FHA home loans require just 3. 5% down and have incredibly lax requirements for employment history and credit scores in comparison to other loan types. To determine whether FHA can help you become a homeowner, run the numbers using this FHA mortgage calculator.

FHA mortgage calculator terms

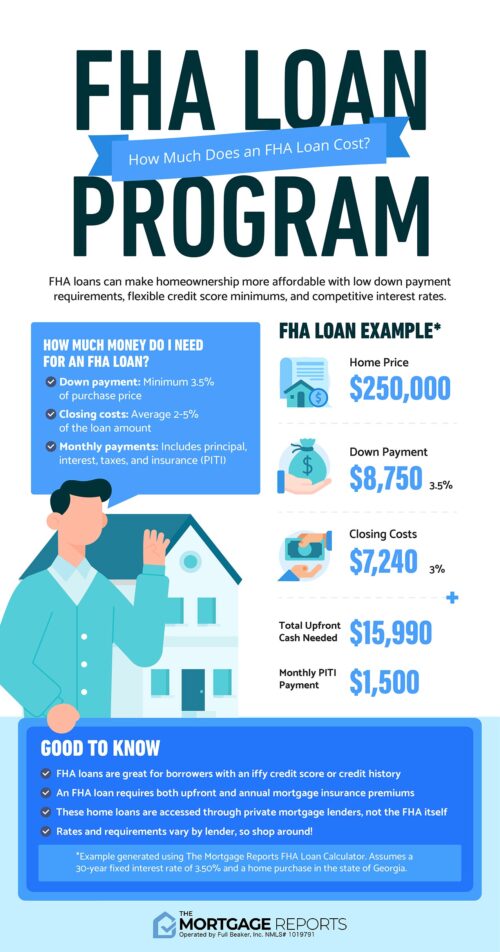

The costs of homeownership are often unknown to many first-time buyers.

When you make mortgage payments, you do more than just reimburse your lender for the loan’s principal and interest. In addition, you must pay property taxes, homeowners insurance, and other related expenses.

You can calculate your estimated “true” payment using the FHA mortgage calculator above. This will enable you to obtain a more precise figure and determine how much house you can actually afford using an FHA loan.

To better understand all of the terms and charges listed in our FHA loan affordability calculator, here is a breakdown:

You contributed this amount of money toward your house purchase. FHA features a low down payment minimum of 3. 5% of the purchase price. This can come from a qualified down payment assistance program or a gift for the down payment.

You have a set period of time to pay off your mortgage loan. Most buyers of homes opt for 30-year fixed-rate mortgages, which have equal payments throughout the loan’s term. 15-year fixed-rate loans are also available via the FHA program. Although FHA also provides adjustable-rate mortgages, these are much less common due to the possibility of rising mortgage rates and payments during the loan term.

This is the annual percentage rate that your mortgage lender levies as a borrowing fee. In terms of the loan amount, mortgage interest rates are expressed as a percentage. If your loan balance is $150,000 and your interest rate is 3, as an illustration During the first year, you would pay $4,500 in interest at 0% ( 03 x 150,000 = 4,500).

This is the monthly payment you make to your mortgage provider to cover your loan balance plus interest. This remains constant for the life of a fixed-rate loan. Your monthly mortgage payment stays the same, but until the loan balance is repaid, you pay more principal and less interest each month. This payment progression is called amortization.

FHA charges a similar monthly fee to private mortgage insurance (PMI). The FHA Mortgage Insurance Premium (MIP) is a charge that serves as an insurance against loss for lenders in the event of a foreclosure. The upfront mortgage insurance premium (UFMIP) levied by FHA is 1 75% of the loan amount. This can be rolled into your loan balance. It also levies an annual premium for mortgage insurance, which is typically equal to 0. 85% of your loan amount. The annual MIP is paid in equal monthly payments with your mortgage.

The county or municipality where the house is located levies taxes that total a certain amount each year. This expense is divided into 12 installments and paid monthly with your mortgage. Because the county can seize a home if property taxes are not paid, your lender is required to collect this fee. The calculator estimates property taxes based on averages from tax-rates. org.

Your home must be insured against fire and other perils as required by your lender. Your monthly mortgage payment includes your home insurance premium, which is sent annually to your insurance provider by your lender.

In a planned unit development (PUD), you might be required to pay homeowners association (HOA) dues if you purchase a condo or a house. Loan officers take this expense into account when calculating your DTI ratios. You may enter additional home-related costs here, such as flood insurance, but leave out expenses for utilities.

Usually, along with your mortgage payment, you must pay your lender each month for property taxes and homeowners insurance. When the taxes and insurance are due, they are kept in an “escrow account” and paid to the appropriate company or agency by your lender.

FHA mortgages have great perks for first-time home buyers. However, in order to use this loan program, you must adhere to the FHA’s and your lender’s, requirements.

The following requirements must be met in order to qualify for an FHA loan:

These are general qualifying guidelines. But lenders frequently have the discretion to accept loan applications that are stronger in some areas but weaker in others. For instance, if your credit score is high, you may be able to get away with having a higher debt-to-income ratio.

Check your eligibility with a few different mortgage lenders if you’re unsure if you’d be eligible for financing.

Many prospective home buyers are FHA-eligible, but are not yet aware of this.

How does an FHA loan work?

A home-buying program backed by the Federal Housing Administration is called FHA loans.

This department, which is a division of the Department of Housing and Urban Development (HUD), makes homeownership more accessible to low-income homebuyers through the FHA mortgage program.

The FHA achieves this by lowering the initial barrier to home ownership.

The possibility of becoming a homeowner is made more accessible to buyers who might not otherwise qualify for a mortgage by lower down payments and credit score requirements.

FHA loans are created (or “made”) by private lenders, despite being backed by the federal government. It’s relatively simple to shop around and find your best deal on an FHA mortgage because the majority of significant mortgage lenders are FHA-approved.

An FHA mortgage might make it possible for you to move into a new home sooner rather than later if you have poor credit, little money saved up, or a lot of debt.

FHA loan limits for 2022

In most of the United States, the FHA’s maximum loan amount for a single-family home is $. S.

However, in more pricey real estate markets and metro areas, FHA loan limits rise.

Single-family home loan limits

A low-cost area is one where you can multiply the median home price by 115% and still pay less than $, according to the FHA.

On the other hand, high-cost areas exceed $. In these cases, the maximum loan amount is $. About 65 counties in the U. S. possess enough expensive areas to qualify as those with a high cost of living

Loan limits are set in accordance with the fact that many areas fall somewhere between the low- and high-cost ranges.

Alaska, Hawaii, Guam, and the U. S. Loan amounts are capped at over $1 million in the Virgin Islands as special exceptions.

Multifamily home loan limits

Mortgage loans for buildings with multiple units are also financed by the Federal Housing Administration.

| 2-Unit Property | 3-Unit Property | 4-Unit Property | |

| Low-Cost Area | $ | $ | $ |

| High-Cost Area | $ | $ | $ |

Again, Alaska, Guam, and the United States have higher limits. S. Virgin Islands.

Although multi-family home purchases are permitted by the FHA, you must reside in one of the units as your primary residence.

Loan limits are established by FHA for each county, determining the highest amount borrowers may be eligible for under the FHA program. Loan limits are higher in high-cost real estate markets, and borrowers buying properties with 2-4 units frequently qualify for larger loans than those buying single-family homes. However, not all borrowers will be qualified for the maximum loan amount. Your down payment, income, debts, and credit will determine how much you can borrow through the FHA.

Home buyers must put at least 3. 5 percent down on an FHA loan. That’s because FHA’s maximum loan-to-value ratio is 96. 5 percent, which limits the maximum loan amount to 96. 5 percent of the home’s value. By making a 3. By putting 5 percent down, you lower your loan amount below the LTV limit for FHA.

When you put 20% down on an FHA loan, unlike a conventional mortgage, mortgage insurance is not waived. Regardless of the amount of the down payment, all FHA homeowners must pay mortgage insurance; however, if you put at least 10 percent down, you’ll only pay it for 11 years rather than the entire loan’s term. You’re probably better off with a conventional loan if you have 20% down and a credit score of at least 620 because you won’t have to pay PMI.

Yes, just like with any other loan type, you must pay closing costs for an FHA mortgage. Closing costs for FHA loans are comparable to those for conventional loans: they range from 2 to 5 percent of the loan amount, depending on the home’s price and the lender. Additionally, FHA levies a one-time premium for mortgage insurance. 75 percent of the loan amount. To avoid paying it up front, the majority of borrowers roll it into the loan. However, if you decide to pay in advance, this fee will significantly raise your closing costs.

Principal and interest on the loan balance, mortgage insurance premiums, monthly homeowners insurance costs, and monthly property taxes are all included in a typical FHA loan payment. Homeowners association (HOA) dues must also be paid each month by FHA homeowners who live in a condo or PUD.

That depends. Mortgage insurance is necessary for FHA loans, which will raise your monthly mortgage payments. However, conventional loans with a lower down payment also exist. Your credit score and down payment will determine which loan is more affordable for you; if you have excellent credit and put down at least 5%, a conventional loan will probably have lower monthly payments. But if you have low credit and 3-3. With 5% down, conventional loan PMI may be more expensive than FHA MIP. Speak with a lender to compare payment amounts and identify the ideal loan for you.

Typically, the upfront mortgage insurance premium (upfront MIP) is the only closing expense that can be accounted for in an FHA loan. When purchasing a home or utilizing the FHA Streamline Refinance program, the majority of other closing costs, such as an underwriting fee or origination fees, will need to be paid out of pocket.

Rates for conventional mortgages are frequently higher than those for FHA mortgages. A lower interest rate, however, does not necessarily mean a lower monthly payment. Even though the base rate is lower than for other loan types, FHA mortgage insurance will raise your payments and the total cost of the loan. Since annual percentage rate (APR) includes fees in addition to interest, it can be useful in figuring out a loan’s “true” cost.

No. The government does not determine FHA loan rates, and they vary from one FHA loan to the next. Lenders who are FHA-approved may choose their own mortgage rates, and some may offer more competitive terms than others. Additionally, rates can differ depending on the borrower, with the “safest” borrowers typically paying the lowest rates while those with poorer credit and other risky loan characteristics pay the highest rates.

Yes, the majority of lenders who are FHA-approved can give you both preapproval and prequalification for an FHA mortgage. Prequalification is a less thorough assessment of your financial situation than preapproval, which frequently necessitates verification of financial information like credit score, debt-to-income ratio, and more. When looking for a home, getting a preapproval letter from your loan officer will typically be more valuable because many real estate agents and sellers prefer to work with qualified buyers.

Before refinancing an FHA loan into another FHA loan through a Streamline Refinance or into a conventional loan to get rid of the monthly mortgage insurance, there is a 210-day waiting period. This waiting period is the same for VA loans, too. While the waiting period for USDA loans can range from 6 to 12 months, depending on the situation. If you are using a cash-out refinance to access home equity, there is a 6-month waiting period before you can refinance a conventional conforming loan.

Check your FHA loan eligibility

Numerous homebuyers are eligible for FHA, they just aren’t aware of it yet. To determine your eligibility for the FHA mortgage program and how much house you can afford, speak with a lender. You can get started below.

Sources:

The total finance charges incurred by refinancing an existing loan could be higher overall and over the course of the loan.

FAQ

Why are FHA closing costs so high?

Due to the upfront MIP being included in FHA closing costs, an FHA loan may have average closing costs that are higher than the typical range of 3% to 6%. The value of an FHA mortgage, with its low down payment, lower interest rates, and flexible underwriting, is not diminished in any way as a result.

Does FHA allow you to roll in closing costs?

On a standard FHA refinance loan, you can only increase your loan amount in order to roll in closing costs. Your only choice for an FHA streamline refinance is to accept a higher interest rate in exchange for the lender covering your closing costs with a lender credit. This option is also known as a no-closing-cost loan.

What is the downside of an FHA loan?

FHA loans will likely have higher costs upfront and with each payment, which may indicate that borrowers aren’t ready for a mortgage. Mortgage insurance is also required, and FHA loans are less flexible than conventional loans.

How can I lower my FHA closing costs?

- Increase Your Credit Score. …

- Look For Multiple Lenders. …

- Ask Help From Your Lender. …

- Double Check For Random Fees. …

- Look Around For Title Insurance. …

- Roll Your Closing Cost Into Your FHA Loan.