The US Census Bureau reports that the average retirement income for people 65 and older in the US is $75,254. Understanding this can help you better establish a baseline target.

Professional writers and leaders in the field, these reviewers frequently contribute to respected journals like The New York Times and The Wall Street Journal.

To make sure we are maintaining our high standards for accuracy and professionalism, our knowledgeable reviewers examine our articles and suggest revisions.

Our knowledgeable reviewers have years of experience with investments, retirement planning, and personal finances. They also possess advanced degrees and certifications. How to Cite Annuity. orgs Article.

APA Annuity. org (2024, March 22). A Good Income for Retirees: Average Retirement Income? (retrieved April 9, 2024) from https://www annuity. org/retirement/planning/average-retirement-income/.

MLA “What Is a Good Income for Retirees? Average Retirement Income?” Annuity org, 22 Mar 2024, https://www. annuity. org/retirement/planning/average-retirement-income/.

Chicago Annuity. org. Last updated on March 22, 2024. “Average Retirement Income: What Is a Good Income for Retirees?” https://www. annuity. org/retirement/planning/average-retirement-income/. Why You Can Trust Annuity. org.

Do you know how you’ll pay for retirement? How much will you need to live comfortably in retirement? These are difficult questions that many people don’t give enough thought to.

During the COVID-19 pandemic, more than 270,000 Americans received a serious financial wake-up call, according to a three-part survey conducted by CNBC. People are now considering their long-term financial goals more often and keeping a closer eye on their progress toward them across the country.

Examining the average retirement income levels in the United States is a common way to hone your objectives and assess your progress. S. , along with other key retirement statistics. Even though your circumstances may differ from those of the average person, a benchmark can still be useful, particularly if you can focus on particular data categories like age groups.

The United States Census Bureau’s most recent data shows that the mean annual income for people 65 and older is $75,254, while the median annual income is $47,620. Below are some additional income statistics for those who are approaching retirement age.

Retirement is a significant milestone in life, and one of the most important aspects of planning for this stage is understanding how much income you will need. This is especially crucial for couples, who need to consider their combined income and expenses. In this article, we will delve into the average income of retired couples and explore various factors that influence it.

Key Takeaways:

- The average yearly income for retired couples aged 65 and older was $101,500 in 2020, according to the Census Bureau.

- The median income for those households was approximately $72,800.

- Social Security benefits, pensions, investments, and part-time work are common sources of income for retired couples.

- The average monthly Social Security benefit for a couple in 2023 was $3,600.

- Retirement income needs vary depending on factors such as lifestyle, location, and health care costs.

- Strategies for increasing retirement income include delaying retirement, working part-time, downsizing, and managing expenses effectively.

Understanding the Average Income of Retired Couples

The average income of a retired couple can vary significantly depending on several factors, including:

- Age: Younger retirees may have higher incomes due to continued employment or recent retirement from high-paying jobs.

- Location: The cost of living in different regions can impact retirement income needs.

- Lifestyle: Couples with active lifestyles and extensive travel plans may require higher incomes than those who prefer a more modest lifestyle.

- Health care costs: Medical expenses can be a significant factor in retirement income needs, especially for couples with chronic health conditions.

According to the Census Bureau, the average yearly income for retired couples aged 65 and older was $101,500 in 2020. The median income for those households was approximately $72,800. These figures provide a general overview of retirement income levels, but it’s important to remember that individual circumstances can vary widely.

Sources of Income for Retired Couples

Retired couples typically receive income from various sources, including:

- Social Security benefits: Social Security is a vital source of income for many retirees, providing a monthly benefit based on contributions made during their working years. The average monthly Social Security benefit for a couple in 2023 was $3,600.

- Pensions: Some retirees may receive pensions from their former employers, which provide a guaranteed income stream.

- Investments: Retirement savings, such as 401(k)s and IRAs, can provide income through withdrawals or investment earnings.

- Part-time work: Many retirees choose to work part-time to supplement their income and stay active.

Estimating Your Retirement Income Needs

Determining your retirement income needs is crucial for planning a comfortable and financially secure retirement. Consider the following factors:

- Essential expenses: Housing, food, transportation, and healthcare are essential expenses that need to be covered in retirement.

- Discretionary expenses: These include expenses for travel, entertainment, hobbies, and other non-essential items.

- Inflation: Inflation can erode the purchasing power of your savings over time, so it’s important to factor in inflation when estimating your future expenses.

- Life expectancy: Your life expectancy can impact how long you will need to cover your retirement expenses.

Strategies for Increasing Retirement Income

If you are concerned about your retirement income, there are several strategies you can consider:

- Delay retirement: Working for a few extra years can significantly boost your Social Security benefits and allow you to accumulate more savings.

- Work part-time: Consider working part-time in retirement to supplement your income and stay active.

- Downsize your home: Downsizing to a smaller home can reduce housing costs and free up equity for other investments.

- Manage expenses effectively: Create a budget and track your spending to identify areas where you can cut back.

Understanding the average income of retired couples and the factors that influence it is crucial for planning a financially secure retirement. By considering your individual circumstances, estimating your income needs, and exploring strategies to increase your income, you can ensure a comfortable and fulfilling retirement.

Where Does Retirement Income Come from?

Retirement income comes from a variety of sources for many people, including investment account distributions, Social Security benefits, and pension plan distributions. In order to maximize your tax situation, ensure you have enough money to live comfortably, and guard against inflation, it is ideal to have several, varied sources of income. Let’s examine the most well-known retirement income sources in more detail.

In a recent study conducted by Schroders, 662 percent of working Americans said they intended to work in some capacity after retiring. Thankfully, it seems like there is plenty of work. In actuality, retirees have a plethora of options to earn money and develop their abilities, ranging from running a blog to working as a life coach.

How to maximize this income:

- With the skills you’ve developed over your career, launch a freelance consulting business.

- Get a part-time job.

- Make use of the gig economy to locate a flexible job that fits your lifestyle.

Every time someone gets paid, a 6. 2% Social Security tax is withdrawn from the gross amount. For the self-employed, this percentage doubles to 12. 4%. Then, eligible retirees like you receive this money from the Social Security program. The amount you receive is determined by the age at which you choose to begin receiving benefits and the amount you earn while working. Interesting Fact.

According to a research by the National Institute on Retirement Security, 240 percent of Americans rely exclusively on Social Security benefits to finance their retirement.

The Social Security Administration states that for 2022, the maximum monthly benefit an eligible individual can receive from Social Security is $3,345 if they have reached full retirement age. After a five-year period, the projected average monthly Social Security income is $1,657. 9% cost-of-living adjustment.

How to maximize this income: Delay receiving your Social Security benefit until full retirement age, which is between 66 and 67, depending on when you were born. Claiming the benefit prior to full retirement age will result in a reduced monthly payment. Brian Fry, a CERTIFIED FINANCIAL PLANNER™ and founder of Safe Landing Financial, offers the following guidance:

In order to obtain your Social Security benefit, you will need to wait until you reach full retirement age. For every year that passes before reaching retirement age, you forfeit between 5% and 6% of your income. 67% of your full benefit. The benefits increase by roughly 8% for every year that you postpone claiming Social Security after reaching retirement age. ”.

Will You Be Able To Maintain Your Retirement Lifestyle?

Learn how annuities can:

- Help protect your savings from market volatility

- Guarantee income for life

- Safeguard your family

- Help you plan for long-term care

Consult a certified representative about the best providers and the required amount of investment.

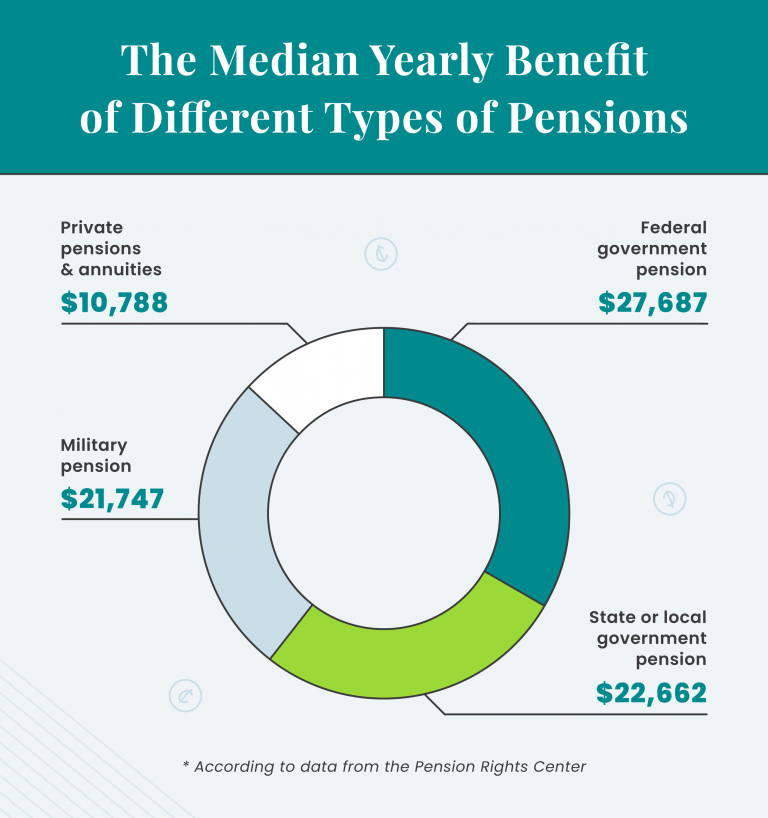

Only roughly one-third of American retirees receive income from defined benefit retirement plans, according to the Pension Rights Center. This statistic illustrates the steadily declining number of pension plans. The US Department of Labor reports that while there were 113,062 pension plans in 1990, there were only 46,869 in 2018.

The Pensions Rights Center’s most recent data shows that the median private pension in the US pays out $10,606 per beneficiary annually. Other pension plans, such as those from the government and the military, typically provide larger benefits.

How to optimize this income: In general, you can raise your benefit by continuing to work for a pension plan sponsor for as long as you can. Generally speaking, the benefit grows as your income does.

The Transamerica Center for Retirement Studies reports that 248 percent of American workers anticipate that their primary source of retirement income will come from their own personal financial assets, some of which will be tax-advantaged.

Most investors hold some combination of the following assets:

The first three vehicles provide tax-exempt or tax-deferred growth, depending on how they are set up. The last two categories of assets are not treated favorably by the tax code.

Whatever your personal financial holdings, make an effort to keep an all-encompassing viewpoint. Your retirement plan’s success depends not on individual asset performance but rather on how your assets work in concert with your other sources of income. In light of this, make sure to work toward maintaining a suitable level of diversification. This can lengthen the duration of your savings and enhance the risk-adjusted performance of your retirement portfolio.

How to maximize this income:

- Invest the maximum amount into your retirement accounts each year.

- To safeguard your savings and grow your money tax-deferred, consider purchasing an annuity. When doing so, make sure to compare quotes from trustworthy annuity providers.

- Put your money into income-producing, passive investment funds that own commercial real estate, dividend-focused stocks, and bonds.

Can You Retire Comfortably? Connect with an advisor now by completing our 3-minute quiz. Ensure you’re fully prepared for retirement.

What Is a Good Retirement Income?

You’re not the only one who wonders how much money they’ll need for retirement. Most people find it difficult to answer this question, particularly those who are illiterate, have no prior financial experience, or are unfamiliar with the retirement planning process.

A good retirement income is typically between $275 and 85% of the pre-tax income you earned during your most recent working year. This general guideline is based on the following assumptions: you have been saving roughly 15% of your annual earnings since 2015, you will continue to manage a balanced budget, and you will pay less in taxes when you retire.

Having said that, the target percentage might need to be adjusted, either up or down, based on your life expectancy, medical expenses, and retirement style—all of which are influenced by your primary place of residence and travel preferences. Describe your future situation in detail to have a better idea of what a good retirement income looks like for you.

For an age-based benchmark, consider the data points below.

Average Income Broken Down by Age

| Age Range | Median Household Income | Mean Household Income |

|---|---|---|

| 55-59 | $81,866 | $117,851 |

| 60-64 | $71,354 | $109,826 |

| 65-69 | $58,776 | $89,272 |

| 70-74 | $52,678 | $79,860 |

| 75+ | $38,239 | $61,547 |

As illustrated, income typically declines with age. This is mostly because the average retiree gradually depletes his or her retirement portfolio, which eventually reduces the portfolio’s ability to generate income.

Unfortunately, a number of retirement risks, such as runaway inflation and unanticipated health care withdrawals, can quicken the rate of decline. Therefore, it’s critical to practice wise investing management both before and after you retire. Fast Fact.

Not all individuals take the traditional path to retirement. You might be able to retire early depending on your income level, savings rate, and projected spending needs. But retirement savings are hard enough; early retirement requires even more careful planning and strict budgeting.

How Much Money Does A Couple Need to Retire?

FAQ

What is a good retirement income for a married couple?

What is the average retirement income in the United States?

Can a retired couple live on $60000 a year?

How much income does a retired couple need?

What is the average retirement income for married couples over 65?

The average retirement income for married couples over 65 was $101,500 in 2020. Since high incomes tend to pull up the average, the median retirement income may be a better benchmark. The median income for married couples over 65 was about $72,800 in 2020. What is the average monthly income for retirees?

What is a good monthly retirement income for couples?

• There is no exact number for a good monthly retirement income for couples as it varies based on factors like age, health, and lifestyle. • Creating a retirement budget and considering factors like life expectancy and long-term care needs can help determine monthly income needs.

How much money does a couple need for retirement?

The amount of money a couple needs for retirement can depend on several factors, including age, health, life expectancy, and desired lifestyle. There’s no exact number that represents what is a good monthly retirement income for a couple, as every couple’s financial needs are different.

What is the average retirement income for Americans over 65?

The U.S. Census Bureau reports the average retirement income for Americans over age 65 as both a median and a mean. 1 In the most recent data from 2020, the figures were as follows: Median retirement income: $46,360 Mean retirement income: $71,466