Do you want to qualify for a mortgage based on the cash flow produced by your investment property instead of having to provide information about your employment, tax filing status, paystubs, W2s, etc. ?.

What is Debt Service Coverage Ratio (DSCR)?

A measure of an entity’s cash flow about its debt obligations is called the Debt Service Coverage Ratio, or DSCR. In corporate finance, the entity is frequently a company or corporation, whereas, in multifamily and commercial real estate, it is typically an income-producing property.

The ability of the borrower to service or repay the annual debt payment relative to the amount of Net Operating Income (NOI) produced by the asset is measured by the debt service coverage ratio (DSCR). More net operating income is available to pay off the debt the higher the DSCR ratio.

A real estate property’s ability to pay its mortgage is revealed by the DSCR. Lenders consider the debt service coverage ratio when a real estate investor applies for a new loan or refinances an existing mortgage to determine the maximum loan amount.

What is a DSCR loan program? And How does it Work?

The DSCR loan is made for real estate investors and mortgage brokers who prefer to qualify for a mortgage using the cash flow produced by their investment property rather than using documentation of their income, tax returns, employment history, etc.

Lenders use a DSCR to assist real estate investors qualify for loans because it can quickly determine a borrower’s capacity to repay without requiring income verification. A standard loan may not be available to some real estate investors because they deduct costs from their properties.

Since they are not required to provide tax returns or pay stubs, which investors either lack or which inaccurately reflect their actual income due to write-offs and business deductions, real estate investors can qualify for the debt service coverage ratio loan more quickly.

Compare Rates from DSCR Lenders

Based on projected rental income, pre-qualify for an Investor Cash Flow Mortgage.

For whom is the DSCR loan perfect?

For investors who do not want to provide employment information, tax returns, paystubs, W2s, etc., the DSCR loan is a good option. It solves the issue of having to deal with complicated tax returns, making it the perfect option for self-employed borrowers with highly complex incomes looking for an investment property. If you have several investment properties and claim to have used up your traditional credit limit of ten, it can also be a great option.

What is a Good DSCR Ratio?

Most commercial lenders require a DSCR ratio of 1 from their clients. The average minimum for most lenders is 1.

A DSCR ratio of 1. 00 means the borrower will have enough cash flow from the subject property to repay the loan. If the DSCR ratio is 1. 25, the borrower has some breathing room to make loan payments. A percentage of 1. 50 would give the borrower even more breathing room, and so forth. Once more, lenders typically demand that your DSCR loan have a minimum DSCR ratio of 1.

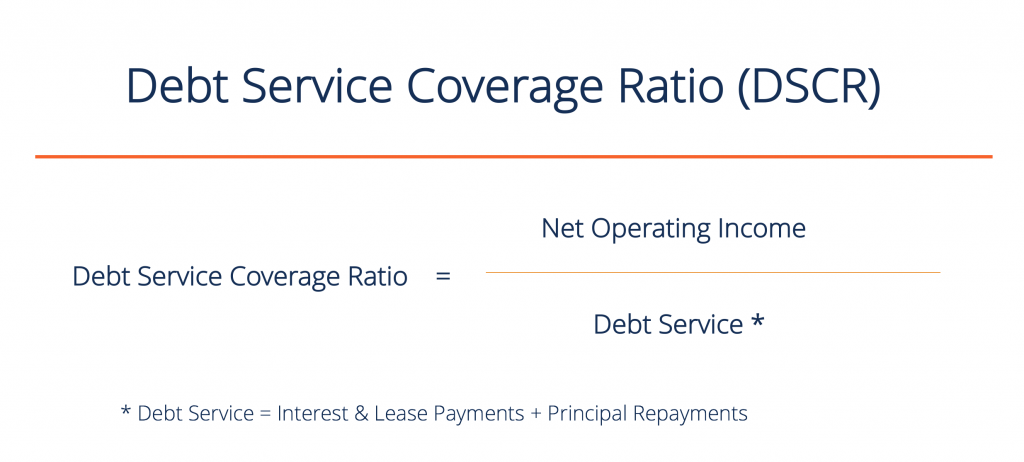

How to Calculate DSCR?

Total debt service (TDS) is multiplied by net operating income (NOI), which is how the DSCR is calculated.

The income from a property’s operations is what’s left over after taxes, interest, depreciation, and amortization are subtracted.

The total debt service (TDS) is the total of all recurring loan payments, which include principal, interest, sinking funds, and lease buyouts.

Formula and Calculation of DSCR

For a commercial or multifamily property, the DSCR is calculated as Net Operating Income / Debt Obligations. Although it is tempting to use this quick and simple calculation, it is crucial to double-check the numbers before applying the formula.

It’s critical to comprehend this when determining the DSCR for your property or business because Net Operating Income (NOI) is typically derived using EBITDA (earnings before interest, tax, depreciation, and amortization). A property might have the following DSCR if, for instance, it had an ROI of $1,000,000 and an annual debt obligation of $850,000:

1,000,000/850,000 = 1.18 DSCR

Net Operating Income= Revenue − COE

COE = Certain Operating Expenses

Total Debt Service = Current debt obligations

DSCR Investor Loan Example:

A property investor might be thinking about a house with a $50,000 gross rental income and a $40,000 annual debt. A DSCR of 1 is obtained by dividing $50,000 by $40,000, or the debt service coverage ratio. 25, which means that the property generates 25% more income. This also denotes a favorable cash flow in the eyes of the lender.

What are the Benefits of a DSCR Loan?

The following are the principal advantages and benefits of a DSCR loan:

Compare Rates from DSCR Lenders

Based on projected rental income, pre-qualify for an Investor Cash Flow Mortgage.

What is a Net Operating Income in DSCR Loan?

Lenders use a number known as a Net Operating Income, or NOI, to assess whether a property will be able to generate enough income to pay back a loan. The NOI needs to be higher than the loan payments for a property to be eligible for a DSCR loan. All operating costs are subtracted from the property’s gross income to determine the NOI. This includes things like taxes, insurance, and repairs. The NOI provides lenders with a precise picture of the property’s potential earnings by deducting these expenses from the income generated by the property.

How Can You Qualify for a DSCR Loan?

The property’s rental income must satisfy or exceed the lender’s coverage ratio requirements in order to be eligible for a DSCR loan. The coverage ratio is calculated as monthly rental income divided by mortgage payment, and varies depending on the lender and borrower. It normally ranges usually ranges from 1. 0x to 1. 5x.

For instance, if the lender’s debt service coverage ratio is 1, the maximum mortgage payment is permitted. 0x and the property generates $5,000 in monthly rent. When the DSCR is 1, the maximum mortgage payment is $3,333. 5x. The mortgage rate and program will determine how much you are able to borrow.

Because eligibility for a DSCR mortgage is primarily based on the rental income generated by the property rather than your personal income, the application process is simplified and may take less time than a standard investment property mortgage.

The DSCR program is a good option for real estate investors who want to purchase or refinance an investment property but lack the necessary personal income or don’t want to provide their tax, financial, and employment records.

How To Apply for a DSCR Loan?

By speaking with a direct lender or working with a mortgage broker, you can submit an application for a DSCR loan.

You must give the lender details about your investment property when you get in touch, including the address, square footage, number of units, and anticipated rental income. The aspects of the application process are such:

Step By Step DSCR Loan Application Process

Your lender will outline every aspect of the loan, including its value, term, fees, and other specifics. During this phase, your lender will also determine your DSCR.

Step 2: Property Information

You must complete the usual loan paperwork for DSCR loans. You should be aware that any financial documentation you submit for a DSCR loan will only ask for details about your company or rental property, not your past income.

DSCR loans must be based solely on your Debt Service Coverage Ratio and not on your personal financial history, so lenders must do this.

Compare Rates from DSCR Lenders

Based on projected rental income, pre-qualify for an Investor Cash Flow Mortgage.

Step 3: Submission and closing

Your financial history is not required for DSCR loans, and the application and closing processes are much quicker than for other kinds of mortgage loan programs.

If your loan application is accepted, the lender will give you a Loan Estimate that details the interest rate, payment amount, and closing costs. A loan commitment or pre-qualification letter will be sent to you by the lender after you have reviewed and agreed to the loan terms.

At this point, you will have to pay for a property appraisal and provide it to the lender. You will go through the mortgage underwriting process after the assessment is finished, sign the last loan documents, and close on the loan.

What are The DSCR Program Requirements?

The following criteria must be met to be eligible for the DSCR program:

The most crucial qualification criterion for a DSCR mortgage, the coverage ratio, is calculated using either the rental income determined by a signed lease agreement or, in the absence of a lease, the estimated rental income determined by a property appraisal report. For small residential income property appraisal reports, two- to four-unit residences use Form 1025, whereas single-family homes use the Form 1007 rent schedule.

As mentioned earlier, the coverage ratio typically ranges from 1 to 2 depending on the lender. 0x to 1. 5x, which requires that the monthly rental income, whether actual or anticipated, equals 1. 0x to 1. 5 of the mortgage payment. The coverage ratio could occasionally be decreased or even eliminated if you put at least 30% down. Please ensure that you and your lender are both clear on all the terms of the DSCR Loan program because they may differ from lender to lender.

Loan To Value (LTV) Ratio

For the DSCR loan program, the majority of lenders will demand an LTV ratio of 80%, or a minimum 20% down payment. Although you may be able to make a lower down payment, doing so will typically result in higher interest rates.

In addition to purchase loans, the majority of DSCR programs offer options for rate, duration, and cash-out refinancing. In some cases, you might be able to withdraw more money from an investment property with a DSCR mortgage than you would with a traditional non-owner-occupied loan.

DSCR loans, as opposed to standard mortgages for investment properties, may have a prepayment penalty. To understand any fees or pre-payment penalties you might have to pay, we advise you to read the terms of your loan carefully.

The majority of DSCR lenders accept all loan types, including fixed- and adjustable-rate loans, interest-only mortgages, and ARM mortgages.

The maximum mortgage loan amount varies by lender and ranges from lower to higher millions. If necessary, you will have the option to use the DSCR loan program to purchase investment properties with higher ticket sizes.

Regular investment property loans typically forbid a variety of properties, such as non-warrantable condos and homes with more than four units. However, DSCR mortgages frequently permit these types of properties. Standard mortgage requirements do not prohibit an LLC from owning properties. Furthermore, the majority of lenders don’t impose a limit on the total number of rental properties you’ve financed, which may enable you to quickly grow your real estate portfolio.

What are the Borrower Qualifications for a DSCR Mortgage?

A credit score of 640 is typically needed for a DSCR mortgage, which is comparable to the score required for a standard investment property loan. The minimal credit score needed for a DSCR mortgage, however, varies depending on the lender and other factors. Furthermore, foreign investors who lack established credit can still be approved for DSCR loans.

Debt-to-Income Ratio of the Borrower

Your application will not be evaluated based on your personal debt-to-income ratio because the DSCR program uses a coverage ratio to determine eligibility.

This suggests that lenders do not verify your employment or income when you apply for a loan, which reduces the amount of paperwork required.

Do DSCR loans require an appraisal?

An appraisal is necessary for DSCR loans, or loans that are not secured by any real property, to be properly underwritten. The goal of the appraisal is to determine the value of a DSCR loan in comparison to other DSCR loans available on the market. The lender can better understand the risks associated with lending to the borrower by evaluating the loan. The appraisal also guarantees that the DSCR loan is being made at a reasonable cost. If DSCR loans are not appraised, higher interest rates and fees might apply.

What are the Program Costs and Fees of DSCR?

As compared to conventional investment property mortgages, DSCR loans frequently have higher fees. These may include a prepayment penalty, points, and a higher origination fee. The fact that the typical maximum LTV ratio is 80% also contributes to the loan’s overall cost being higher. The expenses under a DSCR Loan are:

A percentage of the total loan amount is typically charged by the lender as an origination fee. This fee typically ranges from 0. 5% to 1. 0%. Some lenders might waive the fees entirely or charge lower origination fees.

The appraiser must charge an appraisal fee to determine the value of the property. This fee typically ranges from $300 to $500.

DSCR properties typically have mortgage rates that are 1% to 2% higher than those for typical investment properties. To find the best rates, we suggest comparing mortgage quotes from a few lenders because DSCR loans typically have a wider price range. As was previously stated, the interest rate might be higher if there isn’t a lease on the property and the estimated rental income is based on an appraisal report.

As with conventional rental property mortgages, the closing costs for DSCR loans include lender origination fees, appraisal, title, and escrow fees. Finding the best offers should be made easier by comparing rates from different lenders.

Depending on the state where the property is located, additional fees, such as title insurance and escrow fees, are also common. These fees are typically paid at closing.

Why does DSCR changes over time?

A financial ratio called the DSCR assesses a company’s capacity to pay off its debts. The likelihood of the company being able to repay its debts increases with the ratio. But for a variety of reasons, the DSCR can alter over time. For instance, a business might acquire additional debt, raising its debt obligations and lowering the ratio. Or, a business might expand and become more profitable, which would result in greater cash flow and a higher DSCR.

Additionally, changes in interest rates can affect the DSCR. The amount of interest a business must pay on its debt will increase as interest rates rise, reducing the DSCR. On the other hand, falling interest rates will result in a company paying less in interest, increasing the DSCR. As a result, it’s critical to continuously track the DSCR to obtain an accurate picture of a company’s financial situation.

The same is true for real estate investors; the DSCR may change in response to changes in the property’s profitability or rental income. The DSCR will decrease as your debt burden grows or as your interest rate rises, and vice versa.

What is a 6-month SOFR DSCR loan?

The 6 Month SOFR DSCR Loan has an interest rate based on the Secured Overnight Financing Rate (SOFR). The SOFR is the overnight lending rate between large depository institutions.

The New York Federal Reserve publishes the SOFR as a daily reference rate. The loan’s interest rate will reset every six months, and at the end of the loan term, the entire amount will be due. Throughout the loan term, the borrower will be required to make monthly payments, which will be applied to the loan’s outstanding balance. The Borrower shall be responsible for repaying the unpaid balance of the Loan at the end of the Loan Term. These loans are the best option for borrowers who require a quick loan and are at ease with variable interest rates.

The loan’s maximum maturity is five years, and its maximum loan-to-value ratio is seventy-five percent. Borrowers need to have a minimum debt service coverage ratio (DSCR) of 1 in order to qualify for the 6 Month SOFR DSCR Loan. 25x.

DSCR Loans for Foreign Nationals

Foreign nationals who want to buy real estate in the United States can use DSCR mortgages. These loans differ from typical investment property loans in a few key ways.

First, the maximum loan-to-value (LTV) ratio is usually 80%. This means that if you want to use a DSCR mortgage to finance a property, you will require a down payment of at least 20%.

Second, compared to standard investment property loans, these loans frequently have higher interest rates and fees.

Finally, in order to be eligible for a DSCR loan, you must present evidence of your rental property’s income.

However, purchasing a property in the US can be challenging for foreign nationals, and the loan application process is difficult. In order to give you the right advice and make the mortgage and property buying process easier, HomeAbroad connects you with a CIPS (Certified International Property Specialist) real estate agent and the appropriate lender.

Compare Rates from DSCR Lenders

Based on projected rental income, pre-qualify for an Investor Cash Flow Mortgage.

Q Are DSCR Loans Expensive?

DSCR loans aren’t the cheapest option on the market. They typically require a 20-25% down payment.

Q Is it hard to get a DSCR Loan?

No, the income from your property, not your financial situation, determines whether you will be approved for a DSCR loan, making the process simpler. DSCR loans are easier to obtain, and the application process is quicker and more straightforward. The criteria for DSCR loans are generally less stringent.

Q What type of property can I buy with a DSCR Loan?

You are able to purchase a variety of properties with the DSCR loan for a variety of uses, including long- and short-term rentals. As long as you can demonstrate that a property will produce a positive cash flow, you may purchase it whether it will be used as a temporary or permanent residence.

Q How do I know if I’m eligible for a DSCR Loan?

You must be in need of a DSCR Loan and have excellent credit. Most importantly, you’ll need to show that you can pay your mortgage by producing documentation of your rental property’s income.

Q What are the benefits of a DSCR Loan?

DSCR loans offer several benefits, including: Easier to qualify for. No personal income verification is required. Flexible underwriting guidelines. It is possible to finance homes with little to no rental history.

Q How long is a DSCR loan?

DSCR loans are typically provided for terms ranging from 5 to 25 years, with 15 or 20 years being the most typical. The lender will typically choose the loan’s duration based on the type of property being purchased and the anticipated cash flow of the business, among other considerations.

Q How can I improve my DSCR?

The simplest way to raise your DSCR is to increase your investment, but you can also increase your rent, purchase insurance, and fight yearly property taxes. Easy ways to raise your rent include allowing pets or adding extras like a washer and dryer. Additionally, you need to raise net operating income or lower debt service payments to improve your debt service coverage ratio (DSCR).

Q What is a no DSCR loan?

A commercial loan known as a “no DSCR loan” does not call for the borrower to have a DSCR of 1. 0 or higher. This shows that the borrower does not have to make a sufficient income to pay their monthly debt obligations. Businesses that are growing or undertaking new endeavors typically use no DSCR loans because they might not have the income necessary to pay off all of their debt.

assisting newcomers and foreign nationals with their travels within the USA

© 2022 HomeAbroad Inc. All rights reserved.

FAQ

Do you need down payment for DSCR loan?

A DSCR loan does require a down payment, typically between 20 and 25 percent. You still need to put down money even if the rental income would cover the entire payment with no down payment. Due to lower risk, the lender is able to offer this loan without income verification.

Is it hard to get a DSCR loan?

Since DSCR loans are based on your property’s potential cash flow, qualifying is simpler than with other loan types. In fact, it may be much simpler to get approved for DSCR loans since they depend on the income from your property rather than your personal financial situation.

What is needed for a DSCR loan?

You must satisfy your lender’s DSCR requirements in addition to making a 20 to 25 percent down payment and having a credit score of 640 or higher in order to be eligible for a DSCR loan. Some lenders might demand that your property generate 150% of the monthly mortgage payment for the house. That would be a DSCR of 1. 5.

Is a DSCR loan interest only?

Interest-only loan option available. Suited for new and seasoned real estate investors. Both long-term and short-term rentals are eligible (Airbnb, VRBO, etc. (Cashout loans do not require reserves, but all other loans must be repaid within six months unless the DSCR ratio is less than 1.