In a Nutshell: Your debt-to-income ratio, which contrasts your monthly loan balance with your income, is one of the numerous factors that lenders consider when you apply for a mortgage. Here’s how this important number is calculated and what you need to know about it. Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but that doesn’t affect.

We think its important for you to understand how we make money. Its pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make enables us to produce our other fantastic tools and instructional materials as well as to provide you with free credit scores and reports.

Compensation may factor into how and where products appear on our platform (and in what order). However, since the majority of our revenue comes from the offers you accept, we make an effort to present you with offers we believe are a good fit for you. Thats why we provide features like your Approval Odds and savings estimates.

Naturally, not all financial products are represented by the offers on our platform, but our aim is to present you with as many excellent options as possible.

When you’re applying for a mortgage you’ll likely hear the term “debt-to-income ratio” (DTI) thrown around a lot. This ratio is a crucial factor that lenders consider when assessing your ability to repay the loan. But what exactly is a DTI and what does it include?

What is a Debt-to-Income Ratio?

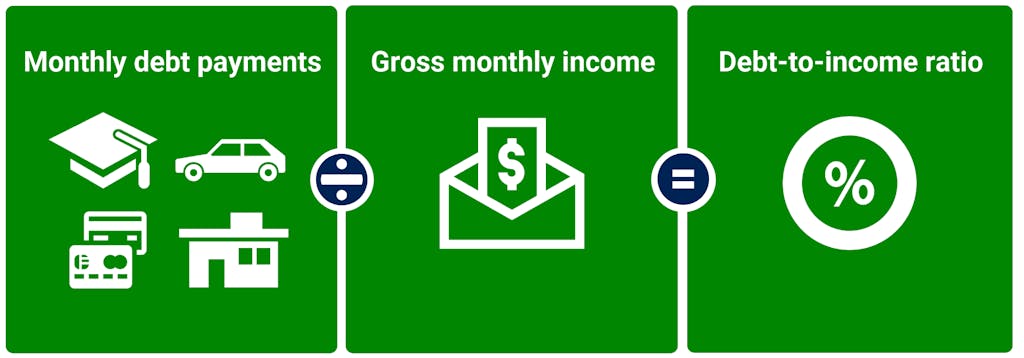

Simply put, your DTI is the percentage of your gross monthly income that goes towards paying off your debts This includes things like your mortgage payment, credit card payments, student loans, car loans, and other recurring debt obligations

Do Utilities Count in a DTI?

The good news is that utilities are not included in your DTI calculation. This means that your monthly expenses for things like electricity, water, gas, garbage, and internet won’t affect your DTI.

Why are Utilities Excluded?

Utilities are considered essential expenses that most people have to pay regardless of their income level. Including them in the DTI calculation would unfairly penalize people who live in areas with higher utility costs. Additionally, utilities are typically not considered debt, as they are paid for on a month-to-month basis.

What Does Count in a DTI?

Here’s a breakdown of the types of debt that are typically included in a DTI calculation:

- Mortgage payments: This includes your principal, interest, taxes, and homeowner’s insurance.

- Credit card payments: This includes the minimum payment due on all your credit cards.

- Student loan payments: This includes the minimum payment due on all your student loans.

- Car loan payments: This includes the monthly payment on your car loan.

- Personal loan payments: This includes the monthly payment on any personal loans you have.

- Alimony and child support payments: These are considered recurring debt obligations and are included in your DTI.

How to Improve Your DTI

If you’re concerned about your DTI, there are a few things you can do to improve it:

- Pay down debt: This is the most effective way to lower your DTI. Focus on paying off high-interest debt first, such as credit card debt.

- Increase your income: This can be done by getting a raise, taking on a side hustle, or starting a business.

- Reduce your expenses: This could involve cutting back on unnecessary spending, negotiating lower bills, or finding cheaper housing.

While utilities are not included in your DTI, it’s still important to factor them into your overall budget. By understanding what your DTI is and how to improve it, you can increase your chances of getting approved for a mortgage and securing the home of your dreams.

How to calculate DTI ratio

Although there are two types of DTI: front-end and back-end ratios, there is an extra layer of complexity to understanding how your DTI ratio is calculated.

Your front-end ratio reveals how much of your pretax income would go toward a mortgage payment. The amount of your pretax income that would be allocated to housing costs, such as homeowners insurance and property taxes, is also examined by your front-end DTI ratio. Lenders tend to prefer that your front-end DTI ratio does not exceed 28%. Should your DTI exceed that threshold, it may indicate that you will struggle to make ends meet.

A lender may compute your back-end DTI ratio, which compares your pretax income to all of your debts, including current debts with the addition of a mortgage payment, in order to assess your ability to afford a mortgage loan. If the amount is excessively high, it can mean that you don’t make enough money to cover your daily expenses and debts.

When talking about DTI, the term “back-end ratio” is usually used by default. It is computed by dividing the total amount of debt payments you make each month by your gross monthly income. All of the money you have made before taxes, including investments and paychecks, is known as your gross income. Other deductions include contributions to retirement plans and health insurance.

Your projected monthly mortgage payment, credit card debt, auto loans, school loans, and alimony or child support are usually among the monthly debt payments that are included in your back-end DTI calculation. Don’t include non-debt expenses like utilities, insurance or food. The percentage that is used as your DTI ratio is obtained by dividing that amount by your gross monthly income and multiplying the result by 100.

Calculating back-end DTI ratio: Some examples

| Total monthly debt payments | Gross monthly income | Debt-to-income ratio |

|---|---|---|

| $1,500 | $2,500 | 60% (needs work) |

| $1,000 | $3,000 | 33% (good) |

| $1,500 | $3,500 | 43% (fair) |

Remember that there are numerous costs associated with homeownership that are not included in your DTI calculation because they are not debts. Think homeowners insurance, utilities, homeowners association fees, property taxes, routine maintenance and repairs … you get the point. Other basic expenses not factored into your DTI calculation include food and transportation.

How to Calculate Your Debt to Income Ratios (DTI) First Time Home Buyer Know this!

FAQ

Do utilities affect debt-to-income ratio?

Are utilities included in debt-to-income?

What bills are included in debt-to-income ratio?

What should be included in debt-to-income ratio?

Do I need to know my debt-to-income ratio?

You need to know this number if you’re going for a mortgage. Your debt-to-income ratio (DTI) is a personal finance measure that compares the amount of debt you have to your gross income. You can calculate your debt-to-income ratio by dividing your total recurring monthly debt by your gross monthly income

What is debt-to-income ratio (DTI)?

Lenders have different DTI requirements. Personal loan companies may allow higher DTIs than mortgage lenders. Debt-to-income ratio divides your total monthly debt payments by your gross monthly income, giving you a percentage. Here’s what to know about DTI and how to calculate it.

How do I calculate my debt-to-income ratio?

This article will walk you through the steps to take to determine your debt-to-income ratio. To calculate your debt-to-income ratio (DTI), add up all of your monthly debt obligations, then divide the result by your gross (pre-tax) monthly income, and then multiply that number by 100 to get a percentage.

What is gross monthly income & debt-to-income ratio?

Gross monthly income is the amount you earn each month before taxes and other deductions are taken out. If your gross income for the month is $6,000, your debt-to-income ratio would be 33%: However, if your gross monthly income was lower, but your debts were the same, your DTI ratio would be higher.