Homebuyers who are veterans, whether they are active or not, can receive assistance in buying a new home through several mortgage programs created solely for U.S. military veteran borrowers. Both the U.S. Department of Veteran Affairs (VA*) and the California Department of Veterans Affairs (CalVet) offer veteran loan programs to eligible military veterans.

If you’re a veteran living in California, you have two great options for financing a home purchase without a down payment – CalVet and VA loans. CalVet loans are state loans in California specifically for veterans. VA loans are federal loans open to eligible veterans nationwide. How do these two zero-down payment loan programs compare and which one is better for you?

Overview of CalVet Loans

CalVet home loans are administered by the California Department of Veterans Affairs (CalVet) They provide several purchase and refinance loan options to qualifying veterans living in California

Some key features of CalVet loans include:

- Requires California residency

- No down payment needed

- Can be used to purchase single-family homes, condos, manufactured homes, and multifamily properties

- Offers fixed and adjustable rate mortgages

- Loans up to $647,200 in most counties, higher in pricier markets

- Allows non-occupant co-borrowers

CalVet also offers loans to disabled veterans and National Guard members who don’t qualify for VA loans Interest rates are set by CalVet based on market conditions

Overview of VA Loans

VA loans are backed by the federal Department of Veterans Affairs. They are available to eligible veterans, reservists, active duty military, and surviving spouses nationwide.

Key VA loan features include:

- Requires veteran to occupy the home

- No down payment required on purchase

- Can be used to buy single-family homes, condos, manufactured homes, and 2-4 unit multifamily properties

- Offers a variety of fixed and adjustable rate mortgages

- Maximum loan limits determined by county, same as conforming limits

- Allows veteran to buy another home as rental property

VA loan rates can vary by lender but remain within an acceptable range set by the VA. VA loans are provided by private lenders but guaranteed by the VA.

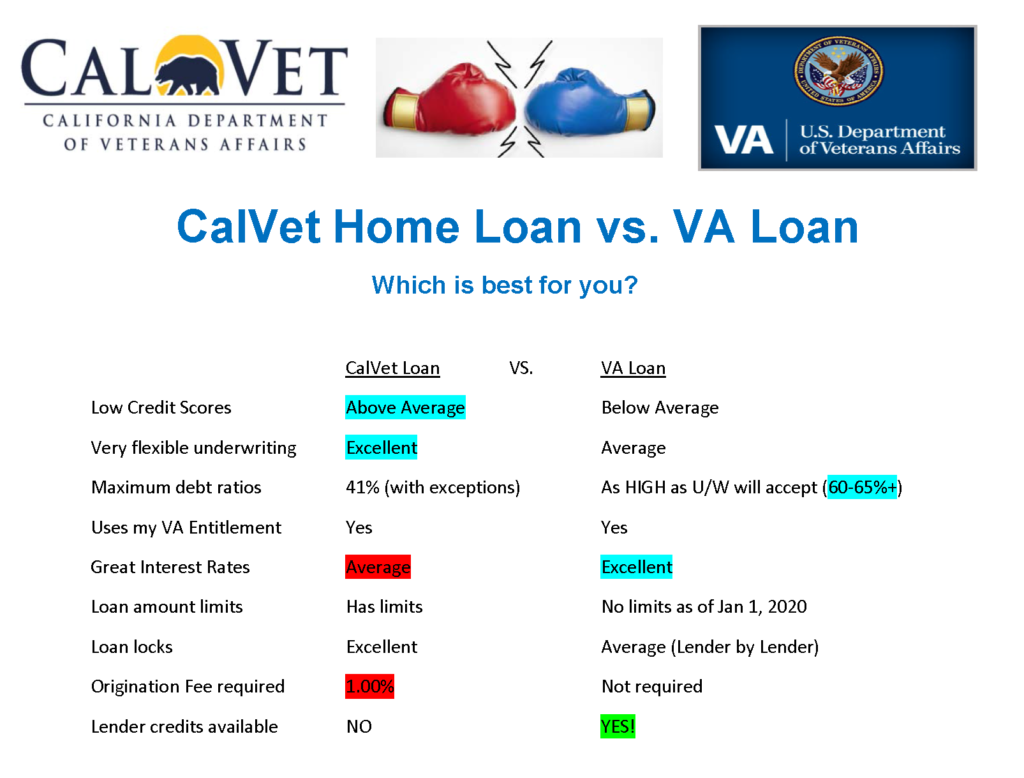

Key Differences Between CalVet and VA Loans

While CalVet and VA loans share similarities, here are some of the main differences:

Eligibility – CalVet restricts loans to California veterans; VA has no state residency requirements. Certain National Guard members and disabled veterans may only qualify for CalVet.

Rates – CalVet sets interest rates on its loans; VA loan rates vary by lender.

Loan amounts – CalVet conforming limit is $647,200 in most counties; VA uses federal conforming loan limits based on county, usually higher.

Title – CalVet holds legal title until loan is repaid; VA provides full title immediately when loan closes.

Fees – CalVet charges a 1% origination fee; VA allows lenders to offer no or low fee options.

Prepayment – CalVet charges a prepayment penalty if refinanced; VA has no prepayment penalties.

Lien position – CalVet does not allow secondary mortgages; VA allows secondary financing.

Refinance – CalVet does not offer refinancing of its loans; VA allows rate/term and cash-out refinancing.

Funding – CalVet loans funded by state bonds; VA loans funded by private lenders and sale of Ginnie Mae securities.

CalVet Loan Pros and Cons

CalVet loans offer advantages like these:

Easier to qualify – More flexible credit and income requirements than VA loans.

Lower rates – Rates can be lower than VA loans depending on market conditions.

No mortgage insurance – No upfront or monthly mortgage insurance premiums.

Lower costs – Only 1% origination fee; no lender fees.

Purchase and refinance options – Offers home purchase, rate/term refi, and cash-out refinance loans.

However, there are also disadvantages to weigh:

Limited availability – Only open to California veterans; active duty members may not qualify.

Prepayment penalties – Loans can’t be refinanced without penalty for first few years.

No secondary financing – CalVet does not allow second mortgages or home equity loans.

Lower loan limits – Maximum CalVet loan amount lower than VA in some counties.

No instant title – Must repay loan in full before getting legal title.

VA Loan Pros and Cons

VA loans offer these types of benefits:

Nationwide availability – Offered to veterans in all states who meet requirements.

No residency requirements – Active duty members qualify even if stationed outside California.

Higher loan limits – VA uses federal conforming loan limits, higher than CalVet in some counties.

Full legal title – Ownership transfers to veteran as soon as loan closes.

No prepayment penalties – Can refinance with no early payoff fees.

Allows secondary financing – Can have second mortgages and home equity loans.

Lender flexibility – Rates and fees negotiable; can find no closing cost options.

Downsides of VA loans include:

Must live in home – Veteran borrower must occupy the home.

Possible VA funding fee – Upfront fee of up to 1.4% may apply depending on details.

Lower approval odds – Tougher approval criteria through private lenders vs. CalVet.

Varies by lender – Rates and costs differ between lenders.

Potential mortgage insurance – Funding fee acts as monthly mortgage insurance premium.

Which is Better – CalVet or VA Loan?

There’s no universal “better” option, as it depends on your specific situation as a veteran. Here are some examples to help decide:

Purchasing primary residence in California – For a main home, VA likely better due to higher loan limits, instant full title, no prepayment penalty, and lender choice.

Building a home as contractor – CalVet may be better if you’ll act as builder. Easier to qualify and construction loans offered.

Buying rental properties – VA allows veterans to buy rental homes; CalVet loans require owner occupancy.

Refinancing an existing CalVet loan – CalVet only allows rate/term refinancing of its own loans. To do a cash-out refi, need to refinance into a VA loan.

Active duty veteran relocating – VA loans have no residency requirements, so easier for active duty members with PCS moves.

Purchasing manufactured home – Both VA and CalVet allow financing manufactured home purchases.

Tips for Qualifying for CalVet or VA Loans

If you’ve decided a CalVet or VA loan is right for you, here are tips to improve your odds of approval:

- Maintain a minimum 620 credit score

- Keep debt-to-income ratio below 50%

- Lower credit card balances before applying

- Get preapproved to confirm you qualify and can afford desired home

- Save up for closing costs and down payment if possible

- Shop lenders to compare VA loan costs if going that route

- Ask lenders about credit or income documentation needed

Key Takeaways on CalVet vs VA Loans

- CalVet loans restricted to CA veterans; VA open to eligible veterans nationwide

- VA offers more flexibility on rates/fees, home types, title, prepayment, secondary financing

- CalVet has easier approval criteria, lower costs, and down payment help programs

- Consider loan differences, home plans, and finances to decide which is better

Do a side-by-side comparison using your situation and homeownership plans to choose between a CalVet or VA loan. Both allow veterans and military members to purchase a home with no down payment required.

CalVet Loan vs VA Loan – What is the Difference?

The CalVet loan is offered by the California Department of Veteran Affairs, while the VA loan* is provided by the U.S. Department of Veteran Affairs. The main difference between the two programs lies in how the properties are held.

Compare: CalVet vs VA loans

The main difference is in how the titles of the properties are held

CalVet purchases the property the homebuyer desires. They then sell that property to the homebuyer using a contract of sale, which is also referred to as a land contract. This means that CalVet holds the legal title to the house that was bought using the CalVet mortgage and the homebuyer holds the equitable title, which is the right to obtain full ownership of the property.

Under the VA loan program, which is administered by U.S. Department of Veteran Affairs, the homebuyer receives the property’s full legal title and complete ownership right away.

Homebuyers who are U.S. military veterans should speak to one of our home loan specialists to find out whether they are eligible for either a VA loan* or a CalVet loan.

CalVet loans are given out to eligible veterans through approved lenders by the State of California.

The following is a breakdown of some of the commonly asked questions about CalVet home loans:

A CalVet loan is a loan that is insured by CalVet. This means that borrowers who are eligible for the CalVet loan program are less of a risk for lenders to approve, which in turn makes it easier for eligible borrowers to qualify despite potentially low reserves or poor credit. It also means that eligible borrowers may be able to secure favorable terms compared to other loan options. For example, CalVet loans often do not require a downpayment and are available at low-interest rates.

To be eligible for the CalVet loan program, homebuyers must be veterans of the U.S. military who have served on active duty for at least 90 days, whether during wartime or peacetime. This period of time does not include active duty for training purposes only. Service must have been performed under honorable conditions. Where the borrower entered their service does not matter. National Guard or Reserves veterans are also eligible.

Borrowers will need to meet the federal VA loan’s* standard guidelines as well. This includes having stable income and employment, and having a debt ratio no higher than 41 percent. Although the VA* has no credit score minimum, most lenders require a credit score of at least 600 to qualify.

CalVet loans offer fixed interest rates that vary based on the length of the loan term, the price of the house, and the amount of the down payment paid. Rates, though they are subject to change, are generally lower than current market rates.

There are loan limits to how much an eligible borrower can take out using a VA loan*. These limits are based on where the borrower lives in California. Depending on where the borrower is purchasing a house, the loan limit currently ranges from $453,100 to $679,650.

CalVet loans are available in 15, 20, 25, and 30-year loan terms* for single, multi-family, manufactured, and condo-style homes. Seller-paid closing costs are limited to 4 percent of the sales price. Some borrowers may not be required to pay a down payment. However, those that are required to pay a down payment (as a result of a low credit score or other factors), will typically pay a small percentage of the home’s price. An origination fee is charged on CalVet loans, as is an upfront funding fee, which can be wrapped into the loan.

What is the Difference Between a CAL Vet Loan and a VA Loan

FAQ

Is CalVet loan the same as VA loan?

Is a CalVet loan good?

What is the minimum credit score for the Cal Vet?

Who generally qualifies for CalVet loans?

What is the difference between Cal Vet loan VS VA loan?

The greatest difference between Cal Vet loan vs VA loan is that the CalVet loan program purchases the house and then sells the home back to you. Essentially, CalVet is the lender and holds the legal title to the home until the loan amount is paid in full. You will have the equitable title which is the right to use and enjoy the property.

Is Calvet a good home loan program?

Many Veterans are not familiar with the CalVet program, but those that are sometimes automatically assume the CalVet home loan program must be better. But it depends on the situation. For most California Veterans, the standard VA loan program will be the best option. But there are times when the CalVet program can get things done that VA cannot.

Can veterans get a home loan in California?

Similar to the US Department of Veteran Affairs, the California Department of Veterans Affairs offers a mortgage loan program of its own to assist eligible veterans in becoming homeowners. This home loan program is strictly for service members who live in California. The following are the types of loans that are offered through the CalVet program:

What is the difference between Calvet and VA home loan programs?

In this blog post, we will compare and contrast the CalVet and VA home loan programs so that you can make an informed decision about which program is best for you. The first difference is the CalVet home loan program is offered by the California Department of Veteran Affairs.