This calculator will compute an interest-only loans accumulated interest at various durations throughout the year. These amounts reflect the amount which would need to be paid in order to maintain a constant principal balance.

For your convenience we list current Denver mortgage rates to help you perform your calculations and find a local lender. Calculator Rates

Amortization loan calculators are invaluable tools for anyone considering an interest-only mortgage. With interest rates rising, these unique loans are regaining popularity as borrowers seek ways to lower their monthly payments. However, interest-only loans come with risks and complexities that standard amortizing mortgages do not. Using an amortization calculator can help you make an informed decision when weighing an interest-only mortgage.

What Is an Interest-Only Mortgage?

With a standard mortgage, part of each payment goes towards interest and part goes towards paying down the loan’s principal balance. This is called amortization, and results in the loan being completely paid off by the end of the term.

Interest-only mortgages are different – the monthly payments only cover the interest portion, not the principal. This results in much lower payments during the interest-only period, which typically lasts for 5-10 years. However, once the interest-only period ends, the payments will increase significantly to start paying down principal.

Essentially, an interest-only loan allows you to delay paying towards the loan balance. This reduces monthly payments in the short-term, but increases total interest paid over the life of the loan.

Why Use an Amortization Calculator?

Interest-only loans can be confusing, making it hard to determine what your payments will be This is where using an amortization calculator comes in handy

Here are some key reasons to use an amortization calculator for interest-only mortgages:

-

See payment impacts – An amortization schedule shows what your monthly payments will be during the interest-only period and after. This lets you plan for the payment spike when principal payments kick in.

-

Compare loan scenarios – Adjusting the loan details in the calculator helps you model different interest-only scenarios to find the best fit. You can compare 5-year vs 10-year interest-only periods, or see the impact of interest rate changes.

-

Avoid payment shock – The calculator visually demonstrates the large payment increase coming down the road. Being prepared for this payment shock can help avoid future financial strain.

-

Estimate total interest costs – Since interest-only loans accrue more interest over time, the calculator can add up total interest paid so you understand the true long-term costs.

-

Assess risks – The calculator highlights potential risks, like falling home values leading to negative equity as the loan balance remains unchanged.

How to Use an Amortization Calculator

Using an interest-only mortgage calculator is straightforward. Here are the key steps:

-

Enter loan details – Start by entering the mortgage amount, interest rate, loan term, and length of the interest-only period.

-

View payments – The calculator will generate an amortization schedule showing the monthly payments. Pay special attention to the payment increase after the interest-only period.

-

Change scenarios – Adjust the details to model different interest-only scenarios. For example, reduce the interest-only period from 10 years to 5 years to see the impact.

-

Assess risks – Review the total interest paid over the life of the loan. Check the remaining balance after the interest-only period – if home values decline, this could lead to being underwater on the mortgage.

-

Compare options – Use the calculator to compare an interest-only loan to a standard amortizing mortgage, factoring in the pros and cons of each.

Things to Watch Out For

While interest-only mortgages can make sense in certain situations, they do come with downsides to be aware of:

-

Payment spike risk – Being prepared for the large payment increase is critical. Factor this into your budget before committing to the loan.

-

Negative equity potential – Remaining balances stay high after the interest-only period. Falling home values could lead to owing more than the home is worth.

-

Difficulty refinancing – If rates go up, refinancing the balloon payment could be challenging. Locking in low fixed rates for the remainder of the term provides stability.

-

Qualifying may be tougher – Lenders have tightened requirements on interest-only loans after problems seen in the 2008 housing crash. You’ll need a good credit score and down payment.

-

Requires budget discipline – Interest-only loans aren’t a good idea if you’ll just spend the extra monthly cash flow rather than investing it wisely.

When Interest-Only Loans Make Sense

While risky, interest-only mortgages can be reasonable options in certain situations:

-

If you expect your income to rise soon, but are limited by current cash flow. The lower payments provide temporary relief.

-

If you plan on selling the home before the interest-only period ends. This avoids the payment spike.

-

If you will pay down principal using other assets. For example, using bonus income to make lump sum payments.

-

If you’re an investor using rental income to cover payments. Lower payments provide more positive cash flow.

The key is going in with full knowledge of the risks, a solid payoff plan, and a timeline for when you’ll exit the interest-only loan.

Choose an Amortization Calculator

When evaluating an interest-only mortgage, it’s essential to use a comprehensive amortization calculator. Here are two recommended options:

-

Calculatorsoup interest-only calculator – This calculator provides an excellent level of detail, including showing if the loan results in negative amortization. It also lets you export the full amortization schedule.

-

AmortizationCalc.org – This calculator provides a simple, clean interface while still offering advanced options like adjusting the interest-only period duration. It also sums total interest paid.

Both these calculators are free to use and don’t require signing up. They offer the versatility needed to properly evaluate an interest-only mortgage.

Take Your Time Deciding

Interest-only mortgages can make monthly payments much more affordable, but also come with long-term risks. Be sure to take your time running different scenarios to find the right loan structure. Consult with financial and real estate professionals to determine if an interest-only mortgage aligns with your situation. Leverage an amortization calculator for deeper insight into the impacts over the lifetime of an interest-only loan.

Current Local Mortgage Rates

The following table shows current Denver 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down

See the Real Cost of Debt

The above calculator also has a second tab which shows the current interest rates on savings accounts. This further shows how expensive debt is because most forms of consumer debt charge a far higher rate of interest than banks pay savers AND savers get taxed on interest income they earn at their ordinary tax rates. The table below shows the full cost of $10,000 of debt at various rates of interest. While different consumer debt types typically have different amounts, we kept the amount column constant to show the absolute difference in cost per Dollar earned or borrowed. We also presumed interest-only payments on the debt & a 25% tax rate on income.

| Account Type | Amount | Rate | Annual Interest | After Tax Income | Required Income to Cover Interest Expense |

|---|---|---|---|---|---|

| Big Bank Savings | $10,000 | 0.02% | $2 | $1.50 | – |

| High-yield Savings | $10,000 | 4.00% | $400 | $300.00 | – |

| Certificate of Deposit | $10,000 | 5.00% | $500 | $375.00 | – |

| New Car, Good Credit | $10,000 | 6.49% | $649 | – | $865.33 |

| Used Car, Bad Credit | $10,000 | 10.90% | $1,090 | – | $1,453.33 |

| Credit Card | $10,000 | 21.52% | $2,152 | – | $2,869.33 |

| Personal Loan, Good Credit | $10,000 | 14.5% | $1,450 | – | $1,933.33 |

| Personal Loan, Bad Credit | $10,000 | 30.0% | $3,000 | – | $4,000 |

| Payday Loan | $10,000 | 400% | $40,000 | – | $53,333.33 |

Adding an “Interest Only” Period to an Amortization Schedule, 1 of 2

FAQ

How do you calculate an interest-only loan?

Is there amortization on an interest-only loan?

How much down payment for interest-only loan?

How much is interest only on $250,000?

|

250K Interest Only Mortgage

|

|

|

|

|

2%

|

4%

|

|

10 years

|

£417

|

£833

|

|

15 years

|

£417

|

£833

|

|

20 years

|

£417

|

£833

|

What is an interest-only amortization calculator?

The interest only amortization calculator is a tool that shows you everything you need to know about an interest-only loan and its payments. An interest-only loan is a loan in which the borrower makes only interest payments during an initial period, usually the first 5 to 10 years.

How does the interest only loan calculator excel with amortization work?

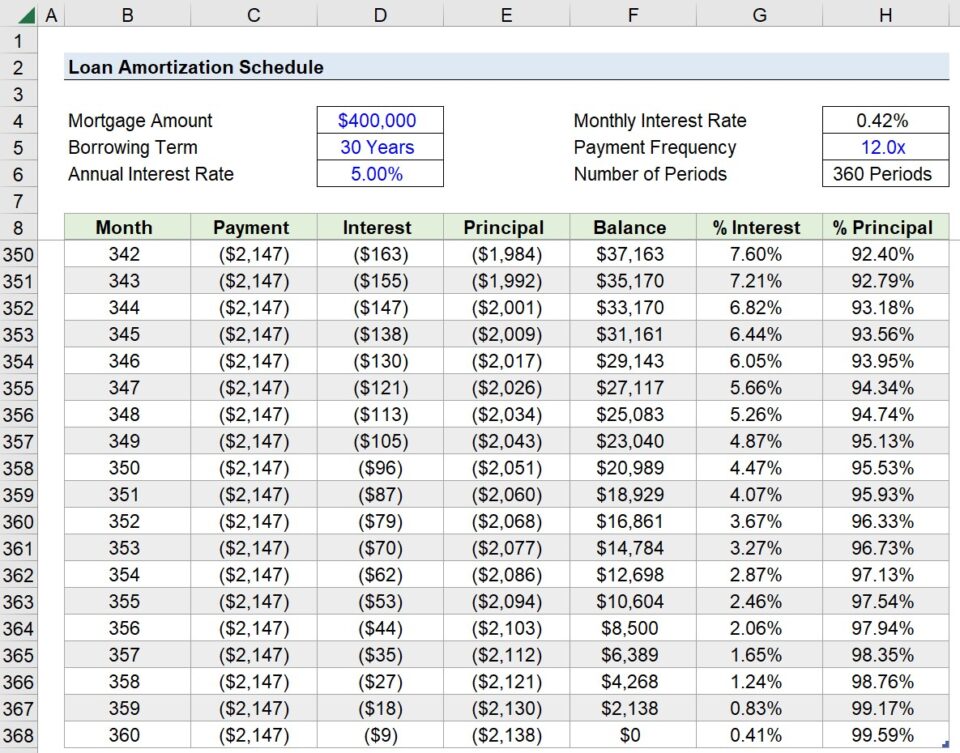

The Interest Only Mortgage Loan Calculator with amortization will calculate the monthly payment based on mortgage amount, loan terms, and interest rate. It will show a printable amortization schedule that is downloadable as a PDF, displaying the interest only payments.

What is an Interest Only Loan Calculator?

An Interest Only Loan Calculator is used to calculate the monthly payment for your mortgage and generates an interest only amortization schedule Excel spreadsheet*. The calculator’s amortization schedule shows you everything you need to know about the loan and payment.* What is an interest-only loan?

How do I calculate my interest only loan payment?

This Interest Only Loan Calculator figures your payment easily using just two simple variables: the loan principal owed and the annual interest rate. Click “Calculate Interest Only Payment” and your monthly interest payment will display. Interest-only loans are simple.