Our loan comparison calculator is designed to show you when the costs of your two fixed-rate loan options are the same — also known as the break-even period. So whether you stay in your home for 5 years, or 25, you’ll have all of the info you need to make the right decision about which loan is right for you. Mortgage amount Interest rate (%)

If you’re shopping for a mortgage, using an online home loan calculator can help you easily compare interest rates and payments across multiple lenders. With just a few inputs, these tools provide key data to determine which mortgage option best suits your budget and homebuying goals.

Overview of Home Loan Rate Calculators

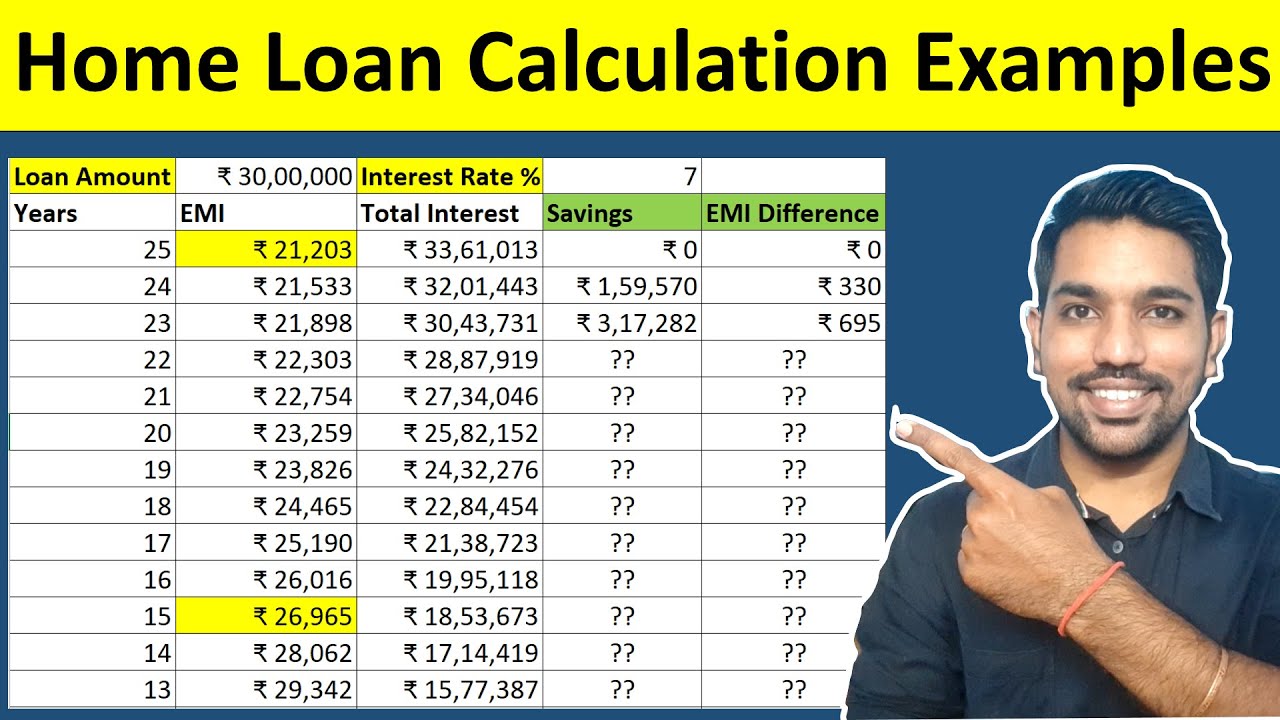

Online mortgage calculators allow you to enter details like the loan amount, interest rate and repayment term to calculate figures such as the monthly payment total interest costs, and lifetime loan amount.

Most also have built-in amortization schedules showing how much of each payment goes to interest vs principal over time. Many feature side-by-side comparison of two or more loan scenarios.

These calculators help you understand how factors like the interest rate, points/credits, and loan term impact affordability. This allows smarter comparison shopping when evaluating mortgage offers.

How Home Loan Rate Calculators Work

Mortgage calculators use your inputs on the loan details to determine figures like:

- Monthly principal & interest payment

- Total interest paid over loan term

- Lifetime cost including principal, interest, fees

- Amortization schedule and payoff timeline

- Side-by-side comparisons of multiple loans

For example, you might enter a $300,000 loan amount, 35% interest rate, and 30-year term to calculate the monthly payment, total interest costs, and amortization schedule

You can then tweak the parameters to see how different interest rates or terms affect affordability. The side-by-side comparisons also allow you to clearly visualize the impacts of choosing Loan A vs Loan B.

Key Factors to Compare in a Home Loan Calculator

Interest Rates

The interest rate is the annual percentage rate (APR) charged on the mortgage loan. Even small rate differences of 0.25% can add up to thousands in interest costs over the loan term.

Rate comparisons should factor in not just the starting rate but also how long you plan to keep the mortgage. If rates trend up or down in the coming years, your starting rate may not stay the lowest long-term.

Loan Terms

Typical terms are 15, 20, or 30 years. The longer the term, the lower the monthly payment but higher lifetime interest costs. Think about your long-term plans and use the calculator to see payment differences.

For example, a 30-year $300,000 mortgage at 4% has a payment of $1,432. The same loan at 3.5% over 15 years has a payment of $2,108.

Points & Credits

Points are fees paid upfront to lower the interest rate. Credits give you money back at closing in exchange for a higher rate. See how points vs credits impact costs long-term.

If you plan to move soon, credits likely save more money. For long-term owners, points often provide better interest savings despite higher upfront costs.

Loan Amounts

The principal loan amount can significantly impact your monthly payment. Compare different down payments and loan amounts to find your sweet spot.

For instance, a $300,000 mortgage payment is $300 higher than a $270,000 mortgage at the same rate/term. Make sure you take on a loan amount you can comfortably afford.

Total Interest & Costs

See exactly how much interest you’ll pay over the full loan repayment period. Also look at the total lifetime loan amount including principal, interest, and fees.

A lower rate can save tens of thousands in interest costs over 30 years. But don’t sacrifice points/credits just to get the absolute lowest rate if the costs outweigh the savings.

Amortization Schedule

This shows how each mortgage payment gets divided between interest and principal over time. You’ll see how much goes toward interest upfront before more starts going to pay down the loan amount.

Watching the amortization helps you understand how home loans work. It also highlights why points or a shorter term reduce interest costs faster.

Side-by-Side Comparisons

The side-by-side loan scenarios help you easily visualize how the terms, rates, and points/credits stack up between different mortgage offers.

You can quickly compare total costs and payments over time and see which option saves the most money based on your individual situation and plans.

How to Choose the Best Home Loan with an Online Calculator

Follow these steps when using a mortgage calculator to identify the most affordable home loan:

-

Enter your actual loan details – For accurate results, use figures from real loan offers you’ve received.

-

Compare 2-3 loan scenarios – See how adjustable parameters like rate, term, and points/credits impact costs.

-

Focus on long-term costs – While upfront fees matter, lifetime interest is usually the biggest cost.

-

Consider your time horizon – If moving soon, upfront costs may outweigh lifetime savings from a lower rate.

-

Double check the amortization – Verify you’re comfortable with how much goes to interest vs principal over time.

-

Don’t sacrifice affordability – A “lower” rate with high points might not actually save money long-term.

-

Run comparisons with your down payment – See how monthly payments change with different down amounts.

-

Ask your lender questions – If unclear on the implications of certain loan terms or fees, request clarification.

-

Compare pre-approvals too – Use calculators to estimate costs when applying and comparing pre-approvals.

-

Pick the most affordable option – Choose the loan that provides the optimal balance of low payments and long-term savings.

Using an online mortgage calculator takes the guesswork out of deciding which home loan works best for your personal financial situation. By comparing detailed payment and cost scenarios, you can determine both short-term and long-term affordability.

Be sure to use credible calculators from reputable sources to get reliable results. And always discuss the specifics with loan officers when evaluating actual mortgage offers. But overall, these tools provide tremendous insight to help you confidently choose the right home loan.

After 9 years 2 months, Option A will be less expensive than Option B

When we took into account upfront costs and interest, both options cost the same at the 9 year 2 month mark. If you plan to own your home less than 9 years 2 months, Option B is a better choice.

This is when both loan options cost the same amount of money overall. After this, your total cost for one loan may be higher than the other.

Points are a one-time payment you make at closing in exchange for a lower rate. Credits are a rebate you receive to help cover closing costs, resulting in a higher interest rate.

This is the interest you’ll be charged for your loan each year. It’s slightly different than your Annual Percentage Rate (APR), which also takes into account things like taxes and insurance.

This is the amount you pay toward the principal (and interest) on a monthly basis. For a fixed loan, this payment will stay the same throughout the life of the loan.

This is the amount you end up paying over the life of the loan — it takes into account the initial amount you borrowed, as well as the interest.

How to choose a home loan

It can be overwhelming to evaluate your home loan options, but it doesnt have to be. As it turns out, there are a few important numbers you can focus on first. Our loan comparison calculator takes into account the length of a loan, as well as the interest rate, loan amount, and whether youll have points or credits. Once youve decided to go with a fixed rate instead of an adjustable one, youll want to start to consider all of those details. Were here to help them make a little more sense along the way.

First up, youll want to think about the term. In other words, would you like to make smaller payments over a longer amount of time? Or would you prefer to make larger payments, but over a shorter period of time? The loan amount could vary too, based on how much of your assets youre willing to use for a down payment. Trying out both options show you how much you save each month, as well as over time, so its easier to weigh the benefits.

Some of the most confusing factors youll tackle when youre comparing loan options are the interest rate and points and credits. Luckily, theyre closely connected to one another. Once you understand that relationship, theyre easier to compare. Basically, most loan options will have the option of either points or credits, and that has an effect on the interest rate thats available to you. When you choose a loan option with points, youre opting to pay more upfront at closing in exchange for a lower interest rate. So while your costs are higher at first, you may notice you pay less in interest over the life of the loan. On the other hand, choosing a loan option with credits means youll save some money upfront on closing costs in exchange for a higher interest rate. This is a great option if youre hoping to keep costs lower at first, but it does cost more over time.

All of these factors work together, so its best to compare their effects over time by using a tool like our calculator that stacks them against each other. At the end of the day, a major question youll need to tackle is: how long do you plan to stay in your new home? For example, if you plan to sell or refinance before your break-even period (the point at which both loan options cost the same), youll want to choose the loan option that costs less in the short term. However, if you plan to stay in that home for the life of the loan, you might care a little less about the short-term costs, and instead you will want to pay more attention to how the costs shift after that break-even period. In other words, which loan option costs less during the time youll be living in the home, or before you refinance?

If youre comparing drastically different fixed-rate loan options — with varying terms and amounts, for example — you may not have a break-even period at all. In those cases, youll also want to think about how long you plan to stay in the home, as well as which option is more financially feasible for you.

The mortgage you choose today will impact your finances for years to come. It will determine your upfront expenses, monthly payments, and long-term costs. But, don’t worry. Our fixed-rate loan comparison calculator will crunch the numbers for you so that you can choose the right home loan for your needs.

How To Calculate Your Mortgage Payment

FAQ

What is a good interest rate for a house loan right now?

What is the difference between 3% and 7% interest rates?

How much difference does 1% interest make on a loan?

How much difference does .25 make on a mortgage?