We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free – so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Buying your first home is an exciting milestone! As a first-time homebuyer, you’ve likely heard that FHA loans are a great option thanks to low down payments and flexible credit requirements. However you may be worried about the closing costs associated with FHA mortgages. Closing costs can run from 3-6% of the total loan amount which can add up to thousands of dollars.

As a first-time homebuyer myself, I totally get the anxiety around closing costs. When my husband and I bought our starter home last year, we were shocked by some of the fees on our Closing Disclosure. I wish we’d had a guide to FHA closing costs beforehand so we knew what to expect.

That’s why I decided to write this in-depth guide to demystify FHA closing costs for other first-time buyers Here’s what I’ll cover

- What are FHA closing costs?

- Itemized breakdown of standard FHA closing costs

- Estimated FHA closing costs based on home price

- Tips for reducing your FHA closing costs

- Answers to common first-time buyer questions

Let’s get started!

What Are FHA Closing Costs?

FHA closing costs refer to the various fees you’ll pay when finalizing your FHA mortgage loan. Closing costs are paid at the end of the homebuying process, usually at the “closing” when you sign your final loan documents.

Closing costs are not unique to FHA loans. You’ll pay them no matter what type of mortgage you get. However, FHA loans do have some unique costs like upfront mortgage insurance premiums. We’ll break those down next.

Itemized Breakdown of Standard FHA Closing Costs

FHA closing costs generally fit into four main categories:

1. Lender Fees

When you apply for a mortgage, your lender has to underwrite your loan. This involves processing your application, reviewing your financials, and preparing your closing documents. Lender fees compensate them for their work. Common lender fees include:

- Origination fee – Flat fee charged by lender, around 1% of the loan amount

- Underwriting fee – Cost of underwriting process

- Document preparation fee – For preparing your closing documents

- Processing fee – For processing your application

2. Upfront Mortgage Insurance Premium

A unique cost of FHA loans is the upfront mortgage insurance premium (MIP). The FHA charges this fee to insure your loan, protecting the lender from losses if you default. The upfront MIP is 1.75% of the total loan amount.

For example, on a $200,000 loan, your upfront MIP would be $3,500 (1.75% of $200,000). This can be paid at closing or financed into your loan.

3. Third-Party Fees

You’ll also encounter fees charged by third-parties for services related to your transaction:

- Appraisal fee – For the appraisal on the home

- Credit report fee – For running your credit report

- Title fees – Title insurance, title search, etc.

- Recording fees – To record your deed with the county

- Survey fee – If a survey of the property is required

- Pest inspection fee – If a pest inspection is required

4. Prepaid Costs

Finally, there are prepaid costs that include:

- Homeowners insurance – Prepaid policy for first year

- Mortgage insurance – Prepaid monthly premiums

- Property taxes – Prorated taxes due at closing

- Interest – Prepaid interest from closing date to first payment

- Escrows – Initial escrow deposit for taxes and insurance

Now that you know what’s included, let’s look at estimated totals.

Estimated FHA Closing Costs Based on Home Price

As a general guideline, FHA closing costs range from 3-6% of your loan amount. The upfront MIP pushes costs toward the higher end of that range.

Here are estimated FHA closing costs for different home prices:

- $150,000 home – Around $6,000 in closing costs (4% of loan amount)

- $200,000 home – Around $8,000 in closing costs (4% of loan amount)

- $300,000 home – Around $12,000 in closing costs (4% of loan amount)

- $500,000 home – Around $20,000 in closing costs (4% of loan amount)

As you can see, closing costs scale up directly with the home price and loan amount.

Now let’s talk about reducing these costs.

Tips for Reducing Your FHA Closing Costs

Closing costs can put a dent in your savings, especially as a first-time buyer. Here are some tips for lowering your FHA closing costs:

Shop Around With Multiple Lenders

Lender fees can vary widely, so compare quotes from 3-4 lenders. Online lenders tend to have lower overhead and offer discounted origination fees.

Ask About Discounts and Credits

Ask your lender if they offer any discounts or lender credits. They may discount origination fees for first-time buyers or match competitor quotes.

See If Seller Will Cover Any Costs

Sellers can contribute up to 6% of the purchase price toward the buyer’s costs in the form of a closing cost credit. This helps lower your out-of-pocket expense.

Pay Discount Points for Lower Interest Rate

Paying discount points upfront can lower your interest rate, reducing overall costs. Do the math to see if spending more upfront saves long-term.

Use Downpayment Assistance Programs

Many state and local programs help cover down payments and closing costs. Reach out to a HUD-approved housing counselor to learn about options.

Ask for Gift Funds

The FHA allows family gifts to help with downpayment and closing costs. Draft a gift letter to document the transfer of funds.

Answers to Common First-Time Homebuyer Questions

If you still have questions as a first-time buyer, here are answers to some common ones about FHA closing costs:

Can I roll closing costs into my FHA loan?

Yes, you can finance closing costs by adding them to your mortgage loan amount. However, you’ll pay interest on the costs over the loan term.

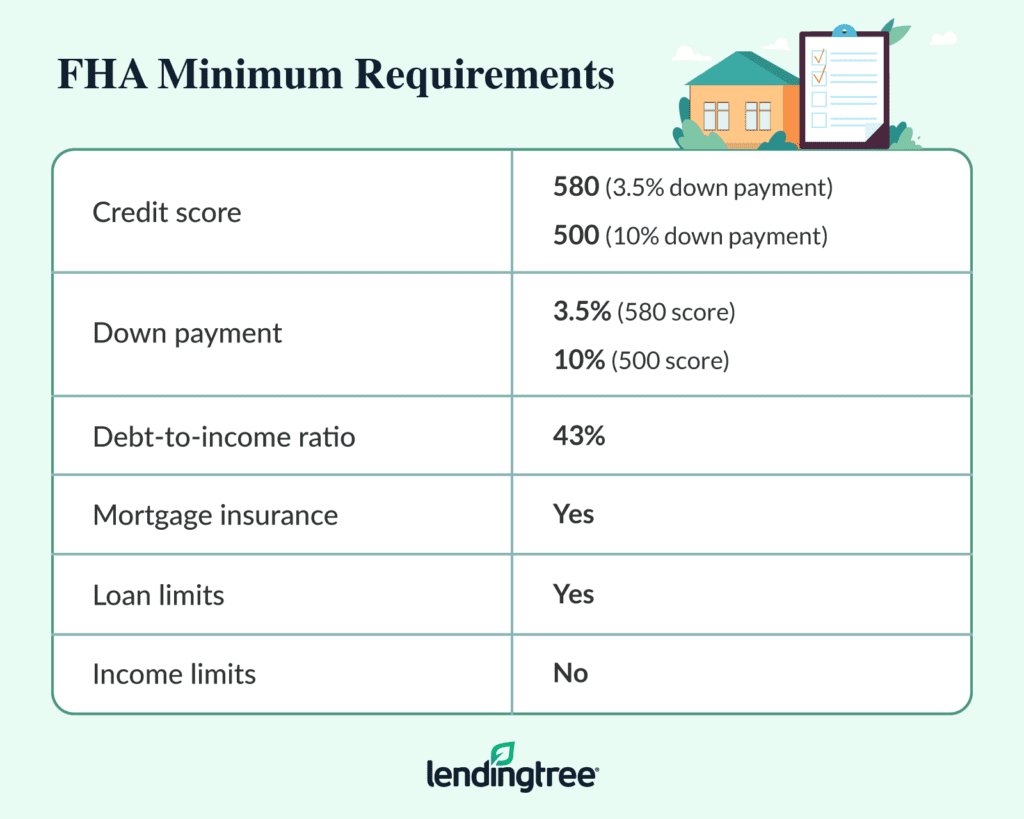

What credit score do I need for lowest FHA closing costs?

The best FHA rates and fees require a minimum 580 credit score. Scores of 620+ qualify you for better pricing.

Can the seller pay my FHA closing costs?

Yes, the seller can provide a closing cost credit of up to 6% of the purchase price. This effectively reduces your out-of-pocket costs.

When will I know my final FHA closing costs?

Your lender will issue a Closing Disclosure 3 days before closing that lists your finalized closing costs.

Can I use gift funds for FHA downpayment and closing costs?

Yes, the FHA allows gifts from family, employers, charities etc. Get a gift letter to document the transfer of funds.

What are the monthly costs after closing an FHA loan?

After closing, expect to pay the monthly mortgage payment plus mortgage insurance, homeowners insurance, and property taxes.

How to reduce FHA closing costs

Whether you’re looking to reduce the sting of immediate expenses or hoping to lower the lifetime cost of your loan, consider these tips to lower your FHA closing costs:

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

FHA Closing Costs Explained – FHA Loan 2022 – First Time Home Buyer | Team Tackney – GMT Real Estate

FAQ

Are closing costs higher on an FHA loan?

What is the payment to the FHA closing?

Are FHA loans difficult to close?

What is the funding fee for the FHA loan?