Stocks are a fundamental component of any well-diversified investment portfolio They represent ownership in companies, granting investors a share in their future success Understanding their role as an asset class is crucial for making informed investment decisions.

What are Stocks?

Stocks, also known as equities, are securities that represent ownership in a publicly traded company. When you purchase a share of stock, you essentially become a part-owner of that company, entitled to a portion of its profits and assets. The value of your investment fluctuates with the company’s performance, reflecting its growth, profitability, and market perception.

Stocks as an Asset Class

Stocks fall under the broader category of financial assets, which are investments that derive their value from contractual rights or ownership claims. Unlike real assets like land or buildings, financial assets do not have a physical form. Their value is determined by factors such as market demand, company performance, and future growth potential.

Key Characteristics of Stocks

- High Growth Potential: Stocks have the potential to generate significant returns over the long term, outperforming other asset classes like bonds or cash.

- Liquidity: Stocks traded on public exchanges are highly liquid, meaning they can be easily bought and sold, providing investors with flexibility.

- Volatility: Stock prices fluctuate based on market conditions and company performance, leading to potential gains or losses.

- Dividends: Some companies distribute a portion of their profits to shareholders in the form of dividends, providing a regular income stream.

Advantages of Investing in Stocks

- Long-Term Growth: Historically, stocks have outperformed other asset classes over extended periods, offering the potential for substantial wealth accumulation.

- Inflation Hedge: Stocks can serve as a hedge against inflation, as their value tends to rise alongside increasing prices.

- Diversification: Investing in stocks across different industries and sectors can mitigate risk and enhance portfolio stability.

- Passive Income: Dividend-paying stocks provide a regular income stream, supplementing your overall investment returns.

Considerations for Investing in Stocks

- Volatility: Stock prices can fluctuate significantly, requiring investors to tolerate short-term market swings.

- Risk: Investing in individual stocks carries a higher risk compared to diversified investments like mutual funds or ETFs.

- Time Horizon: Stocks are best suited for long-term investment horizons, allowing time for market fluctuations to even out and potential growth to materialize.

Stocks are a valuable asset class for building wealth and achieving long-term financial goals. Understanding their characteristics, advantages, and considerations is essential for making informed investment decisions. By incorporating stocks into a diversified portfolio, investors can harness their growth potential while mitigating risks and generating passive income.

How do stocks work?

A stock is a claim to a portion of a company’s ownership, including its profits and assets. As such, stockholders are partial owners of the company. The value of the stock changes in tandem with the business’s value.

Typically, stocks are purchased and sold electronically via stock exchanges; the New York Stock Exchange (NYSE) and the National Association of Securities Dealers (NASDAQ) are the two main ones in the US. While some businesses offer stock to investors directly, the majority only do so through brokerages like Schwab.

Purchasing and selling stocks can be done for a variety of reasons, such as the chance to increase the value of the investment over time, to take advantage of more transient changes in stock prices, or even to generate income from dividend-paying stocks. These choices are frequently supported by both qualitative and quantitative methods such as technical or fundamental analysis. Remember that a stock’s price can decrease just as easily as it can increase. There is no assurance when investing in stocks that you will profit; in fact, many investors lose money. Dividend payments on stocks are not guaranteed, and they may be stopped. The underlying common stock is vulnerable to certain business and market risks, such as bankruptcy.

How do stocks work within a portfolio?

Because they have the potential to grow and yield higher returns than other investment products, stocks play a significant role in every portfolio. You should first create a thorough financial plan that takes into account your investment horizon, risk tolerance, and the possible upside that stocks may provide in order to decide how much you might think about investing in stocks.

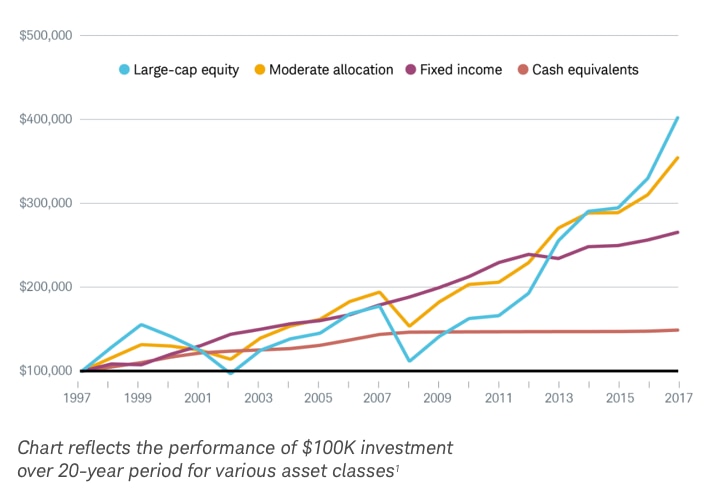

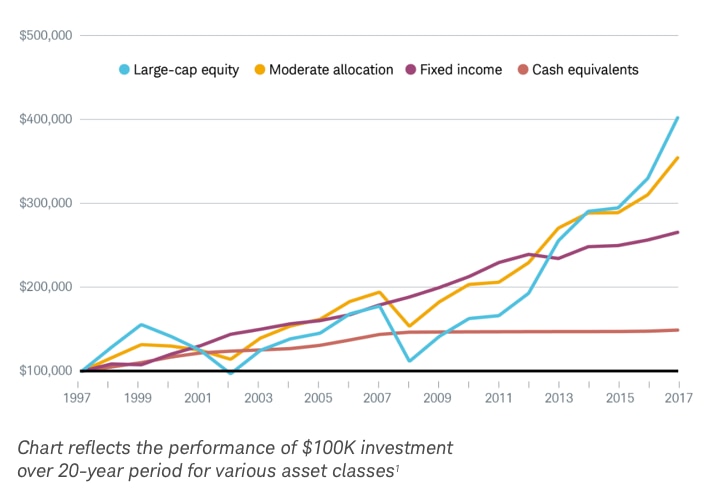

Different asset classes have different performance patterns, making it nearly impossible to forecast which asset class will do best in a given year. If you had invested $100,000 in just U. S. By 2017, stocks would have nearly quadrupled to $400,000, but the volatility would have caused many ups and downs. A portfolio of investments with greater diversity would have had less volatility but a lower return.

Assets vs Liabilities and how to generate assets

FAQ

Is a stock an asset or expense?

Is a stock a current asset or not?

Are stocks a good asset?

Is common stock an asset?

With 2 of the 5 criteria already not being applicable, it’s clear that Common Stock is not an asset for a company. For investors, however, common stock can be seen as an asset. For instance, if you own shares in Apple Inc., you’d technically own some of its ‘common stock’. As far as you’re concerned, that’s an asset for you.

Why is a stock considered an asset?

It’s easy to see why a stock might be considered an asset. A stock’s share price can increase, reflecting a rising valuation for the company. It’s also easy to see why one might consider a stock a liability. Companies sometimes take on debt in order to buy back their own stock or use stock for employee compensation or acquisition deals.

Are stocks a financial asset or a real asset?

Stocks are financial assets, not real assets. A financial asset is a liquid asset that gets its value from a contractual right or ownership claim. Real assets are physical assets that have an intrinsic worth due to their substance and properties such as precious metals, commodities, real estate, land, equipment, and natural resources.

Is common stock an asset or a liability?

No, common stock is neither an asset nor a liability. Common stock is an equity. Image source: Getty Images. What makes common stock an equity? Common stock is a type of security that represents an ownership position, or equity, in a company. When you buy a share of common stock, you are buying a part of that business.