Filing for bankruptcy can feel like a major setback on the road to homeownership. With your credit score plummeting and debts discharged many would-be buyers may feel like their dream of owning a home is dashed after bankruptcy. However, if you’re a qualifying Veteran or military member a VA home loan may provide a viable path to financing a home purchase even after a bankruptcy.

VA loans offer more lenient credit standards and guidelines than conventional loans, providing borrowers a better chance of approval after financial hardship. While bankruptcy will impact your VA loan eligibility, understanding the nuances around waiting periods, credit rebuilding, specific lender policies and more can position you for success when applying for a mortgage post-bankruptcy.

Overview of Bankruptcy’s Impact on VA Loans

Declaring bankruptcy has an undeniable impact on your credit profile and loan qualification criteria. The two most common bankruptcy filings – Chapter 7 and Chapter 13 – both can significantly drag down credit scores. According to FICO research, consumers may see their credit scores fall between 130 to 240 points after a bankruptcy. This steep credit score drop combined with the bankruptcy notation on your credit report makes getting approved for financing incredibly difficult.

Beyond the credit score impact, VA lenders also want to see that borrowers meet a minimum “seasoning period” after bankruptcy to demonstrate they are a satisfactory credit risk again. While bankruptcy presents challenges, Veterans and military borrowers may have more options through VA loans than conventional mortgages. This is because VA loans are government-backed, have flexible qualifying guidelines, and are specially designed to aid servicemembers.

VA Loan Bankruptcy Waiting Periods

VA lenders want reassurance borrowers have reestablished solid financial footing before taking on a mortgage post-bankruptcy As a result, they institute seasoning periods borrowers must satisfy before applying

For a Chapter 7 bankruptcy discharge, you must typically wait a minimum of 2 years before qualifying for a new VA loan. With a Chapter 13 bankruptcy, the seasoning period is often shorter, usually just 1 year from the bankruptcy filing date.

Here is how VA bankruptcy seasoning periods compare to other common mortgage loan types

| Loan Type | Chapter 7 Waiting Period | Chapter 13 Waiting Period |

|---|---|---|

| VA Loan | 2 years | 1 year |

| Conventional Loan | 4 years | 2-4 years |

| FHA Loan | 2 years | 1 year |

| USDA Loan | 3 years | 1 year |

As you can see, VA loans tend to have the shortest waiting periods, providing an advantage over conventional mortgages in particular.

Requirements for a VA Loan After Chapter 7

A Chapter 7 bankruptcy liquidates assets to pay off creditors and then discharges remaining debts. Any assets not exempt from liquidation can be seized and sold by the bankruptcy court.

To qualify for a VA loan after a Chapter 7 bankruptcy discharge, you’ll typically need to satisfy these general requirements:

- Complete the 2-year waiting period

- Have no late payments or new collections on your credit report since the bankruptcy discharge

- Rebuild your credit with a minimum FICO score of 620 for most lenders

- Meet all other standard VA loan eligibility criteria

Specific requirements vary by lender, so be sure to consult with a VA mortgage expert to understand what you’ll need to provide for your situation. Having a strong, improving credit profile is key.

Requirements for a VA Loan After Chapter 13

With a Chapter 13 bankruptcy, filers repay creditors through a court-supervised repayment plan over 3-5 years. Remaining debts are discharged once completed.

The seasoning period for a VA loan after Chapter 13 is just 1 year from the filing date, allowing quicker access to financing than a Chapter 7 bankruptcy. General requirements may include:

- Waiting at least 12 months from the Chapter 13 filing date

- Supplying documentation to explain any late payments within the last 12 months

- Rebuilding your credit with a minimum FICO score around 620

- Getting permission from your bankruptcy trustee to take on new mortgage debt

A strong payment history on your Chapter 13 plan is vital. Talk to a lender to learn more about Chapter 13 policies.

Tips for Rebuilding Your Credit After Bankruptcy

Your bankruptcy waiting period offers a valuable opportunity to rebuild and improve your credit. Doing so will strengthen your VA loan application. Here are some tips for credit repair after bankruptcy:

- Make all loan and credit card payments on time – payment history is a major factor in credit scores.

- Keep credit utilization low – aim to use less than 30% of your total available credit.

- Don’t open too many new credit accounts too quickly. Add new credit lines slowly over time.

- Consider becoming an authorized user on someone else’s credit card account in good standing.

- Limit new credit checks by comparison shopping for your VA mortgage within a short window of time.

Rebuilding a strong credit profile demonstrates to lenders you are ready to take on mortgage debt responsibly.

Finding the Right VA Lender After Bankruptcy

Not all lenders have the same standards for approving VA loans after bankruptcy. Your chances may improve by shopping around with multiple lenders to compare interest rates and qualification terms. Seek out lenders well-versed in VA loans and bankruptcy guidelines. Their expertise can prove invaluable in navigating the complexities bankruptcy can create.

Be ready to provide key documents like your bankruptcy discharge papers, tax returns, proof of income, and explanation for any red flags on your credit report. Patience and perseverance are vital, as is a commitment to transparency.

Weighing the Pros and Cons of VA Loans After Bankruptcy

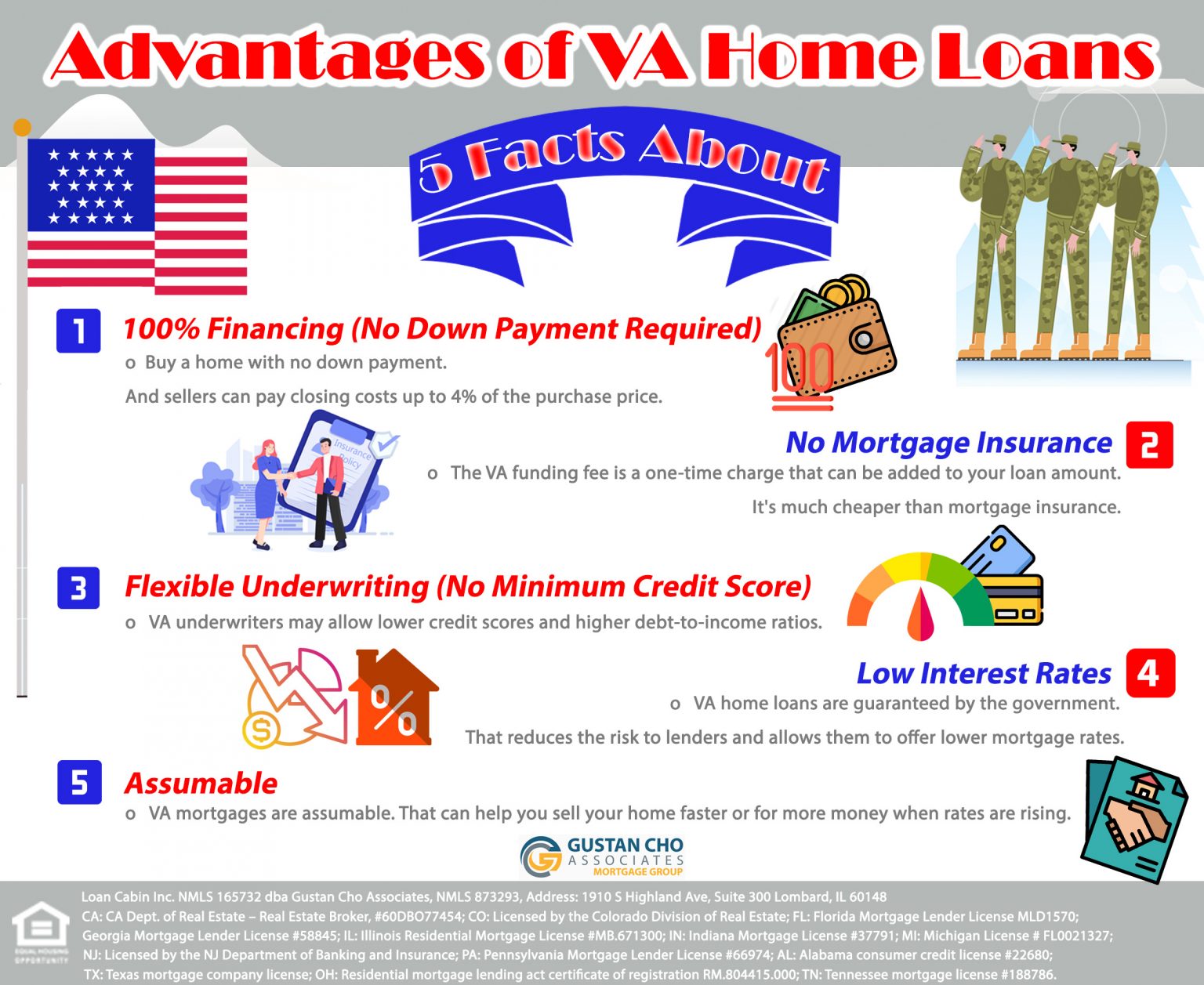

While VA loans offer a lifeline after bankruptcy, it’s wise to consider both the potential benefits and drawbacks before moving forward:

Pros

- Shorter seasoning periods than conventional loans

- Lenient credit score requirements as low as 580 FICO

- Low or no down payment options

- May qualify while still making Chapter 13 plan payments

- VA loans limited to lender fees of 1% of the loan amount

Cons

- Refinancing limitations within 6 months of closing a VA loan

- Required VA funding fee rolled into the loan amount

- VA loans not permitted on co-ops or commercial properties

- Potentially higher interest rate than conventional financing

- Lower max loan limits than conventional mortgages

Weigh the pros and cons carefully as you map out your post-bankruptcy mortgage strategy.

Alternative Credit Qualifying for VA Loans

Some prospective buyers may fall short of minimum credit score requirements even after bankruptcy waiting periods expire. In certain cases, you may still have options through alternative credit qualification with manual underwriting.

Lenders can assess your overall financial profile, including your job stability, savings, payment history, down payment amount, and other strengths. This holistic manual review from lenders may possibly help you overcome credit challenges. Ask your lender if you may be a candidate for alternative credit qualification.

Purchasing a Home After Bankruptcy is Possible

Navigating the complex financial fallout of bankruptcy poses undeniable challenges on the journey toward homeownership. However, VA loans can provide active duty servicemembers and Veterans a path forward after bankruptcy that may not be available through conventional financing.

By satisfying seasoning period requirements, diligently rebuilding your credit, saving for a down payment, and working with experienced VA lenders, you can put yourself in position to buy a home after bankruptcy.

If homebuying is your goal after financial hardship, be patient, committed and remain hopeful. Don’t let bankruptcy discourage you. The VA home loan program exists to help Veterans buy homes, even after bumps in the road. With perseverance and a strategic approach, you can achieve the dream of homeownership.

Work with a Knowledgeable VA Lender

Choose a lender experienced in VA loans and familiar with bankruptcy guidelines. They can guide you through the process, provide valuable insights and help you navigate any unique requirements. A knowledgeable VA lender can assess your specific situation, offer tailored advice and increase your chances of approval.

Save for a Down Payment

While a down payment is not required for most VA loans, having some savings to put down can strengthen your loan application. It shows the lender you have the ability to save and manage your finances responsibly. A down payment can also help reduce the loan amount, making it more appealing to lenders and potentially lowering your interest rate.

Bankruptcy & the VA Home Loan

FAQ

Does bankruptcy affect a VA loan?

Will filing bankruptcy affect my VA benefits?

How much debt do you have to have to file bankruptcy in VA?

Can mortgage be written off in bankruptcy?