If you’re taking out a conventional home loan, you may be wondering if a home inspection is needed. While it’s not required by most lenders, it’s still a good idea to get one done. Read on to learn more about home inspections and why they may be worth your time.

Buying a home is likely the biggest investment you’ll ever make. That’s why it’s critical to have all the facts before signing on the dotted line. One key question homebuyers should ask is, “Does a conventional loan require a home inspection?”

The short answer is no. With a conventional loan, lenders typically won’t require a home inspection; it’s up to the buyer whether or not to get one But not ordering an inspection can be a costly mistake.

While lenders don’t mandate inspections for conventional loans, homebuyers should still schedule one. An inspection provides valuable information on the property’s condition, allowing buyers to make an informed decision.

In this article. we’ll cover

- What is a conventional loan?

- Conventional loan requirements

- What is a home inspection?

- Should you get an inspection with a conventional loan?

- Home inspection costs

- What a home inspection covers

- Using your inspection report

What is a Conventional Loan?

A conventional loan is a mortgage not backed by the federal government. This differs from FHA, VA and USDA loans which are government-insured.

Conventional loans must meet guidelines set by Fannie Mae and Freddie Mac. These government-sponsored enterprises buy loans from lenders, allowing continued lending.

Conventional loans come with several benefits including:

- Potentially lower interest rates

- Lower mortgage insurance

- More flexible credit guidelines

- No limit on loan amount

They tend to have stricter eligibility requirements than government loans, however. We’ll explore these next.

Conventional Loan Requirements

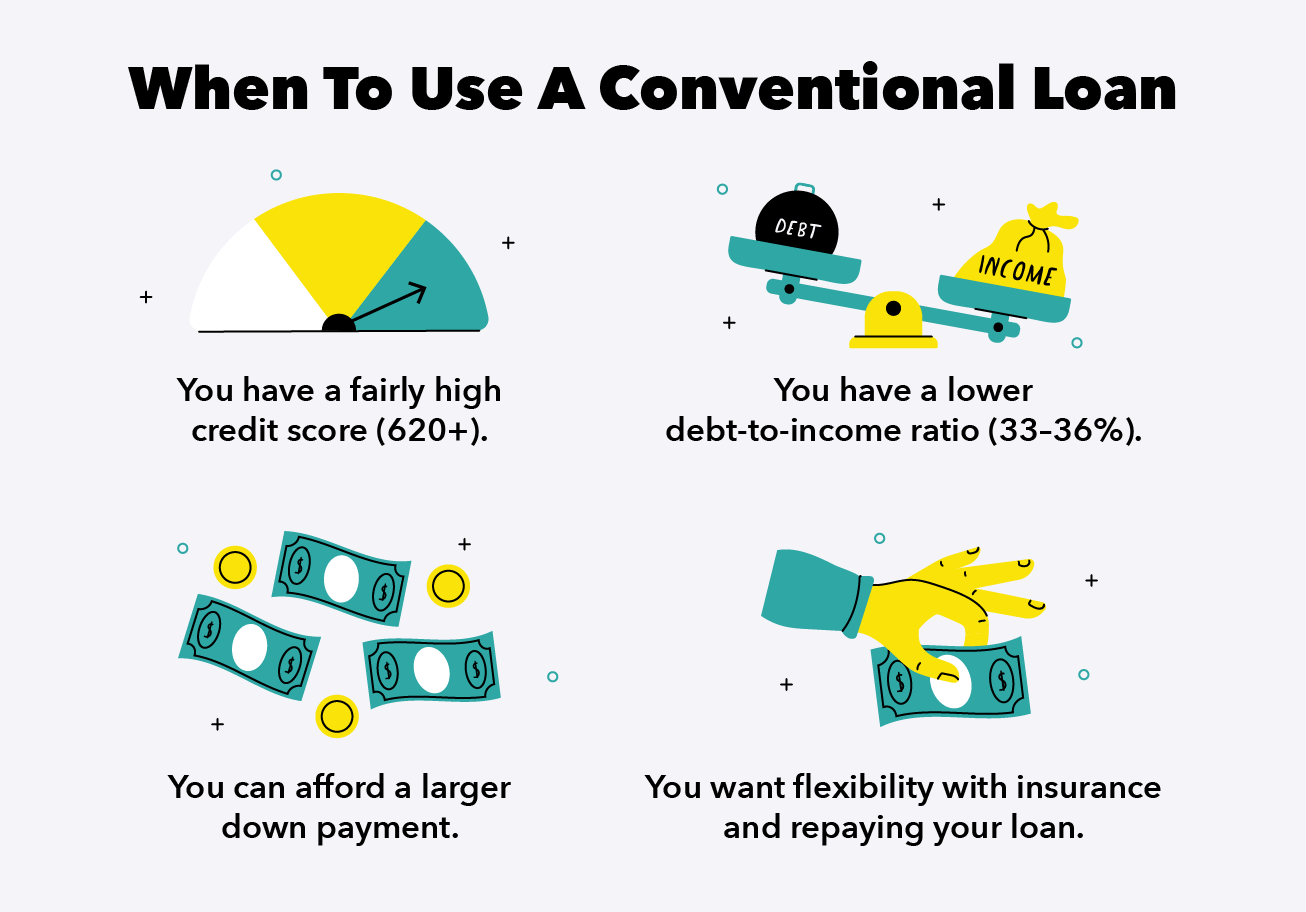

To qualify for a conventional loan, borrowers typically need:

- A minimum credit score of 620

- A down payment of at least 3%

- A debt-to-income ratio below 45%

- Loan amount below conforming limits

- Sufficient income and assets

A home appraisal is mandatory with a conventional mortgage to ensure the property is worth the purchase price. But a professional inspection is not required.

What is a Home Inspection?

A home inspection is a detailed examination of the property’s condition. A qualified inspector checks the home’s:

- Structural elements

- Exterior

- Roof

- Insulation

- Plumbing

- Electrical systems

- HVAC

The goal is identifying any issues that may impact the home’s safety, function and integrity. Inspectors provide an unbiased assessment of the property’s overall condition.

Home inspections differ from appraisals. An appraisal determines the home’s market value, while an inspection evaluates its physical condition.

Should You Get an Inspection with a Conventional Loan?

Although not mandated, home inspections are highly recommended for conventional loan borrowers. An inspection provides critical insights such as:

1. Identifying Hidden Defects

Inspections can uncover problems not visible to the naked eye like:

- Structural damage

- Pest infestations

- Faulty wiring

- Plumbing leaks

Knowing these issues upfront prevents unwelcome surprises after moving in.

2. Negotiating Power

Inspection reports give buyers leverage when negotiating repairs with the seller. You can request the seller fix certain defects or reduce the price accordingly.

3. Peace of Mind

Perhaps most importantly, an inspection brings peace of mind. You can rest easy knowing you’ve made an informed decision about this major purchase.

Home Inspection Cost

Home inspection fees range from $300-$500 on average based on factors like:

- Home size

- Location

- Scope of inspection

Consider this a small price to pay for the insights an inspection provides. The potential cost savings make inspections well worth the investment.

What Does a Home Inspection Cover?

A standard home inspection examines:

- Foundation – Checks for cracks, signs of settling, moisture issues

- Framing – Inspected for structural integrity

- Roof – Evaluates age, condition, remaining lifespan

- Exterior – Siding, trim, paint, drainage, graded away from home

- Electrical – Panel, wiring, outlets, switches, grounding, amps

- Plumbing – Pipes, water pressure, functionality of fixtures

- HVAC – Age, capacity, distribution, overall operation

- Attic – Insulation coverage, ventilation

- Interior – Walls, ceilings, floors, windows, doors

- Built-in appliances – Ovens, ranges, microwave, dishwasher

The inspection covers hundreds of items. Inspectors note any deficiencies and recommend repairs.

Using Your Inspection Report

Carefully review your home inspection report. Ask your inspector to explain any unclear or concerning findings.

Use the report when negotiating with sellers. Request they remedy major defects or lower the purchase price accordingly.

For minor issues, consider setting aside funds for future repairs. Develop a home maintenance plan based on the inspection findings.

The Bottom Line

Conventional loans don’t require a home inspection. But not getting one is risky. Inspections provide homebuyers with objective insights into the property’s condition.

While optional, inspections are strongly recommended. For a few hundred dollars, you gain negotiating power, prevent unexpected repair costs, and make an informed decision on your most significant investment.

What Happens if an Inspector Finds Something Concerning During Your Home Inspection?

If an inspector finds something concerning during your home inspection, they may recommend that you have a professional come and look. Depending on the severity of the issue, they may also recommend that you have the home repaired or replaced. If you have any questions about what the inspector found, be sure to ask them for clarification.

How Does a Home Loan Inspection Differ from a Home Appraisal?

It’s important to note that a home loan inspection is different from a home appraisal. A home loan inspection is carried out by a professional inspector who assesses the property for any issues that could affect its value or habitability. A home appraisal, on the other hand, is conducted by a licensed appraiser and focuses on estimating the market value of the property. While both inspections are important, they serve different purposes and provide different information to lenders.

A home loan inspection is more comprehensive than a home appraisal. It covers all aspects of the property, from its condition to its safety, and can provide valuable information to lenders deciding whether or not to approve a loan. Home appraisals, while important, are primarily concerned with the market value of the property. If you’re looking to get a home loan, be sure to ask your lender about both inspections.

Do Mortgage Companies Require Home Inspections

FAQ

What type of inspection is required for a conventional loan?

What does a conventional loan appraiser look for?

What will fail a conventional appraisal?

Is it hard to qualify for a conventional loan?

Do you need a home inspection for a conventional loan?

No, a professional home inspection is not required to obtain a conventional loan. But buying a home without a home inspection can be a big mistake. Your real estate agent may require you to sign a home inspection waiver if you decide to skip the home inspection.

Is a home inspection required from the lender?

The lender does not need a home inspection because they won’t have to pay for home renovations. However, as a buyer, you’ll want to know about any potential problems — and the likely cost to fix them — before the purchase. Therefore, it’s important for you to arrange for a home inspection.

What are the requirements for a conventional loan?

To secure a conventional loan, one of the main requirements is that the home must be appraised. The appraiser determines the property’s actual market value by comparing it with other, similar homes in the neighborhood that have sold recently.

Am I eligible for a conventional home loan?

Your income can help you qualify for a conventional home loan. Lenders consider various income streams such as retirement income, alimony, child support, and Social Security payments. Different types of income can help you qualify for a conventional home loan.