If your bank immediately recognizes loan origination fees and costs directly to your income statement, you are not alone. This is a common practice among many community banks. However, this practice is not in accordance with Generally Accepted Accounting Principles (GAAP).

According to Accounting Standards Codification (ASC) 310-20-25-2, loan origination fees and direct costs are to be deferred and amortized over the life of the loan to which they relate.

Amortization of loan origination costs is an important concept in accounting and finance. However, it is often not well understood by many individuals and businesses seeking loans In this article, we will explain the key aspects of amortizing loan origination costs in simple terms

What Are Loan Origination Costs?

When a lender provides a new loan, there are typically costs incurred in the process of originating, or starting the loan. These costs are known as loan origination costs (or fees).

Some examples of common loan origination costs include:

- Application fees

- Processing fees

- Underwriting fees

- Appraisal fees

- Credit check fees

- Attorney fees

- Document preparation fees

These costs cover the lender’s expenses for evaluating the loan application, assessing risk, preparing documents, and completing the lending transaction. The fees help compensate the lender for the work required before funding the loan.

Why Are Origination Costs Amortized?

Rather than expensing loan origination costs immediately when the loan is funded, lenders amortize the costs over the life of the loan.

Amortization spreads out the impact of the costs over multiple accounting periods. This matches the cost recognition with the periods when the loan generates interest income for the lender.

If origination costs were expensed upfront, it would create a mismatch on the income statement in the period the loan was funded. Expenses would be high relative to interest income, negatively impacting the lender’s profitability measures for that period.

Amortization ensures the lending costs are recognized in line with the economic benefits of the loan over time. This leads to more accurate financial reporting.

How Does Amortization of Origination Fees Work?

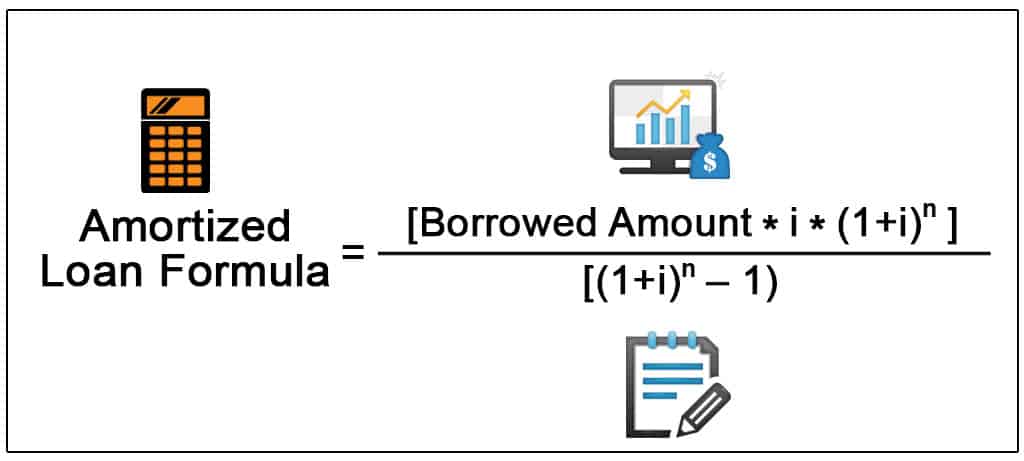

The typical approach to amortizing loan origination fees is the interest method defined in ASC 310-20 and ASC 835. This method spreads out the fees over the loan term based on the outstanding principal balance each period.

Here is a simple example:

- A lender charges $1,200 in origination fees on a 5-year $100,000 loan with a 5% interest rate

- Each year, 1/5th of the $1,200 in fees, or $240, will be amortized to expense

- The amortization will be calculated each period based on the loan’s remaining principal balance

This means more of the fees are amortized in the early periods when the principal is higher. Less is amortized in the later years when the balance is lower after principal repayments occur.

The result is a level yield where the loan’s net interest income after considering the amortized fees is the same 5% each year. This matches expenses with revenues.

Key Points on Origination Cost Amortization

Here are some key points to remember on amortizing loan origination costs:

- The interest method spreads out costs over the loan term based on principal

- Amortization matches interest revenues and creates level yield

- More costs amortized early when balance is higher

- Lenders defer upfront fees to align with income over time

- Helps avoid distortion and volatility in period expenses

- Required under ASC 310-20 and 835 when holding loans

- Does not apply to loans held for sale (defer until sale)

Why Amortizing Costs Matters

Properly amortizing origination costs has important implications in accounting and finance:

- Produces accurate financial statements that reflect economics

- Helps assess true loan profitability over time

- Enables consistent performance metrics and trends

- Meets accounting standards for balance sheet presentation

- Avoids skewed results from upfront cost recognition

For both lenders and borrowers, understanding amortization of loan costs leads to better lending decisions and financial management.

What constitutes loan origination fees and costs?

The fees and costs include but are not limited to:

- Prepaid interest

- Fees to reimburse the lender for origination activities

- Other fees charged to the borrower directly related to the loan origination

- Costs directly related to evaluating the financial performance of the potential borrower

- Preparing and processing loan documentation

- Employees compensation directly related to the loan

What Is a Mortgage Origination Fee?

FAQ

Do you amortize loan origination fees?

Can loan origination fees be expensed?

What is amortization period of loan costs?

Are loan closing costs amortized or depreciated?

Are loan origination fees amortized?

However, this practice is not in accordance with Generally Accepted Accounting Principles (GAAP). According to Accounting Standards Codification (ASC) 310-20-25-2, loan origination fees and direct costs are to be deferred and amortized over the life of the loan to which they relate. What constitutes loan origination fees and costs?

What are loan origination fees and costs?

According to Accounting Standards Codification (ASC) 310-20-25-2, loan origination fees and direct costs are to be deferred and amortized over the life of the loan to which they relate. What constitutes loan origination fees and costs? The fees and costs include but are not limited to: Recent Read: A Look at the Modern Audit: Are You Missing Out?

Why are loan costs amortized?

Loan costs, such as legal and accounting fees, registration fees, appraisal fees, and processing fees, are necessary costs to obtain a loan. If these costs are significant, they must be amortized to interest expense over the life of the loan due to the matching principle.

Are loan origination fees capitalized?

Beyond origination fees, loan origination involves direct costs incurred by financial institutions. Navigating the cost landscape requires careful accounting to reflect the economic impact accurately: Direct costs directly attributable to the acquisition of a mortgage loan are capitalized.