Conventional Loan Flipping Rules A Guide to Navigating Financing When Buying and Selling Quickly

Flipping houses for profit can be an exciting and lucrative endeavor for real estate investors. However, financing these quick flips comes with its own set of rules and requirements, especially when using conventional loans. In this comprehensive guide, we’ll explore conventional mortgage guidelines for investors flipping properties, helping you successfully navigate financing.

What is House Flipping?

Before we dive into flipping rules let’s review what house flipping entails. House flipping refers to buying a property, renovating or repairing it then selling for a profit, all within a short timeframe, usually less than a year.

Flips typically follow this process:

-

Find a distressed property priced below market value

-

Purchase the property with cash or financing

-

Rehab and repair the home to increase value

-

List and sell the improved home for a higher price

-

Pay off mortgage and keep profits

Flipping can be done with cash, but financing allows investors to take on more deals. Conventional loans are a popular financing choice.

Conventional Loan Overview

A conventional loan is a mortgage not backed by a government agency like FHA or VA loans. conventional loans are issued directly by private lenders like banks and credit unions. They come with stricter approval standards but offer perks like lower interest rates.

Key features of conventional loans:

-

Typically need a 620+ credit score

-

Require a down payment, usually 10-20%

-

No mortgage insurance with 20% down

-

Lower interest rates than government loans

-

Loan limits up to $970,800 in expensive markets

Now let’s look at guidelines when using conventional financing to flip homes.

Conventional Loan Rules for House Flipping

Lenders have guidelines to limit risk when financing flips. While possible, here are hurdles to expect:

Higher Down Payments

Most lenders require a 20% down payment to finance a flip, sometimes more. This ensures you have “skin in the game”. Expect to put up more cash than other loans.

Shorter Loan Terms

Conventional flip loans often have shorter 5-10 year terms. You must sell before the term expires to avoid balloons. Longer 30-year mortgages are harder to obtain.

Higher Interest Rates

As an investor mortgage, expect rates 0.5 to 1% higher than owner-occupied loans. Still lower than hard money loans though.

Limited Capital for Repairs

Your loan amount will be based on the as-is value. Extra funds for repairs generally need to come from your own capital.

No Gift Funds or Grants

Unlike primary home loans, you can’t use gifted funds or down payment assistance for the down payment.

No First-Time Buyer Programs

Conventional flip loans don’t qualify for special programs like down payment assistance available to owner-occupants.

Lender Due Diligence

Be ready to provide a detailed scope of work, cost estimates, ARV analysis, and proof of rehab experience.

No HomeStyle or HomePath

Fannie Mae’s special financing for flips can’t be used by investors – only owner-occupants.

No Delayed Financing

Can’t get a cash-out refi shortly after purchasing the property like some owner-occupants can.

Restrictions on Quick Resale

Most lenders prohibit quickly reselling a property you purchased with financing except in special circumstances like a job relocation.

Second Appraisal for Some Flips

If buying a recently flipped home at a certain price premium above the seller’s purchase price, lenders require a second appraisal.

Location Matters

Rural properties often have easier flipping guidelines than urban/suburban areas where flipping is more restricted.

How Conventional Flip Loan Terms Differ from Primary Homes

Conventional flip loans differ from primary mortgages in a few key ways:

| Primary Home | Flip Loan |

|---|---|

| Down Payment | Typically 3-10% |

| Loan Term | Up to 30 years |

| Interest Rate | Lower |

| Finance Repairs | Yes via reno loan |

| Application | Easier |

| Resale Rules | None |

Tips for Securing Conventional Flip Financing

Though challenging, patient investors can get approved for conventional loans for flips by following these tips:

-

Seek out lenders familiar with investor lending

-

Highlight rehab experience and successful project plans

-

Get pre-approved for the mortgage before making offers

-

Be ready to cover the down payment and extra costs

-

Ask about portfolio lending if you don’t meet overlays

-

Consider using a mortgage broker to shop multiple lenders

-

Maintain a 680+ credit score and low debt-to-income ratio

-

Have ample cash reserves – many lenders want 12+ months’ worth

-

Purchase 1-4 unit residential properties, not commercial

-

Buy in less regulated markets if possible

Alternatives to Conventional Loans for Flipping

If you can’t qualify for a conventional mortgage to finance a flip, alternatives include:

FHA 203(k) Loan – Government-backed rehab loan allowing finance of purchase + repairs with 3.5% down.

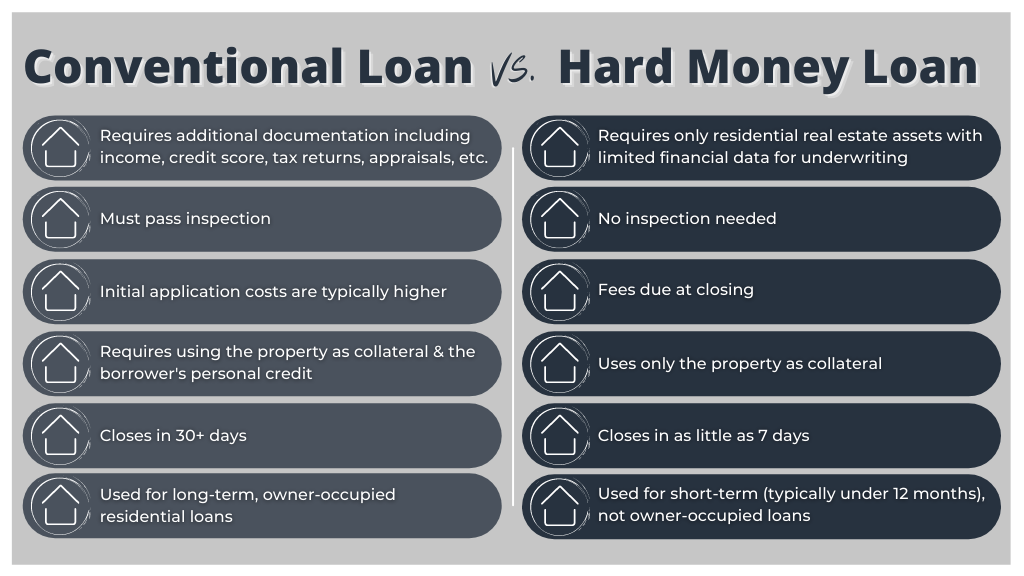

Hard Money Loans – Asset-based financing from private lenders at higher rates but easier approvals.

Private Money Loans – Borrow from individuals like friends, family, or business partners.

Home Equity Line of Credit (HELOC) – Tax-deductible funds accessible from existing home equity.

Cash-Out Refinance – Tap into equity of an already-owned investment property.

Credit Cards – Putting repairs on plastic is an option but expensive long term. Proceed with caution.

Seller Financing – Some motivated sellers may finance a flip themselves.

Crowdfunding – Pool funds from multiple small investors.

The Conventional Loan Flipping Decision

Want to flip houses but not sure if conventional financing is right for you? Ask yourself:

-

How much cash can I put down? Is it 20% or more?

-

Does my credit score and financial profile meet lenders’ guidelines?

-

Am I prepared to cover extra holding and repair costs out of pocket?

-

Do I have experience completing successful flips already?

If you answered yes, a conventional loan may be a viable route for financing your next profitable flip. Just be prepared to jump through some hoops and have capital available.

The Bottom Line

Navigating lender guidelines makes financing flips with conventional loans challenging but not impossible. Following the tips above helps experienced investors use these mortgages as long term tools to scale their flipping business. Conventional loans provide better rates and terms compared to alternative financing options. Just know the rules of the game before jumping in.

VA Loans and Flipping

Loans backed by the Department of Veterans Affairs (VA) offer more flexibility when it comes to flipping rules. VA loans do not have specific regulations for flips, and the decision is left to the underwriter’s discretion. Each flip is evaluated on a case-by-case basis.

Here’s What You Need to Know About Flips and Financing

The Federal Housing Administration (FHA) has specific rules regarding house flips. A property is considered a flip if the current seller has owned it for less than 90 days.

Between days 91 and 180, you can still sell the home, but there are additional requirements. If the resale price is 100% or more than what the seller paid, a second appraisal must be ordered. However, if the second appraisal is more than 5% lower than the first one, the lower appraisal must be used. It’s important to note that the borrower cannot pay for the second appraisal.

Can You Flip a House With a Conventional Loan?

FAQ

Do conventional loans have a flip rule?

Does Fannie Mae have a 90 day flip rule?

What is the 70% rule in flipping?

What is the hud 4000.1 rule for flipping?

Can you buy a flipped home with an FHA loan?

Yes, you can purchase a flipped home with an FHA loan, as long as the property meets the FHA flipping regulations. However, it’s essential to thoroughly review these guidelines and ensure the property is eligible for FHA financing before proceeding with the purchase.

What is the FHA flip rule?

The FHA flip rule prevents you from using an FHA mortgage to buy a home within 90 days of its last sale. In other words, an FHA loan requires the seller of a flipped home to own the property for at least 90 days before selling it to you. If you try to buy a property that was sold within the last 90 days, FHA will deny your loan.

What are the FHA 90-day flip rules?

Let’s dive into the details of each rule and how they may affect your purchasing timeline. The 90-day flip rule is a regulation introduced by the FHA that restricts financing for homes that have been sold within the previous 90 days.

What is the 90-day flip rule?

The 90-day flip rule is a regulation introduced by the FHA that restricts financing for homes that have been sold within the previous 90 days. This rule aims to prevent property flipping schemes where investors buy homes, make minimal renovations, and then sell them at significantly higher prices to unsuspecting buyers.