As a real estate investor looking to build a portfolio of rental properties, you need financing that matches your long-term investment strategy. That’s where buy and hold loans come in.

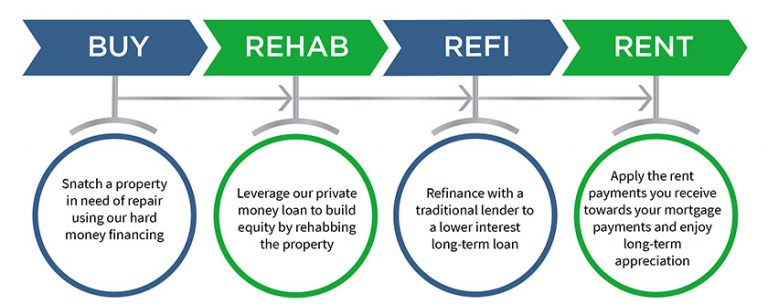

These specialty loans offered by hard money lenders allow investors to purchase and rehab an investment property, then refinance into a traditional long-term mortgage once the renovations are complete. This helps investors get into deals quickly, make improvements, and start generating rental income without having to sell the asset right away like you would with a short-term fix and flip loan.

In this comprehensive guide, I’ll explain everything you need to know about buy and hold loans, including:

- What is a buy and hold loan?

- Pros and cons of buy and hold loans

- Types of buy and hold loans

- Interest rates, fees, and repayment terms

- Lender requirements and qualifications

- How to choose the right lender

- Alternatives to buy and hold loans

- FAQs

Let’s dive in!

What is a Buy and Hold Loan?

A buy and hold loan, also called a rental loan or rehab loan, is a short-term financing option offered by private or hard money lenders to purchase and renovate an investment property.

These loans are designed for real estate investors who want to buy a property, fix it up, rent it out, and hold it long-term as a rental instead of flipping it quickly like you would with a traditional fix and flip loan.

The typical buy and hold loan term is 6 months to 3 years. This gives the investor enough time to purchase the property, complete renovations, find tenants, and season the rental for 6-12 months to show consistent monthly income.

Once the property is rehabbed and rented the investor can refinance into a conventional long-term mortgage or rental property loan using the monthly rental income to qualify. This allows them to get their capital back out to purchase another investment property and repeat the process.

Essentially, a buy and hold loan serves as a short-term bridge to get a rental property purchased and generating income until you can qualify for permanent financing. The property itself and future rental income serve as collateral for the loan.

The Pros and Cons of Buy and Hold Loans

Buy and hold loans offer some attractive benefits for real estate investors but also come with drawbacks to consider.

Pros of Buy and Hold Loans

-

Fast access to capital These loans can fund your purchase and renovations much faster than a conventional mortgage, helping you act quickly on an off-market or distressed property

-

Requires less investor capital: Buy and hold loans typically offer 75-80% LTVs so you can purchase with less money down. Some lenders even offer 100% financing.

-

Covers purchase + repairs: The loan provides capital to buy the property and make updates, eliminating the need to save up rehab costs.

-

Lower asset requirements: Lenders focus more on the deal/property rather than your income, credit, and financials.

-

Interest-only payments: Most buy and hold loans don’t require full PITI payments during the loan term. You only pay interest each month.

-

No prepayment penalties: These loans can be repaid with no early repayment fees when you refinance into permanent financing.

Cons of Buy and Hold Loans

-

Higher interest rates: Expect rates around 7-13% since these are considered riskier loans than conventional mortgages.

-

Shorter terms: The loan may need to be paid back in 1-3 years, requiring refinancing.

-

Need to qualify for refinancing: You’ll eventually need to refinance into a longer-term product requiring income, assets, and credit qualifications.

-

Upfront fees: Lenders typically charge 2-5 origination points, application fees, etc.

-

May require reserves: Some lenders want to see 6-12 months of mortgage reserves or other liquid assets.

-

Personally guaranteed: Buy and hold loans often require the borrower to personally guarantee the debt.

As you can see, buy and hold loans offer more flexibility and faster access to funding compared to conventional loans, but come with higher rates and the need to refinance when the short term expires. Make sure the numbers make sense for your investment strategy.

Types of Buy and Hold Loans

There are a few different types of buy and hold loan structures and terms that borrowers can take advantage of:

Interest-Only – With an interest-only buy and hold loan, you only pay the monthly interest charges and don’t pay down principal during the loan term. This keeps payments low so you can reserve cash for renovations.

Partial Interest-Only – Some lenders offer partial interest-only loans where a portion of the payment covers interest and part goes towards paying down principal each month.

No Monthly Payments – Also called an accrual loan, some buy and hold loans don’t require any monthly payments during the initial loan term while you rehab the property. The payments accrue and are due as a lump sum when the loan matures.

DSCR (Debt Service Coverage Ratio) Loans – A DSCR loan uses projected rental income minus expenses to qualify rather than your income, credit, and assets. This allows real estate investors to take on more properties.

80/20 Piggyback Loan – One lender provides 80% LTV financing to purchase the asset, while a second lender covers the remaining 20% plus rehab costs at a higher rate and shorter term.

100% Financing – A few lenders will provide 100% of the purchase price and estimated renovation budget, eliminating the need for any down payment. However, expect to pay a higher rate and fees.

Renovation Draws – The buy and hold loan provides access to the rehab funds in tranches as certain milestones and inspections are completed, ensuring the money is used as intended.

Float-Down Option – Some lenders allow you to lock in a lower fixed rate on your long-term refinance when you first take out the buy and hold loan, eliminating some uncertainty.

Interest Rates, Fees, and Repayment Terms

Buy and hold loan rates, fees, LTVs, and terms can vary significantly between lenders. Here’s an overview of ranges you can typically expect:

- Interest Rates: 7 – 13%

- Origination Fees: 2 – 5 points (2-5% of loan amount)

- Loan Terms: 6 months – 3 years

- Max LTV: 75-80% purchase + rehab costs

- Max Loan Amounts: Up to $5M

- Prepayment Penalties: None usually

Interest rates are higher than conventional loans to account for the increased risk lenders take on with these short-term loans. But they should be lower than a fix and flip loan.

You’ll also pay origination points of 2-5% upfront when the loan is funded along with application fees, processing fees, etc. Lenders want to be compensated for putting these riskier loans on their books.

Look for lenders offering at least 75% LTV so you can buy with less money down. Many lenders will also finance 100% of the rehab budget allowing you to fund upgrades completely with the loan capital.

Aim for longer terms in the 2-3 year range. This provides ample time to execute renovations and stabilize the asset without needing to repay or refinance too quickly. You want time to add value if you plan to refinance into permanent financing and hold long term.

Lender Requirements and Borrower Qualifications

While buy and hold loans are easier to qualify for than conventional mortgages, lenders still look closely at borrowers’ experience, credit, and capacity to repay. Here are some typical requirements:

- Credit Score: 620+ but higher scores get better rates

- Experience: At least 2-3 prior investment flips or rentals

- Income & Assets: Enough to cover payments until rented

- Down Payment: 20-25% recommended but less is possible

- Loan Reserves: 6-12 months PITI payments in reserves

- Guarantor(s): Personal guarantee almost always required

Lenders want to see some experience flipping houses or managing rental properties, proving you can successfully operate the business. Solid income and cash reserves provide confidence you can make payments if it takes longer than expected to get the property rented.

A higher credit score and down payment will get you the best deal on rates/fees, but those with lower scores or equity can still qualify by putting up additional collateral or getting a guarantor.

How to Choose the Right Buy and Hold Loan Lender

Choosing the right lender for your buy and hold loan is critical, as this partner will provide the capital to purchase, rehab, and stabilize your rental property until you can refinance long-term. Here are some tips for picking the best lender:

- Check their portfolio loan amounts – Look for lenders that actively provide portfolio loans over $2-3 million to ensure they have the capacity to finance your future flips

National Non-Bank Private Lender. Great Rates. Fast Closings. Speak with a Local Lender.

LendingOne is a private money lender offering short-term mortgage loans to real estate investors for investment properties across the state of California. Locating Buy and Hold lenders in California that understand your market is very important. Get a private money loan for an investment property purchase, refinance, equity cash out, rehab or new construction in the California area.

LendingOne buy and hold rental loans can provide the cash you need to grow your real estate investment property portfolio:

- Competitive financing for new acquisitions of residential properties

- Cash-Out refinances available for currently-owned investment properties

- All Loans 30-Year Amortization

- 5/1, 7/1, 10/1 and 30-Year Fixed-Rate

- Up to 80% LTV

- Single Family 1-4 Unit Properties

- Portfolio Loans available for 5 or more homes

Choose which loan you’re interested in for your California Buy and Hold Property or speak to an expert today by calling 866-918-1974

Fast, Flexible Funding for Real Estate Investors.

Speak with Your Local Lender Today!

How To Get A Hard Money Loan In 2024

FAQ

What is a buy and hold loan?

What is a fix and hold loan?

What is buy and hold real estate?

You may recognize the term “buy and hold” as a stock market investing term. It refers to when you buy a stock or another asset and keep it in your portfolio for a period. Buy and hold real estate involves the same basic concept. We’ll walk through an overview of buy and hold real estate investing and why you might want to invest in real estate.

Is buy and hold a good investment?

Ultimately, it’s a long-term approach to investing, unlike purchasing real estate to sell immediately, also known as a fix-and-flip. In a buy and hold real estate situation, you might even hold onto a property for your kids or grandkids someday to bring them rental income or even the proceeds if they decide to sell the property. Buy And Hold Vs.

Should you buy and hold real estate?

Buy and hold real estate investing probably isn’t a decision you can make overnight. It involves a serious financial obligation. The process means looking at investment properties, buying the property, renting it out, managing it, monitoring market trends and deciding when to sell it.