A home equity loan allows you to borrow money against the value built up in your home. While most people seek out these loans using their primary residence, it is possible to get a home equity loan on a rental property – it just tends to be harder and more expensive.

In this article, we’ll go through the information you need to make an informed decision before taking out a home equity loan on a rental property. We’ll cover the potential benefits, risks and long-term implications of such a financial move, and common questions you may have.

Getting a home equity loan for a rental or investment property can seem tempting, especially if you need access to cash quickly. However, there are some major risks and drawbacks to be aware of before taking out this type of loan. As the owner of a financial advice blog, I want to provide a clear, detailed explanation of whether or not you can get a home equity loan on a rental property, the pros and cons, and alternative financing options you may want to consider instead.

What is Home Equity and How Does it Work?

Before diving into the specifics of using home equity loans for rental properties, let’s start with a quick overview of what home equity is and how it works:

-

Home equity is the difference between what you owe on your mortgage and the current market value of your home.

-

You build equity over time by making mortgage payments which reduces the amount you owe. Appreciation in your home’s value also builds equity.

-

Lenders allow you to borrow against your equity through home equity loans and lines of credit This converts your equity into usable cash

-

Most lenders want you to have at least 15-20% equity before approving a home equity loan. Requirements are stricter for rental properties.

-

Your loan-to-value (LTV) ratio compares your loan amount to the home’s value. Lenders prefer an LTV of 85% or less for primary residences and even lower for rental properties.

So in a nutshell, home equity represents the portion of your home that you fully own. Lenders will allow you to borrow against this equity, but will want to see significant equity built up first, especially for loans against rental/investment properties.

Can You Get a Home Equity Loan Against a Rental Property?

The short answer is yes, it is possible to get a home equity loan or line of credit (HELOC) against a rental property, but it’s much harder to qualify and comes with greater risks.

Here are some key points to understand:

-

Lenders view these loans as higher-risk so they impose stricter eligibility requirements compared to primary residences.

-

You’ll likely need at least 30% equity in the rental property to qualify. Some lenders may require as much as 50%.

-

Your credit score should be over 700, and ideally over 750 for the best terms.

-

Lenders want rental income to exceed the new loan payment by at least 25% to 50%. Proof of consistent rental income is required.

-

Interest rates are typically 0.5% to 1% higher compared to primary residence home equity loans.

-

Closing costs, lender fees and prepayment penalties may also be higher.

As you can see, the bar is set much higher to get approved for a home equity loan or HELOC against an investment property. But if you meet all the requirements, it is possible.

The Risks and Downsides of Using Home Equity Loans for Rentals

Just because you can tap into home equity on a rental property doesn’t necessarily mean you should. There are some major drawbacks and risks to be aware of:

You take on another monthly mortgage payment – This adds significant financial burden and risk, especially if your rental income fails to cover it.

Variable rates on HELOCs can spike payments – HELOC rates float with the market, exposing you to payment shocks as rates rise.

It can jeopardize your ownership – If you default, the lender can foreclose and take possession of the property.

Falling home values reduce your equity – Equity could dip below what you borrowed, making it impossible to refinance.

Interest rates are high relative to other options – Personal loans or credit cards may provide lower rates, with less risk than home equity loans.

Prepayment penalties may apply – You could face stiff fees if you pay off the loan early or refinance the property.

As you can see, using home equity loans on investment properties requires taking on substantial risk. You must be 100% certain you can handle the higher monthly costs. Otherwise, you could lose the rental property if you default on the loan.

Alternatives to Tap Cash from a Rental Property

Given the drawbacks of utilizing home equity loans, you may want to consider these safer alternatives for accessing cash from your rental:

-

Refinance – If rates have dropped, a cash-out refinance can provide funds at a lower cost than home equity options.

-

Personal loan – An unsecured personal loan will have a higher rate but doesn’t put the property at risk.

-

Credit cards – Similarly, credit cards provide unsecured access to cash, though at higher rates. Rewards can provide value.

-

Business line of credit – Secured by the company, not personal assets, which reduces risk.

-

Hard money loans – Asset-based loans using the property as collateral with more flexible qualifying.

-

Private money loans – Borrow from individuals rather than institutions, often with better terms.

Each of these options comes with pros and cons, but the key advantage is reducing the risk of losing your rental property if you default. For many real estate investors, that trade-off is worthwhile given current high home equity loan rates.

Questions to Ask Before Tapping Home Equity on a Rental

If you’ve decided a home equity loan or HELOC is still the best option for your situation, here are some key questions to carefully consider:

- Will the rental income reliably cover the new loan payment, as well as existing costs?

- Do you have a large enough emergency fund to cover periods of vacancy?

- Are you prepared for higher payments if the HELOC rate increases?

- Can you afford the loan if property values decline?

- Are there prepayment penalties or large loan origination fees?

- Could refinancing provide similar proceeds at a lower cost?

Thinking through scenarios like loss of tenants, rising rates, and falling home values can help assess the risks and determine if the rewards outweigh the potential pitfalls.

The Bottom Line

At the end of the day, weighing the pros and cons of tapping home equity on investment properties comes down to your risk tolerance and overall financial situation. If you have ample reserves and rock-solid confidence in your ability to manage higher costs, it may be a viable option for you.

However, for many real estate investors, the smarter choice is to utilize alternative forms of financing that don’t put their hard-earned equity at risk. As the owner of a financial advice website, I generally encourage conservatism and caution over maximizing leverage. But as with any big financial decision, be sure to carefully assess your own specific circumstances.

How To Get a Home Equity Loan on a Rental Property

Obtaining a home equity loan on a rental property can be a strategic financial move for investors looking to leverage their real estate assets. This section will outline the steps and considerations in securing a home equity loan on a rental property and help you navigate the process effectively.

Not all lenders offer home equity loans on rental properties, and those who do may have stricter requirements compared to loans on primary residences. Home equity loans on rental properties also often have higher interest rates than those for primary residences, reflecting the lender’s increased risk due to the property being an income-generating asset.

Qualifying for a home equity loan on a rental property typically involves meeting certain eligibility criteria set by lenders. These criteria often include a minimum credit score.

Lenders also consider the loan-to-value ratio (LTV), which is the ratio of the loan amount to the property’s appraised value. While lenders often require an LTV ratio below 80% for home equity loans on primary homes, this is often lowered to 70% for rental property home equity loans. This means you likely will need to have at least 30% equity in the property to be eligible.

Additionally, lenders may assess the condition and marketability of the rental property, as they want to ensure that the property is in good shape and has the potential to generate rental income.

>> Related: Learn more about home equity loan requirements

Applying for a home equity loan on a rental property involves several steps. Below is a general step-by-step guide to help you through the application process:

- Research lenders: Start by researching and comparing lenders that offer home equity loans on rental properties. Look for favorable terms and requirements that align with your financial situation.

- Get pre-qualified: Contact your chosen lender for pre-qualification. During this stage, the lender will assess your eligibility based on factors like credit score, income and the property’s value. This pre-qualification step gives you an idea of how much you may be able to borrow.

- Gather documentation: Prepare the necessary documentation, which typically includes:

- Proof of identity, such as a driver’s license or passport.

- Proof of income, such as tax returns, W-2 forms or rental income statements.

- Property-related documents, such as the deed and recent appraisal.

- Information about your existing mortgage, if applicable.

- Submit application: Complete the lender’s application form, providing accurate and detailed information about yourself and the rental property. Be prepared to disclose your financial history, including debts and assets.

- Complete property appraisal: The lender will usually order an appraisal of the rental property to determine its current market value. This step helps establish the property’s equity and the maximum loan amount you can qualify for.

- Go through underwriting and approval: Once your application is submitted and all required documentation is provided, the lender’s underwriting team will review your application, assess your creditworthiness and verify the property’s value. If everything meets their criteria, they’ll likely approve your loan.

Pros of Home Equity Loans on a Rental Property

- Access to cash: Home equity loans provide rental property owners with cash for various purposes, such as property improvements, expanding their real estate portfolio or handling unexpected expenses.

- Lower interest rates compared to some other options: These loans often come with lower interest rates compared to unsecured personal loans or credit cards, potentially saving you money on interest payments over time.

- Potential tax deductions: The interest paid on a home equity loan for a rental property may be tax-deductible, reducing your overall tax liability and making it a financially efficient option.

- Possible improved property value: Using the loan to invest in property upgrades may increase your rental property’s value, potentially leading to higher rental income and property appreciation.

- Flexible use: Home equity loan funds are versatile and can be used for a wide range of purposes, providing flexibility in making strategic financial decisions for your rental property investments.

HELOCs for Rental Property Are BACK (Use Your Equity!)

FAQ

How to pull equity out of rental property?

Can you do a HELOC on an investment property?

Can I deduct home equity loan interest on rental property?

Can you do a cash out refinance on an investment property?

What can I do with my home equity loan?

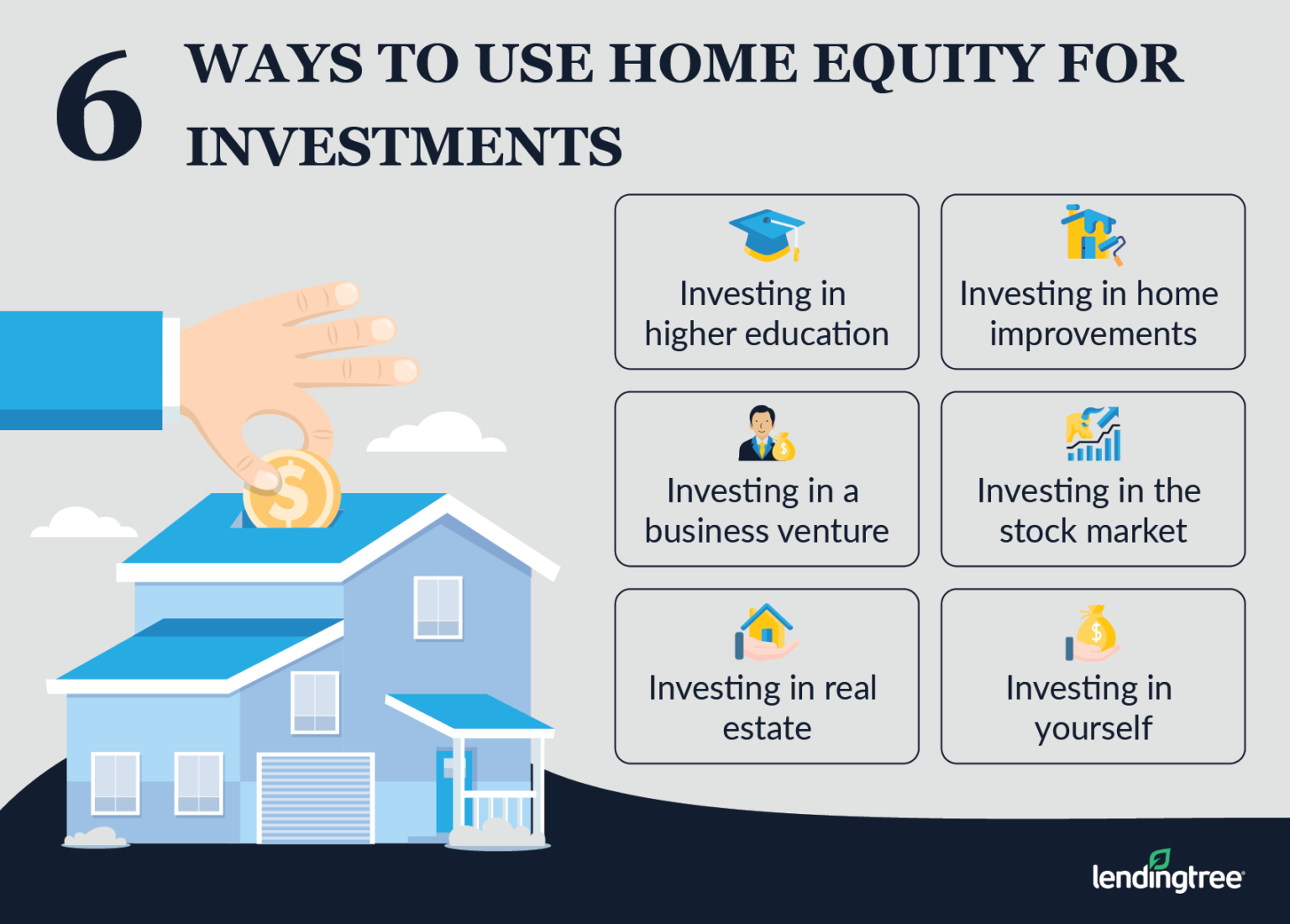

Once your home equity loan has closed and you have picked out an investment property, you can use the proceeds from your home equity loan in any way you choose on your investment property, or anything else. The cash is yours to use as you wish after the loan closes.

How do I get a home equity loan?

You can get home equity loans for investment properties and rental properties These loans are generally more difficult to get than home equity loans for primary residences because lenders view them as higher-risk To get this type of loan, you’ll usually need a stronger-than-average financial profile and substantial assets

Can you get a home equity loan on a rental property?

The short answer: Yes, it’s possible to get a home equity loan on a rental property/investment property. Under certain circumstances. However, in the eyes of a home equity lender, investment properties are a riskier proposition: As collateral, they don’t afford the same peace of mind as a primary residence.

Can you borrow against equity in a rental property?

For a home equity loan, an investment property and rental property are treated the same; you can borrow against the equity in either. Here’s what you should know about borrowing against your equity in a rental property (or other non-primary residence) and why other types of financing may be a safer bet. What is home equity?