You never thought bankruptcy would give you too much. But sometimes it does.

You never thought bankruptcy would give you too much. But sometimes it does.

When you file for Chapter 7 bankruptcy, the goal is to get out of debt. Simply put, the discharge removes your personal responsibility for debts that are discharged in bankruptcy.

Your liability expires at the conclusion of the case, provided that the debt is not one of those that is not discharged.

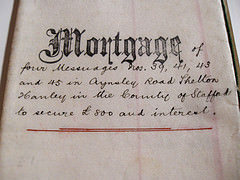

Title: Navigating Your Mortgage After Bankruptcy: What You Need to Know

Filing for bankruptcy can be a stressful and overwhelming experience, especially when it involves your home. Many people worry about how their mortgage will be affected and whether they will lose their home. This guide will address these concerns and provide you with a clear understanding of how your mortgage will appear on your credit report after bankruptcy.

Understanding Discharged Debt and Credit Reporting:

When you file for Chapter 7 bankruptcy, most of your debts are discharged, meaning you are no longer legally obligated to repay them. This includes your mortgage debt. However the discharged debt will still appear on your credit report for up to 10 years. The credit report will indicate that the debt was discharged in bankruptcy, which can impact your credit score.

Reporting of Discharged Debts:

The Federal Trade Commission (FTC) has specific guidelines on how discharged debts should be reported on credit reports. According to the FTC, it is inaccurate and misleading to report a discharged debt as “charged off as bad debt” if the account was open and not charged off when you filed for bankruptcy. The credit report should accurately reflect that the debt was discharged and has a $0 balance.

Disputing Inaccurate Reporting:

If your discharged mortgage debt is inaccurately reported on your credit report, you have the right to dispute the error under the Fair Credit Reporting Act (FCRA). You can file a dispute with the credit bureau directly or through a credit repair company. If the error persists, you may have grounds for a lawsuit.

Mortgage Foreclosure and Credit Reporting:

In most cases your personal liability to pay your mortgage is discharged at the end of your Chapter 7 bankruptcy. This means that if you fail to pay the lender can foreclose on the property but cannot pursue you for any deficiency after the foreclosure sale. However, the foreclosure itself will appear on your credit report for up to seven years.

Reaffirmation of Debt:

You have the option to reaffirm your mortgage debt during the bankruptcy process. This means you agree to remain personally liable for the debt even after it is discharged. While this can help you keep your home, it also means you are responsible for the full amount of the debt, even if you face financial difficulties in the future.

Proving Mortgage Payments:

Even though your mortgage debt is discharged, you can still prove your payment history to potential lenders or anyone else who needs to verify your creditworthiness. You can request a payment history from your mortgage company, which will show all payments you made, along with the amounts and dates.

Navigating your mortgage after bankruptcy can be complex. By understanding how discharged debt and foreclosure are reported on your credit report, you can take steps to protect your credit score and ensure your financial future. Remember, it’s crucial to consult with a bankruptcy attorney to discuss your specific situation and explore your options.

Additional Resources:

- American Bankruptcy Institute (ABI): https://www.abi.org/

- Federal Trade Commission (FTC): https://www.consumer.ftc.gov/topics/credit-reports-and-scores

- National Foundation for Credit Counseling (NFCC): https://www.nfcc.org/

Frequently Asked Questions:

- Will my mortgage show up on my credit report after bankruptcy?

Yes, your mortgage will still appear on your credit report for up to 10 years after it is discharged. However, it will be marked as “discharged” and have a $0 balance.

- Will foreclosure show up on my credit report after bankruptcy?

Yes, foreclosure will appear on your credit report for up to seven years.

- Can I reaffirm my mortgage debt after bankruptcy?

Yes, you can reaffirm your mortgage debt during the bankruptcy process. However, this means you will remain personally liable for the debt.

- How can I prove my mortgage payments after bankruptcy?

You can request a payment history from your mortgage company, which will show all payments you made, along with the amounts and dates.

- Where can I get help with my mortgage after bankruptcy?

You can consult with a bankruptcy attorney or a credit counselor for guidance.

Remember:

Bankruptcy is a complex legal process. It’s crucial to seek professional advice from a bankruptcy attorney to understand your options and protect your rights.

Your Mortgage Was Discharged

At the conclusion of your Chapter 7 bankruptcy, your personal obligation to pay your mortgage was typically discharged. This implies that the lender may foreclose if you don’t pay, but they can’t pursue you for the remaining balance following the foreclosure sale.

It means you owe $0 on your mortgage. You’re paying the security interest, but there’s no personal liability.

The mortgage company isn’t allowed to report on the account – at all. No payments, no balance, no skipped payments. Nothing.

That’s advantageous if you fall behind, but if you make your payments on time, you won’t “get credit” for them.

Credit Reporting Of Discharged Debts After Bankruptcy

The Federal Trade Commission, in the famous Brinckerhoff-Lovern letter of April 24, 1998, spells out exactly how a debt discharged in bankruptcy must be reported. It states as follows: