We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free – so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Buying a home is an exciting process, but it also involves many expenses. One of the costs you’ll encounter is closing costs, which are the fees charged to finalize and fund your mortgage. Closing costs apply to all loan types, including popular Federal Housing Administration (FHA) loans.

In this comprehensive guide I’ll explain what exactly closing costs on an FHA loan cover how much they typically total, and tips to reduce them. As an aspiring homeowner and FHA loan borrower, it’s important to understand these expenses so you can plan and budget accordingly.

What Are Closing Costs on an FHA Loan?

Closing costs are charges paid to your lender and third parties to process underwrite, and close your mortgage loan. With an FHA loan closing costs generally range from 3-6% of your total loan amount.

For example, if you receive a $200,000 FHA loan, expect to pay $6,000-$12,000 in closing costs. I’ll outline the specific fees below, but first, let’s go over the key benefits of an FHA loan

Why Choose an FHA Loan?

FHA loans are government-insured mortgages that come with several perks:

-

Low down payments: You only need 3.5% down, versus 15-20% on conventional loans. This makes FHA loans ideal for first-time homebuyers with limited savings.

-

Lenient credit guidelines: FHA approves borrowers with credit scores as low as 500 and recent foreclosures or bankruptcies. Their underwriting is more flexible than conventional loans.

-

Low mortgage insurance: FHA loans require monthly mortgage insurance premiums (MIP) to protect the lender from defaults. But FHA’s MIP rates are lower than private mortgage insurance (PMI) on conventional loans.

These features make FHA financing accessible for buyers who may not qualify through conventional underwriting standards. But what exactly will you pay in closing costs?

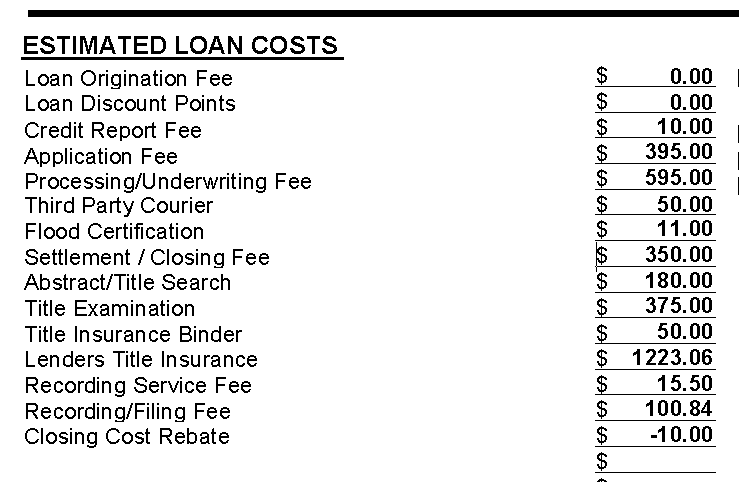

Breakdown of Typical FHA Closing Costs

FHA closing costs fall into three main buckets:

1. Fees Charged by Your Lender

These cover loan processing, underwriting, and origination services:

- Origination fee: Up to 1% of the loan amount

- Underwriting fee: $500-$1,000

- Wire transfer fee: $15-$40

- Document preparation fee: $75-$100

2. Fees Charged by Third Parties

Third-party fees pay for title insurance, appraisals, credit checks, and more:

- Appraisal fee: $400-$600

- Credit report fee: $25-$50

- Home inspection fee: $300-$500

- Title services fee: $700-$2,000

- Recording fees: Varies by state, usually under $100

- Survey fee: $150-$400

3. Prepaid Costs

Prepaid costs cover your initial homeownership expenses:

- Homeowner’s insurance premium: Depends on the policy

- Mortgage insurance premium: 1.75% of loan amount

- Property taxes: Varies by state and home value

- Interest: Covers first 1-2 months

- Initial escrow deposit: 2 monthly payments for taxes and insurance

Two of the biggest prepaid FHA costs are the upfront mortgage insurance premium (UFMIP) and escrow deposit. Let’s look at these in more detail.

Upfront Mortgage Insurance Premium

FHA borrowers must pay an upfront mortgage insurance premium (UFMIP) equal to 1.75% of the purchase price or loan amount. On a $200,000 home FHA loan, your UFMIP would be $3,500.

You can finance this fee into your mortgage instead of paying out of pocket. But keeping the premium in-house increases your loan balance and monthly payments.

Either way, the UFMIP protects lenders from taking losses if you default. It’s required on all FHA loans.

Escrow Deposit

At closing, you’ll prepay 2 months of property taxes and insurance premiums into an escrow account. This account is used to make those payments on your behalf when they are due.

For instance, if your property taxes and home insurance equal $250 per month combined, expect to prepay $500 into escrow upfront.

Escrow buffers you from large, lump-sum tax and insurance bills each year. But it also increases your closing costs.

Now that we’ve examined typical FHA closing costs, how much should you actually budget?

What’s the Total Amount of Closing Costs on an FHA Loan?

As mentioned earlier, FHA closing costs range from 3-6% of your loan amount. On a $200,000 home loan, you would pay an estimated $6,000-$12,000 at closing.

But it depends on your specific situation. Here are the main factors that influence your total FHA closing costs:

-

Purchase price: The higher the sale price, the higher your closing costs. Costs based on a percentage of the loan amount (like title fees and UFMIP) increase for pricier houses.

-

Down payment: The lower your down payment, the higher your loan amount and associated percentage-based fees. With only 3.5% down, FHA borrowers tend to finance more costs.

-

Credit score: Borrowers with lower credit scores pay higher interest rates, which raises prepaid interest at closing. Poor scores can also trigger lenders to charge higher origination fees to offset risk.

-

Location: Recording fees, title charges, and taxes vary significantly by state and county. Closer scrutiny of coastal properties can also drive up appraisal and inspection costs.

As you can see, closing fees are directly tied to your financial profile and the home itself. Now let’s explore ways to reduce these FHA expenses.

8 Tips to Lower Your FHA Closing Costs

Because FHA loans require upfront MIP and low down payments, their closing costs tend to fall on the higher end of the 3-6% range. But you’re not powerless against these fees. Here are 8 proven strategies to lower your FHA closing costs:

1. Opt for a single closing – Simultaneous home purchases and sales add extra settlement charges versus buying first and selling later. Go for a single closing if possible.

2. Shop around for title fees – Title charges can vary dramatically between providers. Compare rates to find the best deal.

3. Seek lender credits – Ask your lender to cover some minor fees or offer a closing cost credit. This effectively reduces your out-of-pocket costs.

4. Negotiate seller concessions – Sellers can credit you up to 6% of the purchase price for closing costs. This reduces the amount you finance into your loan.

5. Pay discount points – Paying points upfront reduces your interest rate and prepaid interest charges. Break even comes within a few years.

6. Buy down your rate – As above, ask the seller to pay discount points or buy down the rate to decrease prepaid interest.

7. Lower your UFMIP – Putting 10% or more down reduces the upfront mortgage insurance premium from 1.75% to 1.0% of your loan amount.

8. Apply for down payment assistance – Many state and local programs help cover down payments and closing costs for eligible buyers.

Every dollar saved on closing costs reduces loan fees you’ll pay interest on for years. Shopping around and negotiating is worth the effort.

How and When Will You Know Your Final Closing Costs?

About 1 week before closing, you’ll receive a document called the Closing Disclosure (CD). This lists your finalized closing costs.

The lender must send the CD at least 3 business days before closing. Take this time to thoroughly review all fees and charges. Report any errors or inconsistencies to your loan officer immediately.

The closing costs disclosed on the CD won’t deviate more than 10% from the initial estimates on your Loan Estimate unless an unexpected change occurs. But it pays to verify everything matches your expectations.

You’ll sign the CD at closing, affirming you agree to the terms. This becomes the final tally of what you’ll pay in upfront costs.

FHA Closing Costs FAQs

If you’re still fuzzy on some details of FHA closing costs, here are answers to some frequently asked questions:

Does an FHA loan cover closing costs?

You can roll closing costs into your FHA loan amount instead of paying out of pocket. But this increases your principal and interest charges over the life of the loan.

Can I buy a multifamily home with an FHA loan?

Yes, you can use an FHA loan to buy a 2-4 unit property as long as you live in one of the units. This opens up investment property options for FHA buyers.

Where do I find lenders offering FHA loans?

Many national lenders like banks and mortgage companies

Compare mortgage lender fees

FHA lenders don’t all charge the same fees. When you shop around for a mortgage lender, ask about fees to get a sense of what different lenders charge. This can also help you spot fees that seem out of the ordinary.

How much are FHA closing costs?

FHA closing costs vary widely by lender and location. Typically, a borrower can expect to pay between 3 percent and 6 percent of the home’s purchase price in closing costs. On a $400,000 home, for example, you’d need to budget $12,000 to $24,000 to cover your closing costs.