Buying a home is expensive, especially in the weeks preceding and following closing. Homebuyers can be caught off guard by the money needed to cover down payment, closing costs, inspection fees, and home repairs.

However, they may be able to alleviate some of these expenses by negotiating seller concessions with the home seller. If the seller agrees, they may pay for part of the closing costs incurred by the homebuyer. This is typically equivalent to 2% to 5% of the home purchase price.

If the seller offers concessions, the buyer is able to save some of their funds for a larger down payment. Or, they can put those funds toward some of the other costs associated with moving and buying a house.

Seller concessions can be a great way for buyers to reduce their closing costs when purchasing a home with a conventional loan However, there are specific guidelines that limit the amount sellers can contribute. In this comprehensive guide, we’ll explain what conventional loan seller concessions are, the benefits for buyers and sellers, limitations, and how to negotiate seller concessions

What Are Conventional Loan Seller Concessions?

Seller concessions are when the home seller agrees to cover some of the buyer’s closing costs in a real estate transaction. The seller effectively reduces the sale price and uses those funds to pay for the buyer’s closing costs

Seller concessions can include paying for the buyer’s title insurance, home inspection fees, attorney fees, property taxes, and more. They cannot be used to cover the buyer’s down payment or reserve requirements.

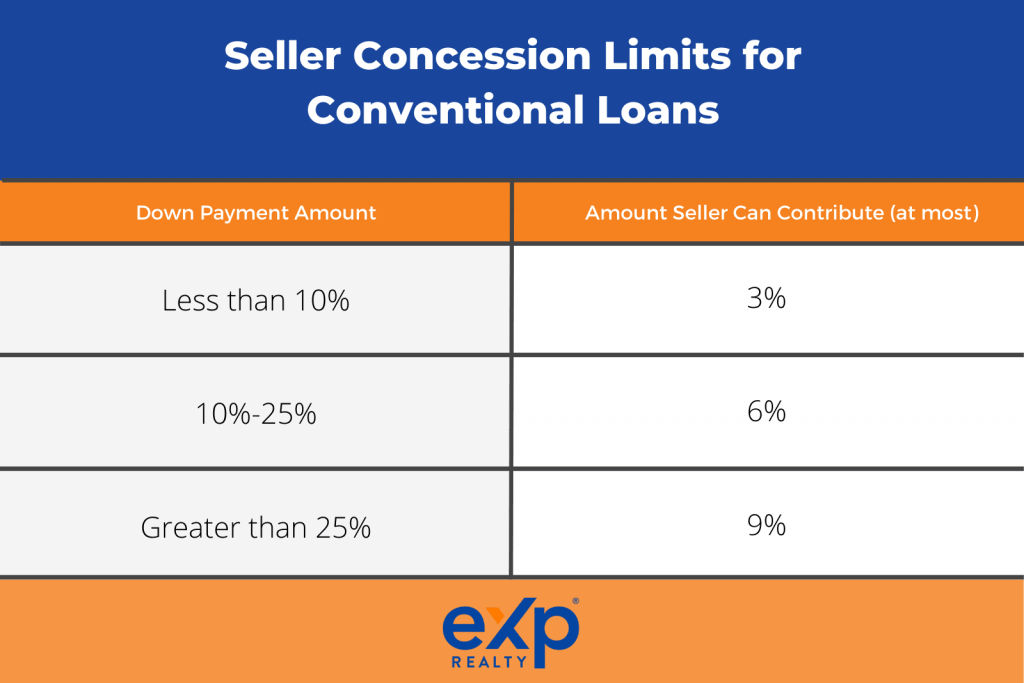

Conventional loans have limits on the maximum seller concessions based on the down payment:

<ul><li><div>If your down payment is less than 10%, the seller can contribute up to 3%.</div></li> <li><div>If your down payment is 10% – 25%, the seller can contribute up to 6%.</div></li><li><div>If your down payment is more than 25%, the seller can contribute up to 9%.</div></li></ul>

If the seller concessions exceed these limits, the sales price must be reduced to bring the concessions within the allowed thresholds.

The Benefits of Conventional Loan Seller Concessions

Seller concessions can benefit both the buyer and seller in a real estate transaction:

For buyers:

- Reduce high upfront closing costs

- Make homeownership more affordable

- Allow buyer to preserve more cash savings

For sellers:

- Make offer more appealing to potential buyers

- Help sell the home faster

- Complete the sale in a buyer’s market

First-time homebuyers with limited savings often find seller concessions very helpful to manage closing costs. Sellers may be motivated to offer concessions if their home has sat on the market for a prolonged time.

Negotiating Conventional Loan Seller Concessions

When negotiating seller concessions, it’s important to first understand the current real estate market conditions. If it’s a buyer’s market, sellers will be more willing to cover closing costs to entice buyers. Here are some tips:

-

Research sales data and trends in your area, with help from a real estate agent. Look for examples of recent seller concessions on comparable sales.

-

Limit other contingencies and demands on the seller when asking for concessions. Simple, clean offers are most appealing.

-

Prioritize must-have repairs and requests. It may be better to ask for a lower purchase price instead of closing costs.

-

Get pre-approved for your mortgage. Showing you are a qualified buyer will help strengthen your negotiating position.

-

Act fast once your offer is accepted. The seller may retract the concessions if negotiations drag on.

-

Be flexible. Consider splitting closing costs with the seller if they are hesitant to cover the full amount.

Limits on Conventional Loan Seller Concessions

Fannie Mae sets limits on the maximum seller concessions to prevent sales price inflation and increased housing prices. Sellers cannot pay unlimited closing costs.

The maximum concessions are based on the lesser of the sales price or appraised value. Here are the basic limits:

Down payment below 10% – Maximum seller concession is 3%

For example, on a $200,000 home with 5% down:

- 5% down payment = $10,000

- 3% of $200,000 = $6,000 maximum concession

Down payment between 10-25% – Maximum seller concession is 6%

For example, on a $200,000 home with 15% down:

- 15% down payment = $30,000

- 6% of $200,000 = $12,000 maximum concession

Over 25% down – Maximum seller concession is 9%

Investment property – Maximum 2% seller concession regardless of down payment

If the seller concessions exceed these limits based on the sales price or appraised value, the purchase agreement will have to be re-worked to bring them into compliance. This may require reducing the sales price.

How Seller Concessions Impact Your Mortgage

Seller concessions that stay within the allowed limits do not have to be repaid or negatively impact your conventional loan approval. However, there are some key factors lenders consider:

Loan-to-Value (LTV) Ratio – Seller concessions alter the true LTV of your loan, so lenders will re-calculate your LTV and down payment after concessions are applied. Higher concessions mean a higher LTV.

Mortgage Insurance – If your down payment is less than 20%, your revised LTV after concessions may impact your mortgage insurance rate.

Debt-to-Income Ratio – While seller concessions reduce your cash outlay, your monthly mortgage payment and total debt obligations stay the same. So your debt-to-income ratio is not impacted.

Appraisal – The appraiser will need all details of seller contributions for an accurate appraisal. Seller concessions in excess of limits could lower the home’s appraised value.

As long as you stay within the seller concession limits for a conventional loan, the contributions can be a great way to reduce closing costs and make homebuying more affordable. Discuss your specific situation with a mortgage loan officer to fully understand the impact on your loan program.

FAQs About Conventional Loan Seller Concessions

Can sellers pay any closing costs with a conventional loan?

Sellers can pay for the buyer’s legitimate closing costs, up to the maximum thresholds based on the conventional loan down payment and sales price/appraised value. Common fees paid include title insurance, home inspection, attorney fees, and prepaid property taxes.

Do seller concessions affect your interest rate?

No. With conventional loans, seller concessions have no impact on the interest rate as long as they are within the allowed limits. The lower interest rate is tied to the loan amount, FICO score, and other risk factors.

Can sellers pay more than the appraised value?

No. Seller concessions are capped at a percent of the lesser of the sales price or appraised value. If concessions exceed those limits, the sales price must be lowered.

Are seller concessions taxable?

No. Seller concessions come from the seller’s proceeds at closing. They reduce the taxable gain for the seller. The buyer does not pay taxes on the received contributions.

Can sellers pay my down payment?

No, the seller cannot contribute funds toward the buyer’s down payment, reserves, or minimum borrower contribution requirements on a conventional loan.

Should I ask for lower price or seller concessions?

It depends on your situation. Lower price may be better in a seller’s market when you need a strong offer. Seller concessions directly lower your cash needed at closing, so may be preferred if you have limited funds.

Final Thoughts on Conventional Loan Seller Concessions

Seller concessions can be a win-win scenario for both buyers and sellers when used appropriately on conventional loans. As a buyer, be sure to negotiate concessions within the permitted amounts, and provide all details to your lender early in the process.

This ensures seller contributions will not jeopardize or complicate your new conventional home loan. With the right preparation and research, seller concessions can significantly reduce your upfront costs and help you achieve the dream of homeownership.

Max Seller Concession on FHA Loan

Seller concessions for all Federal Housing Administration (FHA) loans are capped at 6%, regardless of the size of your down payment. In addition, the sellers cannot assist the buyer with the down payment.

Limits on Seller Concessions

Depending on the loan type you are using, there may be limits regarding how much sellers are allowed to provide in sellers’ concessions. Let’s look at seller concessions limits by different loan types: