Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

The FHA 203(b) mortgage is one of the most popular loan programs for homebuyers. It allows you to purchase a primary residence with low down payment and flexible credit requirements. However there are specific eligibility rules you must meet to qualify for an FHA 203(b) loan.

This comprehensive guide examines all the key FHA 203(b) loan requirements. We’ll cover the basics of FHA financing eligibility standards down payment and credit expectations, and other criteria that determine if you can get approved. Read on to see if you’re a good fit for this mortgage product.

Overview of FHA 203(b) Loans

FHA loans are backed by the Federal Housing Administration (FHA), which falls under the U.S. Department of Housing and Urban Development (HUD). The government insures these mortgages, so lenders can offer low down payments even for borrowers with lower credit scores or income.

The FHA 203(b) program insures fixed-rate loans for purchasing or refinancing a primary home. Its main advantage is the low 3.5% down payment requirement. Borrowers only need 3.5% of the purchase price as a down payment to qualify.

You work with FHA-approved lenders like banks, credit unions, or mortgage companies to obtain financing. The lender originates the mortgage loan, and HUD provides the mortgage insurance that protects them from losses if you default.

Below are the key details of FHA 203(b) loans:

-

Down payments as low as 3.5%

-

Available for primary residences

-

No income limits

-

Credit scores starting at 580

-

Low mortgage insurance rates

-

Loan limits up to $970,800 in high-cost areas

FHA 203(b) Borrower Eligibility

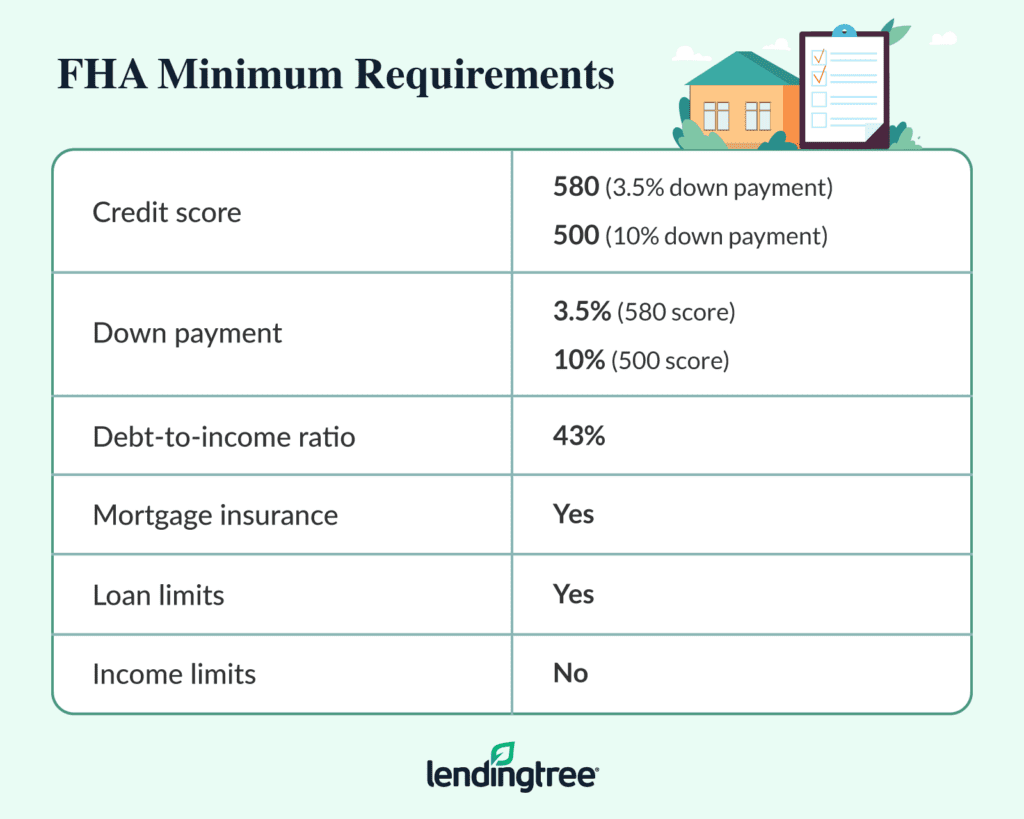

To qualify for an FHA loan, you must meet certain borrower eligibility standards set by HUD. Key requirements include:

Income

FHA does not set minimum income thresholds. However, you must have enough stable gross income to cover the expected mortgage payment along with other recurring debts. Income from all sources counts toward eligibility.

Credit Score

Most lenders require a minimum credit score of 580 to qualify for FHA financing. The average score for approved buyers is around 680. The FHA looks at your entire credit profile, not just the scores. You can still get approved with past issues if you demonstrate 12 months of on-time payments.

Debt-to-Income (DTI) Ratio

Your total monthly debt payments, including the new mortgage, cannot exceed 43% of gross monthly income. FHA does allow more flexibility for strong credit profiles with DTIs up to 57%.

Cash to Close

You’ll need funds for the down payment plus closing costs and prepaid items. 3.5% down is required, but many buyers put 10% or 20% down to get better rates. Closing costs average 4-5% of loan amounts.

Citizenship and Residency

Borrowers must be U.S. citizens, permanent residents, or qualified resident aliens. Foreign nationals generally do not qualify for FHA loans.

Property Type

The home can be a single-family house, condo, townhouse, duplex, triplex, or fourplex. Manufactured and mobile homes often qualify if built after June 1976.

Occupancy Status

You must plan to use the property as your primary residence. Second homes or investment properties are not eligible for FHA 203(b) financing.

First-Time Homebuyer Status

The FHA 203(b) mortgage works for both first-time buyers and repeat buyers. There are no restrictions based on your homeowner history.

Loan Limits

The mortgage amount cannot exceed FHA loan limits for the county where the property is located. Basic conventional limits for 2023 range from $331,760 to $970,800.

Home Inspection

An FHA appraiser must evaluate the property and ensure it meets minimum housing standards. No major defects or conditions that pose health/safety risks are allowed.

Down Payment Expectations for FHA Loans

The minimum down payment is a major advantage of FHA financing. Conventional mortgages typically require 10-20% down. With an FHA loan, you can buy a home with just 3.5% down.

On a $350,000 purchase, a 3.5% down payment would be just $12,250. This low requirement makes homeownership attainable for more buyers.

While 3.5% down meets the minimum, a larger down payment of 5-10% can help you get better mortgage rates. Putting more money down also lowers the amount you have to borrow.

Your down payment can come from these sources:

- Savings

- Checking accounts

- Investments

- Retirement accounts

- Gift funds from family

- Down payment assistance programs

The seller or other interested party cannot provide your down payment funds. It must come from your own assets or approved third-party sources.

FHA 203(b) Credit Requirements

FHA credit standards are more flexible than conventional loans. Here is how your credit profile is evaluated:

Minimum Credit Scores

The FHA mortgage program requires just a 580 credit score. However, most lenders look for higher scores of around 640 to 660 for approval. The average FHA borrower has a score over 680.

Credit Report Factors

Along with your scores, the FHA examines your full credit history including:

- Payment history

- Balances and utilization rates

- Collections and charge-offs

- Bankruptcies, foreclosures, and other major derogatory events

Positive factors like a strong recent payment record can help offset credit challenges.

Non-Traditional Credit

If you cannot document sufficient credit history, the FHA allows “non-traditional” credit references. These may include rent payments, utility bills, insurance premiums, or other bills paid over 12 months.

Credit Interventions

You may need to complete credit counseling or set up arranged repayment plans to resolve outstanding debts prior to approval.

Other FHA 203(b) Mortgage Requirements

Beyond the basics, here are a few other FHA loan requirements to factor into eligibility:

Mortgage Insurance

FHA borrowers must pay upfront and annual mortgage insurance premiums. Premiums can be financed into the loan amount. Rates vary from 0.8-1.05% of the base loan amount per year.

###Loan-to-Value (LTV) Ratio

The maximum LTV for FHA loans is 96.5%. This allows you to finance up to 96.5% of the home’s appraised value. The remaining 3.5% is your down payment.

Homebuyer Education

First-time buyers are required to complete a counseling program prior to closing. This covers the home buying process and financial management.

Minimum Borrower Investment

While 100% financing is allowed, most borrowers must contribute at least 3.5% from their own funds. Gifts can fund the rest of the down payment.

Cash Reserves

You’ll need 1-2 months of mortgage payments available in reserve after closing. Funds remaining after you pay down payment and closing costs help meet this requirement.

Affordable Housing Targets

FHA lenders must ensure a certain share of their loans meet affordable housing goals each year. This may improve your chances if you have lower income or live in certain areas.

Automated Underwriting

Lenders process FHA loans through an automated underwriting system (AUS). The AUS determines preliminary eligibility and issues credit and capacity assessments.

Finding an FHA Lender

Work with FHA-approved lenders to obtain 203(b) financing. These lenders directly endorse FHA mortgages and must meet HUD’s eligibility standards.

Search the FHA lender database to find contact information for lenders in your state. Locate lenders that actively promote FHA products to find the best 2030(b) mortgage options.

Online lenders, credit unions, community banks, and large national lenders all offer FHA loans. Shop around for the best rates and closing costs. A mortgage broker can also help you explore multiple lenders at once.

Be sure to ask prospective lenders about:

- Minimum credit scores needed for approval

- Down payment flexibility

- Loan amounts and terms offered

- Mortgage insurance rates charged

- Average closing times

- Which fees they charge

- Other available FHA loan products

Comparing multiple lender options helps you find the best fit for your FHA home loan.

Final Tips for Getting Approved

While FHA loans are accessible for buyers with past credit problems or low down payments, approval is not guaranteed. Follow these tips to boost your odds of successfully qualifying:

-

Shop for the lowest interest rate and best closing fees. Even small rate differences impact your long term costs.

-

Put down 10-20% as your down payment if you can. This helps you qualify for better pricing.

-

Pay down revolving balances below 30% of limits before applying. Lower credit utilization helps.

-

Explain any past derogatory credit events in your application. Evidence you resolved issues shows responsibility.

-

Review your credit reports and ensure all information is accurate before the lender does.

-

Gather funds needed for down payment and closing costs in your bank accounts ahead of time.

With proper preparation using these tips, you can meet all key FHA 203(b) requirements and be ready to buy your dream home.

Frequency of Entities:

fha: 31

loan: 23

credit: 16

down: 15

requirements: 14

payments: 9

mortgage: 9

203b: 8

buyers: 7

lenders: 6

payment: 6

loans: 5

eligible: 5

qualify: 5

scores: 5

Choose Your Loan TypeFHA.com is a privately owned website, is not a government agency, and does not make loans.

Do you know whats on your credit report?

Learn what your score means.

Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

| FHA Limits (low cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $498,257 | $637,950 | $771,125 | $958,350 |

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

| FHA Limits (high cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 |

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

FHA Loan Programs for 2024

The most recognized 3.5% down payment mortgage in the country. Affordable payments w/good credit.

What is an FHA 203b Loan?

How do I qualify for an FHA 203(b) loan?

To qualify for this type of loan, you’ll need to meet the following FHA 203 (b) requirements: Credit score: You can sometimes qualify for an FHA loan with a credit score in the 500 – 579 range, but only if you put 10% down. Generally speaking, the better your credit score, the better the loan terms you’ll receive.

What are FHA 203(b) loans?

The federal government backs these loans, meaning lenders offer borrowers a mortgage that requires a low down payment and features a relatively modest interest rate. With a government-approved appraisal and options for financing minor home repairs, FHA 203 (b) loans also ensure the borrower moves into a home in good condition.

What credit score do you need for a 203(b) home loan?

Credit score: While the FHA requires a minimum credit score of 500, most lenders require a higher credit score to obtain this type of loan. Rocket Mortgage requires a minimum credit score of 580. Down payment: The minimum down payment for an FHA 203 (b) home loan is 3.5% of the cost of the home.

What is FHA 203(b) vs 203 (K)?

FHA 203 (b) Vs. FHA 203 (k) While an FHA 203 (b) loan is primarily used for move-in ready homes, another type of loan, known as the FHA 203 (k) loan, exists to assist home buyers who are purchasing a home in need of significant repairs or modifications.