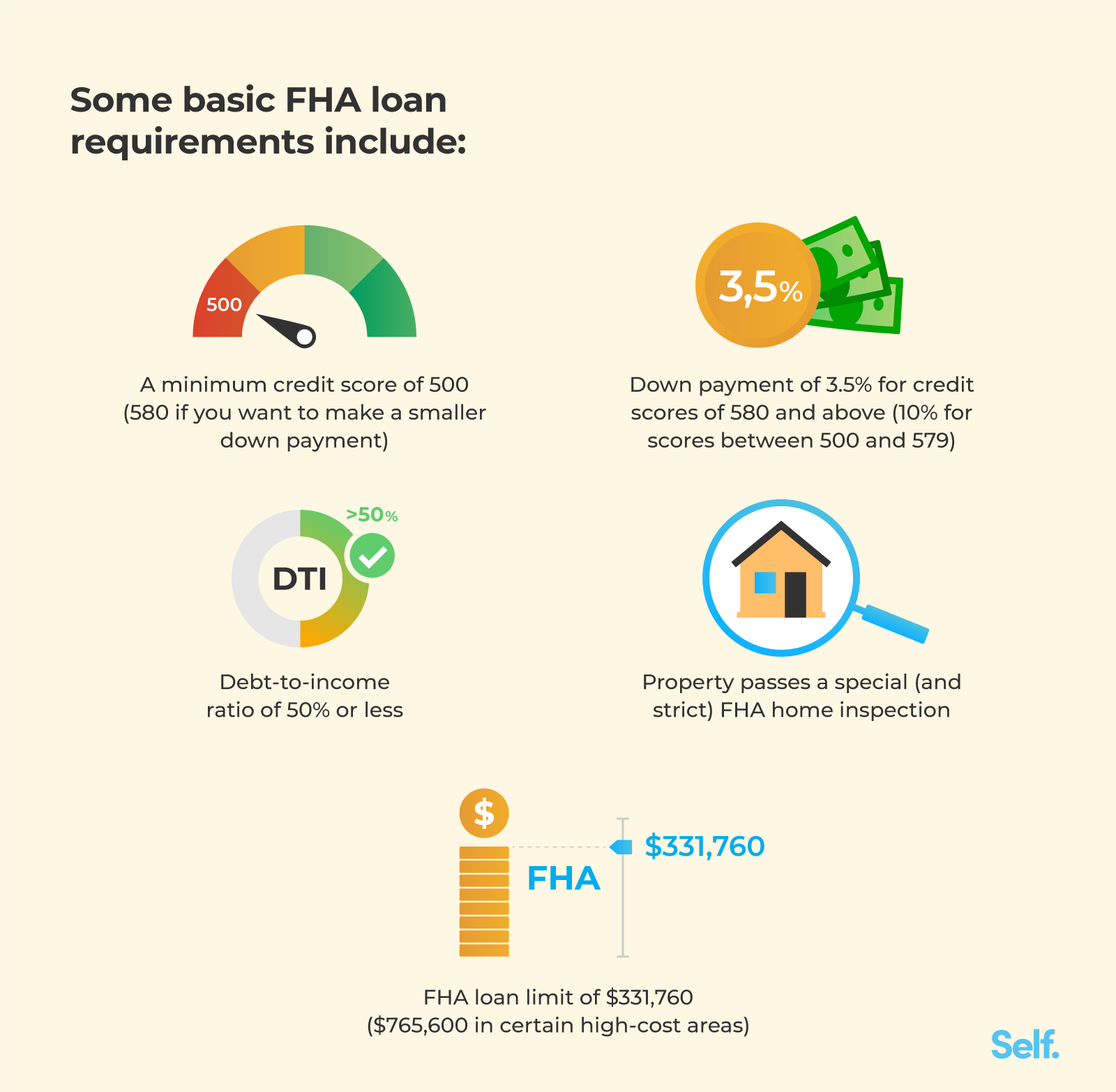

Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

Purchasing a home with an FHA loan is an excellent way for first-time buyers and those with lower credit scores to attain affordable homeownership. FHA loans only require a 3.5% down payment and have flexible credit guidelines. But what happens when life circumstances change and an FHA borrower needs to sell their home? Are FHA loans transferable to the new owner?

The answer is yes – with some caveats. FHA loans originated after 1986 require lender approval and a creditworthiness review of the new borrower, also known as the assumptor Loans originated before 1986 can be freely transferred without lender intervention.

In this comprehensive guide we will cover

- The benefits of assuming an FHA loan

- FHA loan transferability rules

- The loan assumption process

- Tips for assumptors and sellers

- Alternatives to FHA loan assumptions

Benefits of Assuming an FHA Mortgage

Assuming an existing FHA mortgage can be advantageous for both buyers and sellers. Some key benefits include:

-

Lower interest rate – The assumptor takes over the seller’s existing rate, which may be lower than current rates. This saves money over the life of the loan.

-

Limited costs – No loan origination fees for the assumptor. Closing costs are typically 1-2% of the loan amount.

-

Easier to sell – Assumable loans are more enticing to buyers. Sellers can expand their pool of potential buyers.

-

Flexible financing – Assumption provides financing option for buyers who may not qualify for a new loan.

FHA Loan Transferability Rules

FHA loans are assumable due to the absence of a due-on-sale clause. However, transferability depends on when the loan originated:

-

Pre-1986 loans – Freely assumable without lender review of assumptor. The buyer and seller handle the transfer privately.

-

Post-1986 loans – Assumable but the lender must approve the assumptor’s creditworthiness via a full underwriting process.

The lender cannot prevent transfer of an assumable FHA loan, but can reject the assumptor if they do not meet qualification standards.

The FHA Loan Assumption Process

If you’re considering having a buyer assume your FHA mortgage, here is a general overview of the process:

- Find a qualified buyer interested in assumption

- Provide loan documents to assumptor for review

- Assumptor applies and is approved by lender

- Closing held to legally transfer property and loan

- You’re released from liability and loan is transferred to new owner

For pre-1986 loans, the process is straightforward. But post-1986 loans require extensive coordination with the lender to evaluate and approve the assumptor prior to closing.

The timeline can take 30-60 days with apost-1986 assumption. Make sure all parties are communicating throughout.

Tips for FHA Loan Assumptors

As the buyer assuming an FHA loan, make sure you understand the terms and conditions before moving forward:

- Review the loan documents and note rate, terms, balance, escrow status, etc.

- Check your credit score – lender minimum is usually 640. Improve if needed.

- Get pre-approved to ensure you will be accepted by lender.

- Budget for closing costs – usually 1-2% of loan balance.

- Inspect home carefully as you are buying “as-is” essentially.

- Consider asking seller for a price reduction or credit for any needed repairs.

Taking over an FHA mortgage is similar to obtaining a new loan. You want to ensure it is affordable and sustainable long-term.

Tips for FHA Loan Sellers

If trying to sell your home via an FHA loan assumption, here are some tips:

- Gather original loan documents and information to share with potential buyers.

- Highlight assumability in home listings and promote existing low interest rate.

- Find a knowledgeable real estate agent who understands the assumption process.

- Be responsive to lender requests for paperwork to expedite the process.

- Accept that you may need to offer price concessions or repairs if rate is above market.

- Consult a real estate attorney – some use assumption addendums to sales contract.

Promoting assumability can expand your pool of buyers. But you need to be prepared to facilitate the transfer process.

Alternatives to FHA Loan Assumption

Assuming an FHA loan has benefits, but also limitations. As the seller, you remain liable until the new owner is officially approved by the lender. This could take months.

Two alternatives include:

1. Refinancing – If you can qualify based on income, credit, and home value, refinancing transfers the loan to your name only.

2. Paying off loan – If you have sufficient equity, you can pay off the FHA loan upon sale and convert it to a traditional mortgage for the buyer.

Explore all your options if selling a home with an assumable FHA loan. An assumption provides cost savings, but may not be the most efficient path.

Is Assuming an FHA Mortgage Right for You?

Transferring an FHA loan from seller to buyer can benefit both parties, allowing flexible financing terms and below market interest rates. But the qualification and approval requirements for post-1986 loans should not be underestimated.

Do your due diligence upfront as both the assumptor and seller. With proper planning and coordination, an FHA loan assumption can be a win-win arrangement.

Choose Your Loan TypeFHA.com is a privately owned website, is not a government agency, and does not make loans.

Do you know whats on your credit report?

Learn what your score means.

Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

| FHA Limits (low cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $498,257 | $637,950 | $771,125 | $958,350 |

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

| FHA Limits (high cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 |

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

FHA Loan Programs for 2024

The most recognized 3.5% down payment mortgage in the country. Affordable payments w/good credit.

Are FHA Loans Assumable

FAQ

Can I transfer my FHA loan to someone else?

Can you take over someone’s FHA loan?

Can a FHA loan be sold?

Can a buyer assume an existing FHA loan from a seller?

Can I transfer my FHA loan to my spouse?

Yes, you can transfer your FHA loan to anyone if the FHA or Department of Housing and Urban Development (HUD) gives the okay. If you want to assume your spouse’s FHA mortgage or your child wants to assume your FHA mortgage, it can happen as long as you or your child can demonstrate creditworthiness that meets the FHA’s standards.

Can you transfer an FHA loan to a conventional loan?

Yes, it is possible to transfer an FHA loan to a conventional loan.However, it is not a direct transfer.You will need to refinance your FHA loan into a conventional loan.To do this, you will need to meet

Can I assume a home loan with an FHA mortgage?

You will NOT be able to assume a home loan purchased with an FHA mortgage for most loans today without the lender’s approval. Loan assumption rules are published in HUD 4000.1, the FHA Single Family Home Loan Handbook. The rules in this area don’t tend to change much.

Are FHA loans assumable?

FHA loans are assumable because they do not have a “Due on Sale” clause. A “Due on Sale” clause states that a lender can require that the full amount of a loan be paid if the borrower sells or transfers a loan before paying off their mortgage. Why does this matter?