If you’re wondering how to invest $200,000, that’s a positive indication. After all, you’re well on your way to accumulating long-term wealth if you have this much to invest.

This is particularly true if you have $200,000 to invest and can leave it untouched for a year or two, allowing compound interest to work its magic.

That really depends on your investment strategy and average rate of return. Should you manage to invest $200,000 and manage to earn a 6% return on your investment over the course of 2020 years, you would have $641,427. 09 after two decades of growth.

On the other hand, if you are able to secure a 2010% return, you will end up with $1,345,499 at the end of the next two decades. 99.

Congratulations on reaching a significant financial milestone! Having $200,000 to invest opens up a world of possibilities for generating passive income and securing your financial future. But with so many options available, deciding where to put your money can be overwhelming.

Don’t worry, we’ve got you covered. This guide will explore various investment strategies, helping you understand which ones might be the best fit for your goals and risk tolerance.

Understanding Your Investment Goals and Risk Tolerance:

Before diving into specific investment options, it’s crucial to define your financial goals and risk tolerance.

Financial Goals:

- Retirement planning: Are you aiming to build a nest egg for a comfortable retirement?

- Generating additional income: Do you need extra income to supplement your current earnings?

- Leaving a legacy: Do you want to pass on wealth to your loved ones?

Risk Tolerance:

- Conservative: You prioritize preserving your capital and are comfortable with lower potential returns.

- Moderate: You are willing to take on some risk for the potential of higher returns.

- Aggressive: You are comfortable with significant risk for the chance of maximizing your returns.

Once you have a clear understanding of your goals and risk tolerance, you can start exploring different investment options.

Smart Investment Options for Generating Passive Income:

1. Dividend Stocks:

Dividend stocks are a popular choice for generating passive income. These stocks pay out a portion of their profits to shareholders regularly, providing a steady stream of income.

Pros:

- Regular income generation

- Potential for capital appreciation

- Diversification through investing in various sectors

Cons:

- Dividends can fluctuate depending on company performance

- Requires research to identify reliable dividend-paying companies

2. Index Funds:

Index funds track a specific market index, such as the S&P 500, offering instant diversification and low fees. They provide passive exposure to a broad range of stocks, minimizing the risk associated with individual stock selection.

Pros:

- Low fees and expenses

- Diversification across multiple sectors

- Potential for long-term growth

Cons:

- Lower potential returns compared to individual stock picking

- Limited control over investment choices

3. Rental Properties:

Investing in rental properties can provide a consistent stream of passive income through rental payments. However, it also requires active management, including tenant screening, maintenance, and repairs.

Pros:

- Potential for high returns

- Tax benefits associated with depreciation and mortgage interest

- Building equity over time

Cons:

- Requires significant upfront investment

- Time commitment for managing the property

- Potential for vacancy periods and tenant issues

4. Real Estate Investment Trusts (REITs):

REITs offer a way to invest in real estate without directly owning or managing properties. They pool investor money to purchase and manage income-generating properties, distributing profits to shareholders.

Pros:

- Diversification across multiple properties

- Liquidity through trading on stock exchanges

- Passive income generation without direct management

Cons:

- Lower potential returns compared to directly owning properties

- Exposure to market fluctuations and economic factors

5. Real Estate Crowdfunding:

Real estate crowdfunding platforms allow individuals to invest in commercial or residential real estate projects with smaller amounts of capital. This option provides access to a wider range of investment opportunities and potentially higher returns.

Pros:

- Lower investment minimums compared to traditional real estate

- Access to a wider variety of projects

- Potential for higher returns

Cons:

- Illiquidity of investments

- Higher risk associated with startups and development projects

6. Fixed-Income Securities:

Fixed-income securities, such as bonds, offer regular interest payments and a return of principal at maturity. They are generally considered less risky than stocks but also offer lower potential returns.

Pros:

- Regular income generation

- Lower risk compared to stocks

- Diversification for a balanced portfolio

Cons:

- Lower potential returns compared to stocks

- Interest rate risk can impact bond prices

7. Peer-to-Peer Lending:

Peer-to-peer lending platforms connect borrowers and lenders directly, allowing individuals to earn interest by lending money to others. This option can offer higher returns than traditional savings accounts, but also carries a higher risk of default.

Pros:

- Potential for higher returns compared to traditional savings accounts

- Diversification across multiple borrowers

Cons:

- Risk of borrower default

- Limited liquidity of investments

8. Art and Fine Wine Investments:

Investing in art and fine wine can be a unique way to generate passive income, but it requires specialized knowledge and carries a higher risk.

Pros:

- Potential for high returns

- Tangible assets with potential for appreciation

Cons:

- Requires specialized knowledge and expertise

- Illiquidity of investments

- High risk of赝品 and market fluctuations

Choosing the Right Investment Strategy:

The best investment strategy for you depends on your individual circumstances, goals, and risk tolerance. Consider consulting with a financial advisor to create a personalized investment plan that aligns with your financial objectives.

Additional Tips for Success:

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk.

- Invest for the long term: Don’t get caught up in short-term market fluctuations. Stay invested for the long haul to maximize your potential returns.

- Rebalance your portfolio regularly: As your financial situation and goals change, adjust your portfolio accordingly to maintain a balanced risk profile.

- Stay informed: Keep up-to-date on market trends and economic news to make informed investment decisions.

By carefully considering your options, conducting thorough research, and adopting a long-term perspective, you can successfully invest your $200,000 and generate a steady stream of passive income for a secure financial future.

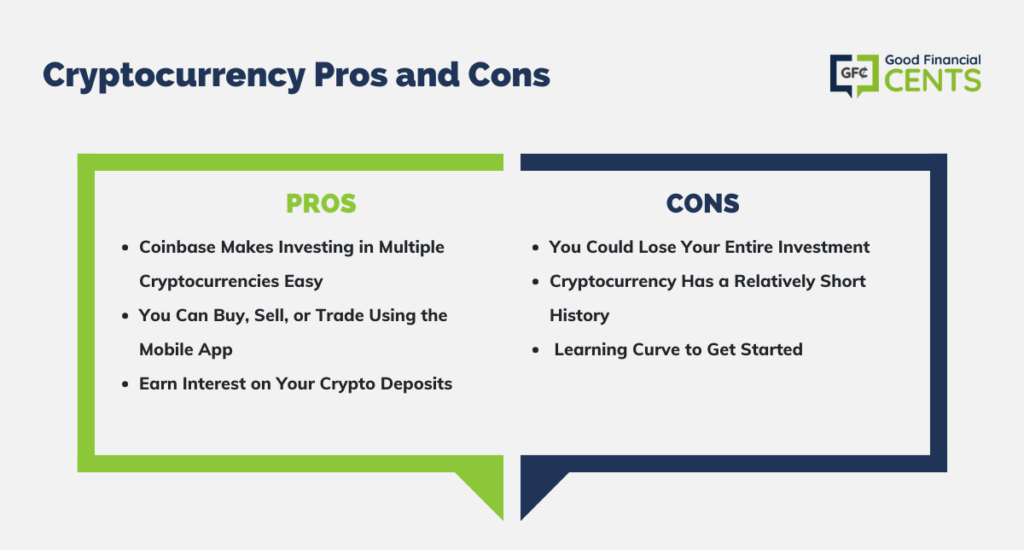

Invest in Cryptocurrency

Suggested Allocation: 5%

Risk Level: High

Investing Goal: Long-term growth

It seems that despite the belief held by many that cryptocurrencies would never become widely accepted, this isn’t the case. More than ever, you can pay with cryptocurrencies like Bitcoin, and Bitcoin ATMs are opening up all over the world.

Because of the large-scale adoption of Bitcoin, in particular, some industry experts have suggested a single Bitcoin will be worth $1,000,000 or more within years.

Through a cryptocurrency app, anyone can invest in Bitcoin and other cryptocurrencies like Ethereum or LiteCoin. These apps hold your cryptocurrency securely until you’re ready to sell or trade it.

How to Get Started: Coinbase is a great place to purchase cryptocurrencies, but it also allows you to stake your deposits in cryptocurrencies and earn interest. Certain forms of cryptocurrency offer a return of up to 5%, and interest on deposits made with them accrues daily and is paid out monthly. 75%.

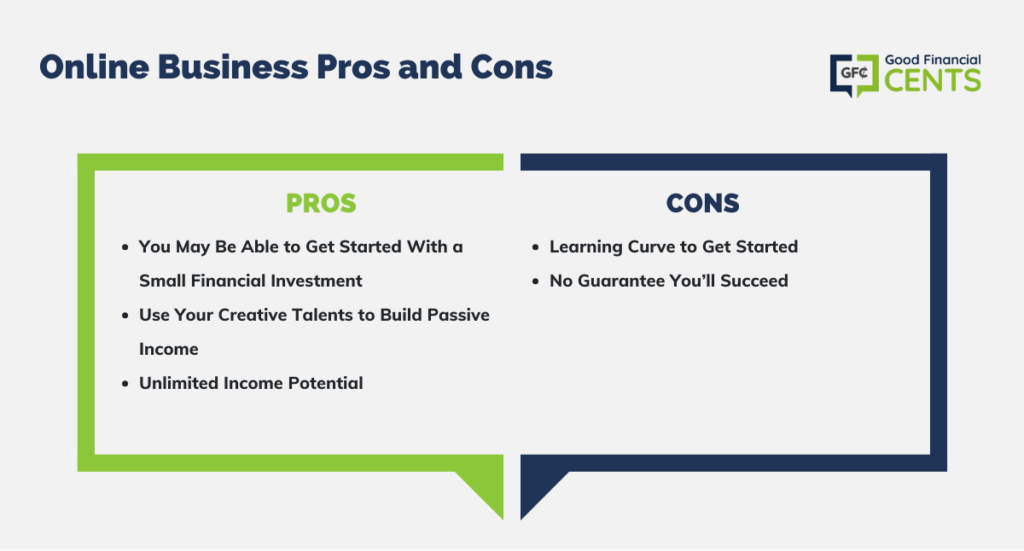

Buy a Business

Suggested Allocation: Varies

Risk Level: High

Investing Goal: Income

It’s true that this investment strategy requires a lot more “hands-on” work than other strategies, and buying a business is definitely not for everyone. On the other hand, investing in a business allows you to create something that may generate income for you in the years or decades to come.

You can even grow your company to the point where others can manage it in your place. At that point, you could manage the overall strategy and have a lifetime source of passive income.

How to Get Started: I advise looking into purchasing an online business through Flippa, even though you can also purchase a local business or a franchise in your area. You can select fully-developed websites, domain names, and other online businesses on this website. These websites can then be used to generate passive income through product sales, affiliate marketing, advertising, and other means.

Even better, in certain situations, you can launch your own internet business for as little as $1,000. Finding an online business that you can work with and eventually monetize requires a lot of research, which is required for this option.

I’m Getting $200,000, What Should I Do With It?

FAQ

What can I buy with 200K dollars?

How anyone can turn 200K into monthly income?

Can you live off 200K savings?

What to do if you have 200000?

How do you invest a $200,000 a year?

1. Invest in the Stock Market 2. Invest in Real Estate 3. Invest in Cryptocurrency 4. Buy a Business 5. Invest in Gold 6. Open a Solo 401 (k) Still, the real problem is figuring out how to invest hundreds of thousands of dollars. As a financial advisor, I suggest spreading out a $200,000 investment into several different buckets.

What is the best way to invest $200,000 in real estate?

The best way to invest $200,000 in real estate is through a platform like Realty Mogul. This is the simplest way to get started with real estate investing without the headache and stress of managing a property. Easily invest in residential real estate with Realty Mogul today.

What can I do with $200k?

Pay off debt. If you have credit card debt, student loans, or other high interest debts – paying these off is probably the best thing you can do with $200k. Invest in yourself. There are plenty of ways you can invest in yourself such as furthering your education or learning new skills.

What is a good way to invest $200k?

I Bonds are a perfect example that help you shelter some of your cash from the impact of inflation. And companies like Worthy Bonds currently pay 5% interest on their bonds, which isn’t too shabby. 5. Real estate Another classic way to invest $200k is to invest in real estate.