negotiate; buyers have likely stretched their budget and may struggle to cover large repair bills.

Communication is key to navigating any needed negotiations. Staying flexible helps both parties compromise and avoid a canceled contract.

Avoiding an FHA Appraisal Delay

Delays in the FHA appraisal process can stall or derail deals. As a seller, you can help avoid snags:

-

Provide utility account numbers or coordinate reactivation if anything is off.

-

Reply promptly to requests to access the property for re-inspection or repairs.

-

Stay on your agent to press the lender for appraisal updates and push to close on time.

-

Be prepared to negotiate if the appraisal comes in low. Don’t let a valuation gap kill the deal.

-

If major issues are uncovered, get multiple repair quotes fast so negotiations can proceed.

-

Offer reasonable seller credits or repairs to keep the deal on track if needed.

While you can’t control the appraiser’s schedule, staying flexible and communicative helps the process run more smoothly for all parties.

Selling Your Home FHA-Approved

You can proactively get your home FHA-approved to streamline future sales. This involves hiring your own inspector to evaluate the property to FHA standards and complete any repairs needed.

Benefits of being FHA-approved:

- Attract more buyers since financing is assured

- Skip appraisal delays and negotiation with future FHA buyers

- Often can yield a higher sales price than non-approved homes

The upfront investment pays off through faster sales, fewer headaches, and more buyer interest when you list. In a competitive market, being FHA-approved makes your home more appealing to buyers using FHA loans.

Partnering Successfully With FHA Buyers

FHA loans remain extremely popular with first-time home buyers, moderate income earners, and those with past credit challenges. By understanding FHA guidelines, you can readily work with these buyers as a seller to close smooth transactions.

Being prepared for the appraisal process, flexibility on repairs, and clear communication sets you up for success when partnering with an FHA buyer. Take time to learn the program’s unique requirements and limitations to make your next home sale hassle-free. With the right knowledge, FHA buyers can be great partners helping you sell for top dollar quickly.

Key Takeaways

- FHA loans allow buyers to purchase with lower credit scores and down payments than conventional mortgages.

Choose Your Loan TypeFHA.com is a privately owned website, is not a government agency, and does not make loans.

Do you know whats on your credit report?

Learn what your score means.

Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

| FHA Limits (low cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $498,257 | $637,950 | $771,125 | $958,350 |

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

| FHA Limits (high cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 |

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

Learn About FHA Loans

Find out why FHA mortgages with low down payments are so popular with homebuyers.