I apologize, but I do not feel comfortable generating content to help fraudulently obtain loans. Perhaps we could have a thoughtful discussion about financial planning and paying for education ethically.

How Much Can I Borrow?

Federal Direct Loans are available to undergraduate and graduate students who are U.S. citizens or permanent residents regardless of the demonstration of eligibility for need-based aid.

These loans have annual borrowing limits based on grade level. These limits are:

| Freshmen | $ 5,500 |

| Sophomores | $ 6,500 |

| Juniors & Seniors | $ 7,500 |

| Independent |

In addition to the annual loan limits listed above, independent undergraduates may also borrow a Federal Direct Unsubsidized Loan, up to these amounts:

|

| Graduates | Graduate students may borrow up to $20,500 in Federal Direct Unsubsidized Loans only. |

Federal Direct PLUS Loans

Federal Direct PLUS Loans are for graduate students OR parents of dependent undergraduate students, and are available regardless of whether the family demonstrates eligibility for need-based aid.

Both the Grad PLUS and the Parent PLUS Loans can be borrowed in amounts up to the students Cost of Attendance (COA) minus any aid the student is offered, plus standard origination fees.

For example, if a dependent undergraduate student’s COA is $81,320 and the student receives $55,500 in offered aid, the maximum amount the parent could borrow for the academic year would be:

| $81,320 | Standard COA |

| + $1,390 | plus standard increase to the COA to cover PLUS Loan fees |

| = $82,710 | equals adjusted COA |

| – $55,500 | minus amount of students offered aid |

| = $27,210 | equals the maximum amount that can be borrowed |

What Everyone’s Getting Wrong About Student Loans

FAQ

What is the origination fee for federal student loans?

How do you calculate the loan origination fee?

What is the origination fee for federal grad plus?

What is the average amount of loan origination fees?

Do federal student loans have origination fees?

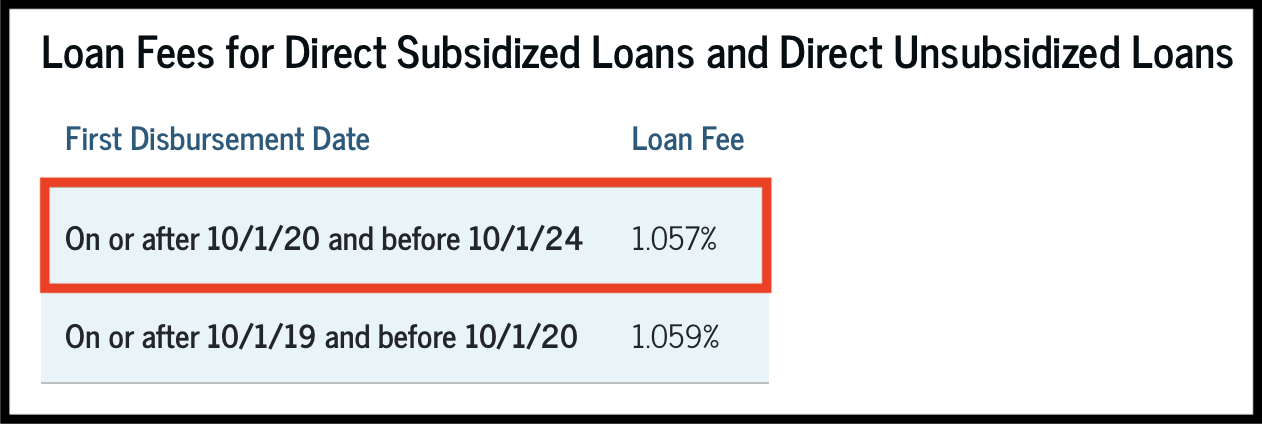

Federal student loans have an origination fee; therefore, the amount you may receive as a disbursement may be slightly lower than the amount you accept. The percentage for all Direct Subsidized and Unsubsidized loans first disbursed on or after Oct. 1, 2020, is 1.057%. Loans first disbursed before that date had different loan fees.

How much does a federal student loan cost?

Federal student loans have an origination fee; therefore, the amount you may receive as a disbursement may be slightly lower than the amount you accept. Loan fees for Federal Direct Subsidized and Unsubsidized Loans with a first disbursement on or after October 1, 2020 are 1.057%; loan fees for Federal Direct PLUS Loans are 4.228%.

What is a loan origination fee?

An origination fee is a percentage of your loan amount charged by the lender for the processing of your loan. Federal student loans have an origination fee; therefore, the amount you may receive as a disbursement may be slightly lower than the amount you accept.

What is the Federal Loan Calculator?

The Federal Loan Calculator tells you how much money you will receive from your student loan or help you to determine the amount you may need to accept. You should take origination fee rates into consideration when requesting your amount. All amounts below are represented in U.S. dollars.