Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. Follow along as we demonstrate how to use the site

When getting a new loan, you’ll often encounter fees charged by the lender to cover the costs of originating and processing the loan. Known as loan origination fees, these costs can include application fees, underwriting fees, and attorney fees for reviewing loan documents. So how should you account for these fees on your books?

In this comprehensive guide. I’ll walk through everything you need to know about amortizing loan origination fees including

- What loan fees should be amortized

- Why amortization is required

- How to calculate loan fee amortization

- Recording amortization entries step-by-step

- Potential impacts on financial statements

- Alternative options and considerations

As an accounting advisor with deep expertise in this area my goal is to provide clear detailed information on properly accounting for loan costs over the life of the debt. Let’s dive in!

Overview of Loan Origination Fees

When you take out a new loan or renegotiate an existing one the lender often charges fees to cover their administrative costs.

Here are some common examples of loan origination fees:

- Application and underwriting fees

- Processing and documentation fees

- Lender fees to review and approve the loan

- Attorney fees for legal review of loan agreements

- Prepaid interest charges

- Other fees tied directly to originating the loan

These fees can range from a few hundred to several thousand dollars depending on the size and type of loan.

Why Amortization of Fees is Required

Under generally accepted accounting principles (GAAP), loan origination fees must be amortized over the life of the loan.

This matches the cost of obtaining the loan against the period when the funds are available for use. Amortization applies the expense systematically over the loan term.

The rationale is that amortization of fees follows the matching principle in accounting. By spreading the fees over the loan period, it accurately matches costs to the time frame when the related asset is in use.

Immediate expensing of loan fees when paid would distort net income in the period they are incurred. Amortization avoids this distortion.

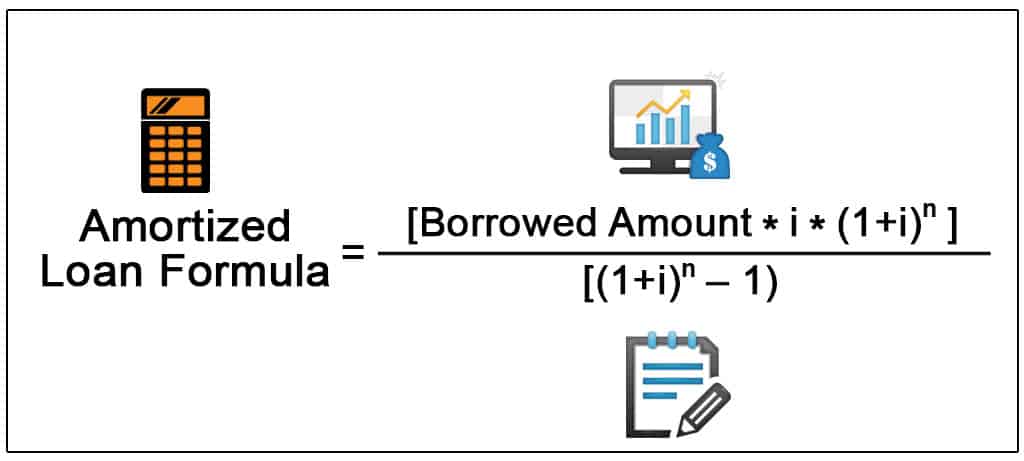

How to Calculate Loan Fee Amortization

To calculate loan origination fee amortization, you first need to know:

- Total fees paid to the lender

- Loan period or term length

For example:

- You paid $20,000 in total loan origination fees

- The loan term is 5 years

To amortize, divide fees by the loan term:

- $20,000 total fees / 5 year term = $4,000 amortized per year

Each year, you will amortize $4,000 of the fees over the life of the 5-year loan.

The amortization schedule would look like:

| Year | Amortization |

|---|---|

| 1 | $4,000 |

| 2 | $4,000 |

| 3 | $4,000 |

| 4 | $4,000 |

| 5 | $4,000 |

So in this case, 1/5th of the total fees are expensed each year on the income statement.

Recording Amortization Entries in the Books

Let’s go through a full example of how to record loan fee amortization entries.

- Company ABC takes a 5-year business loan

- Loan origination fees total $20,000

- Annual amortization is $4,000

Initial Entry When Fees Are Paid:

Dr. Loan Origination Fees $20,000

Cr. Cash $20,000

- Debits the asset account for deferred fees

- Credits the cash paid to the lender

Annual Amortization Entries:

Dr. Interest Expense $4,000

Cr. Loan Origination Fees $4,000

- Debits interest expense on the income statement

- Credits the deferred loan fee asset account

This reduces the asset each year and recognizes amortization as interest expense on the income statement.

Impact of Amortization on Financial Statements

How does amortizing loan fees affect your financial statements? Here are the key effects:

Balance Sheet

- Loan fees capitalized as an asset when paid

- Asset balance reduced over time through amortization

Income Statement

- Interest expense increased by the amortized loan fee amount each year

- Better matches interest costs with the period of loan benefit

Cash Flow Statement

- No impact on cash flows, which reflect the upfront fee payment only

Proper amortization gives a more accurate picture of the asset and interest expense over time.

Alternatives to Amortizing Fees

Instead of amortizing fees, some companies expense loan costs immediately or take another approach like:

- Record fees as a contra-liability instead of an asset

- Treat fees under 1-2% of the loan as immaterial

- Expense only costs tied directly to the lender, capitalizing other third-party costs

However, amortization of all loan fees over the debt term is considered the standard acceptable method under GAAP. Deviations may not comply with accounting standards.

Key Considerations When Amortizing Fees

Here are a few other important points on amortizing loan origination fees:

- Disclose your amortization policy and schedule in financial statement footnotes

- Assess materiality – fees under a set threshold could potentially be immediately expensed

- Recalculate amortization schedules if loans are renewed or terms change

Proper documentation, disclosure, and policies are key when amortizing material loan costs.

The Bottom Line

Search within this section

Select a section below and enter your search term, or to search all click Loans and investments

{{isCompleteProfile ? “Setup your profile before Sign In” : “Profile”}}

You can set the default content filter to expand search across territories.

Welcome to Viewpoint, the new platform that replaces Inform. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

How to Calculate Loan Origination Fees

FAQ

Can loan origination fees be amortized?

Are loan origination fees capitalized or expensed?

What is the amortization code for loan fees?

|

IRC Section

|

Property or Expense

|

|

Sec. 197

|

Amortization of goodwill/other intangibles

|

|

Sec. 178

|

Acquiring a lease

|

|

Sec. 171

|

Bond premiums

|

|

Sec. 461

|

Loan fees

|

What is the amortized cost of a loan?

Are loan origination fees amortized?

However, this practice is not in accordance with Generally Accepted Accounting Principles (GAAP). According to Accounting Standards Codification (ASC) 310-20-25-2, loan origination fees and direct costs are to be deferred and amortized over the life of the loan to which they relate. What constitutes loan origination fees and costs?

Why are loan costs amortized?

Loan costs, such as legal and accounting fees, registration fees, appraisal fees, and processing fees, are necessary costs to obtain a loan. If these costs are significant, they must be amortized to interest expense over the life of the loan due to the matching principle.

What are loan origination fees and costs?

According to Accounting Standards Codification (ASC) 310-20-25-2, loan origination fees and direct costs are to be deferred and amortized over the life of the loan to which they relate. What constitutes loan origination fees and costs? The fees and costs include but are not limited to: Recent Read: A Look at the Modern Audit: Are You Missing Out?

Should deferred loan origination fees and costs be amortized?

Deferred loan origination fees and costs should be netted and presented as a component of loans. If the loans are classified as held for sale, the net fees and costs should not be amortized; instead, they should be written off as part of the gain or loss on the sale of the loan.