Interest-only loans allow borrowers to pay only the interest on the loan for a set period of time before needing to start making payments toward the principal as well. These types of loans can make sense in certain situations, but it’s important to understand how amortization schedules work with interest-only periods In this article, I’ll explain in simple terms how amortization schedules work for interest-only loans

What is an Amortization Schedule?

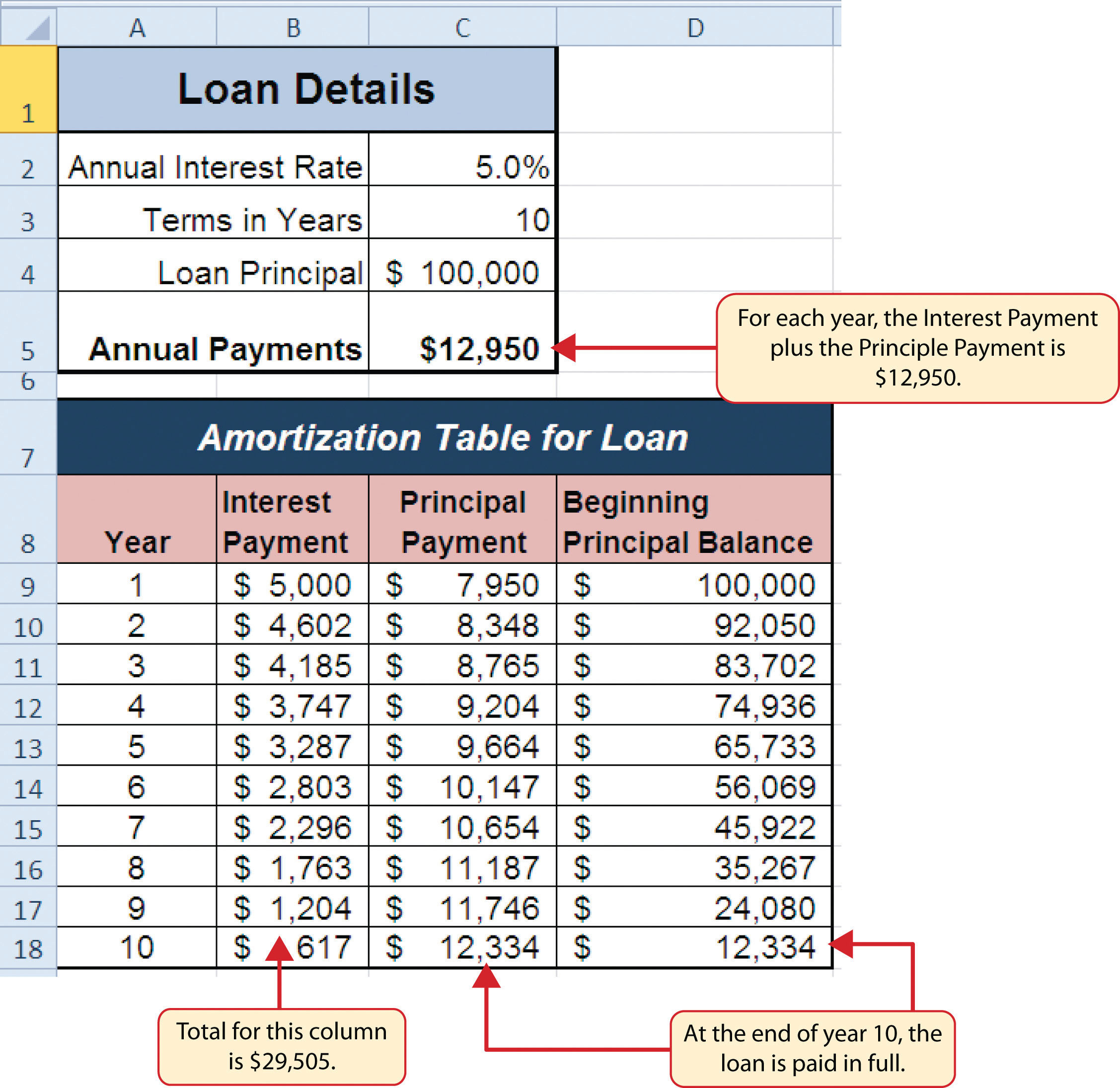

An amortization schedule is a table that shows how each payment on a loan is applied towards interest and principal over the full loan term. It maps out

- The total number of payments

- The amount of each payment

- How much of that payment goes towards interest vs principal

- The remaining loan balance after each payment

This schedule allows you to clearly see how much interest you’ll pay over the life of the loan, and how the principal balance declines with each payment.

For a normal loan without an interest-only period, some amount of each payment goes towards interest and some goes towards paying down principal right from the first payment.

How Interest-Only Periods Work

With an interest-only loan, you only pay the interest portion of the payment for a set period of time. This keeps your payments lower in the beginning.

The amortization schedule for an interest-only loan has two distinct phases

1. Interest-Only Period

- For the first X years, you only pay interest

- The entire payment only covers the interest charge for that period

- None of the payment applies to principal during this phase

- Therefore, the principal balance remains unchanged

2. Amortization Period

- After the interest-only period ends, payments apply to both interest and principal

- The principal portion slowly declines the remaining balance

- By the end of the loan, the principal is fully paid off

Benefits of Interest-Only Loans

There are a few potential benefits of interest-only loans:

- Lower payments in the beginning to ease short-term cash flow

- Allows you to pay down other debts faster initially

- Interest is tax deductible (for mortgages) which reduces effective rate

For these reasons, an interest-only loan can make sense when you expect your income to rise significantly in a few years. Once the interest-only period ends, you’ll be able to afford the higher payments.

Interest-only loans are also sometimes used for investment properties where the rent covers the interest payment. The investor may then sell the property before payments apply to principal.

Risks of Interest-Only Loans

However, interest-only loans do carry some risks to understand:

- Your equity will not build during interest-only period

- Payments jump significantly once principal payments start

- Risk of payment shock if income does not increase as expected

- Possibility of negative amortization if unpaid interest gets added to balance

It’s critical to consider these risks before opting for an interest-only loan. Make sure you budget properly for the higher payments down the road.

How to Read an Interest-Only Amortization Schedule

Now let’s walk through how to read an amortization schedule for an interest-only loan. Here is an example:

Loan Amount: $200,000

Interest Rate: 5%

Loan Term: 30 years

Interest-Only Period: 10 years

| Payment # | Payment | Interest Paid | Principal Paid | Balance |

|---|---|---|---|---|

| 1 | $833.33 | $833.33 | $0 | $200,000 |

| 2 | $833.33 | $833.33 | $0 | $200,000 |

| 3 | $833.33 | $833.33 | $0 | $200,000 |

| … | … | … | … | … |

| 120 | $833.33 | $833.33 | $0 | $200,000 |

| 121 | $1,228.35 | $916.67 | $311.68 | $199,688.32 |

| 122 | $1,228.35 | $916.10 | $312.25 | $199,376.07 |

| 123 | $1,228.35 | $915.52 | $312.83 | $199,063.24 |

| … | … | … | … | … |

| 360 | $1,228.35 | $100.29 | $1,128.06 | $0 |

Let’s break down what this shows:

- For the first 120 payments, the $833.33 goes entirely toward 5% interest

- The principal remains unchanged at $200,000 during this period

- At payment 121, principal repayment begins

- The payment jumps to $1,228.35, with interest decreasing and principal increasing each month

- In the final payment, the balance reaches $0 after principal is fully paid off

This clearly illustrates how the interest-only period works and how repayment accelerates once it ends.

Other Considerations

When evaluating an interest-only loan and its amortization schedule, some other factors to consider include:

- Prepayment penalties – will there be fees for paying off early?

- Rate adjustments – does the rate stay fixed or adjust at any point?

- Negative amortization – could unpaid interest get added to the principal?

Reading the amortization table closely can help you analyze these types of issues as well.

The Bottom Line

Hopefully this breakdown demystifies how amortization works on interest-only loans! The interest-only period keeps payments low at first, but then principal repayment must accelerate to pay off the balance over the remaining term.

Carefully evaluating the risks and ensuring you can handle higher future payments is crucial before committing to one of these loans. But used properly, they can be an effective tool in certain financial situations. Just be sure to read the amortization schedule closely to know what you’re getting into.

How to Calculate an Interest-Only Loan

An interest-only loan is simply a loan where the borrower is obligated to pay only the interest on the loan for a certain period of time, whether that be for a portion of the loan period or the entire loan period (with the obligation to pay back the principal of the loan at the end of loan period).

How to Calculate an Interest Only Mortgage

FAQ

Does an interest-only loan have an amortization schedule?

How do you calculate an interest-only loan?

What is an example of an interest-only loan?

How much down payment for interest-only loan?

What is the interest only amortization calculator?

The interest only amortization calculator has an amortization schedule that shows you everything you need to know about the loan and payment. What is an interest-only loan? An interest-only loan is a loan in which the borrower makes only interest payments during an initial period, usually in the first 5 to 10 years.

How does the interest only loan calculator excel with amortization work?

The interest only loan calculator excel with amortization will calculate the monthly payment based on mortgage amount, loan terms, interest rate, and the starting payment date. The interest only calculator will show a printable interest only loan amortization that is downloadable as a PDF.

How does a loan amortization schedule work?

As the principal gets paid on the loan the proportionate amount of each payment gets reduced until nearly the entire payment becomes principal toward the end of the loan term. An amortization schedule shows the progressive payoff of the loan and the amount of each payment that gets attributed to principal and interest.

What is the amortization schedule calculator?

Our Amortization Schedule Calculator is a flexible solution that will create a free amortization schedule you can print and keep for future reference. To understand how amortization schedules work, and how to use them to find your loan payment, interest costs, and more, read on . . . .