It is crucial to comprehend the kind of income that is taken into account when calculating IRMAA because avoiding it can result in monthly savings of hundreds of dollars on each spouse’s Medicare bill.

The income related monthly adjustment amount, or IRMAA, is an additional Medicare premium that is determined by your income from the previous two years. The surcharge’s effects change and are based on your income.

The precise amount will change annually, but if you are single and your household income was between $161,000 and $193,000 in 2022, you would have to pay an extra $279 in 2024. 50 monthly in addition to your Medicare part B’s regular monthly rate, for a total of $454 20 per month!.

Navigating the complexities of Medicare can be challenging, especially when it comes to understanding how your income impacts your premiums. One aspect that often raises questions is the Income-Related Monthly Adjustment Amount (IRMAA), a surcharge added to your Medicare Part B and Part D premiums based on your income from two years prior.

This guide delves into the specifics of IRMAA, focusing on whether Roth IRA withdrawals are included in the calculation and how you can potentially avoid or minimize the surcharge.

Understanding IRMAA and Its Impact on Medicare Premiums

IRMAA applies to individuals with higher incomes, effectively increasing their monthly Medicare Part B and Part D premiums. The surcharge amount varies depending on your income level, ranging from $12.40 to $347.10 per month for Part B and $12.20 to $77.40 per month for Part D in 2024.

Here’s a breakdown of the IRMAA income thresholds and surcharges for 2024:

| Filing Status | Income Threshold (2022) | Part B Surcharge | Part D Surcharge |

|---|---|---|---|

| Individual | $97,001 – $123,000 | $12.40 | $12.20 |

| Individual | $123,001 – $157,000 | $34.30 | $34.20 |

| Individual | $157,001 – $194,000 | $77.70 | $77.40 |

| Individual | $194,001+ | $124.90 | $124.60 |

| Married Filing Jointly | $194,001 – $252,000 | $12.40 | $12.20 |

| Married Filing Jointly | $252,001 – $314,000 | $34.30 | $34.20 |

| Married Filing Jointly | $314,001 – $388,000 | $77.70 | $77.40 |

| Married Filing Jointly | $388,001+ | $124.90 | $124.60 |

Does Roth IRA Income Affect IRMAA?

No, Roth IRA withdrawals are not included in the calculation of IRMAA. This means that you can withdraw funds from your Roth IRA without worrying about them increasing your Medicare surcharges.

This exclusion is a significant advantage of Roth IRAs, as it allows you to access your retirement savings without triggering higher Medicare costs. In contrast, withdrawals from traditional IRAs are considered taxable income and are therefore factored into the IRMAA calculation.

Strategies to Minimize or Avoid IRMAA

While Roth IRA withdrawals are exempt from IRMAA, there are other strategies you can employ to minimize or avoid the surcharge altogether:

- Convert Traditional IRA Assets to Roth IRAs: Converting some of your traditional IRA assets to a Roth IRA can be beneficial, even if it means paying taxes on the conversion amount. This is because the converted funds will no longer be subject to taxation in the future, including when calculating IRMAA. However, it’s crucial to consider your individual circumstances and consult with a financial advisor before making any conversion decisions.

- Maximize Retirement Contributions: If you’re still working, maximizing your contributions to 401(k) and/or IRA accounts can help reduce your taxable income and potentially bring you below the IRMAA threshold. This strategy allows your retirement savings to grow tax-deferred and reduces your current taxable income, potentially lowering your IRMAA burden.

- Sell Appreciated Assets Before Retirement: If you have appreciated stocks or funds in a taxable brokerage account, consider selling them before you retire and pay the capital gains taxes. This strategy allows you to “reset” the cost basis of those assets, reducing the potential tax burden when you sell them during retirement.

- Delay Social Security Income: Delaying your Social Security income until age 70 can be advantageous, as it won’t count towards IRMAA during the delay. Additionally, your Social Security benefits will grow at a rate of 8% per year until you reach age 70, further increasing your future retirement income.

- Explore Medicare Advantage Plans: Consider exploring Medicare Advantage plans as an alternative to traditional Medicare, as they often have lower out-of-pocket costs. This can be particularly beneficial if you’re facing high IRMAA costs, as the lower out-of-pocket expenses can offset the increased premiums.

- Appeal IRMAA Surcharge: If you’ve experienced a significant life-changing event, such as divorce, retirement, death of a spouse, or a lost pension, and your income is now significantly lower than two years ago, you can appeal the IRMAA surcharge. You can also appeal if you believe the calculation is incorrect.

Understanding how IRMAA works and the impact of Roth IRA withdrawals can help you make informed decisions about your retirement planning and Medicare costs. By employing the strategies outlined above, you can potentially minimize or even avoid the IRMAA surcharge, ensuring you have more money available to enjoy your retirement years.

Frequently Asked Questions

Q: What is IRMAA?

A: IRMAA stands for Income-Related Monthly Adjustment Amount. It’s a surcharge added to your Medicare Part B and Part D premiums based on your income from two years prior.

Q: How does IRMAA work?

A: The IRMAA surcharge is calculated based on your Modified Adjusted Gross Income (MAGI) from two years prior. Your MAGI includes your taxable income, such as wages, salaries, interest, dividends, and capital gains, as well as certain tax-exempt interest.

Q: Does Roth IRA income affect IRMAA?

A: No, Roth IRA withdrawals are not included in the calculation of IRMAA. This means you can withdraw funds from your Roth IRA without worrying about them increasing your Medicare surcharges.

Q: How can I avoid IRMAA?

A: There are several strategies you can employ to minimize or avoid IRMAA, including converting traditional IRA assets to Roth IRAs, maximizing retirement contributions, selling appreciated assets before retirement, delaying Social Security income, exploring Medicare Advantage plans, and appealing the IRMAA surcharge if applicable.

Q: Where can I find more information about IRMAA?

A: You can find more information about IR

Does IRMAA include total gross social security, or the taxable portion of Social Security?

This is a frequently asked question, and many well-known websites provide inaccurate answers to it.

The calculation for IRMAA MAGI (Modified Adjusted Gross Income) includes just the taxable portion of Social Security. This comes from the Social Security Handbook here, which states:

“Modified Adjusted Gross Income is the sum of:

- The beneficiary’s adjusted gross income (AGI), plus

- Tax-exempt interest income”

The taxable part of Social Security is the sole basis for calculating AGI and total income:

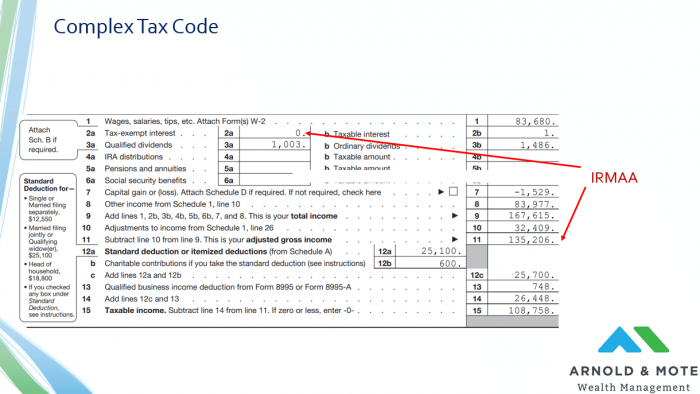

What Type of Income Contributes to IRMAA?

Your Modified Adjusted Gross Income, or MAGI, serves as the basis for IRMAA.

Since your tax return does not include a specific line item for this, it may be difficult to find or calculate.

You take your AGI and add tax-exempt interest to get your MAGI for Medicare IRMAA.

The total of your taxable income is known as your adjusted gross income, or AGI. For retirees, the most common sources of this are dividends, capital gains, IRA withdrawals, interest from certificates of deposit, and only the taxable portion of your social security income. Your yearly tax return includes a line item for this total.

Next, include the entire amount of your non-taxable interest, which is typically any income from municipal bonds. For IRMAA purposes, your MAGI is the sum of your AGI and non-taxable interest.