Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

The Federal Housing Administration’s (FHA) mortgage insurance program can help make homeownership more accessible and affordable. FHA loans require lower down payments and credit scores compared to conventional loans. This makes them especially attractive to first-time homebuyers. However even with the program’s lenient guidelines some borrowers still struggle to qualify on their own. In this case, adding a co-signer to your FHA loan application can improve your chances of getting approved. But can you actually have a co-signer on an FHA loan?

FHA Guidelines For Co-Signers

Yes FHA guidelines do allow for co-signers also referred to as non-occupying co-borrowers. A co-signer is someone who does not live in the home but signs onto the mortgage. This means they are equally responsible for making the monthly payments.

The FHA has specific eligibility criteria that co-signers must meet

-

Must be either a U.S. citizen or have permanent residency status.

-

Have a qualifying credit score, debt-to-income ratio, and income.

-

Occupy their own primary residence in the U.S.

-

Be a family member if the borrower wants to make a minimum 3.5% down payment. Family members include spouses, children, parents, grandparents, grandchildren, step-children, foster children, and domestic partners.

Non-family member co-signers can help the borrower qualify for the loan. But in this case, the required down payment increases to at least 10%.

The Benefits Of An FHA Co-Signer

Adding an FHA co-signer to your loan application can offer several benefits:

1. Higher Loan Approval Chances

A co-signer with a high income, excellent credit, and low debt can significantly improve your chances of qualifying for an FHA loan. Their finances help balance out any issues with your own credit or debt profile.

2. Access To Lower Interest Rates

Better rates are available to borrowers with higher credit scores. Your co-signer’s strong credit could land you a lower interest rate on your FHA loan, saving you money each month.

3. Ability To Buy Sooner

First-time buyers often take years trying to improve their finances enough to qualify on their own. A co-signer may help you meet FHA requirements much faster so you can purchase sooner.

4. Lower Down Payment Options

As mentioned, the FHA requires just 3.5% down from borrowers using family member co-signers. Without a co-signer, you may need to save up a 10% or 20% down payment.

5. Buy A More Expensive House

Your co-signer’s added income could qualify you for a larger loan amount. This means you can set your sights on more expensive homes.

Drawbacks Of An FHA Co-Signer

Adding a co-signer does come with some potential disadvantages to consider as well:

-

The co-signer is equally responsible for the mortgage. If you miss payments, it damages their credit too. This may make some hesitant to co-sign.

-

Refinancing or selling the home requires the co-signer’s approval since they co-own the property.

-

Having a co-signer limits how much interest and property tax deductions you can claim on your taxes.

-

The co-signer must pay income taxes on any mortgage interest you deduct on a jointly signed mortgage.

-

If the co-signer dies, their estate may become liable for the mortgage balance.

-

Some first-time homebuyer programs prohibit having a co-signer on the loan.

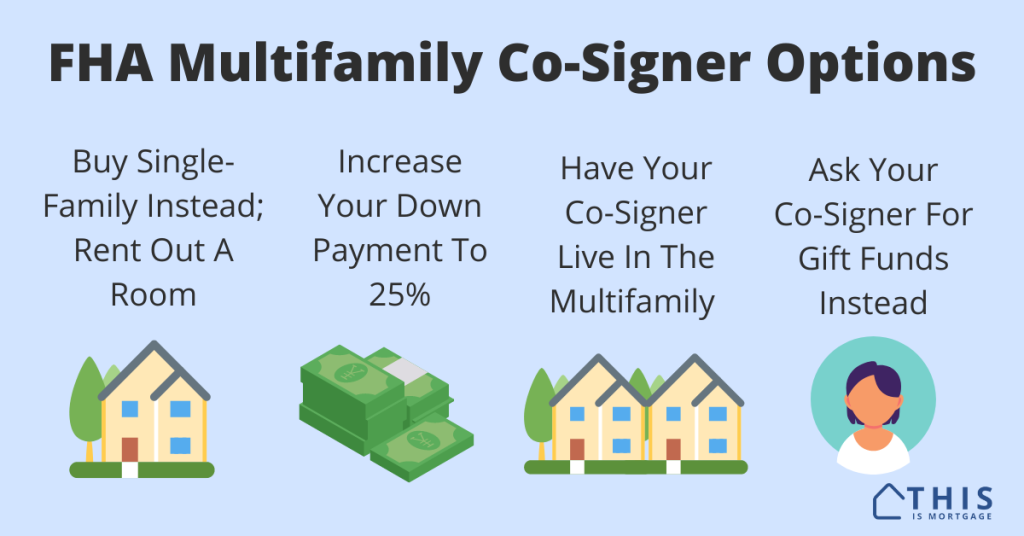

Alternatives To A Co-Signer on FHA Loans

If you are having trouble finding a willing co-signer, here are a few other options to consider:

-

Save a larger down payment – Putting down 10% or more can help you qualify without a co-signer.

-

Ask about alternative credit – The FHA allows non-traditional credit references like rent and utility payments.

-

Dispute credit report errors – Mistakes on your report could be impacting your score. Get them corrected.

-

Pay down existing debts – Reducing your monthly debt obligations helps lower your DTI.

-

Increase your income – Consider taking on a second job or freelance work temporarily.

-

Enroll in credit counseling – Counseling agencies can help create a plan to improve your finances.

-

Delay your purchase – Give yourself more time to save and work on your credit.

The Bottom Line

Yes, it is possible to have a co-signer or non-occupying co-borrower on an FHA loan, provided they meet all eligibility criteria. This can help borrowers who may fall slightly short of qualifying on their own gain approval. But proceed with caution – make sure your co-signer understands the obligation and risks involved before signing onto your loan. Thoroughly evaluate all your options so you can make the most informed decision about your path to homeownership.

Frequency of Entities

Co-signer: 21

FHA loan: 18

Co-borrower: 5

Down payment: 5

Interest rates: 2

Debt-to-income ratio: 2

Credit score: 2

Mortgage: 2

First-time homebuyer: 2

Choose Your Loan TypeFHA.com is a privately owned website, is not a government agency, and does not make loans.

Do you know whats on your credit report?

Learn what your score means.

Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

| FHA Limits (low cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $498,257 | $637,950 | $771,125 | $958,350 |

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

| FHA Limits (high cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 |

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

FHA Loan Programs for 2024

The most recognized 3.5% down payment mortgage in the country. Affordable payments w/good credit.

FHA Loan with a Cosigner Rules for 2024

FAQ

What is required to be a cosigner on an FHA loan?

Can I get an FHA loan with bad credit and a cosigner?

Can a first time buyer have a cosigner?

Whose credit score is used with a co-signer?