[et_pb_section fb_built=”1″ admin_label=”section” _builder_version=”4.15.1″ custom_margin=”0px||||false|false” custom_padding=”0px||||false|false” global_colors_info=”{}”][et_pb_row admin_label=”row” _builder_version=”4.15.1″ background_size=”initial” background_position=”top_left” background_repeat=”repeat” custom_margin=”0px||||false|false” custom_padding=”0px||||false|false” global_colors_info=”{}”][et_pb_column type=”4_4″ _builder_version=”4.15″ custom_padding=”|||” global_colors_info=”{}” custom_padding__hover=”|||”][et_pb_text admin_label=”content” module_class=”glossarycontent” _builder_version=”4.15.1″ _module_preset=”default” locked=”off” global_colors_info=”{}”]

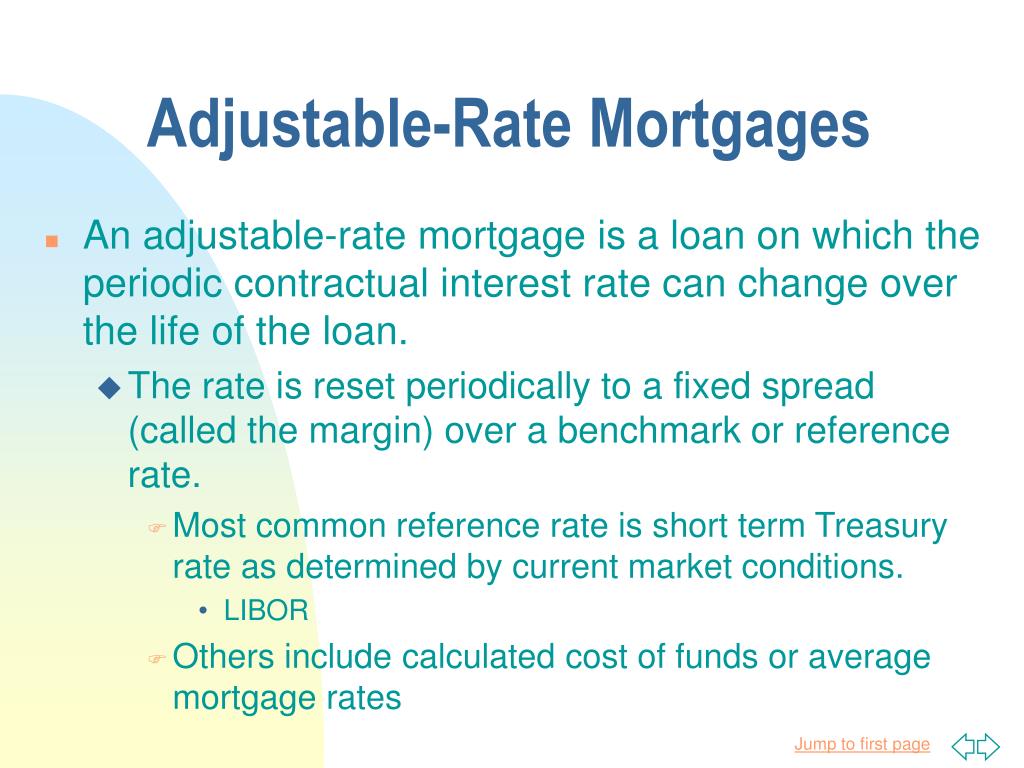

The interest of adjustable-rate mortgages (ARM) are tied to the index and margin. The index is a reference point for the interest rate and will vary based on the market. The margin, on the other hand, is a firm set of percentage points that the lender determines. When added together, a new interest rate for the loan is established. Ultimately, this will affect how much borrowers will pay every month for the loan.

When taking out an adjustable-rate mortgage (ARM) one of the most important things to understand is the index. The index is a key component that determines how the interest rate on the ARM will adjust over time. By law lenders must use a published index for ARMs, not just any rate they want. So what exactly must the index on an ARM be?

The Index Must Be Publicly Available and Verifiable

The most fundamental requirement is that the index must be publicly available meaning it is published regularly and borrowers can easily find the current value. The index rate cannot be set at the sole discretion of the lender.

Federal law states that the index must be “readily verifiable by the borrower and beyond the control of the creditor.” This ensures transparency for borrowers and prevents lenders from arbitrarily raising rates.

Popular indexes that meet this criteria include:

-

The Prime Rate: Published in the Wall Street Journal, this is the rate banks charge their most creditworthy customers.

-

The London Interbank Offered Rate (LIBOR): Published daily, this measures the cost banks pay to borrow from each other.

-

The 12-Month Treasury Average: Based on weekly auctions of 12-month Treasury bills.

Borrowers should be able to look up and verify the current value of the index on their loan, such as by checking the Wall Street Journal for the Prime Rate. Index values in the past can also be verified.

The Index Must Be Beyond the Lender’s Control

In addition to being publicly available, the index must be entirely outside of the lender’s control. It cannot be a rate simply set at the lender’s discretion.

This prevents predatory lending situations where the lender could arbitrarily raise rates on borrowers. Again, this is why indexes like the Prime Rate or LIBOR are commonly used – lenders cannot influence them, they simply follow the market.

Borrowers should verify that the index on their loan meets this objective criteria and is not an internal rate created by the lender. Indexes set by government entities, such as the Federal Reserve, are generally acceptable.

The Index Must Have a Proven, Published History

For an index to be verifiable, there must be a published history of its values over time. The index cannot be something invented by the lender with no track record.

Federal housing regulators recommend an index should have at least a one-year history before being used for ARMs. However, the most common indexes used have much longer track records:

-

The Prime Rate has been published since the 1950s.

-

LIBOR has been published since the 1980s.

-

The 12-Month Treasury Average also has decades of history.

This extensive historical data allows borrowers to evaluate how sensitive the index is to interest rate changes. A stable index may be preferable for many borrowers.

Ideally, the publication providing the index’s historical values should be easily accessible to verify its consistency over time.

The Index Must Be Correlated to the Overall Market

While lenders have some flexibility in choosing an index, in general it should be correlated to broader market interest rates.

The index needs to be responsive to changes in the macro economy and interest rate environment. This ensures ARM rates adjust fairly based on real changes in market conditions.

This is why most lenders use benchmark indexes that track the general market, like the Prime Rate or Treasury yields. But some more obscure, niche indexes have come under scrutiny for having no clear relation to the broader market.

Regulators have warned lenders against using indexes uncorrelated to normal interest rates. So borrowers should evaluate if the index seems to track logically with the overall market direction.

The Index Value Must Be Readily Available to Borrowers

Regulations state the index value used to adjust an ARM must be the most recently available figure as of the date the new rate takes effect.

For example, if an ARM adjusts on January 1st, the lender cannot use an index value from November or December. It must be the most current value published in that publication specifically for January 1st.

This prevents lenders from cherry-picking older index values that are less favorable for the borrower. It also requires the index to be published frequently enough to have a value available for each adjustment date.

Borrowers should check their mortgage agreement to verify the lender is required to use the most recent index value published as of the adjustment date.

The Index Must Allow for Clear Calculation of Rate Changes

The index methodology must allow for clear, mathematical calculation of future interest rates based on its value. There should be no ambiguity or room for interpretation by the lender.

For example, most ARMs are simply the index value plus a fixed margin, such as:

ARM Interest Rate = Index Value + 2% Margin

When the index changes, the new interest rate is easily calculated. More complex index formulas can obscure rate adjustments from borrowers.

- Published regularly in a public, verifiable source

- Determined objectively based on market factors, not by the lender

- Have an extensive published history of values over time

- Correlated to movements in the overall interest rate market

- Frequently updated and readily available to borrowers

- Allow clear calculation of interest rate changes

Following these guidelines ensures the ARM adjusts fairly based on real changes in the market environment. It prevents predatory lending by removing subjectivity and lending discretion from the process.

While lenders have flexibility in index choice, stick to well-known benchmarks like the Prime Rate that are time-tested and trusted. Scrutinize any unfamiliar, opaque indexes that could harm borrowers. Above all, understand how the index works so you can better evaluate ARM loans.

What is an adjustable-rate mortgage?

An ARM is a loan with a fluctuating interest rate, which depends on the index and margin. This is also known as a variable-rate mortgage or floating mortgage. ARMs can change as often as one year, three years, and even five years. However, this change takes place only after the initial period is over.

This is the opposite of a fixed-rate mortgage, where the interest remains the same for the duration of the loan. ARMs also typically have lower monthly payments compared to fixed-rate mortgages. However, the difference may not be much. Other things to keep in mind about ARMs are:

- Your payments can vary month-to-month

- You may end up owing more money than you originally borrowed.

- You could face a penalty if you pay your ARM ahead of time.

Refer to the Consumerfinance.gov ARMs handbook for a detailed look at ARMs and all they entail.

[/et_pb_text][et_pb_text admin_label=”CTA” _builder_version=”4.15″ _module_preset=”default” locked=”off” global_colors_info=”{}”]

[/et_pb_text][et_pb_text admin_label=”content” module_class=”glossarycontent” _builder_version=”4.15.1″ _module_preset=”default” locked=”off” global_colors_info=”{}”]

How much the interest rate changes on an ARM depends on the index, which is based on the current market conditions. If the index rate rises, so will the interest rate and monthly payment. If it falls, however, both the interest rate and monthly payment could also drop. Lenders will base the interest rates of an ARM on a few indexes, including the Cost of Funds Index (COFI) and 1-year constant-maturity Treasury (CMT) securities. Other lenders will use their own cost of funds as an index, allowing them to have more control.

If you’re thinking about an ARM, consider asking the lender what index they’ll be using, how often it’s changed in the past, and where it’s published.

The margin is the percentage points you’ll add to the index to set the interest rate. The amount of the margin ultimately depends on the lender and the type of loan, but you can negotiate to keep it low. It also won’t change after you’ve closed the loan.

Pros and Cons of Adjustable Rate Mortgages – ARM Loan – First Time Home Buyer

FAQ

What is the index of an adjustable-rate mortgage?

What is the index in relationship to an adjustable-rate mortgage quizlet?

What is the adjustable-rate mortgage?

What index is used for mortgage rates?

What is an adjustable rate mortgage?

An adjustable-rate mortgage has an interest rate that changes periodically with the broader market. An ARM starts with a low fixed rate during the introductory period, which typically is three, five, seven or 10 years. When the introductory period expires, the interest rate changes regularly, based on a benchmark index.

How do you calculate an adjustable rate mortgage?

To calculate the mortgage for an adjustable rate mortgage, you would add the ARM index and the ARM margin. The sum of the ARM index and the ARM margin is the fully indexed rate, or the rate that is applied to your loan’s monthly payments.

What is an adjustable rate mortgage (ARM)?

For the Adjustable-Rate Mortgage (ARM) product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate period, the interest and payments may increase according to future index rates. The APR may increase after the loan closes.

What are margins & indexes in an adjustable rate mortgage?

Margins and indexes are two of many terms that determine your monthly payment for an adjustable-rate mortgage. It’s also important to understand caps, carryover, and other terms. If you’re considering an adjustable rate mortgage, read the Consumer Handbook on Adjustable Rate Mortgages (CHARM) booklet .