The VA loan offers active troops and veterans an incredible mortgage option. But, to offset the program’s costs, the government charges many borrowers a funding fee. Fortunately, some veterans qualify for funding fee exemptions.

If you didn’t meet the requirements for a VA funding fee exemption when applying for a VA loan but do now, a path may exist to seek a refund. Below we explain who can get a VA funding fee refund and the steps to take.

The VA funding fee is a one-time cost that helps offset risks for the VA home loan program. While most borrowers pay this fee at closing certain Veterans may qualify for a full or partial refund if approved for VA disability compensation after closing.

In this comprehensive guide, we’ll cover:

- Who is eligible for a VA funding fee refund

- When and how to request your refund

- What to do if your refund is denied

- Tax implications of receiving a refund

Understanding the key rules and processes can ensure you recoup this fee if entitled.

What Is the VA Funding Fee?

The VA funding fee is a percentage of the total loan amount charged on most VA-backed loans and direct VA mortgages. For first-time users, it is typically 2.3% of the loan amount.

This fee helps the VA cover potential losses if a VA mortgage goes into default. Since VA loans don’t require private mortgage insurance, this funding fee helps protect taxpayers from costs.

The fee is due at closing and can either be paid upfront or rolled into the loan amount. Only certain groups, like disabled Veterans receiving compensation from the VA, are exempt.

Who Is Eligible for a VA Funding Fee Refund?

The most common situation where a Veteran or servicemember qualifies for a refund is if they are awarded VA disability compensation retroactive to before their loan closing date.

Here are the key eligibility rules according to VA guidelines:

-

You must be officially approved for VA disability compensation related to your military service.

-

The “effective date” of your disability compensation award must be prior to the date you closed on your VA loan This makes the award retroactive.

-

The VA considers proposed or memorandum rating decisions that come after loan closing as non-qualifying for refunds,

-

Refunds typically process within 10 business days after requesting.

How Do I Request My VA Funding Fee Refund?

If you meet the eligibility criteria, submitting a refund request is straightforward:

Contact your mortgage lender/servicer: Get in touch with the lender who originated your VA loan or the company currently servicing it. Ask them to process a request for a refund of your VA funding fee.

Contact your VA Regional Loan Center: You can also contact your regional VA loan center directly to submit the request. Locate your closest center by calling 877-827-3702.

Your lender or the VA will verify your approved disability status and closing date to confirm you qualify. Have your VA disability award letter handy when making the request.

Submit any paperwork your lender requires to show your VA compensation was made retroactive. This may include your VA rating decision letter.

I Was Denied a Refund – What Should I Do?

If your VA funding fee refund request gets denied, don’t panic. Here are some steps to take:

-

Find out why: Ask your VA lender or loan center to explain specifically why you were not eligible. There may be a simple mistake.

-

Confirm your dates: Verify that the effective date on your disability award truly was retroactive to before your closing date. If not, you won’t qualify based on that claim.

-

File an appeal: If you disagree with the decision, submit an appeal to the VA to have them re-review your claim timeline and loan closing date. Provide documentation to support your case.

-

Get help: Work with a VA accredited representative or your state’s Department of Veterans Affairs to assist you in filing your appeal. They can help ensure it’s successful.

With persistence and documentation, many initially denied requests can get overturned, enabling Veterans to eventually get their refund.

Who Gets the Refund Payment?

The VA will issue approved VA funding fee refunds directly to the eligible Veteran or servicemember. The refund does not get credited toward your mortgage principal.

You can choose to:

- Keep the refund as cash

- Make extra principal payments on your mortgage to save interest

- Use it to pay other bills or expenses

Talk to a loan officer or financial advisor about the wisest use of your refund money based on your situation.

How Does a Refund Affect Taxes?

The tax implications of receiving a VA funding fee refund are:

-

If you deducted the fee when paid, the refund must be reported as taxable income when received.

-

You’ll get a Form 1099 from the VA reporting the amount.

-

The refund could bump you into a higher tax bracket for the year received. Plan accordingly.

To avoid a tax surprise, speak to a tax professional to determine the impact and proper reporting of your refund.

Get the VA Funding Fee Refund You’ve Earned

If you paid this fee at closing but were later approved for retroactive VA disability compensation, take action to request your refund. Submit the proper paperwork and follow up diligently to get back every dollar you deserve.

Who Can Get a VA Funding Fee Refund After Closing?

When you apply for a VA loan, your lender reviews your VA loan Certificate of Eligibility (COE). Your COE clearly states whether or not you qualify for a funding fee exemption. Borrowers exempt include those receiving VA disability compensation, Purple Heart recipients and eligible surviving spouses.

However, the COE doesn’t consider those who may receive a future exemption, specifically those with a pending disability rating.

Eligibility for a VA funding fee refund depends on your VA disability status and effective date. To be eligible for a VA funding fee refund, borrowers must obtain VA disability compensation with an effective date before the loan’s closing date.

The VA typically places the effective date of a disability caused or made worse by service as the later between the day the VA received the claim and the date of your injury or illness.

Let’s look at two scenarios of borrowers who both paid the VA funding fee and closed their VA loans on February 6, 2023:

- Borrower 1 filed a VA disability claim on January 1, 2023, and received a 20% disability rating on April 2, 2023. The VA sets the effective date of Borrower 1’s VA disability compensation as January 1, 2023, meaning Borrower 1 is now eligible for a VA funding fee refund.

- Borrower 2 filed a VA disability claim on February 15, 2023, and received a 30% disability rating on April 5, 2023. Borrower 2’s effective date is after the loan closing date, meaning Borrower 2 does not qualify for a VA funding fee refund.

The VA Loan Funding Fee

First, let’s refresh our memory on the VA funding fee. The VA funding fee is a mandatory fee applied to most VA loans meant to offset the government’s cost of administering the program.

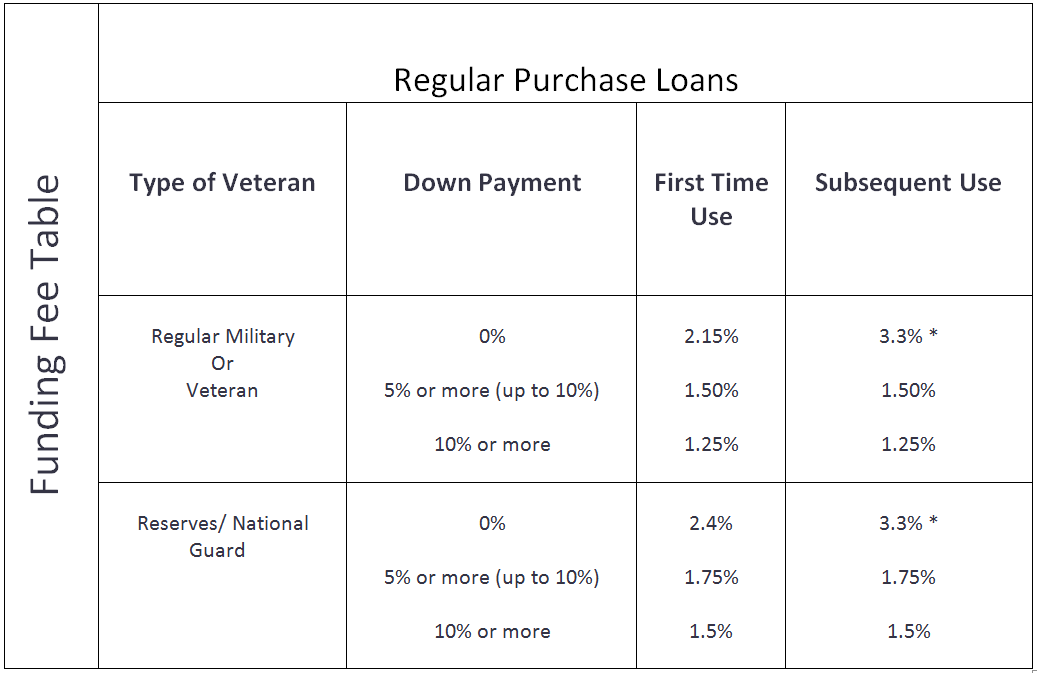

The fee previously varied by service type (active duty vs. reservist) but now varies by loan type, down payment amount and prior usage of the VA loan.

If your loan closed before April 7, 2023, your funding fee likely ranged from 2.3% to 3.6% for most purchase loans and 0.5% to 3.6% for refinance. Loans closed after April 7, 2023, range from 2.15% to 3.3% for most purchase loans and 0.5% to 3.3% for refinancing.

The 2023 VA Loan Funding Fee (Explained)

FAQ

Does VA funding fee get refunded?

How do I claim the VA funding fee on my taxes?

Which of the following is true concerning the refundability of a VA funding fee?

Did VA complete home loan funding fee refund initiative?

VDOMDHTMLtml> VA completes home loan funding fee refund initiative – VA News The U.S. Department of Veterans Affairs (VA) recently completed an aggressive initiative to process home loan funding fee refunds to Veteran borrowers, issuing more than $400 million in refunds.

Can I get a refund of my VA funding fee?

The effective date of the disability compensation must be retroactive to a date prior to the date of loan closing. If you feel that you are entitled to a refund of the VA funding fee, please contact your mortgage holder or VA Regional Loan Center at (877) 827-3702 to request a refund.

Can I get a funding fee refund after closing on a VA loan?

The key is when the pre-discharge claim is adjudicated. According to VA policy guidelines, service members who receive a proposed or memorandum rating dated after closing on their VA loan are not eligible for a funding fee refund. If you’re unsure of your refund status, contact your lender, servicer or the VA Regional Loan Center at 1-877-827-3702.

How do I get a refund from the VA?

If the VA approves your request, you typically receive the refund in one of two ways, depending on how you initially paid the funding fee. If you paid the fee in cash at closing, you will receive a cash refund for the amount of the funding fee.

What is a VA funding fee?

If you’re looking to use a VA-backed mortgage, odds are you’ll run into the VA funding fee. The VA funding fee is a set cost applied to most VA loans that helps cover losses if a VA loan goes into default. The funding fee applies to all purchase and refinance loans and is typically 2.15 percent of the loan amount for most first-time VA borrowers.

Can a VA loan be refunded to a veteran?

Note: As VA issues funding fee refunds directly to the Veteran, VA will not pursue collection from the Veteran or otherwise be able to assist the lender in the event the lender pre-emptively reduces the principal balance of the loan or issues a refund to the Veteran.