Three continents’ worth of journalists coordinated the release of an investigation they dubbed Jersey Offshore in the fall of 2020. Their accounts lifted the veil from the exclusive realm of offshore banking. The coverage includes information that is rarely seen by the public and is based on more than 350,000 documents that were leaked from inside a trust company called La Hougue on the Isle of Jersey, a British Crown possession in the English Channel.

Amid the data, one document stood out for its candor. That was a memo from a managing director of La Hougue dated July 6, 2000, outlining several ways the trust company could assist a client with moving money offshore. Experts who looked over the memo said that these choices might result in large tax write-offs, possibly going beyond what is legal and even crossing the border between criminal tax evasion and legitimate tax avoidance. The memo, which intriguingly begins with a warning to the reader not to allow it “fall into the wrong hands,” came to be known by the reporters who covered the leak as simply “the 11 ways.” ”.

Here are the 11 ways to get a glimpse of offshore money movement and to familiarize yourself with the financial concepts at work when reading the Jersey Offshore coverage. However, another reason this specific memo is being made public is that it’s the kind of thing you never see: a customer-facing document that was discovered in a significant offshore data leak that quotes sums of money that very few people have ever held in their hands.

To put it briefly, it allows you to picture yourself as a member of the world’s 1 percent who is trying to outwit your own government. That’s quite the fantasy, for most of us.

Let’s say you’re pretty damn rich. And you’ve decided you’re through paying taxes. The cost, the anxiety, and the embarrassing portion of it all You are already an experienced tax evader, and you are now willing to consider using an offshore tax haven trust company to take your game to the next level. However, you don’t feel comfortable using your work computer to search for “how to dodge taxes.” Nor is it as though other influential people check Yelp reviews of their offshore tax havens. Getting started is the hard part.

Here, then. Permit us to move the eleven ways across your roomy desk composed of hardwoods from Amazonia that were obtained unethically. Even in its heyday, La Hougue was a word-of-mouth operation, so you can’t exactly dial it up these days, if you ever wanted to. The company’s principals left the small island (and the hassles of newly attentive regulators) in 2007 to start a business in Panama. Nevertheless, that infamously lax tax haven cancelled their license in 2015. As of January 2021, a third business, La Hougue Trustees Limited, with concealed registered ownership, exists in the British Virgin Islands. Numerous calls to the BVI Financial Services Commission went unanswered. When the Jersey Offshore reporters contacted the memo’s author for comment, the author did not reply. Therefore, we are unable to inform you of where these techniques are still being used.

Thanks to the whistleblowers who provided the reporters with thousands of documents, including this one, we can at least get things moving. Consider it a menu that a discriminating capitalist such as yourself can use to identify potential options now that you have accumulated the kind of wealth that not even the government, your family, your ex-spouses, or your business partners should be able to obtain—or even be aware of.

You’ll see that every one of the eleven approaches applies a crucial premise. In order to help you better understand the patterns at work, we’ve broken them down and grouped them below. Every option provides a fabricated business transaction through which you can transfer funds into an offshore account that is anonymous. And here’s where the genius comes in: they craft those deals to give you a tax break of some kind, either by inventing expenses or falsely deducting deductions, or by erasing your capital gains.

The result for you is a win-win. A win-win, that is, provided that you and the people you care about never use the courts, hospitals, roads, or any other publicly funded facility. Leona Helmsley is famous for saying, “Only the little people pay taxes,” and you can be sure she meant it because she served 19 months in federal prison for it.

So, yeah, speaking of. The answer to the question of whether following these guidelines to the letter will actually result in you committing a crime depends on the laws in your state or country regarding tax evasion and government fraud. It’s important to remember that funding an offshore account does not automatically make money unlawful. Making business arrangements that provide tax benefits is also not illegal in and of itself. However, activities that involve overt dishonesty or blatant bad faith—such as entering into a business arrangement just to evade paying taxes—are likely to catch the attention of tax authorities and government investigators. Furthermore, some of these methods seem to describe fraud in many countries, so you might actually invite people with briefcases and badges to knock on your door.

We obtained the opinions of two tax-specialist law professors (one in British Columbia, Canada, and one in California) about the proposals as they are presented in the memo. They all agree that this document, if followed exactly, describes possible illegal acts under US and Canadian tax laws. It is also remarkably transparent, the kind of thing you could spend your entire career as a tax professional and never see in print.

True, in the 20 years since the memo, those regulations have become more stringent. Yet even for its time, they argue, these were brazen.

“It is possible to argue that certain tactics were designed to be debatably successful under Canadian tax law (i e. law professor at the University of Victoria in British Columbia, Geoff Loomer, writes in an email, “creatively avoid Canadian taxes) as the law stood in 2000, when the memo is dated.” Loomer used to work for a big Canadian law firm and studied tax policy. “There are other, more concerning transactions proposed here. A portion of them entail transactions that could potentially—indeed, very probably—qualify as “shams” under Canadian tax law. Lastly, some of the transactions that are suggested here, in my opinion, involve tax evasion, i e. , deliberate non-compliance with Canadian law. ”.

Thus, yes, you could argue that some of the techniques are lawful. Yet that may prove difficult if authorities press you. After reviewing the document, Omri Marian, a law professor at the University of California, Irvine School of Law and the economic director of the graduate tax program, responded almost right away, saying, “I have to say I’m not sure what else I can add other than ‘WTF’? (you can quote me on that) No, it’s not legal. How foolish (or certain that nothing bad will ever happen to you) do you have to be to put this in writing? None of it is. Nothing in this place could survive even a somewhat serious investigation by the IRS. Indeed, it appears that the entire memo is predicated on the idea that tax authorities won’t be able to ascertain the true nature of the proposed transactions, which, in accordance with US law, renders the entire undertaking illegal. ”.

However, before you lose heart, let us clarify that none of the La Hougue principals have been accused of any offenses connected to the contents of this document. And that there are some further nuances at play here. Naturally, people frequently “avoid” paying taxes, or try to pay as little as possible while still abiding by the law. Marian explains that tax attorneys usually look for little loopholes in the law that allow them to boldly argue that decisions made or acts done on behalf of a client are compliant with the letter of the law.

“I will state that, depending on the situation, some of the transactions there might pass muster,” he says. “I can think of transactional structures that might actually work; I don’t want to say legitimate. It may not please the IRS, but it is unquestionably not illegal. Furthermore, even in the worst scenario, you will have to pay back taxes and face civil penalties for breaking the law.

“But when you lay out your intention to basically defraud the government in terms of what is the nature of the transaction, and you outline in such a manner that these are basically fake fees, and there are no real services that are being provided, I mean, honestly, I have never seen anything like that. ”.

More of Marian and Loomer’s analysis, along with the precise techniques, can be seen below. Their fine print may be a bit of a buzzkill for the aggressive tax avoider aspiring to be. A cynic (perhaps one of the little people?) might see the 11 methods as charades, as unethical fronts. Perhaps you should just consider them as possibilities for your cover story. Because you’ll require one if your name is ever discovered in a data leak.

Navigating the complex world of taxes can be daunting, especially when seeking ways to minimize your tax liability. While it’s essential to remain within the boundaries of the law, there are numerous legitimate strategies you can employ to reduce your tax burden and keep more of your hard-earned money

Key Takeaways:

- Invest in Municipal Bonds: Municipal bonds offer tax-exempt interest income, making them an attractive option for investors seeking to reduce their taxable income.

- Aim for Long-Term Capital Gains: Holding assets for over a year before selling them qualifies you for lower capital gains tax rates, potentially saving you a significant amount on your tax bill.

- Start a Business: Starting a business can offer various tax advantages, including deductions for business expenses, depreciation, and home office expenses.

- Maximize Retirement Accounts and Employee Benefits: Contributing to retirement accounts like 401(k)s and IRAs reduces your taxable income, and employer-sponsored benefits like health insurance and dependent care assistance programs can further lower your tax burden.

- Utilize a Health Savings Account (HSA): HSAs offer triple tax benefits, allowing you to contribute pre-tax dollars, grow them tax-free, and withdraw them tax-free for qualified medical expenses.

- Claim Tax Credits: Take advantage of available tax credits, such as the Earned Income Tax Credit, Child Tax Credit, and Premium Tax Credit, to reduce your tax liability.

Strategies for Reducing Your Tax Burden:

1. Invest in Municipal Bonds:

Municipal bonds are debt securities issued by state and local governments. The interest income earned from these bonds is exempt from federal income tax and often exempt from state and local taxes as well making them an attractive option for investors seeking to reduce their taxable income.

2. Aim for Long-Term Capital Gains:

When you sell an asset you’ve held for more than a year, you qualify for long-term capital gains tax rates, which are significantly lower than short-term capital gains tax rates. This means you can potentially save a substantial amount on your tax bill by holding your investments for the long term.

3. Start a Business:

Starting a business can offer various tax advantages, including:

- Business Expense Deductions: You can deduct ordinary and necessary business expenses from your taxable income, such as rent, utilities, supplies, and travel expenses.

- Depreciation: You can depreciate the value of your business assets over time, reducing your taxable income each year.

- Home Office Deduction: If you use a portion of your home exclusively for business purposes, you may be able to deduct a portion of your home expenses, such as mortgage interest, utilities, and depreciation.

4. Maximize Retirement Accounts and Employee Benefits:

Contributing to retirement accounts like 401(k)s and IRAs reduces your taxable income for the year, allowing you to save more money for retirement while lowering your current tax burden. Additionally, employer-sponsored benefits like health insurance and dependent care assistance programs can further reduce your taxable income.

5. Utilize a Health Savings Account (HSA):

HSAs offer triple tax benefits:

- Contributions are made with pre-tax dollars, reducing your taxable income.

- Earnings grow tax-free.

- Withdrawals are tax-free for qualified medical expenses.

6. Claim Tax Credits:

Tax credits directly reduce your tax liability dollar for dollar, making them highly valuable. Explore available tax credits like the Earned Income Tax Credit, Child Tax Credit, and Premium Tax Credit to see if you qualify and potentially reduce your tax burden.

Reducing your tax burden is not about evading taxes but rather about utilizing legitimate strategies to minimize your tax liability within the boundaries of the law. By employing the strategies outlined above, you can keep more of your hard-earned money and achieve your financial goals. Remember to consult with a qualified tax professional for personalized advice and guidance on your specific situation.

OFFSHORING STRATEGY: Pay yourself

Have your domestic business pay your offshore business. If you have a lot of money and would like to relocate abroad, La Hougue is providing two easy ways to do it. The first uses consultancy fees. Employ an offshore firm to perform fictitious consulting work for your company (after all, who knows what consultants actually do?). Your offshore account receives your payments, which you can deduct from your income. The second method asks you to make small-scale, dishonest deposits into your account in order to avoid breaking anti-money-laundering disclosure regulations.

How it operates: As a business consultant, you are paired with an offshore firm. They are only there to bill you, so they could be reading you mojito recipes on speakerphone for all you care about. After you pay them, the money enters your offshore account, and the expense is written off against your company’s taxes.

And the fine print: If it weren’t for the sections where, in his words, “you lay out your intention to basically defraud the government,” Marian could envision structuring this in a legitimate manner. ”.

Loomer concurs that this method is full of landmines. “A Canadian taxpayer operating a business may reimburse a related non-resident individual for deductible expenses,” he states. “But there are all kinds of concerns here. The controlled foreign affiliate regulations and Canada’s transfer pricing laws must be taken into account if fees are paid for legitimate business purposes. Should the services be fraudulent, this is a classic case of a “sham.” That is, a transaction that is solely made in order to evade taxes, which may or may not be illegal.

How it works: Since you enjoy looking after people, you must be the giving kind. Thus, while you’re at it, let’s make sure you take care of Numero Uno. Using this method, you write checks or give your offshore trust account money orders related to business. As long as you declare them as “gifts,” “holiday costs,” or “regular cash expenditures,” they ought to be tax-free. Take advantage of your local tax authorities’ understanding if they don’t penalize generosity. Just make sure the gifts don’t exceed $10,000 in order to avoid having to report them in accordance with US law.

And the small print: Marian remarks of this approach, “As someone who deals with sophisticated transactions as part of my everyday job, this actually is the one that stood out for me.” “This is just plain fraud—the simplicity and audacity of simply lying about the nature of payments.” This is just plain cheating. I mean, there is nothing sophisticated about it. It’s just plain lying about what you are doing.

“Canadians are allowed to move capital around—that’s fine. It is evident that the intention is to evade the need to report transfers of $10,000 or more, and it is likely that the capital will be used to generate investment income in the future without disclosing the income. That is straight-up tax evasion. ”.

OFFSHORING STRATEGY: Hide your assets

Bury your money, or don’t ever get it in the first place. These involve some more complicated plans, but they allow you to pull off a daring maneuver, namely selling real estate while lowering your tax liability and potentially even retaining the title. One easier way to stash your winnings is to have debtors deposit the money straight into your account, eliminating the need for you to declare it.

How it works: Use your own property as security to obtain a mortgage from an offshore lender. For a few years, just make interest payments on your mortgage before going into default. The property is moved offshore after the lender forecloses and seizes the title. You relocate the mortgage’s principal separately, which is approximately 70% of the property’s worth. The end result is that you have successfully transferred the title of your property offshore using offshore funds.

The small print also matters: Marian states, “We know there’s going to be a mortgage with a foreclosure, this is another twist on” fraudulent loans. “Outrageous. ”.

According to Loomer, “this is a more complicated version of the sham loan.” “I don’t see how this can work. ”.

How it works: You pretend to sell a property offshore and at a price that lowers your tax liability in order to conceal your ownership of it. First, sell the property for less than asking price to an offshore buyer under client control, which will lower your gains’ tax liability. The unusual lease you keep for the building’s occupants allows the seller to choose to occupy the building for one month out of the year, which is why the sale is discounted. Because of the uncertainty, rent will be less expensive, which lowers the building’s value when it’s sold. In summary, you have relocated the title offshore and are now subject to lower gains taxes.

And the fine print: “This is also cheating,” Marian says. “There are many ways that the IRS can address this. Certain sections of the code are designed to specifically stop people from doing it. Here, they are clear: You will sell it to yourself at a lower price than you would have sold it to third parties, not for its full value. ”.

“To whom is this property being sold by the client? Is it a business that the client owns?” inquires Loomer. According to Canadian regulations, deals involving non-arm’s-length parties must happen at fair market value. ”.

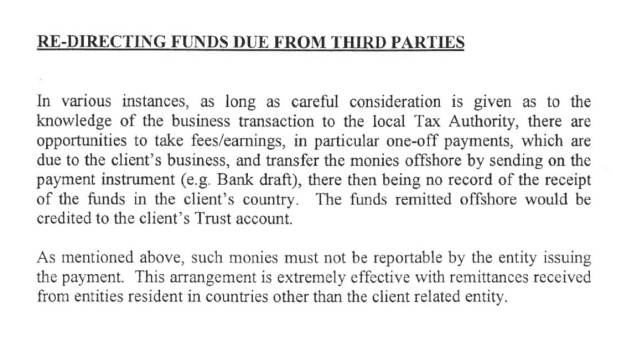

How it operates: When someone owes your company money, your first thought will probably be to send them an invoice. Instead, have them transfer the money to your offshore account so that it stays off the company’s books. This is most effective when used for one-time payments and international transactions, keeping your local tax authority in the dark.

And the small print: according to Loomer, “this is deliberate non-compliance with Canadian law.” “We have ‘constructive receipt’ rules that say, basically, if you have a legal right to some payment that would be income to you but you redirect it to a third party to benefit them or you, then the income is still yours. A Canadian resident is required to report all of their worldwide income.” It seems that this approach is intended to circumvent the constructive receipt regulations and conceal the evidence. I don’t know if any citizens of Canada chose to use this tactic, but if they did, it was a poor choice!

#1 BEST Way to LEGALLY Hide Money From the Government!

Why do people hide money from the IRS?

The Internal Revenue Service (IRS) can only tax income that it knows about. For a bold segment of the taxpaying public, this is an invitation to hide as much money from the IRS as possible. Hiding money is a form of underreporting income in which there is no question that the perpetrator is committing tax evasion.

Where should I hide my money in my retirement plan?

One of the best places to hide your money is an ERISA-qualified retirement plan. Not only can you keep some of your money safe, but you can also earn a tax-advantaged return on the money. The money in your retirement account is protected from liability lawsuits.

How can I hide my money?

Consider transferring some of your assets. One place to hide your money is in a business — just make sure that you set everything up properly. If you keep assets in your business, they can be protected from liability lawsuits, and they even might be protected from different creditors. Your can also use your business as a shield for other assets.

Is hiding money a form of tax evasion?

Hiding money is a form of underreporting income in which there is no question that the perpetrator is committing tax evasion. You don’t “accidentally” deposit millions of dollars in gambling winnings in an untraceable offshore account. This type of tax evasion requires a knowing intent to cheat the system and is punishable by significant jail time.