A single-payment loan requires the borrower to repay the entire principal balance and the interest in one lump sum on the due date.

Single-payment loans, also known as lump-sum loans, allow borrowers to receive the full loan amount upfront in a single payout. These loans require one large repayment at the end of the loan term, rather than multiple installments over time like traditional loans. While single-payment loans may seem attractive for their simplicity and full access to funds, they are not necessarily the best choice for every borrower. In this article, we’ll take an in-depth look at when a single-payment loan is truly advantageous versus other loan types.

How Single-Payment Loans Work

With a single-payment loan, the lender provides you with the entire loan amount at the outset. You can then use this money as you wish during the loan term for large purchases, investments, debt consolidation, or other needs. These loans typically last 1-7 years

At the end of the term, you must repay the original loan amount plus all accrued interest and fees in one lump sum payment Monthly payments are not required However, you do pay interest on the full amount for the duration of the loan.

Single-payment loans often come with higher interest rates than traditional installment loans since the lender is providing all funds upfront without periodic payments. The lender also takes on increased risk by not receiving regular repayments.

Key Factors in Evaluating Single-Payment Loan Advantages

When weighing whether a single-payment loan is advantageous for your situation, there are a few key factors to consider:

Interest Calculation Method

The biggest factor is how interest is calculated on the loan. There are two main methods:

-

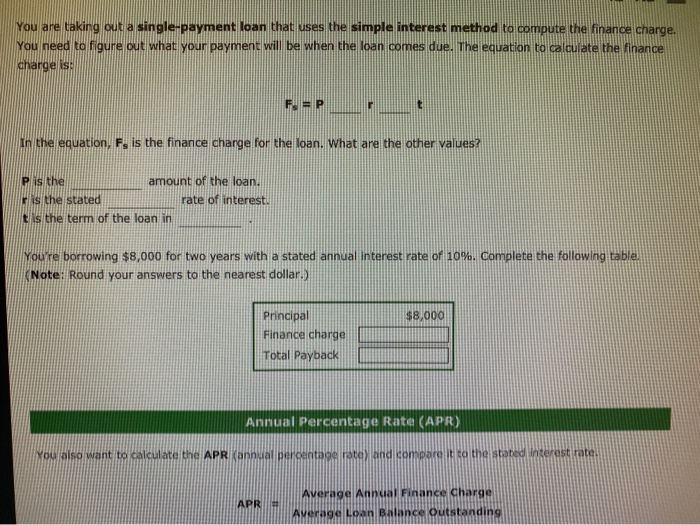

Simple interest – Interest is charged only on the original principal balance. Your total interest cost stays the same no matter when you repay the loan.

-

Compound interest – Interest accrues on the principal and any unpaid interest. The longer you wait to repay, the more interest builds up in a snowball effect.

With simple interest loans, it doesn’t matter whether you take a single-payment loan or an installment loan – your total interest costs will be the same if the term length and interest rate are identical. This makes single-payment loans very advantageous since you gain flexibility in using the funds.

However, compound interest loans charge significantly higher total interest on a single-payment structure since interest accrues on a higher balance over time. Installment loans minimize compounding interest by paying down the principal during the term.

Loan Term Length

The longer the term length, the more important loan structure becomes. For short-term loans of 1-2 years, single-payment and installment plans have similar total costs. But as terms extend, compound interest can rapidly inflate costs on single-payment loans.

Prepayment Flexibility

With an installment loan, you’re locked into fixed monthly payments. But single-payment loans allow you to pay down the balance early without penalties. This provides flexibility if you come into extra cash from a tax refund, bonus, or other source. Prepaying principal lowers your interest costs.

However, self-discipline is required to actually make extra payments rather than spending excess funds. If you don’t prepay, you’ll miss out on the savings of an installment plan.

Use of Funds

If you require all funds upfront for a large purchase like a car, medical procedure, or home remodel, a single-payment loan ensures you get the full amount immediately. With an installment loan, you’d need to save up or make do with the smaller monthly disbursements.

But if you only need portions of the loan for ongoing expenses, an installment loan matches better with periodic spending needs rather than receiving a large lump sum.

Examples of Good Uses for Single-Payment Loans

Given the factors above, here are some situations where single-payment loans can make sense for borrowers:

-

Major one-time purchase – If you need to buy a vehicle, pay college tuition, or fund a home renovation project that requires the full amount upfront, a single-payment loan allows you to get all funds immediately.

-

Short-term simple interest loan – A 1-2 year single-payment personal loan with simple interest minimizes total fees for short-term borrowing since you avoid installment loan origination fees.

-

Consolidating high-interest debt – Combining multiple credit cards or payday loans into a single-payment loan at a lower interest rate can save substantially on interest, especially if you pay down the balance early.

-

Bridge financing – Real estate investors often use lump-sum loans as short-term bridge financing while flipping houses or waiting for permanent financing to come through. The flexibility and fast access to funds is advantageous.

-

Smoothing irregular income – Freelancers, contractors, and seasonal workers with fluctuating income can benefit from having a full pool of funds upfront to cover slow months.

Scenarios Where Single-Payment Loans Are Riskier

On the other hand, single-payment loans are riskier and potentially costlier than installment loans in certain situations:

-

Long-term financing – The longer the term, the more compound interest can accrue. A 30-year single-payment mortgage will have massive interest costs relative to a fixed-rate mortgage with incremental payments.

-

Variable income – Without a fixed repayment schedule, it can be tempting to continually push off the lump-sum payment during cash flow shortfalls – resulting in ballooning interest costs.

-

Limited budgeting ability – For borrowers with poor money management skills, a single large repayment could be overwhelming. Installment loans enforce disciplined budgeting.

-

Questionable prepayment discipline – While you have the option to prepay a lump-sum loan, many borrowers never get around to it or pay very little extra. You miss out on enforced principal paydown of an installment plan.

-

Spending temptation – Having access to a large pool of cash upfront can lead to overspending on wants rather than needs. With an installment loan, you only get a fixed monthly amount for budgeting.

Tips for Maximizing Advantages of Single-Payment Loans

If you determine a lump-sum loan makes sense, there are ways to maximize the advantages while minimizing the risks:

-

Select the shortest term possible – This minimizes compound interest and encourages repayment. Be realistic about your ability to repay.

-

Understand the true interest rate – Compare both the nominal interest rate and annual percentage rate (APR), which includes fees. Don’t just look at which rate is lower.

-

Setup automatic payments – Schedule recurring monthly payments from your bank account to gradually pay down the principal. This takes self-control out of the equation.

-

Make payments on due date – To limit compound interest, make auto-payments on the exact loan due date rather than earlier or later. Ask the lender how scheduled payments are applied.

-

Pay extra with windfalls – Use tax refunds, bonuses, inheritance money or other one-time funds to make additional principal payments. Prepaying $1,000 can save hundreds in interest.

-

Avoid unnecessary spending – Be judicious and budget-conscious when spending from the lump sum. Limit purchases to essential needs related to your loan goals.

-

Consider loan refinancing – If your financial situation improves, you may be able to refinance for better terms later in the loan term when the balance is lower.

The Bottom Line – Evaluate Carefully

Single-payment loans can provide flexibility and access to funds that installment loans don’t. However, they also carry risks like ballooning interest costs and overspending. Before obtaining a lump-sum loan, carefully assess your financial situation, spending tendencies, income stability, and discipline to prepay principal. Plot projected costs over the loan timeframe and compare with installment loan options. While potentially cost-effective in the right circumstances, single-payment loans are not beneficial by default. Evaluate each situation individually to make sure it’s the right fit.

The Basics: Your Credit History

Before we talk more about borrowing money, we need to discuss a topic that is crucial to the whole process. Credit history is one of the crucial ways lenders and creditors assess how responsible you are with your financial obligations. The better your credit history and higher your credit score, the more likely you are to get approved for a loan with the most favorable interest rates, possibly resulting in a lower monthly payment. Before borrowing money, it’s important to know what it means to be fiscally responsible and to understand how credit scoring works.

What Is A Single-payment Loan?

Single-payment loans can come in several different forms. Many loans require the borrower to make several monthly payments until their loan is paid in full. However, single-payment loans are paid back with one large payment by the due date decided by the lender. One common form of a single-payment loan is called a payday loan. According to the U.S. Chamber of Commerce, approximately 12 million Americans borrow funds using payday loans each year!1

Loans are a big part of today’s society and understanding them is one key to financial success. Loans are typically issued by financial institutions (such as banks), corporations, and governments. There are many types of loans, so how can you know which one to pick?

There are several types of loans out there. The easiest way to break them down is by “secured” and “unsecured.” A secured loan is one that requires the borrower to offer up collateral in order to take out the loan. This way, if the customer defaults on the loan, the lender can sell the collateral to cover their loss. An unsecured loan is the opposite in that it requires no collateral.

Repaying Loan Early – Is it a Good or Bad Idea? | Loan Repayment Tips | CS Sudheer

FAQ

What are single payment loans used for?

Which of the following statements regarding single payment loans is true?

What are most single payment loans secured by?

What is a single payment loan used to finance a purchase?

What is a single payment loan?

A single payment loan, also known as a balloon loan or bullet loan, is a type of short-term loan that allows borrowers to receive funds upfront with the obligation to repay the loan amount, along with the interest, in a single large payment at the end of the loan term.

What is the difference between a single payment loan and installment loan?

Single payment loans require borrowers to repay the loan amount and interest in one large payment at the end of the loan term, whereas installment loans have monthly payments spread over a fixed period. Can I pay off a single payment loan early? Yes, it is possible to pay off a single payment loan early.

Are there alternatives to a single payment loan?

Here are a few common alternatives to single payment loans: An installment loan allows borrowers to repay the loan amount and interest over a fixed period in regular, equal installments. This structure offers a more predictable repayment plan, providing borrowers with the ability to budget and manage their finances effectively.

What is a simple interest mortgage?

Simple interest usually applies to automobile loans or short-term personal loans. In the U.S., most mortgages on an amortization schedule also involve simple interest, although they can certainly feel like compound interest loans .