When you take out a mortgage, understanding how interest is calculated can help you make the best financial decisions Most mortgages use a simple interest calculation, which is more straightforward and favorable for borrowers compared to compound interest.

In this comprehensive guide, we’ll explain what simple interest is, how it works with mortgages, and the key benefits it provides.

What is Simple Interest?

Simple interest is a method of calculating interest charges based solely on the original principal balance. It does not compound over time.

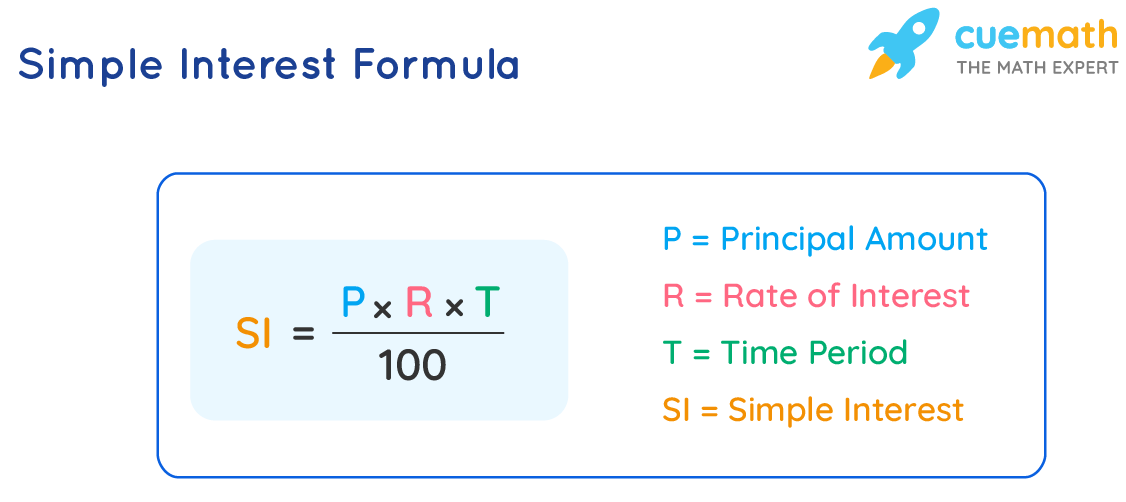

Here is the simple interest formula:

Interest = Principal x Interest Rate x Time

With simple interest, the interest rate is applied only to the initial principal amount. The interest does not accumulate and compound over the loan term like it does with other types of interest calculations.

For example, say you take out a $100,000 mortgage with a 5% interest rate and a 30-year term.

In year one, the interest would be:

$100,000 x 0.05 x 1 = $5,000

In year two, the interest would still be $100,000 x 0.05 x 1 = $5,000

The interest calculation does not change over the life of the loan. It is always based on the original principal.

How Do Mortgage Loans Use Simple Interest?

The vast majority of mortgage loans use a simple interest calculation. With a mortgage, the interest due each month is based on the current outstanding principal balance, not the original amount borrowed. But it still does not compound.

Here is an example of how simple interest works with a mortgage:

- You take out a $200,000 mortgage at 4% interest on a 30-year term

- Your monthly principal & interest payment is $955

- Of that $955, $800 goes toward interest and $155 toward principal

- In month two, the outstanding balance is now $199,845

- So the interest for month two is calculated as $199,845 x 0.04/12 = $798

- Your payment is still $955, but now $798 covers interest and $157 goes to principal

As you pay down the loan, the principal balance declines each month. But the interest is always calculated based on the current principal balance, not the accumulating interest.

Why Are Mortgages Simple Interest Loans?

There are a few key reasons why simple interest is used for most mortgage loans:

-

Simplicity – Simple interest is easier to calculate than compound interest, especially over decades on a mortgage. The interest charges do not need to be computed exponentially.

-

Lower Cost – Without interest compounding, the total interest paid over the life of the loan is less compared to compound interest. This makes mortgage loans more affordable.

-

Amortization – As the loan amortizes (paid down) over time, the interest portion of the monthly payment declines as principal increases. This amortization works well with simple interest calculations.

-

Predictability – Borrowers know exactly how much interest they will pay each month and over the full term based on the original principal and rate.

Overall, simple interest provides a straightforward method to calculate interest charges on long-term mortgage loans, while keeping costs lower for borrowers.

How Does Simple Interest Compare to Compound Interest?

Simple and compound interest vary significantly:

-

Simple interest – Interest is charged only on the principal amount.

-

Compound interest – Interest accrues on principal and accumulated interest.

With compound interest, the interest compounds and capitalizes over time, causing the total interest charges to grow exponentially.

Credit cards, savings accounts, auto loans, and other short-term installment loans often use daily compound interest. Over months or years, compound interest can really add up, which is why credit card debt can easily spiral out of control.

For real estate loans that span decades, like mortgages, simple interest is clearly the better option for borrowers.

Benefits of Simple Interest Mortgages

Simple interest mortgages provide several advantages:

Lower Interest Costs

Without compounding interest, the total amount paid in interest over the loan term is significantly less than it would be with compound interest. This makes mortgage loans more affordable.

Fixed Monthly Payments

Monthly principal and interest payments are fixed for the life of fixed-rate mortgages. This reliability helps borrowers budget.

Interest Declines Over Time

As the loan balance decreases, the amount going toward interest each month gradually declines as well. More of the payment is applied to principal.

Transparency

Borrowers can easily calculate interest charges themselves each month and over the full term. This transparency helps borrowers forecast costs.

Interest Savings from Extra Payments

Any additional payments directly reduce principal, saving all the interest that would have been owed on that portion of the balance. This is not the case with compound interest loans.

Are There Any Drawbacks to Simple Interest Mortgages?

The structure of simple interest mortgage loans strongly favors borrowers. The main drawback is that lenders earn less interest over the long run compared to compound interest loans. But overall, simple interest mortgages are advantageous for consumers.

The Bottom Line

Simple interest is straightforward, predictable, and saves borrowers money compared to compound interest. That’s why most mortgages use a simple interest calculation. The interest charges each month are based only on the current outstanding principal balance, not the accumulating interest. This keeps mortgage loans affordable over their long repayment terms. So when it comes to mortgages, simple interest is a very good thing!

Understanding Simple-Interest Mortgage

A simple-interest mortgage is calculated daily, which means that the amount to be paid every month will vary slightly. Borrowers with simple-interest loans can be penalized by paying total interest over the term of the loan and taking more days to pay off the loan than in a traditional mortgage at the same rate.

At the same time, a simple-interest loan used along with biweekly payments or early monthly payments can be used to pay off the mortgage before the end of the term. This early payoff can significantly reduce the total amount of interest paid.

The differences between a simple-interest mortgage and a traditional mortgage are more critical for longer-term house notes.

For example, on a 30-year fixed-rate $200,000 mortgage with a 6% interest rate, a traditional mortgage will charge 0.5% per month (6% interest divided by 12 months). Conversely, a simple-interest mortgage for the 30-year fixed-rate $200,000 loan costs 6% divided by 365, or 0.016438% per day.

The U.S. Bureau of the Fiscal Service offers a simple daily interest mortgage payment calculator to calculate how much you might owe on late payments.

What Is Simple-Interest Mortgage?

A simple-interest mortgage is a home loan where the calculation of interest is on a daily basis. This mortgage is different from a traditional mortgage where interest calculations happen on a monthly basis.

On a simple-interest mortgage, the daily interest charge is calculated by dividing the interest rate by 365 days and then multiplying that number by the outstanding mortgage balance. If you multiply the daily interest charge by the number of days in the month, you will get the monthly interest charge.

Because the total number of days counted in a simple-interest mortgage calculation is more than in a traditional mortgage calculation, the total interest paid on a simple interest mortgage will be slightly larger than for a traditional mortgage.

- A home loan based on the calculation of interest daily is called a simple-interest mortgage.

- If a borrower pays one day late, the amount owed will go up due to the accrued interest.

- Borrowers who can pay on time biweekly or monthly, or even early, may fare well with a simple-interest mortgage.

- Most borrowers do better with a traditional mortgage due to its built-in grace period.