We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free – so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

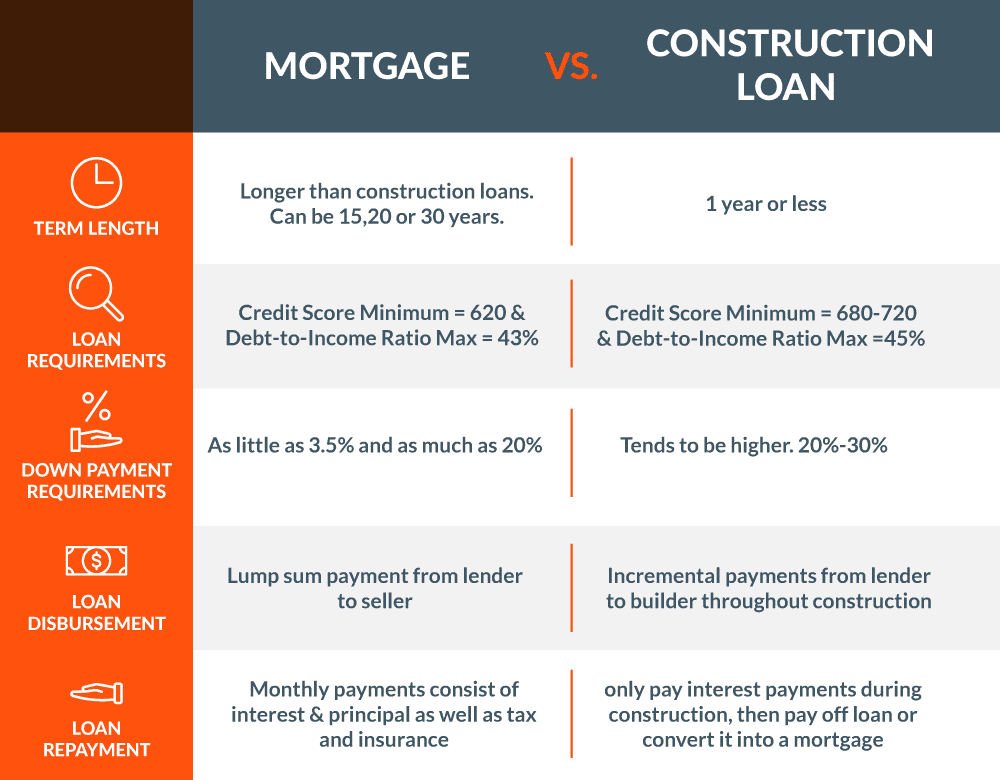

Getting your dream home built can be an exciting endeavor. However financing the construction requires careful consideration of your options. The two main types of construction loans are builders loans and mortgages. While they share some similarities, there are some key differences you need to understand before choosing the right loan for your new build.

What is a Builders Loan?

A builders loan, also known as a construction loan, is a short-term loan used to finance the building of a new home. The loan covers expenses like land purchase, materials, labor, permits, utility connections, and more.

Here are some key features of builders loans:

- Term length is usually around 6-12 months to cover the construction period

- You only pay interest during the construction, no principal

- Once construction is complete, the loan converts into a traditional mortgage

- Interest rates are usually higher than mortgages since no collateral is provided initially

Builders loans allow you to access funds in stages as each phase of construction is completed. The lender will send an inspector to approve each draw request before releasing additional funds.

What is a Mortgage?

A mortgage is a long-term loan used to finance the purchase of an existing home Most mortgages have a 15 or 30-year repayment term,

Here are some key features of mortgages:

- Long-term loan, usually 15-30 years

- Monthly payments cover both principal and interest

- Lower interest rate than builders loans

- You receive the full loan amount upfront at closing

With a mortgage, you get the key benefit of making one long-term financing decision versus having to requalify for a mortgage after the construction loan period.

Key Differences Between Builders Loans and Mortgages

While both loans allow you to finance a home, there are some notable ways that builders loans and mortgages differ:

Interest Rates

-

Builders Loan: Typically have higher interest rates than mortgages, often 1-2% higher. This accounts for the higher risk since no collateral is provided initially. Rates are usually variable.

-

Mortgage: Tend to have lower interest rates than builders loans. Rates can be fixed or adjustable. Lower rates reflect the lower risk with an existing home as collateral.

Loan Term

-

Builders Loan: Short-term loan that covers just the construction period, usually 6-12 months. You pay interest-only during construction.

-

Mortgage: Long-term loan, generally 15-30 years. Monthly payments cover principal and interest over the life of the loan.

Collateral

-

Builders Loan: The lender has no collateral until the home is completed, hence the higher rates.

-

Mortgage: An existing home serves as collateral from day one, allowing lower rates.

Qualification Frequency

-

Builders Loan: You must requalify and apply for a mortgage once construction is done. Two sets of closings and fees.

-

Mortgage: One-time mortgage approval and closing for the long term. Avoid repeat appraisals and closings.

Payment Structure

-

Builders Loan: Interest-only payments during construction. Principal is paid once construction converts to a mortgage.

-

Mortgage: Monthly payments cover both principal and interest over the full loan term.

Disbursement of Funds

-

Builders Loan: Funds released in stages as inspector approves each completed phase.

-

Mortgage: You receive full loan amount upfront at the initial closing.

Completion Risk

-

Builders Loan: Delays may increase rates or force qualification again. New issues may arise requiring additional funds.

-

Mortgage: No completion risk since existing home is purchased as-is.

When to Use Each Type of Loan

With an understanding of the key differences, you can determine when each loan option may make more sense:

Builders Loan If:

- You are building a fully custom home from the ground up.

- You want to act as your own general contractor.

- You want flexibility in accessing funds in phases.

- You want to only pay interest during the build.

Mortgage If:

- You are buying an existing home or completed new construction.

- You want to lock in one long-term interest rate.

- You don’t want the hassle of requalifying for a mortgage.

- You prefer predictable payments covering principal and interest.

Here are a few examples of when each loan would be applicable:

-

If you are buying a home already completed, a mortgage is likely your best option.

-

If you are building a fully custom home on land you already own, a builders loan lets you finance the construction itself.

-

If you are buying a newly built spec home, you may qualify for a traditional mortgage immediately.

How to Get Approved

The approval process has some similarities between builders loans and mortgages:

For both loans you will need to provide:

- Identification documents

- Income documentation like pay stubs and tax returns

- Details on any assets or money you have saved

- Information about recurring debts and expenses

For builders loans you also need to provide:

- Signed contract with your chosen licensed and insured builder

- Detailed construction plans and specifications

- Itemized budget showing all costs

- Projected construction timeline

Getting pre-approved for either loan shows sellers and builders you are ready to move quickly when you find the right home. Having your ducks in a row will give you strong negotiating power.

The Bottom Line

Builders loans and mortgages both allow you to finance a home – whether you are building new or buying existing. But there are some major differences in term length, interest rates, payment structures, and qualification requirements.

Carefully weigh the pros and cons of each to determine the best loan type for your specific home financing situation. Be sure to shop around with multiple lenders to get the best possible deal customized to your needs. With the right loan choice, you’ll be one step closer to turning your home ownership dreams into reality.

How do construction loans work?

The initial term on a construction loan generally lasts a year or less, during which time you must finish the project. Because construction loans work on such a short timetable and are dependent on the project’s progress, you (or your general contractor) must provide the lender with a construction timeline, detailed plans and a realistic budget. Based on that, the lender will release funds at various phases of the project, usually directly to the contractor. Mortgage Construction loan statistics

- Construction loans typically require 20 percent down, at minimum.

- As of the second quarter of 2023, commercial and non-commercial construction loan volume totaled $488.54 billion, according to S&P Global Market Intelligence.

- Currently, the top five construction loan lenders, in terms of number of loans, are (in order): Wells Fargo, JP Morgan Chase, Bank of America, U.S. Bank and Bank OZK, reports S&P.

What are construction loans?

Construction loans are loans that fund the building of a residential home (aka a stick-built house), from the land purchase to the finished structure. Common types are a standalone construction loan — a short-term loan (generally with a year-long term) — which only finances the building phase, and a construction-to-permanent loan, which converts into a mortgage once the construction is done. Borrowers who take out a standalone construction loan often get a separate mortgage to pay it off when the principal falls due.

You can use a construction loan to cover such costs as:

- The land

- Contractor labor

- Building materials

- Permits

The differences between Construction Loans and Long Term Mortgages

FAQ

Is it easier to get a loan to buy or build a house?

Is a construction loan a good idea?

What is the minimum FICO score for a construction loan?

How does construction loan interest work?

What is the difference between a construction loan and a mortgage?

Beyond the cost and repayment timeline, construction loans and mortgages have a few main differences: The funds distribution: Unlike mortgages and personal loans that provide funds in a lump-sum payment, the lender pays out the money for a construction loan in stages as work on the new home progresses.

How do I choose a home builder for a construction loan?

Licensed builder. Before taking out a construction loan, you’ll need to choose a licensed, reputable home builder. Choose a builder who has a proven track record of completing construction projects to a high standard and is a member of a reputable construction trade group, such as the National Association of Home Builders.

What is a construction mortgage?

A construction mortgage is a loan that pays for building a new home. During construction, most loans of this type are interest-only and will disburse money incrementally to the borrower as the building progresses. The two most popular types of construction mortgages are stand-alone construction and construction-to-permanent mortgages.

Can a construction loan be converted to a mortgage?

Some construction loans can be converted to mortgages after your home is finished. Construction loans typically have tougher criteria than conventional mortgages for existing homes. If you can’t find the right home to buy, you might be thinking about building a house instead.