What kind of car are you looking for? Inventory Type: Year: Make: Model: I’m researching; Last updated: May 4, 2023

America runs on credit. It’s likely that you’ll need to fill out a few forms at a car dealership so the dealer can check your credit score when you walk in. However, many people don’t know what credit score car dealers actually use.

Car dealers, or more precisely, lending institutions that supply auto loans to dealerships, do not use your standard FICO score. Instead, they use a different, less well-known score known as The FICO® 8 Auto Score, or its rival CreditVision. We must find out more information about these two products in order to respond to the query, “What credit score do car dealers use?”

We handle every step of the dealership purchase process, making sure you get the car you want at a reasonable price.

Purchasing a car is a significant life decision, and it’s important to comprehend how your credit score plays a part in it. While a number of factors affect your chances of being approved for a car loan, your credit score is a major determinant of the interest rate you’ll pay and how affordable your purchase will be overall.

This guide delves into the intricacies of credit scores and car loans specifically addressing the question: What credit score do car dealerships look at? We’ll explore the different types of credit scores, delve into which ones are most relevant for car loans and provide actionable tips to improve your credit score before heading to the dealership.

Understanding Credit Scores: A Primer

Credit scores are a numerical representation of your creditworthiness, based on your financial history and behavior. These scores are calculated by credit bureaus like Experian, TransUnion, and Equifax, using complex algorithms that analyze factors such as payment history, outstanding debt, credit utilization, and credit mix.

The most commonly used credit score models are FICO® and VantageScore®. Both models range from 300 to 850, with higher scores indicating better creditworthiness. Lenders typically use these scores to assess the risk of lending you money and determine the interest rate you’ll be charged

Which Credit Score Do Car Dealerships Look At?

Depending on the lender they work with, auto dealerships may consider different credit scores. But these are the most typical credit score types that are applied to auto loans:

- FICO® Auto Scores: These industry-specific scores are tailored for auto lenders and are based on a generic FICO® Score. They consider your credit history specifically related to auto loans, making them highly relevant for car financing.

- FICO® Scores 8 and 9: These are the latest generic FICO® scoring models and are widely used by lenders, including auto lenders. While not specifically designed for auto loans, they provide a comprehensive assessment of your creditworthiness.

- VantageScore® 3.0 and 4.0: These are the latest versions of the VantageScore credit scoring model and are increasingly used by auto lenders. They offer a similar analysis of your credit report as FICO® scores but may differ slightly in the weightage given to different factors.

It’s crucial to remember that auto dealerships might obtain your credit report from several agencies, which could lead to the consideration of various credit scores. Furthermore, it’s possible that some dealerships have internal scoring systems of their own that take into account factors other than your credit score.

Improving Your Credit Score for Better Car Loan Rates

The good news is that you can take steps to improve your credit score before applying for a car loan. Here are some effective strategies:

- Pay your bills on time: This is the single most important factor affecting your credit score. Make sure to pay all your bills, including credit card payments, utility bills, and rent, on time every month.

- Reduce your credit utilization rate: This refers to the percentage of your available credit that you’re currently using. Aim to keep your utilization rate below 30% to demonstrate responsible credit management.

- Pay down credit card debt: High credit card balances can significantly impact your credit score. Focus on paying down your balances as quickly as possible.

- Limit new credit applications: Applying for new credit can result in hard inquiries on your credit report, which can temporarily lower your score. Avoid unnecessary credit applications and focus on improving your existing credit.

- Dispute credit report errors: Review your credit reports regularly for any errors and file disputes with the credit bureaus if you find any inaccuracies.

Additional Tips for Getting a Better Car Loan

Beyond improving your credit score, here are some additional tips to secure a favorable car loan:

- Shop around for multiple lenders: Compare interest rates and terms from different lenders to find the best deal.

- Consider a co-signer: If you have a limited credit history or a low credit score, having a co-signer with good credit can improve your chances of approval and potentially lower your interest rate.

- Make a larger down payment: A larger down payment reduces the amount you need to borrow, which can improve your loan terms and lower your monthly payments.

- Negotiate the terms: Don’t be afraid to negotiate the interest rate and other terms of your loan with the lender.

Understanding which credit score car dealerships look at and taking steps to improve your credit score can significantly impact your car buying experience. By following the tips outlined in this guide, you can increase your chances of securing a favorable car loan and driving away in your dream car with confidence.

What credit score do you need to lease a car?

If you haven’t read it already, you might find this article on how much dealers markup used cars to be interesting if you’re considering leasing or buying a vehicle.

After addressing the three factors that affect your credit score and providing an answer to the question, “What credit score do car dealers use?” let’s talk about the credit score that you actually need to purchase or lease a new vehicle.

You must persuade the leasing company that you will be able to pay the monthly payments for the duration of the lease in order to obtain a car lease. Unlike when you buy a car, leasing entails no ownership responsibility. In that regard, leasing is similar to renting an apartment. Each month the landlord expects payment. The same goes for your car lease.

620 is a minimum score you need to secure a lease. Below that, your chances of persuading a leasing company to “rent” you a car become extremely difficult when you reach subprime credit. This isn’t to say it’s impossible, however it certainly won’t be at an attractive price point.

A credit score in the Prime range will yield more favorable terms.

What is CreditVision?

FICO does not have a monopoly on the credit score market. There are other data analytics companies out there that want a slice of the pie.

TransUnion offers a product called CreditVision, which competes directly with FICO. Although CreditVision is not specific to car dealers or auto loans, it is important to mention here. When it comes to understanding what credit score car dealers use, CreditVision is important to be aware of.

TransUnion does offer dealer specific solutions that you should be aware of. This 2018 marketing video helps you get an understanding of what they provide dealerships with.

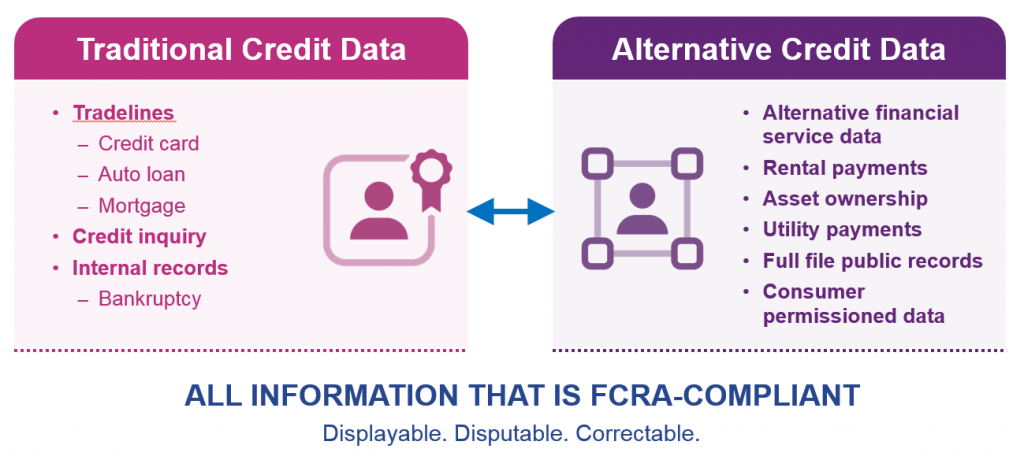

The main draw of CreditVision is the products ability to look at alternative credit data when calculating your score. Alternative credit data can include:

- Rental payments;

- Utility payments;

- Cell phone payments;

- Asset ownership;

- Etc.

What Credit Score Do Car Dealers Use?

FAQ

Do car dealerships look at Equifax or TransUnion?

What FICO Score is used to buy a car?

What is the lowest credit score to buy a car?

When a dealership runs your credit What do they see?

What credit score do car dealerships use?

Car dealerships use a VantageScore or FICO score. The three credit bureaus — Equifax, TransUnion, and Experian — all provide both scores to auto dealerships. What do car dealerships look at for financing? Car dealerships look at your FICO and/or your VantageScore credit score.

How does a car dealer determine your credit score?

If you are buying a car and want to obtain financing, it’s important to know how the auto dealer determines your credit score. Most auto dealers will use FICO or VantageScore to determine a buyer’s credit score. A FICO auto loan score weighs your base score alongside other factors in its credit score model.

Does a dealership look at your FICO score?

Odds are, any dealership with lending partners is going to look at your FICO credit score, but they may look specifically at your FICO Auto score. This differs slightly from your general FICO score. FICO Score vs. VantageScore: What’s the Difference? There are many credit scoring models to choose from when a lender is looking at your credit.

What is a good credit score for a car lender?

The FICO Auto Score uses a 250 to 900 range, which means the auto lender’s credit score could be much higher or lower than the score you check. There are four versions of the FICO Auto Score that a lender may use. The FICO Auto Score 9 is the latest iteration, and the one that’s currently used across all credit bureaus.