Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

Mortgages backed by the Federal Housing Administration have different requirements from other types of home loans. It’s often easier to qualify for an FHA loan than a conventional loan — for example, if you have less-than-perfect credit or a past bankruptcy.

You don’t need to be a first-time home buyer to qualify for an FHA loan. However, FHA loans are popular with first-time home buyers because they couple low down payment requirements with more lenient standards for credit scores and existing debt. Some conventional mortgages allow down payments as low as 3%, but to qualify, you’d likely need to meet stricter credit score and debt-to-income ratio requirements than the minimums set by the FHA.

FHA loans dont come from the government. The FHA insures them on behalf of lenders, such as banks and credit unions. While the government sets minimum requirements for FHA borrowers, each lender is free to set their own standards — for example, requiring a higher credit score.

This is one of the reasons its smart to shop and compare FHA lenders. They might have different qualifications, and you can weigh lenders rates and fees.

For many buyers, Federal Housing Administration (FHA) loans offer an affordable path to homeownership. FHA loans require just a 35% down payment and have flexible credit requirements. This makes them popular with first-time homebuyers as well as those with lower incomes or credit scores

But do FHA loans have any specific income requirements you need to meet to qualify? Can you get approved regardless of your income level if you meet all the other eligibility criteria?

The short answer is no, there are no set minimum income requirements to be eligible for FHA financing. However, your income does impact the amount you can borrow and the types of homes you can afford.

In this comprehensive guide we will cover

- How FHA loan eligibility is calculated

- The role of debt-to-income ratio

- Tips for qualifying on a low income

- FHA loan limits for 2023

- Alternative options if you don’t qualify

Follow along for everything you need to know about FHA loan income requirements for 2023.

How FHA Loan Eligibility Is Determined

The Federal Housing Administration does not publish any specific income brackets or earnings thresholds required to qualify for one of their loans Eligibility is based on a more holistic review of your finances

Here are some of the key factors FHA lenders evaluate:

-

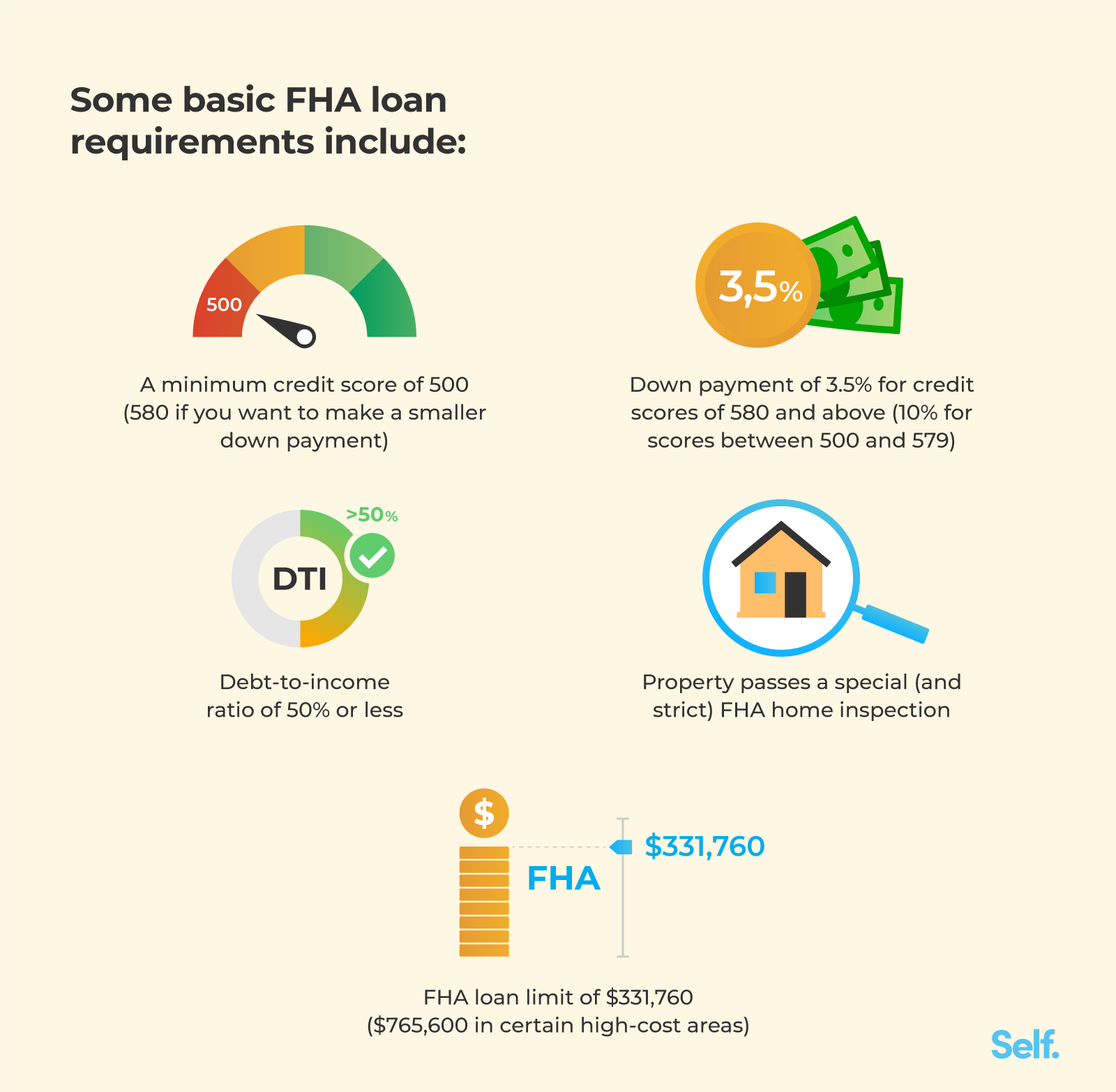

Credit score – At least 500 minimum required. Higher scores improve rates/terms.

-

Down payment – Minimum 3.5% down from your own funds. Gifts allowed for rest.

-

Debts and expenses – Total monthly bills factor into your debt-to-income ratio.

-

Assets and reserves – Money left over after closing must meet guidelines.

-

Loan amount – Based on type of property, location, and finances.

Your lender will review all these items together when determining if you meet the requirements for FHA approval. Your income helps influence some of these key factors.

The Role of Debt-to-Income Ratio

Although FHA loans do not have specific income limits, your earnings do impact your debt-to-income (DTI) ratio. This ratio compares your total monthly debt payments to your monthly gross income.

FHA loans require your backend DTI to be less than 43%. This means all your bills including the mortgage payment cannot exceed 43% of your income. For example:

- Gross monthly income: $4,000

- Total monthly debt: $1,600

- $1,600/$4,000 = 40% DTI

If your DTI would go above 43% based on the mortgage payment, you may not qualify for that loan amount. This indirectly links income to eligibility.

On FHA loans, lenders can make exceptions for higher DTIs with compensating factors. But in general, your income must be adequate to keep your ratios in approved ranges.

Tips For Qualifying On A Low Income

Due to the absence of set minimums, it is possible to get approved for an FHA loan if you have limited income. Here are some tips that can help:

-

Focus on your credit scores – Compensate for low earnings with higher scores. This helps improve mortgage rates and eligibility.

-

Save for a larger down payment – Putting down more than 3.5% allows you to borrow less and qualify easier.

-

Buy below your limit – Opt for lower-priced homes to reduce DTI. Stay under the 43% cap.

-

Include co-borrowers – Adding another applicant combines incomes for higher DTI room.

-

Minimize debts – Pay down bills and avoid taking on new installment loans when possible.

-

Use gift funds if needed – Get help from family for remaining down payment and closing costs.

With careful planning and budgeting, an FHA loan is feasible even with low or moderate earnings. Pre-qualification and talking to lenders is key.

FHA Loan Limits For 2023

One limit that relates indirectly to income are the FHA loan limits, which cap the maximum amount you can borrow. These limits are set by county and vary based on the type of home.

Here are the current FHA loan limits for 2023:

- 1-unit homes – Up to $472,050

- 2-unit homes – Up to $604,550

- 3-unit homes – Up to $749,650

- 4-unit homes – Up to $931,600

The only way your income factors in here is that it determines the mortgage payment you can afford. Higher incomes allow you to qualify for larger loan amounts approaching these FHA limits.

But there is no rule saying you must make a certain salary to be eligible up to these limits. Reviewing the limits in your area helps estimate the home prices you can realistically shop in.

Alternative Options If You Don’t Qualify

In some cases, buyers are not able to meet the requirements for FHA approval, often due to income constraints. If this fits your scenario, here are two alternative options to consider:

FHA 203(k) Purchase and Renovation Loan

This FHA-insured loan allows you to roll the costs to upgrade a home into the mortgage. Minimum incomes for eligibility are based on the as-improved value. This can help if the home needs work that makes it more affordable.

USDA Loan

USDA home loans are guaranteed by the U.S. Department of Agriculture for low- and moderate-income buyers in rural areas. With no minimum credit score and 100% financing available, they can be easier to qualify for than FHA loans.

Be sure to also explore various down payment assistance programs in your state and local area. These can provide grants and below-market loans to fill gaps for eligible borrowers.

The Bottom Line

There are no specific income requirements or thresholds to qualify for FHA financing on its own. However, your income does impact your debt-to-income ratios and home affordability. This in turn influences the loan amounts and types of homes you can buy.

Careful preparation and working with an experienced lender gives you the best chance for approval. They can provide pre-qualification and guide you through FHA requirements. This helps set proper expectations while exploring your options.

With the right approach, FHA loans remain a viable way to become a homeowner even on low or moderate incomes. Learn the guidelines and tap into this resource if it fits your homebuying goals.

FHA loan income requirements

There is no minimum or maximum salary that will qualify you for or prevent you from getting an FHA-insured mortgage. However, you must:

- Show an income history of at least two years through employment verification or proof of enrollment in school or the military.

- Have a credit history, most commonly through a traditional credit score. If you don’t have a credit score, you’ll need to demonstrate a history of paying at least three types of bills on time, such as rent or utilities.

- Not have delinquent federal debt or judgments, tax-related or otherwise, or debt associated with past FHA-insured mortgages.

- Account for cash gifts that help with the down payment. That can include money from a friend or family member, a charity, your employer or union, or from a government agency. These gifts must be verified in writing, signed and dated by the donor.

If you are using a state or local program to obtain down payment or other assistance toward an FHA loan, that program may have its own income limits and requirements.

FHA documentation requirements

Here is some of the documentation you will need when applying for an FHA home loan:

- Valid government-issued ID, such as a drivers license or passport.

- Proof of a Social Security number.

- Two years worth of original pay stubs, W-2 forms or valid tax returns.

- Signed and dated letters that detail the source and amount of any gift funds and explicitly state that you dont need to pay back the money.

An FHA-approved lender will walk you through the details of other documentation you might have to provide.

Mortgage loans from our partners

on New American Funding

on New American Funding

on New American Funding

on New American Funding

on New American Funding

on New American Funding

on First Federal Bank

on First Federal Bank

on New American Funding

on New American Funding

on Bethpage Federal Credit Union

Bethpage Federal Credit Union

on Bethpage Federal Credit Union

on New American Funding

on New American Funding

on Bethpage Federal Credit Union

Bethpage Federal Credit Union

on Bethpage Federal Credit Union

Mortgage loans from our partners

on New American Funding

on New American Funding

on New American Funding

on New American Funding

on New American Funding

on New American Funding

on New American Funding

on New American Funding

NEW FHA Income Requirements 2024 – First Time Home Buyer – FHA Loan 2024

FAQ

What is the minimum income for an FHA loan?

What disqualifies you from an FHA loan?

What are the new FHA changes for 2023?

What will FHA loan limits be in 2023?